BlackRock CEO Larry Fink Says Bitcoin and Crypto Growing Rapidly

BlackRock CEO Larry Fink has once again expressed optimism about the growing role of Bitcoin and digital assets in the global financial system. Speaking at the Global Financial Leaders’ Investment Summit 2025 in Hong Kong. Which is hosted by the Hong Kong Monetary Authority (HKMA), Fink said crypto is “growing very rapidly.” He compared Bitcoin’s role to that of gold in a changing economy. The remarks come as major institutions continue to embrace digital assets. This signals a broader shift in global finance.

Bitcoin as a Modern Safe-Haven

During the summit, Larry Fink emphasized that Bitcoin, much like gold. It has become an asset people turn to in times of uncertainty. He described it as an “asset of fear.” The CEO explained that gold and Bitcoin serve as instruments for those concerned about currency depreciation or financial instability.

“There is a role of gold and there is a role of Bitcoin,” Fink said. “These are assets for people who fear the debasement of currency or face financial insecurity.” He noted that over $1.4 trillion is now being held in digital wallets, calling it “a clear sign of rapid growth in digital assets.” Fink added that the rise of such wallets shows how people are gradually shifting away from traditional banking toward digitally native finance.

Tokenization: The Future of Finance

Beyond Bitcoin, furthermore, Larry Fink discussed the tokenization of real-world assets, calling it the next major transformation in finance. Specifically, he suggested that in the coming years, firms could tokenize exchange-traded funds (ETFs) and other traditional financial instruments. This means that this allows investors to trade seamlessly using stablecoins or digital wallets.

“Tokenization can make markets more efficient, transparent and inclusive,” he said. Fink believes in the ability to transact instantly with programmable assets. Indeed, that could eliminate many frictions that exist in today’s financial infrastructure. This view aligns with BlackRock’s broader vision of integrating blockchain technology into global markets. Furthermore, it’s a strategy that has already seen the asset manager push for regulatory clarity and participate in the ongoing Bitcoin ETF expansion.

AI and Global Market Transformation

Larry Fink also touched on AI and its growing influence in finance. He said AI will not only drive operational efficiency but also help firms deliver personalized investment strategies for clients. “AI is transforming the way we manage portfolios, communicate with clients and predict market movements,” he noted. Calling it one of the most powerful tools shaping the future of finance. Alongside Fink, Citadel CEO Ken Griffin shared the stage. Together, they discussed the resilience of global markets and the importance of innovation in driving growth post-pandemic.

BlackRock’s Expanding Vision

Larry Fink reaffirmed that BlackRock’s long-term strategy still remains focused on helping clients access diversified investment opportunities across traditional and digital assets. In addition, he hinted that the firm will continue expanding into private markets and digital infrastructure. Furthermore, he views tokenization and AI as complementary forces in that growth.

As Fink summed up at the summit: “This is only the beginning. The world of finance is evolving, and Bitcoin, tokenization and AI are all part of that transformation.” His remarks mark another turning point for Wall Street’s growing acceptance of crypto. This time, backed by the world’s largest asset manager.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Update: Separating Hype from Reality—Crypto Market Shifts as BlockDAG, Ethereum, and XRP Aim for Leadership by 2026

- BlockDAG's $435M presale and hybrid DAG/Proof-of-Work model position it as a top 2026 growth candidate with 3.5M active miners. - Ethereum faces technical risks like potential death cross but retains 53% stablecoin dominance through JPMorgan/BlackRock partnerships. - XRP shows $2.40 recovery amid Bitcoin ETF inflows but needs sustained confidence to maintain $3.95B derivatives open interest. - Market shifts toward projects with institutional validation (CertiK audits) and real-world adoption (Seattle spo

Brazil's Cryptocurrency Clampdown: Combating Illicit Activity or Hindering Progress?

- Brazil's Central Bank enforces strict crypto rules by Feb 2026, requiring VASPs to obtain authorization or exit the market. - Stablecoin transactions and cross-border transfers are reclassified as foreign exchange operations under $100k capital controls. - $2-7 million capital requirements spark industry criticism, with concerns over stifling competition and compliance timelines. - Mandatory reporting for international transactions aims to combat money laundering, aligning with global standards like EU's

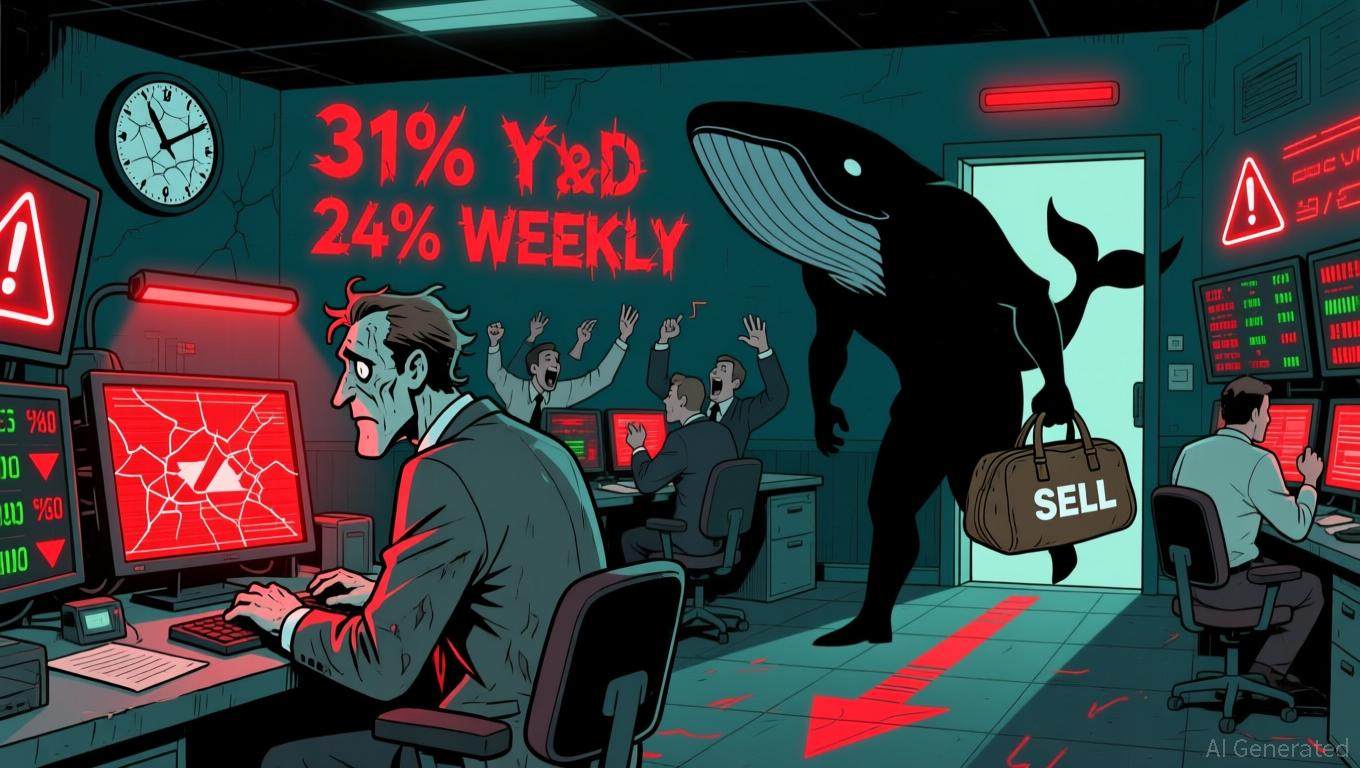

Whales Offload PEPE While Bulls Resist Decline, Forecasting Record High

- A major PEPE whale liquidated a $46M position this week, reflecting broader memecoin market weakness as prices fell 31% year-to-date. - Institutional holders offloaded 0.5% of PEPE holdings amid bearish technical indicators, while some long-term investors predict a new all-time high. - Cross-chain activity highlights volatile memecoin dynamics, with whales shifting focus to ASTER as Coinbase restructures in Texas over regulatory concerns. - Technical analysts warn of continued losses as PEPE forms a "bea

South Korea Seeks to Compete with USD Stablecoins Through Blockchain-Based VAT Reimbursements

- NH NongHyup Bank tests VAT refund system using stablecoin tech with Avalanche , Fireblocks, Mastercard , and Worldpay. - Aims to challenge USD stablecoin dominance by streamlining cross-border refunds via blockchain automation. - South Korea’s FSC plans KRW-pegged stablecoin rules by year-end, restricting non-bank issuers. - Domestic stablecoin transactions exceed $41B, as major banks collaborate on won-backed infrastructure. - Pilot could redefine cross-border payments with faster processing and reduced