Visa Connects Conventional Finance and Blockchain with Real-Time Stablecoin Payments

- Visa launches stablecoin payout pilot, enabling instant cross-border transfers to crypto wallets via Visa Direct, targeting freelancers in emerging markets. - The program converts fiat to USD-backed stablecoins like USDC , addressing delays and volatility while leveraging blockchain for transparency and auditability. - Aligning with growing stablecoin adoption, Visa aims to bridge traditional finance and decentralized systems, competing with Mastercard's crypto initiatives and a $670B market potential. -

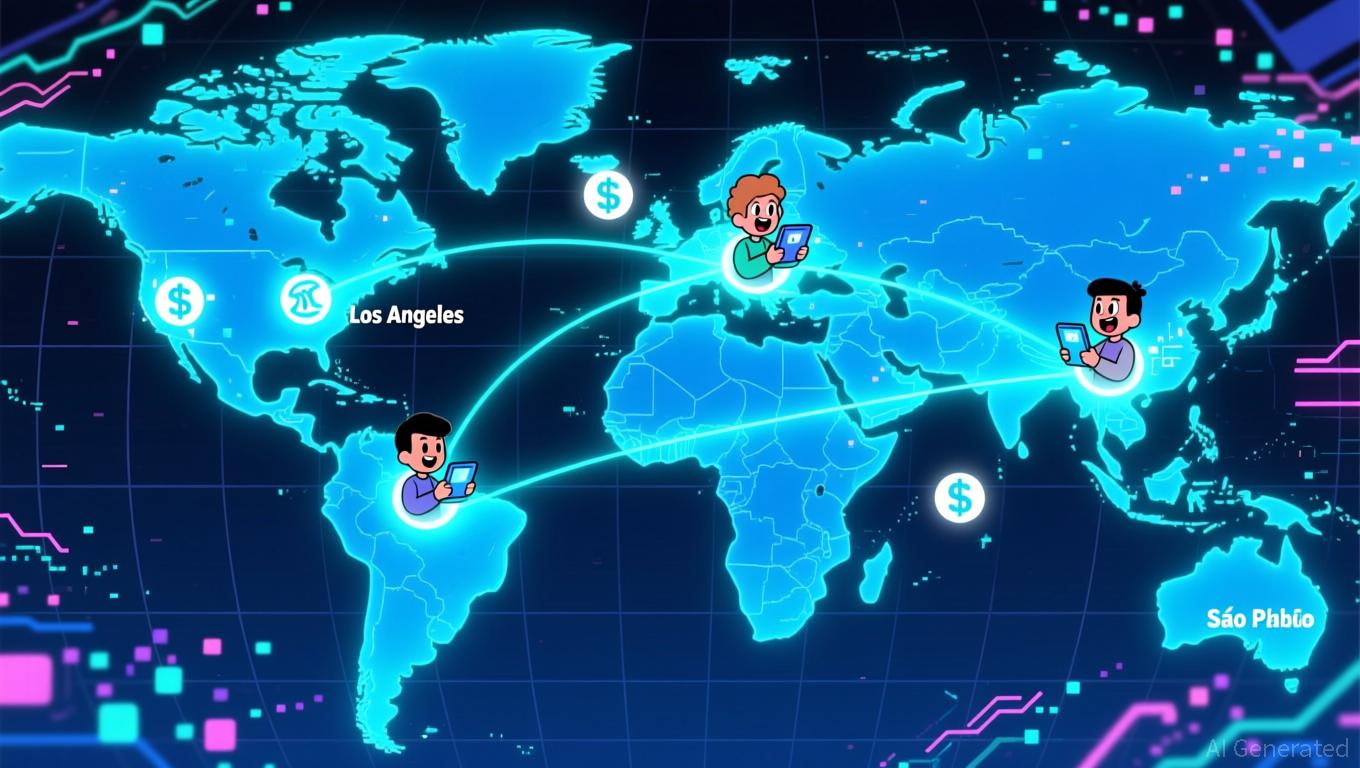

Visa Inc. (NYSE: V) has introduced an innovative pilot project enabling businesses to send stablecoin payments straight to recipients' crypto wallets, representing a major advancement in merging conventional finance with blockchain. Announced at the Web Summit in Lisbon, this program is designed for global freelancers, gig economy workers, and digital creators—especially in regions where unstable currencies and limited banking access create obstacles, as

This pilot seeks to resolve persistent issues in international payments. For example, content creators on platforms like TikTok and Uber often encounter delays in receiving their earnings due to banking schedules or currency exchange complications.

This effort aligns with the rising interest in stablecoins, which are increasingly viewed as a dependable alternative to more volatile digital currencies. In places like Bolivia, where inflation has fueled USDC adoption, the pilot could offer recipients a stable way to store value, as

Visa referenced a 2025 Creator Economy Report, which found that 57% of digital creators consider instant access to funds a top priority when choosing payment options, as

Visa’s stablecoin initiatives are part of a broader industry transformation. Earlier this year, the company rolled out a pre-funding pilot that lets businesses use stablecoins for international transactions, as

Regulation remains a central concern. While the pilot broadens access to stablecoin payments, issues around anti-money laundering, tax compliance, and consumer safeguards remain unresolved, as

This announcement comes as Visa and Mastercard are close to finalizing a landmark settlement in a two-decade dispute over merchant fees, which could lower interchange costs and give retailers more authority to decline rewards cards, as

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: SEC Approval of XRP ETF May Spark $5 Price Jump, Echoing Bitcoin ETF Surge

- XRP's potential surge hinges on SEC ETF approval and Fed rate decisions, with analysts projecting $5+ prices if institutional demand mirrors Bitcoin/Ethereum ETF trends. - Ripple's global liquidity network expansion and $500M institutional backing strengthen XRP's case, while technical indicators suggest $2.60-$2.70 as key near-term thresholds. - Market risks include Fed policy impacts, AI/meme coin competition, and whale inactivity, though $100B ETF volume projections could drive a 2024-2026 rally to $5

Trailblazers Forge Mina’s Mesa Route: Joint Testing Transforms Blockchain Advancements

- Mina Protocol's "Mesa" upgrade introduces faster block slots, expanded on-chain limits, and automated hard forks to enhance performance and developer capabilities. - The five-phase testing plan includes internal validation, testnet experiments, and incentivized community trials to ensure seamless mainnet deployment. - Automated upgrades and expanded zkApp support aim to reduce operational complexity while maintaining network security and accessibility for node operators. - Collaborative testing through T

Ethereum News Today: "Ethereum Giants Face Off: $37 Million Long Position Battles $9.9 Million Short in High-Risk Hyperliquid Wager"

- Ethereum whales opened $37M long and $9.9M short positions with 25x leverage on Hyperliquid, highlighting crypto's high-stakes trading dynamics. - Hyperliquid's deep liquidity and transparent execution attract large players using stablecoins to fund leveraged positions amid volatile markets. - Technical analysis shows Ethereum facing resistance at key levels, while macroeconomic factors like US-China tensions drive risk-averse trading behavior. - Experts warn high-leverage positions risk rapid liquidatio

Hyperliquid News Today: DeFi 'Degen Warfare' Erupts: POPCAT Exploit Results in $4.9M Loss for Hyperliquid

- Hyperliquid suffered a $4.9M loss from a POPCAT token manipulation attack orchestrated by a single trader exploiting thin liquidity and automated risk systems. - The attacker used 19 wallets to inflate POPCAT's price before liquidity removal triggered cascading liquidations, forcing Hyperliquid's HLP to absorb remaining losses. - POPCAT's price dropped 19% in 24 hours to $0.1262, exposing vulnerabilities in DeFi platforms' ability to prevent market manipulation in low-liquidity memecoin markets. - This f