Taiwan May Add Bitcoin to National Reserves — Lawmakers Push for Full Audit by Year-End

Taiwan’s legislature is pushing the government to audit its Bitcoin holdings and explore adding BTC to national reserves. Premier Cho Jung-tai has pledged a full report by year-end as lawmakers warn against overreliance on the US dollar. With global momentum building—from Trump’s Strategic Bitcoin Reserve to multiple US state reserve bills—Taiwan now weighs whether digital assets should play a role in its financial future.

Taiwan’s legislature has urged the government to audit its Bitcoin holdings and consider the cryptocurrency for strategic reserves, potentially diversifying away from its reliance on the US dollar. Premier Cho Jung-tai, responding to legislative pressure, has pledged a detailed report by the end of the year.

This initiative follows growing international momentum for Bitcoin reserves, with several US states and leading financial bodies exploring diversifying into digital assets.

Lawmakers Seek Bitcoin Audit and Reserve Strategy

On Tuesday, Kuomintang legislator Ju-Chun Ko raised concerns about Taiwan’s heavy exposure to the US dollar and the growing relevance of digital currencies during a Legislative Yuan session.

As of September 2025, Taiwan’s foreign exchange reserves totaled $602.94 billion, according to the Central Bank of the Republic of China. Over 90% of these assets are in US dollars, which lawmakers argue puts Taiwan at increased risk from currency fluctuations and policy changes.

Ko warned that over-reliance on the US dollar exposes Taiwan to the risk of currency depreciation if the dollar weakens or the New Taiwan dollar gains value. Such trends could erode the purchasing power of reserves, threaten stability, and challenge macroeconomic resilience.

Ko also called for an immediate inventory of all government-held Bitcoin, including assets seized in legal cases. In 2024, Taiwanese prosecutors confiscated around $146 million in cryptocurrency in a major fraud case, highlighting the potential value of government-held digital assets.

Taiwan’s legislator Ju-Chun KO of Kuomintang asks questions of the Central Bank Governor Yang Chin-long and the government Premier Cho Jung-tai during a Legislative Yuan session. Source: courtesy of Ju-Chun KO

Taiwan’s legislator Ju-Chun KO of Kuomintang asks questions of the Central Bank Governor Yang Chin-long and the government Premier Cho Jung-tai during a Legislative Yuan session. Source: courtesy of Ju-Chun KO

Ko added that confiscated Bitcoin from legal cases should be held for potential strategic use rather than quickly liquidated. This policy would help Taiwan build a digital reserve base, particularly as regulations evolve.

Premier Cho Jung-tai noted that while the US dollar is still the dominant settlement currency globally, the government remains open to evaluating emerging digital assets. Central Bank Governor Yang Chin-long committed to providing an updated, balanced report on a Bitcoin reserve strategy by year-end 2025.

Global Momentum for Bitcoin Strategic Reserves

Taiwan’s exploration of Bitcoin reserves reflects a global shift. On March 6, 2025, President Donald J. Trump signed an executive order establishing the Strategic Bitcoin Reserve and the United States Digital Asset Stockpile.

Several US states are also advancing their own Bitcoin reserve laws. The BITCOIN Act of 2025, led by Senator Cynthia Lummis, instructs the US Treasury to purchase up to one million Bitcoin over five years, requiring secure storage with a minimum 20-year holding period.

The National Conference of State Legislatures reports that many states have proposed or passed cryptocurrency strategic reserve bills in 2025. Ko referenced 18 US states, including New Hampshire, Arizona, and Texas, that have already integrated Bitcoin into reserve policies.

Deutsche Bank analysts project that Bitcoin could become a core financial asset by 2030, achieving a reserve status similar to that of gold. Such forecasts have strengthened arguments for Bitcoin adoption among global central banks.

Regulatory Delays and Taiwan’s Global Position

While reserve planning advances, Taiwan faces regulatory hurdles for digital assets. Legislator Ko criticized slow progress on the Virtual Asset Service Provider specialty law, cautioning that uncertainty could threaten industry growth and dampen Taiwan’s role in digital finance.

Nine cryptocurrency platforms are regulated in Taiwan, but further delays in comprehensive VASP legislation may impede development and limit fintech opportunities.

Internationally, frameworks such as the US GENIUS Act and Singapore’s digital asset standards provide comprehensive models for cryptocurrency oversight. Ko encouraged a cooperative framework between banks and VASPs, rather than a hierarchical approach, to support innovation.

As the Central Bank prepares its year-end evaluation, the debate highlights larger questions of financial autonomy in an increasingly digital world. The government’s response will show whether Taiwan will diversify its reserves or hold to traditional assets as global finance evolves.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

WaFd: Overview of First Fiscal Quarter Results

Net zero efforts to reduce dependence on China ‘could endanger 90,000 jobs’

Major Banks Flag Mixed Signals in Consumer Credit as Card Losses Edge Higher

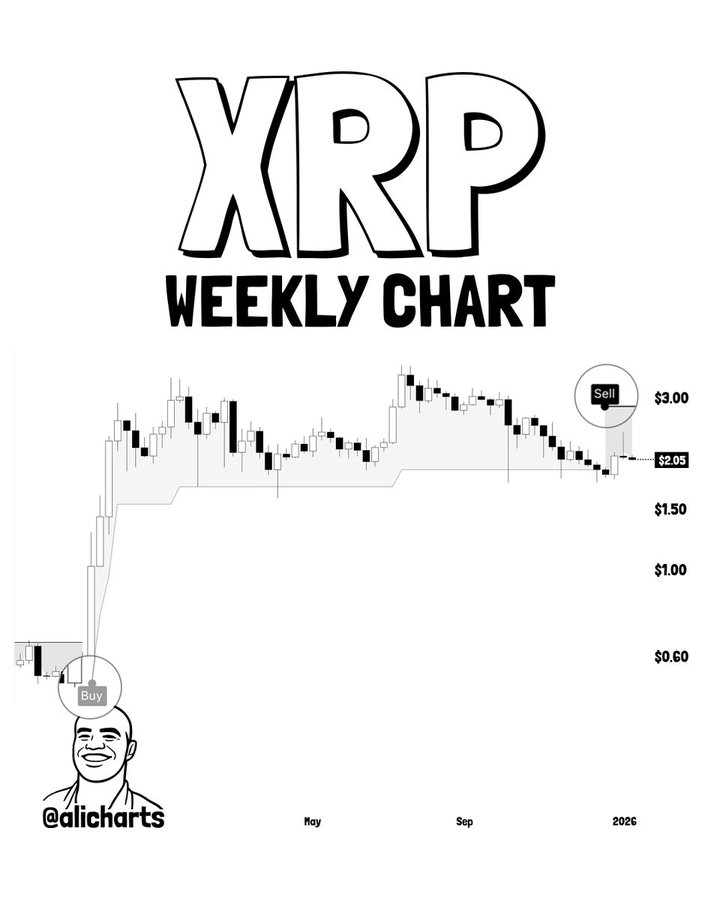

XRP In A ‘Super Cycle’? SuperTrend Suggests Another Story