When Can XRP Price Bounces Turn Into Rallies? One Level Holds the Answer

XRP is showing strength after a fresh bounce, but the price still struggles to turn these quick moves into a real trend shift. The charts reveal one level that continues to block every breakout attempt — and why selling pressure and OBV behavior are still shaping the entire setup.

XRP price is up a little over 4% in the past 24 hours, but this bounce is not enough to call a trend change. XRP has posted several sharp moves of 15% to 20% in recent weeks, yet each one faded before turning into a real rally.

The charts show why these bounces keep failing, and the one level that decides whether this attempt can finally break through.

Repeated Bounce Pattern Forms, but Selling Still Limits Momentum

For weeks, XRP has reacted each time the market’s buying and selling pressure — measured through the On-Balance Volume (OBV) indicator — has pushed against the same downward trendline. OBV tracks whether volume is flowing in or out of the asset, and its trend often leads price.

Since 14 October, OBV has formed a line of lower highs. Every time OBV moves close to that line, XRP gets a bounce.

One move lifted XRP 14.73% between 22 and 26 October. Another pushed the price more than 20% on 6 November. A similar approach toward this trendline is happening now. That surge in volume could be due to the ETF buzz.

XRP Price Responds To Volume:

TradingView

XRP Price Responds To Volume:

TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

But this pattern also explains why each rally faded. Without OBV closing above the trendline, momentum stays weak. XRP needs that breakout first before any bounce can turn into a sustained move.

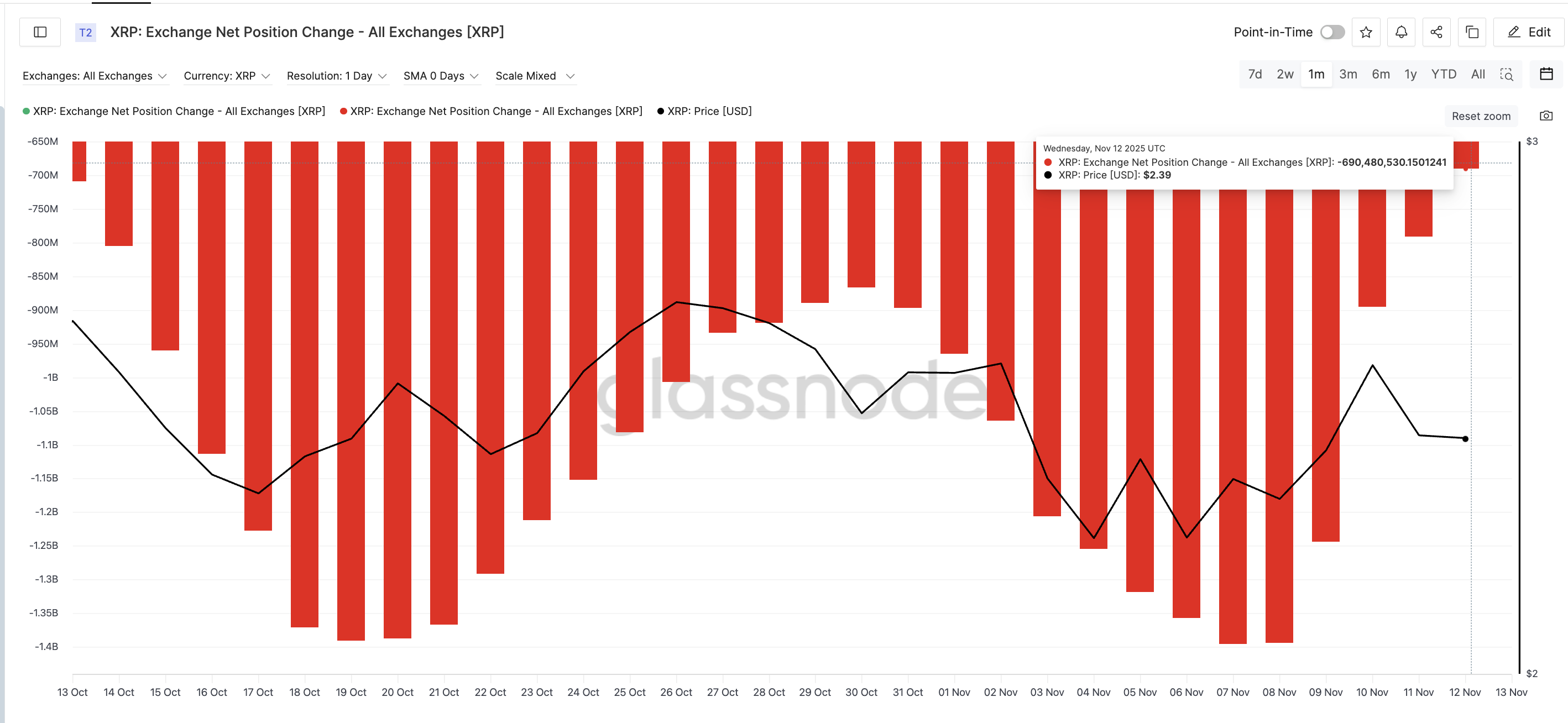

At the same time, fresh selling pressure limits the upside. Exchange data shows outflows — which help price — were strong until 7 November at roughly -1.39 billion XRP. As of 12 November, outflows have shrunk to about -690 million XRP, nearly a 50% drop.

Net Outflows Weaken:

Glassnode

Net Outflows Weaken:

Glassnode

This means more tokens are remaining on exchanges, where they can be sold, making it harder for XRP to extend gains.

Key Supply Wall Still Controls XRP Price Breakout Window

The next question is simple: when can XRP’s bounces finally turn into a proper rally?

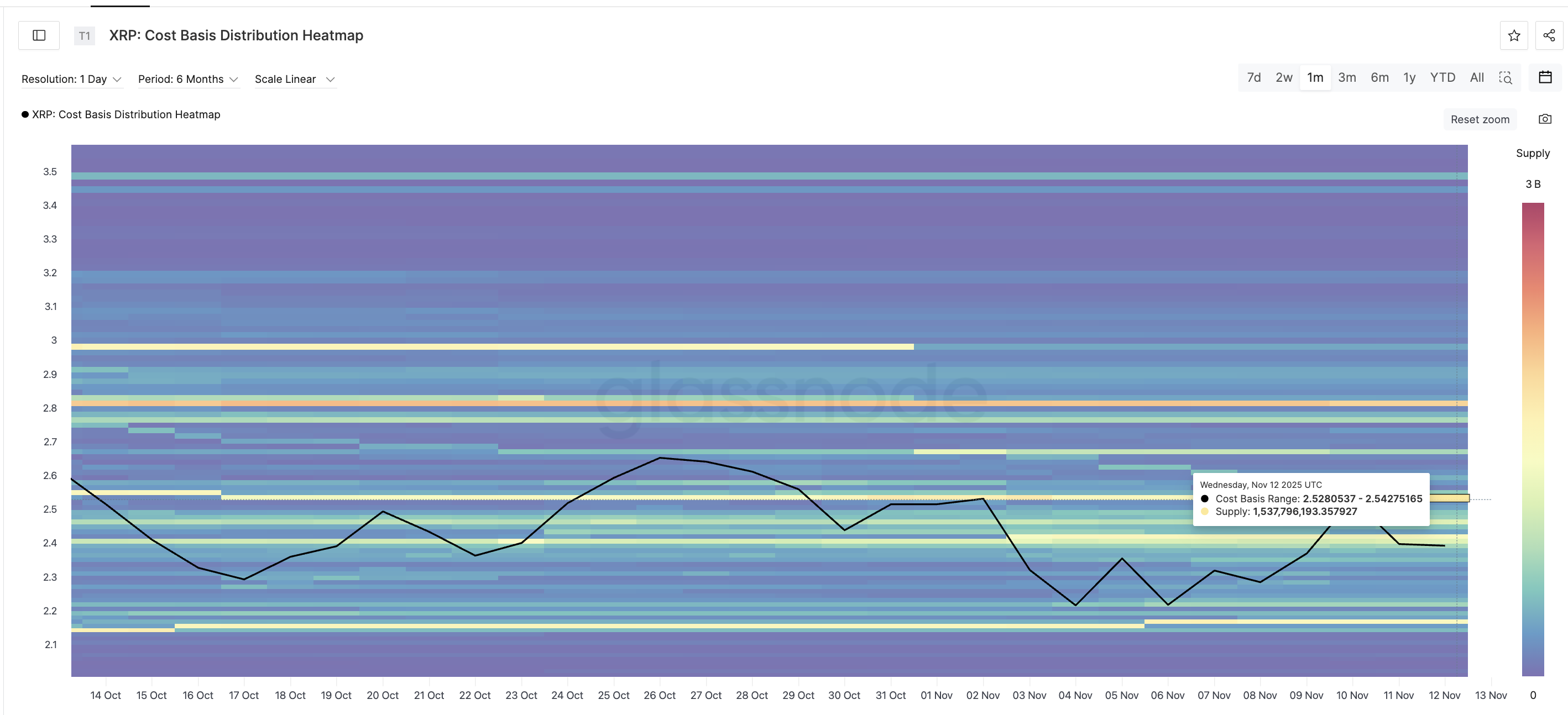

The answer sits on the cost-basis heatmap, which highlights where the biggest supply clusters sit. One of the strongest walls lies between $2.52 and $2.54, backed by about 1.53 billion XRP. This band has stopped every breakout attempt since early November.

Supply Wall Sits Higher:

Glassnode

Supply Wall Sits Higher:

Glassnode

To break the pattern, XRP needs a clean daily close above $2.56, not just a wick. That move would clear the supply block and confirm buyers have absorbed the pressure that has capped the chart for weeks.

If this happens while OBV also breaks its trendline, the move becomes much stronger. That would open the next target at $2.69, where the next major reaction zone sits.

XRP Price Analysis:

TradingView

XRP Price Analysis:

TradingView

The invalidation level remains at $2.21. A close below it would weaken the entire setup and expose $2.06, especially if exchange outflows drop further and selling returns. For now, XRP price is showing strength, but the story is the same: bounces stay bounces until XRP closes above $2.56. Only then can a true rally begin.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ICP Network Expansion and Institutional Embrace in November 2025: Optimal Moment for Pioneering Investment in the Decentralized Infrastructure Transformation

- ICP Network's $4.27B market cap and deflationary model attract investors as it gains traction in Web3/Industry 4.0 adoption. - Coinbase listing speculation and 15% DeFi growth boost momentum, while Microsoft/Google Cloud partnerships enhance industrial IoT scalability. - ICP DAS-BMP's medical TPU innovations and IIoT solutions position the network as a cross-industry infrastructure leader with institutional adoption. - November 2025 marks strategic entry timing as price corrections create discounted acce

Bitcoin News Update: Institutional Embrace Transforms Cryptocurrency from a Speculative Play to a Strategic Investment

- RockToken introduces infrastructure-backed crypto contracts, offering tiered Bitcoin/Ethereum yields to bridge traditional finance and digital assets. - American Bitcoin reports $3.47M Q3 profit but shares drop 13% as Bitcoin dips below $100,000 amid ETF outflows totaling $870M on Nov 14. - Czech National Bank tests $1M digital asset portfolio (Bitcoin, stablecoins), signaling EU regulators' cautious exploration of blockchain-based assets. - Technical analysis warns Bitcoin could fall to $86,000 if it br

Ethereum Latest Updates: Mining Tycoon Transfers $11 Million in ETH—Strategic Liquidity Shift or Threat to Market Stability?

- F2Pool co-founder Wang Chun deposited 3,500 ETH ($11.16M) to Binance amid crypto market volatility. - Analysts suggest large transfers often precede liquidity needs or hedging strategies during price fluctuations. - F2Pool's hash rate fluctuations reflect broader mining industry challenges with energy costs and regulations. - Regulators intensify AML monitoring of major crypto transfers, raising concerns about market stability risks. - Binance's derivatives expansion aims to attract institutional investo

Danish startup FlatPay has become one of the European fintech unicorns to watch