HBAR Heads Toward a Crash Site — One Level Stands Between Price and the Fall

HBAR sits on the edge of a bearish breakdown. One key level, at $0.160, decides whether the head-and-shoulders pattern completes or gets invalidated.

HBAR price is down almost 1% today and has traded flat over the past month. It is up 5.7% in the last seven days, but that bounce does not change the bigger picture.

The chart is close to forming a bearish structure that points to a deeper drop unless one level holds.

Bearish Pattern Forms as Two Risks Amplify

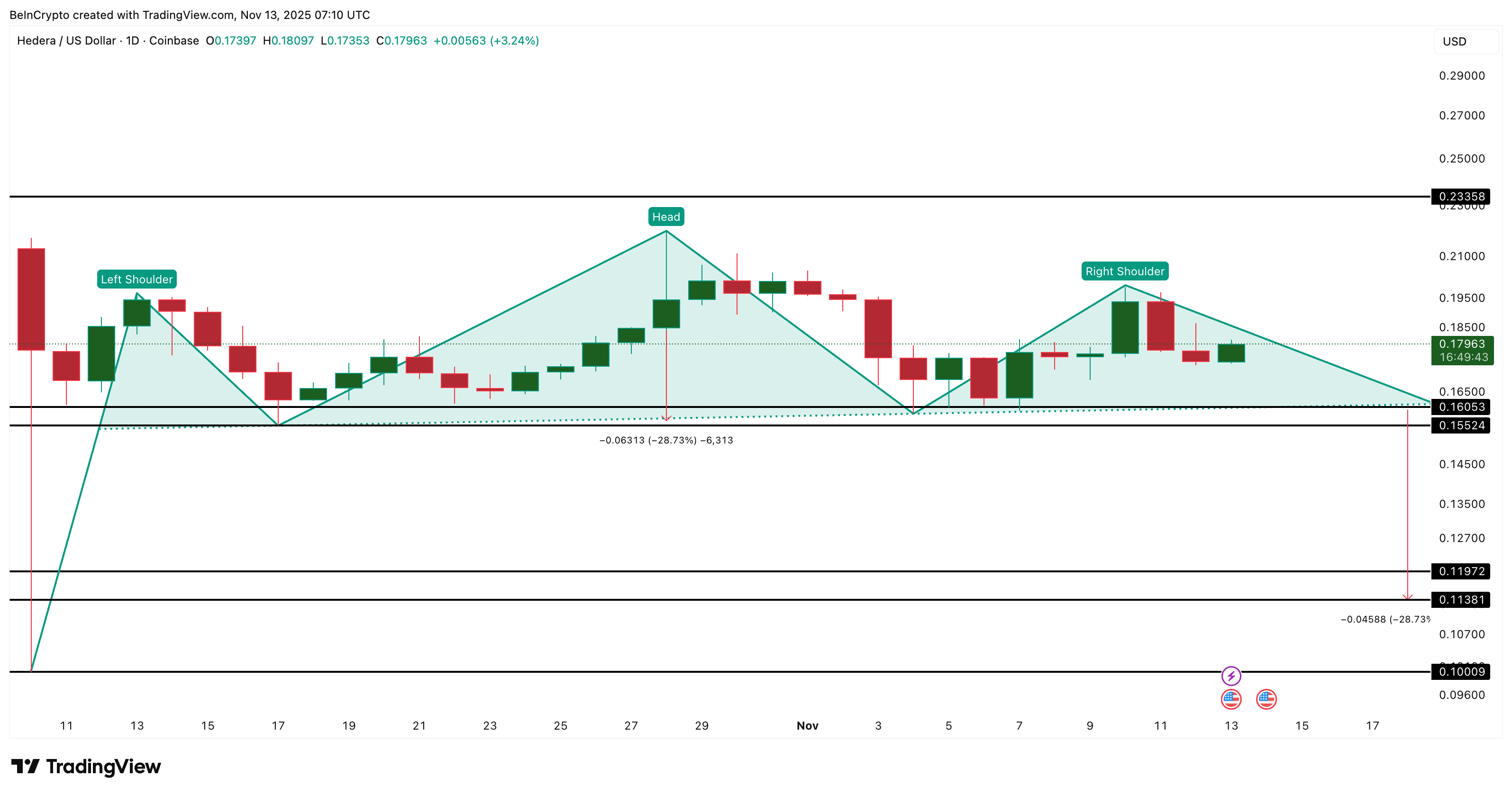

HBAR is close to completing a head-and-shoulders pattern on the daily chart. If price slips below the neckline, the setup signals a potential 28% decline. This pattern is not confirmed yet, but it sits near completion — and the next moves depend heavily on volume behavior.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Head And Shoulders Pattern At Work:

TradingView

Head And Shoulders Pattern At Work:

TradingView

That brings the focus to On-Balance Volume (OBV), a tool that tracks whether volume is flowing into or out of the asset. OBV has been rising slowly along an ascending trendline since 23 October, but this is not a strong signal.

Each time OBV drifts toward the lower edge of this trendline, HBAR price pulls back, showing that buyers are barely holding momentum. OBV is now back at the edge again, which increases the risk of a breakdown. If OBV slips under this line, the head-and-shoulders setup gains momentum.

HBAR Needs Volume Support To Avoid Crash:

TradingView

HBAR Needs Volume Support To Avoid Crash:

TradingView

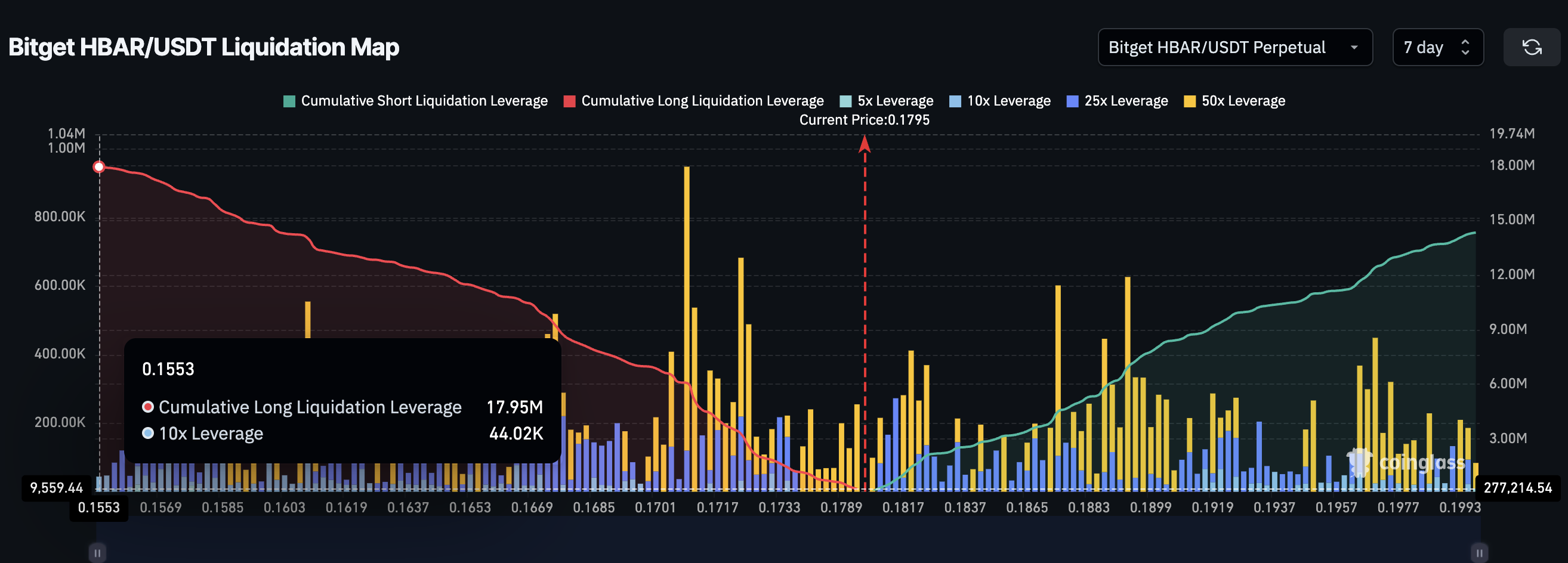

A second risk comes from the leverage map. Over the past seven days on Bitget alone:

- Long liquidations: 17.95 million

- Short liquidations: 14.34 million

Long Squeeze Risk Exists:

Coinglass

Long Squeeze Risk Exists:

Coinglass

Longs outweigh shorts by almost 25%, which leaves the market exposed. If price reaches the neckline, led by weak OBV, a long squeeze could kick in, accelerating the downside.

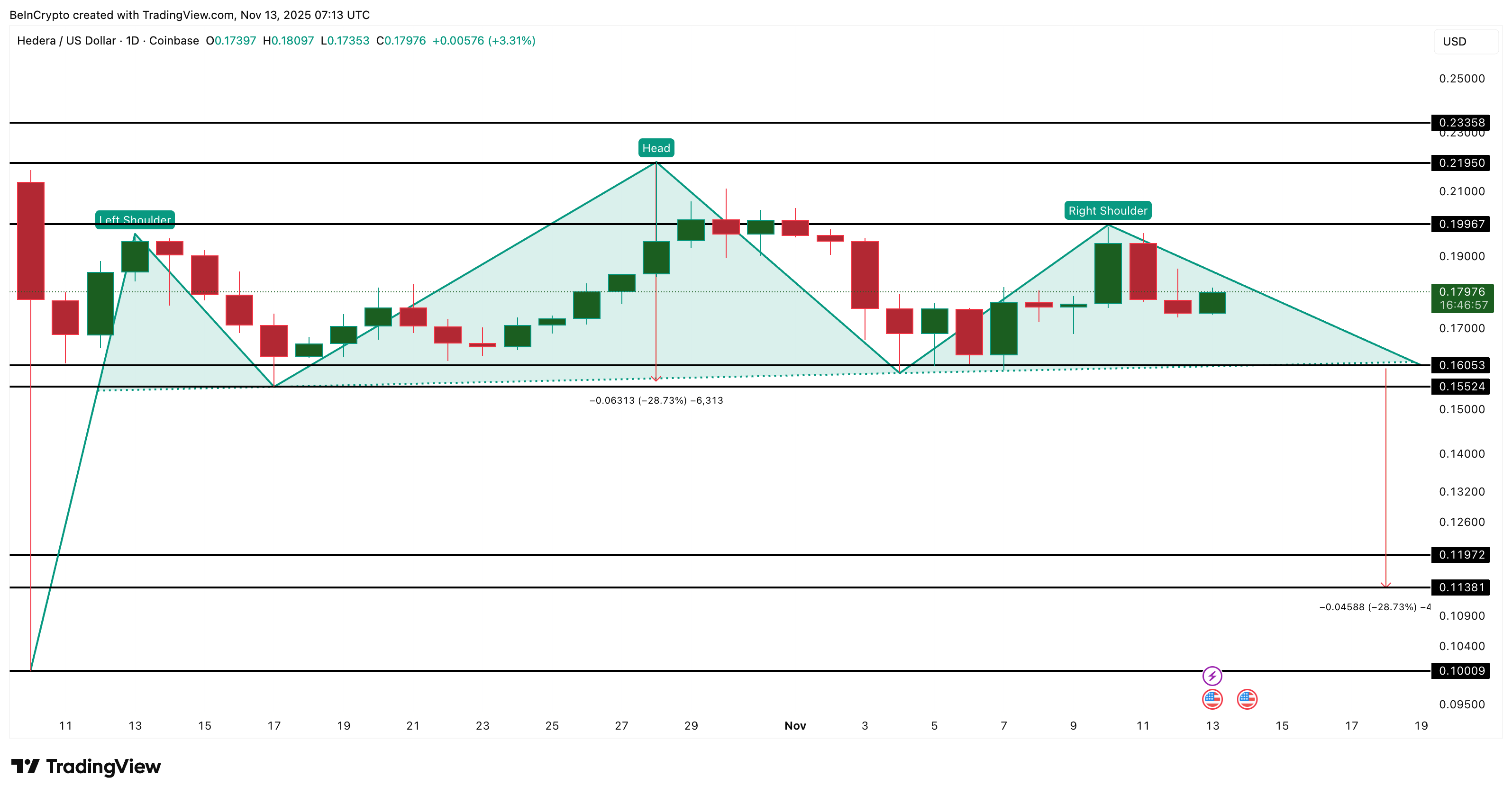

Key Levels Now Decide Whether HBAR Price Drops or Escapes

HBAR now comes down to two paths:

Bearish path (likely if the neckline breaks): The neckline of the head-and-shoulders pattern sits near $0.160. A clean drop below it completes the structure and exposes a 28% fall, with the HBAR price chart pointing toward $0.113 and even $0.100 if long liquidations cascade.

Bullish path (only if reclaimed): A recovery starts only if HBAR reclaims $0.199 with strength. A full invalidation happens at $0.219, which erases the pattern and shifts momentum back to buyers.

HBAR Price Analysis:

TradingView

HBAR Price Analysis:

TradingView

For any bullish scenario to hold, OBV must stay above its ascending trendline. If OBV fails, the neckline breaks faster — and the long squeeze risk increases sharply. For now, the HBAR price is heading toward a crash site, with one level ($0.160) still standing between the price and the fall.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: ARK Invest Remains Committed to Cryptocurrency While Wider Markets Decline

- ARK Invest added $39M to crypto-linked stocks (Bullish, Circle , BitMine) via ETFs during market declines, defying broader pessimism. - Largest single-day purchase ($16.9M in Bullish) followed 3.6% stock drop, while Circle and BitMine saw similar "buy the dip" strategies. - This contrasts with $3.79B net outflows from U.S. Bitcoin ETFs in November, as Bitcoin fell 30% from its peak to $91,700. - ARK maintains long-term crypto optimism , lowering 2030 BTC price target to $1.2M from $1.5M while expanding h

Bitcoin Latest Updates: ARK Invest Seizes Opportunity Amid Crypto Slump While ETFs See $3.8B Withdrawn in November

- ARK Invest increased crypto exposure by buying $39.6M in Bullish, Circle , and BitMine amid market declines. - The firm added 1.16M Bullish shares ($73.85M) and expanded Coinbase/Rollinhood holdings despite Bitcoin's 30% drop. - November saw $3.79B in crypto ETF outflows, with BlackRock's IBIT recording $523M in single-day redemptions. - ARK's "buy the dip" strategy contrasts with institutional bearishness, as Bitcoin's fourth death cross signals prolonged pessimism.

Grayscale: Chainlink’s Middleware Powers the Integration of Crypto and Traditional Finance, Speeding Up the Adoption of Tokenization

- Grayscale's report highlights Chainlink as a bridge connecting blockchain finance with traditional systems through cross-chain infrastructure. - UBS executed first onchain fund redemption via Chainlink's CCIP, demonstrating blockchain integration in $100T fund operations. - General TAO Ventures uses Chainlink to tokenize Bittensor's subnet tokens into ERC-20 assets, expanding DeFi access while preserving architecture. - LINK's $11.65 support level and technical indicators suggest market volatility, but G

Bitcoin News Update: Bitcoin Eyes $82K—Volatility and Regulatory Shifts Challenge Institutional Trust

- Citi's $82,000 Bitcoin price target sparks debate over crypto's long-term potential amid ETF inflows and institutional adoption. - BitMine and GSR expand institutional tools, with BitMine launching a U.S.-based Ethereum validator network in 2026. - Bitcoin faces volatility despite Saylor's continued accumulation, while Ethereum struggles with liquidity and waning dominance. - Regulatory fragmentation and macroeconomic factors remain critical risks for crypto's institutional growth trajectory.