Bitfarms Shifts to AI, Reports $69M Q3 Revenue

- Bitfarms shifts focus to AI infrastructure for increased income.

- Reports strong Q3 revenue of $69 million.

- Impacts Bitcoin mining operations, targets transformation by 2026.

Bitfarms reported $69 million in Q3 revenue amid a major shift from Bitcoin mining to AI infrastructure. Led by CEO Ben Gagnon, the company aims to convert its Washington facility, potentially increasing income with GPU-as-a-Service operations by 2026.

Points Cover In This Article:

ToggleBitfarms has announced a strategic shift toward artificial intelligence infrastructure, reporting $69 million in revenue for the third quarter.

Transition to AI Infrastructure

Bitfarms is transitioning from Bitcoin mining to high-performance computing and artificial intelligence infrastructure. CEO Ben Gagnon stated the Washington facility will be converted to GPU services by 2026. This shift aims to increase income beyond historic Bitcoin mining revenues.

“We believe the conversion of just our Washington site to GPU-as-a-Service could potentially produce more net operating income than we have ever generated with Bitcoin mining.” — Ben Gagnon, CEO, Bitfarms.

Impact on Cryptocurrency Industry

The decision impacts the cryptocurrency industry, particularly Bitcoin mining, as Bitfarms reported lower BTC production and rising costs. The company’s liquidity stands at $814 million with substantial infrastructure investments planned. Shifts in digital asset focus could affect mining profitability and market dynamics.

Broader Industry Trends

Bitfarms’ strategic shift reflects broader industry trends as companies adapt to rising costs and hardware demands. The transition entails extensive capital usage converting mining assets to AI infrastructure, intending to enhance revenue through advanced computing services.

Financial Outlook

Financially, Bitfarms reported Q3 operational losses but maintains liquidity from deal agreements. The transition expects to provide continuous cash flow by 2026, impacting financial structures and operating strategies as Bitfarms winds down its Bitcoin mining business.

Investors reacted with caution, reflected in stock price declines, regarding the feasibility and return on investment from this transformation. Although without direct regulatory updates, Bitfarms’ shift emphasizes the evolving cryptocurrency landscape and how businesses adapt to technological advancements and market demands.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

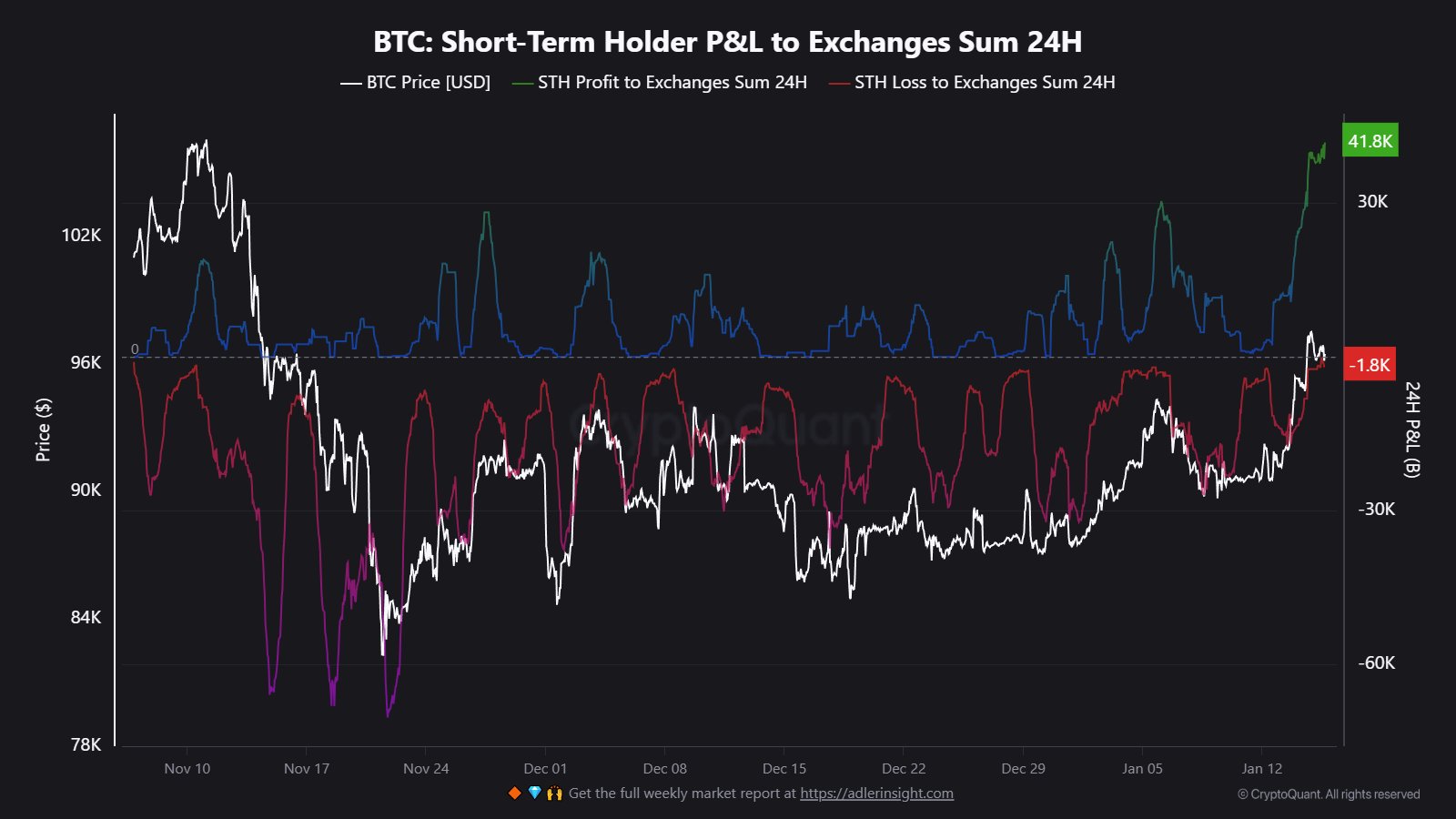

Bitcoin Short-Term Holders Take Profits: 41,800 BTC Sent To Exchanges

ZKP Shows Growing Momentum With 100x ROI Projections: Is It the Top Crypto to Buy in 2026?

Weekly Crypto Gainers – Dash Up 129%, Monero and ICP Post Double-Digit Rallies

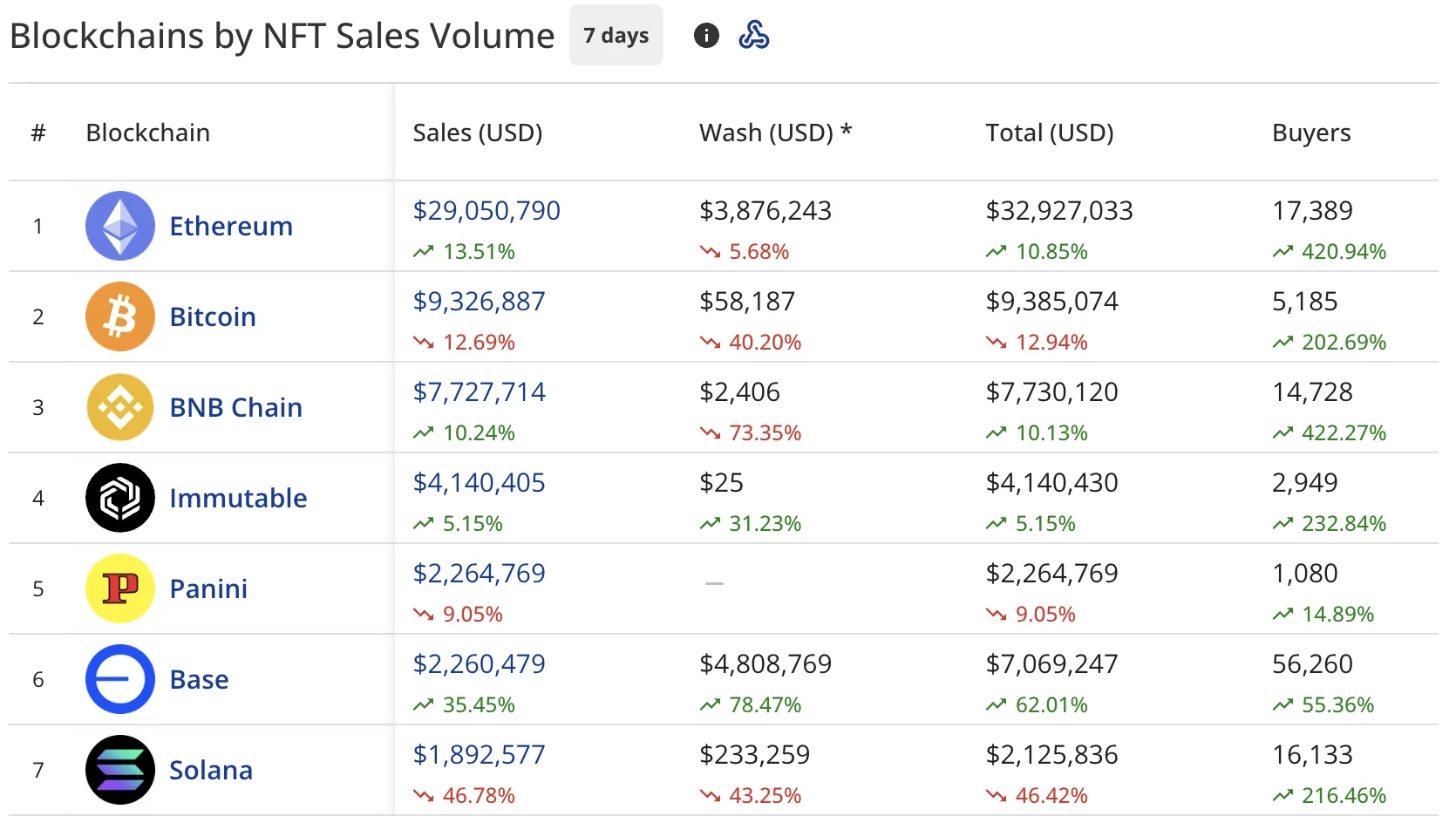

NFT buyers rise 120% despite sales staying flat at $61.5 million