What Are the Core Fundamentals of the Best Crypto to Buy Now? (An $NNZ Coin Analysis)

Every successful crypto project begins with strong fundamentals that can support real growth. Traders who recognize them early often see the biggest rewards later.

Points Cover In This Article:

ToggleOne project that is drawing attention for its structure and transparency is Noomez ($NNZ).

Understanding the Core Fundamentals of the Best Crypto to Buy Now

The strongest crypto projects share a few key fundamentals that determine their long-term success. These include transparent tokenomics, real demand, active community growth, and mechanisms that prevent inflation.

A token’s structure should be visible from the start, with clear allocation and a defined roadmap. Projects that hide supply details or delay public audits often struggle to gain trust.

Strong fundamentals also depend on scarcity. When tokens are limited or burned over time, each remaining unit becomes more valuable as demand increases.

Utility plays an equally important role, since coins that reward holders or offer staking options create steady buying pressure. Transparency through verified wallets and open dashboards builds investor confidence and attracts larger buyers.

These traits separate sustainable tokens from short-lived hype coins, which is why studying fundamentals is the first step toward identifying the best crypto to buy now for 2025 before major growth begins.

How Noomez ($NNZ Coin) Aligns With Strong Market Fundamentals

The Noomez token ($NNZ) is proving how solid fundamentals can drive real investor confidence. The project recently entered Stage 3 at $0.0000151, and interest has surged as traders recognize its structured design.

Key details:

- 28 total stages before launch.

- Unsold tokens are burned after each stage.

- Price path: $0.00001 to $0.0028.

- Real-time tracking through the Noom Gauge.

This design gives investors a clear roadmap and visible progress at all times. The deflationary supply ensures that each stage makes the Noomez token more scarce, while transparency keeps trust high.

With Stage 3 already filling fast, Noomez continues to demonstrate why fundamentals and timing create the perfect storm for early movers.

Inside the Numbers: What Drives Noomez’s Growth Potential

- Total Supply: Noomez has a fixed supply of 280 billion $NNZ, meaning no extra tokens will ever be created. This fixed limit keeps inflation under control and strengthens long-term price potential.

- Liquidity Pool (15%): A portion of the total supply is locked at launch to support stable trading. Locked liquidity prevents sudden dumps and secures trust among holders.

- Staking Pool (5%): Designed to reward loyal holders who lock their $NNZ over time. Staking reduces circulating supply and adds a passive income layer for investors.

- Referral and Reward Pools (10%): These include the 5% Recruit and 5% Burn Reserve pools. Together they fund bonuses, burns, and giveaways that keep the community engaged and supply deflationary.

Why Timing and Fundamentals Work Together with Noomez Coin

Noomez adds real follow-through after its early offering through the Noom Engine, where vetted partners distribute portions of their tokens directly to $NNZ holders. That creates an ongoing stream of value tied to holding.

Staking rewards funded by a 5% pool unlock 30 days after launch, which helps keep supply tight while new buyers arrive. Two Vault milestones raise the stakes further. Stage 14 pays 14,000,000 $NNZ, while Stage 28 delivers 28,000,000 $NNZ plus NFTs and USDT rewards.

Each completed stage lights the Noom Gauge and moves the community closer to those drops. With Stage 3 already drawing steady entries, waiting means paying a higher price at the next step and receiving fewer tokens for the same spend.

For traders still asking what is the best crypto to buy right now, the blend of scarcity, timed rewards, and post-launch utility makes Noomez a compelling choice.

Pro Tip: The best projects explain exactly how they work. If it’s vague or overhyped, think twice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

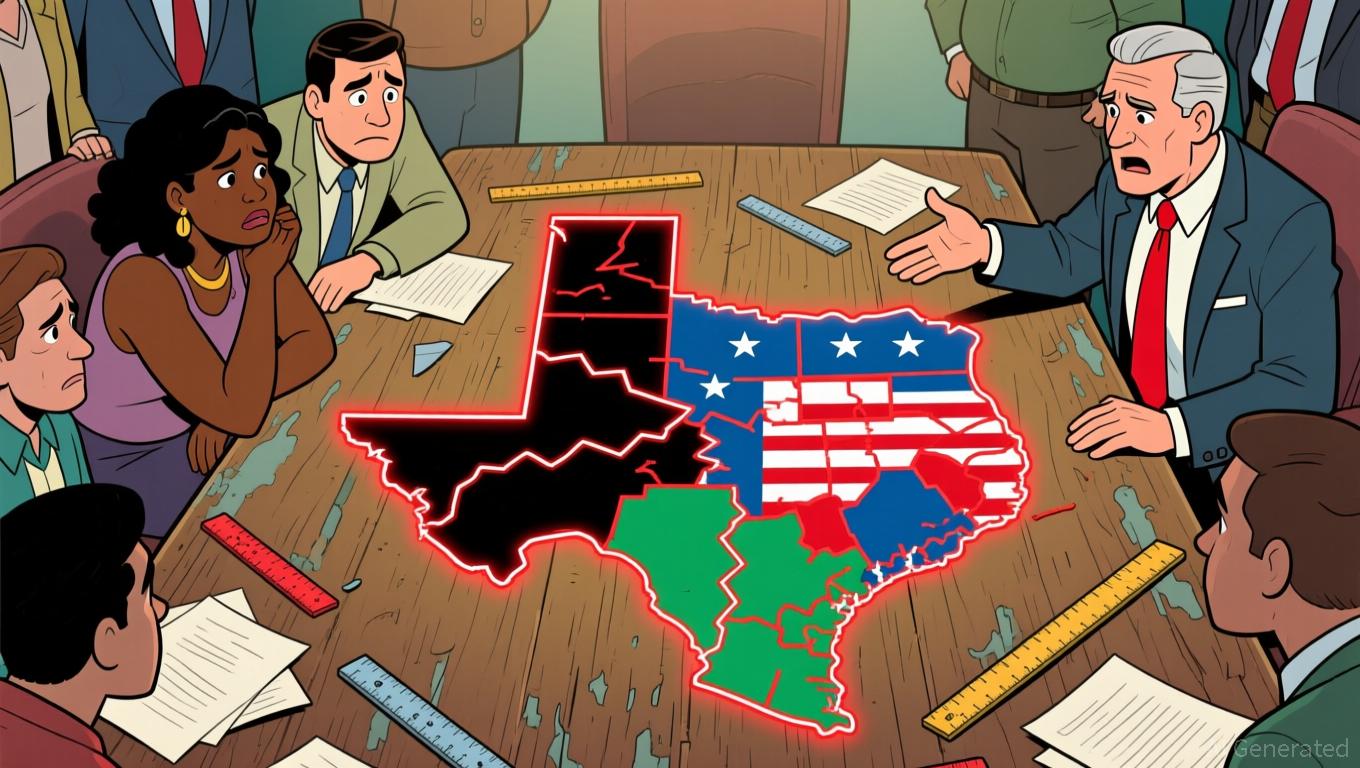

Supreme Court Decision Challenges Party Tactics in Racial Gerrymandering Cases

- Supreme Court Justice Alito blocked a lower court ruling that found Texas' 2026 redistricting plan racially discriminatory, preserving its implementation for the 2026 midterms. - Texas argued the lower court erred by conflating political and racial motivations, citing logistical challenges of changing the map 91 days before the primary. - The case tests boundaries between partisan strategy and racial gerrymandering, with LULAC criticizing the Supreme Court's pause as undermining fair representation for m

XRP News Today: Death Cross Emerges: XRP's Sharp Decline Highlights Broader Crypto Market Fragility

- XRP's price fell below $2.20 on Nov 19, 2025, signaling a "death cross" technical pattern linked to prolonged declines. - The bearish crossover of 50-day and 200-day EMAs suggests intensified selling pressure and potential 55% drop to $1.25. - The decline mirrors weakness in Bitcoin and Ethereum , reflecting systemic crypto market fragility amid macroeconomic and regulatory risks. - Analysts warn of erratic crypto behavior near key levels, emphasizing unpredictable volatility during this bearish phase.

XRP News Today: The Growth of Crypto: Institutional Funding Compared to Market Fluctuations and Risks of Delisting

- Bitwise launches XRP ETF (XRP) to offer institutional exposure to Ripple's blockchain, navigating risks like token depreciation and market volatility. - ARK Invest defies crypto pessimism by injecting $39M into crypto-linked stocks, adjusting its 2030 Bitcoin price target to $1.2M from $1.5M. - Coinbase acquires Solana-based DEX Vector (ninth 2025 deal), aiming to become an "everything exchange" amid surging DEX volume exceeding $1T. - GSR upgrades institutional platform with treasury workflows and marke

Solana News Today: Solana's Emission Reform: Charting a Course for Long-Term Blockchain Economic Stability

- Solana proposes SIMD-0411 to cut $2.9B token emissions over six years, accelerating inflation reduction to 1.5% by 2029. - The "leaky bucket" plan aims to curb supply growth by 3.2% annually, stabilizing market dynamics through scarcity-driven value. - Staking yields may drop from 6.41% to 2.42% by Year 3, risking 47 validators' profitability and forcing industry consolidation. - Institutional adoption surges with $421M in Solana ETF inflows and Coinbase's acquisition of Solana-based DEX Vector. - The ov