Massive $869M Outflow Slams Bitcoin. Is a Crash Coming?

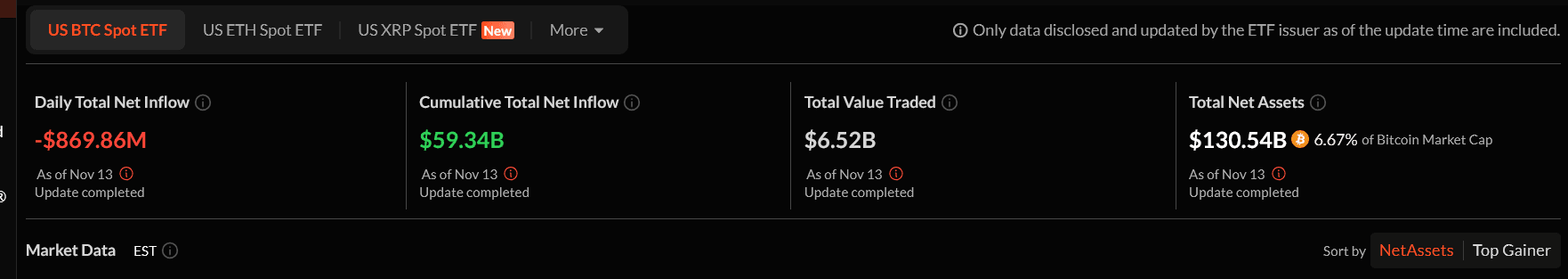

The bitcoin market jus t took another heavy hit. U.S. spot bitcoin ETFs recorded $869.9 million in outflows on Thursday, making it the second-largest daily exit since these products launched. That kind of number doesn’t happen quietly. It rippled through the entire market, dragged prices lower, and sparked fresh questions about whether this is fear taking over or simply a reset before the next leg up.

Why Did Spot Bitcoin ETFs Suddenly See Such Big Outflows?

Thursday’s mass exit wasn’t an accident. According to SoSoValue data , several major funds were hit hard. Grayscale’s Bitcoin Mini Trust saw the biggest drain at $318.2 million. BlockRock’s IBIT wasn’t far behind with $256.6 million slipping out, while Fidelity’s FBTC lost $119.9 million. Even GBTC and funds from Ark, 21Shares, Bitwise, VanEck, Invesco, Valkyrie, and Franklin Templeton were in the red.

This move ranks just behind the all-time record set on February 25, 2025, when investors pulled $1.14 billion in a day.

So what’s going on? The institutional flows tend to move together. When macro conditions start feeling shaky, these players reduce risk in clusters.

Vincent Liu, CIO of Kronos Research, summed it up well . Large outflows reflect a risk-off turn, he said. Institutions are stepping back as macro noise builds, but he doesn’t see it as a collapse in long-term demand. Instead, he views these drops as part of an oversold setup that long-term buyers might soon take advantage of.

What’s Triggering This Risk-Off Mood?

Markets aren’t reacting to a single shock. It’s more of a pile-up of small but worrying signals.

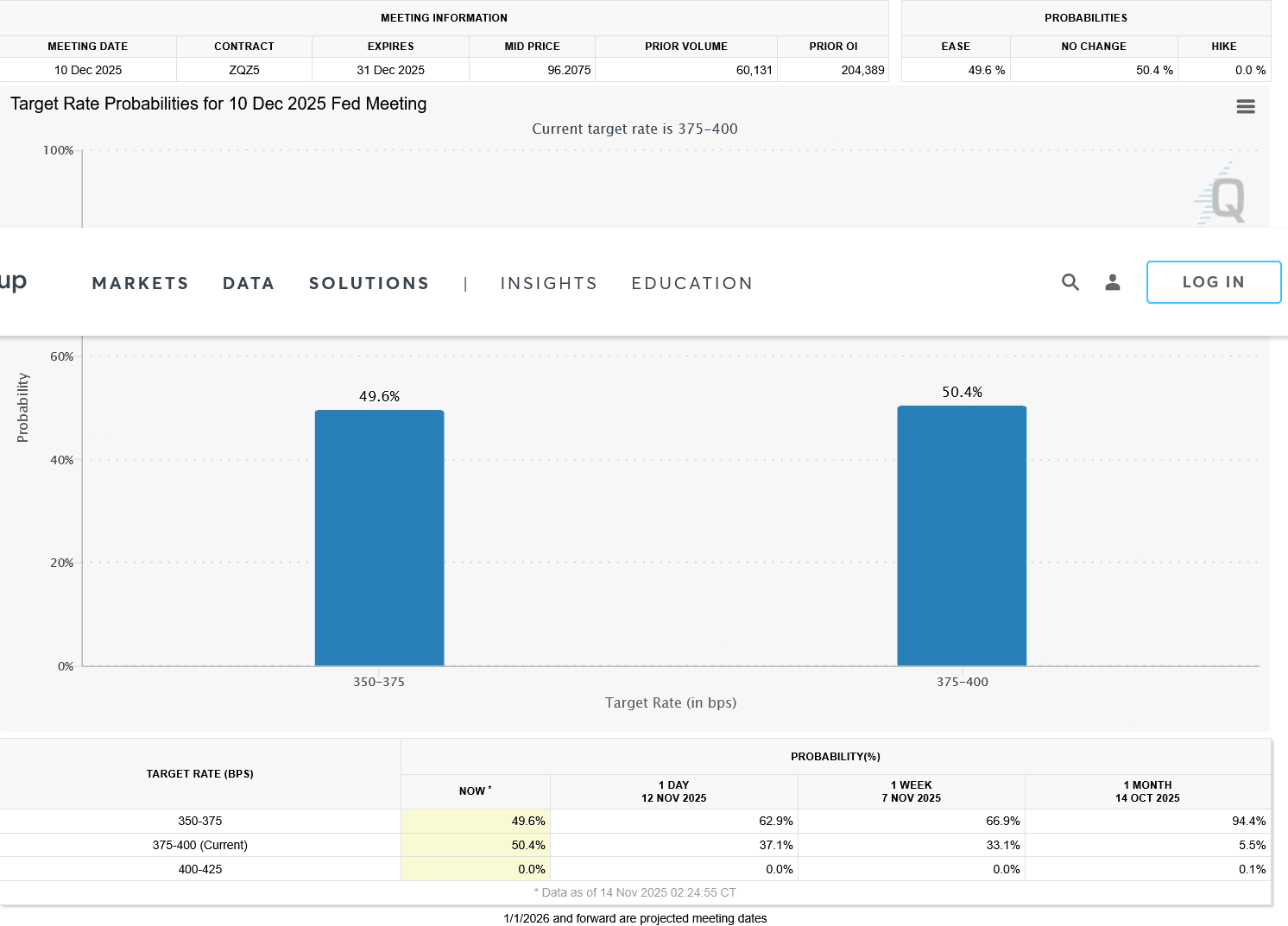

Min Jung of Presto Research noted that investors are rotating out of higher-beta assets and moving toward safety. The uncertainty around the Fed is a big piece of this. Weak ADP and NFIB readings point to a softening labor market. That feeds into expectations that the Fed is preparing to ease, but with caution. And traders hate uncertainty more than bad news.

Fed rate-cut odds for December have now slipped to 50.4 % according to the CME FedWatch Tool . When central bank direction becomes fuzzy, money tends to retreat from volatile assets first. Bitcoin is always at the front of that line.

How Did Bitcoin Price React to the Bitcoin ETFs Outflows?

The Bitcoin price action was quick and sharp. Bitcoin price dropped 6.4% over the past 24 hours, touching $96,956 early Friday.

Liu described the sell-off as a liquidity let-down. With cascading liquidations and fewer buyers in the order book, every drop hits harder. According to him, demand is clustering between $92,000 and $95,000, which could act as a cushion if selling continues.

Justin d’Anethan from Arctic Digital echoed the same idea. He pointed out that if bitcoin dips into the lower $90Ks, plenty of sidelined investors will view that zone as an opportunity. Not long ago, BTC was climbing past the mid-$120Ks. Many missed that move and are waiting for a deeper reset.

Is There a Bigger Trend Behind the Sell-Off?

Sometimes a crash has a clear trigger. This wasn’t one of those days. Jung noted that the pullback didn’t come from a single event. Instead, it was a blend of macro uncertainty, weakening risk appetite, and jittery flows ahead of the next FOMC meeting.

When the market feels unsure, even neutral data gets interpreted negatively. That’s the kind of environment bitcoin is dealing with right now.

What Happens Next?

The story isn’t over. The next few sessions will show whether the $92K to $95K range can hold. If it does, $BTC might see a relief bounce as liquidity stabilizes and buyers return. If it breaks, the lower $90Ks could come into focus quickly.

Here’s what matters most right now:

- Bitcoin ETF outflows are a reflection of macro anxiety, not a collapse in bitcoin’s long-term story.

- Liquidity is thin, so volatility stays elevated.

- Support zones are nearby, and long-term buyers are watching closely.

This is the kind of environment where panic selling and strategic accumulation happen at the same time. The next bounce will reveal which side is in control.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

R25's rcUSD+ Seeks to Connect DeFi and TradFi, Addressing the $55 Trillion Yield Disparity

- R25 launches rcUSD+, a yield-bearing stablecoin on Polygon, bridging DeFi and traditional finance with 1:1 USD peg and low-risk asset returns. - The token differentiates itself by generating income from institutional-grade assets like money market funds, offering DeFi users transparent yield opportunities. - Market growth sees $36B in tokenized RWAs and $300B in stablecoins, but rcUSD+ faces scrutiny over missing audit details and verification gaps. - Competing with USDY and Centrifuge, R25's Ant Financi

Dogecoin News Today: Dogecoin Faces Key Support Challenge While EV2 Presale Attracts Growing Investor Confidence

- Dogecoin (DOGE) tests critical $0.115–$0.125 support, with a breakdown risking a $0.08–$0.09 decline amid weakening technical indicators. - EV2’s $0.01 presale has raised $400K+ for a Web3 shooter game, attracting investors seeking utility-driven crypto projects. - Grayscale’s DOGE ETF launch and institutional interest contrast with bearish market sentiment and regulatory uncertainties. - CleanCore’s 78% stock drop highlights risks of Dogecoin treasury bets as holdings erode below $0.238 average purchase

Ethereum Updates Today: AI Trends and Meme Craze Drive Crypto's Dramatic Rally Despite Bubble Concerns

- Datavault AI (DVLT) announced a meme coin airdrop for shareholders, boosting shares 4.91% pre-market. - Mutuum Finance (MUTM) raised $18.8M in presale, with 800M tokens sold and potential 500% returns for early buyers. - BitMine Immersion (BMNR) holds 3.6M ETH, citing Ethereum tokenization and regulatory progress as growth drivers. - Digi Power X (DGXX) raised price target to $5, planning 55MW HPC deployment and AI infrastructure shift. - J.P. Morgan warned of AI-driven market bubbles, while Sampo's buyb

Ethereum News Update: Buterin: Ethereum's Privacy Features Require Improved User Experience

- Vitalik Buterin introduces Kohaku, a privacy framework for Ethereum to enhance onchain security and user anonymity. - Launched at the Ethereum Cypherpunk Congress, Kohaku aims to integrate mixnets and ZK browsers while addressing usability gaps in privacy tools. - Buterin highlights the "last mile" challenge: advanced cryptography exists, but user experience remains fragmented with separate seed phrases and limited multi-sig options. - The Ethereum Foundation reinforces privacy as a core right, rebrandin