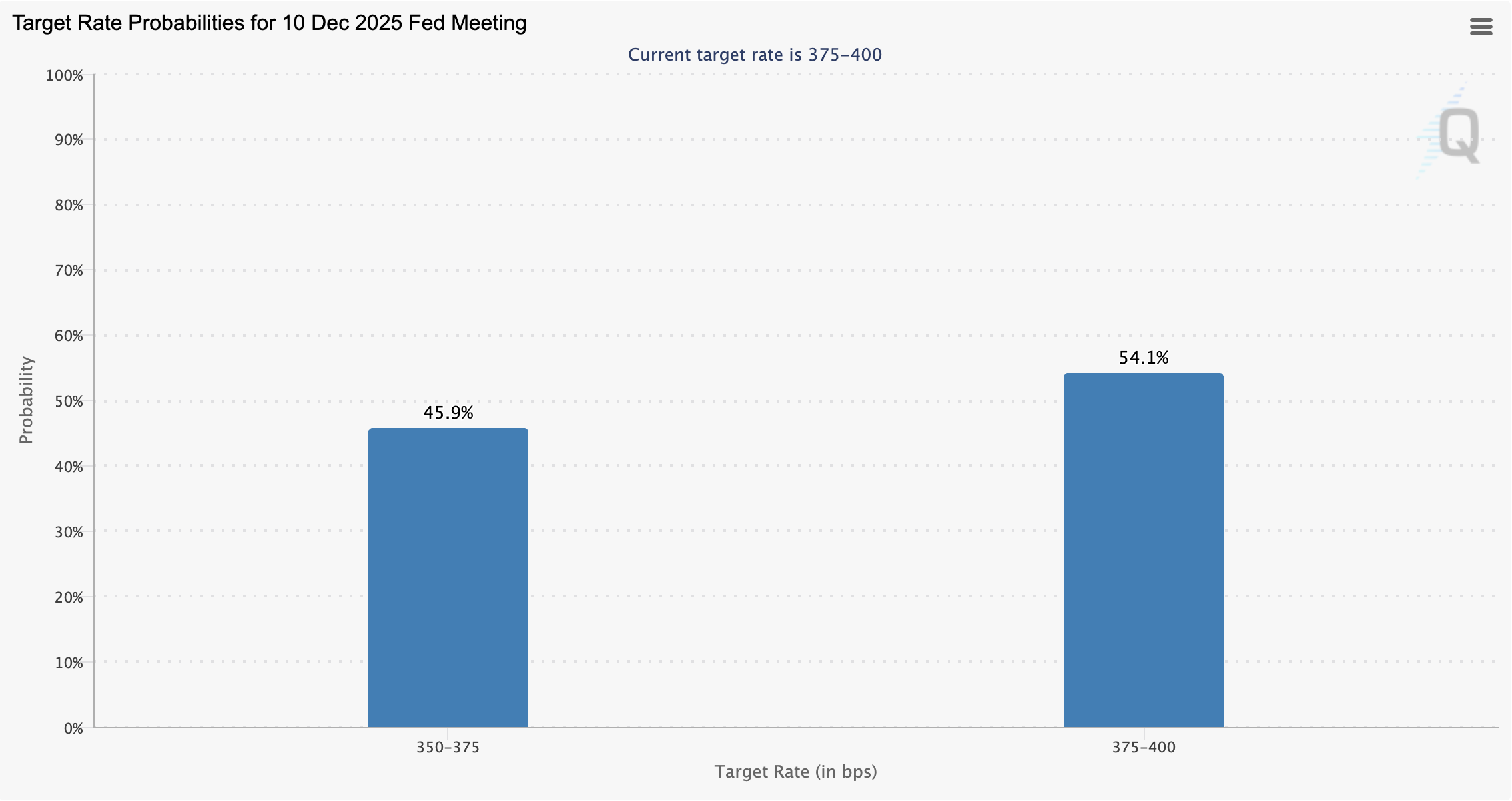

Probability of December interest rate cut falls below 50%

Only 45.9% of investors anticipate an interest rate cut at the next US Federal Open Market Committee (FOMC) meeting in December, amid declining market sentiment and a downturn in the cryptocurrency market.

The odds of a 25 basis point (BPS) interest rate cut in December were nearly 67% on Nov. 7, according to data from the Chicago Mercantile Exchange (CME) Group.

In September, several banking institutions forecast at least two interest rate cuts in 2025, with market analysts at investment banking company Goldman Sachs and banking giant Citigroup each projecting three 25 BPS cuts in 2025.

Interest rate decisions influence crypto prices. Lower interest rates translate into more liquidity flowing into asset markets and propping up prices, while higher rates mean liquidity and prices will be constrained.

The declining odds of a December rate cut are feeding negative market sentiment and may signal that more short-term price pain is coming to the crypto market until the Federal Reserve resumes easing rates.

Related: Stablecoin demand is growing, and it can push down interest rates: Fed’s Miran

Federal Reserve’s Jerome Powell casts doubt on a December rate cut

“There were strongly differing views about how to proceed in December. A further reduction in the policy rate at the December meeting is not a foregone conclusion — far from it. Policy is not on a preset course,” Federal Reserve Chair Jerome Powell said in October.

As expected, the Federal Reserve slashed rates by 25 BPS in October; however, crypto prices extended their decline following the lowered rates.

The October rate cut was “fully priced in” by investors, who widely anticipated the cut months ahead of time, according to Matt Mena, a market analyst at investment company 21Shares.

Economist and former hedge fund manager Ray Dalio warned that the Federal Reserve is cutting rates into record-high asset prices, relatively low unemployment and low credit spreads, a historic anomaly.

In November, Dalio said the Federal Reserve is likely stimulating the economy into a bubble, adding that this is a feature typical of debt-laden economies headed toward hyperinflation and currency collapse.

Magazine: If the crypto bull run is ending… it’s time to buy a Ferrari: Crypto Kid

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: MicroStrategy's Bold Bitcoin Investment Stands Strong Despite 57% Drop in Stock Value

- MicroStrategy's CEO reaffirms Bitcoin buying strategy amid market volatility, adding 8,178 BTC for $835.6M. - Despite 57% stock decline, MSTR's Bitcoin holdings reach $61.7B, funded by preferred shares and convertible notes. - Critics question debt-driven model's sustainability, but analysts praise its Bitcoin-per-share growth and $535 price target. - Saylor envisions $1T Bitcoin balance sheet, leveraging appreciation for credit products and reshaping global finance.

Ethereum Updates Today: Buddy Goes All-In on ETH with $13 Million Leveraged Wager Amid Market Slump

- Buddy Huang’s ETH long position was liquidated, prompting a $9.5M reentry amid market turmoil. - Market selloff attributed to macroeconomic pressures, with BTC dropping 28.7% below $90K. - A $1.24B ETH whale added 13,117 ETH despite $1.59M unrealized losses, signaling bullish conviction. - Institutional caution grew as SoftBank exited $5.8B NVIDIA stake, while Coinbase hinted at December 17th product launch. - Buddy’s $13M leveraged bet faces liquidation risk if ETH fails to stabilize above $3,000, highl

The Rapid Drop in COAI Shares: Red Flag or Investment Chance?

- COAI Index fell 88% YTD in Nov 2025, sparking debate over systemic collapse vs undervalued opportunity. - Market sentiment diverges from fundamentals: C3.ai shows 26% YoY revenue growth despite governance crises and $116M Q1 loss. - CLARITY Act regulatory uncertainty, leadership turmoil at C3.ai, and crypto frauds like Myanmar's $10B scam fueled sector-wide selloff. - C3.ai's $724M cash reserves and 69% gross margin highlight resilience, but legal battles and regulatory ambiguity persist as key risks. -

DappRadar's Shutdown Reflects Challenges Faced by the Industry Amid Market Volatility

- Web3 analytics firm DappRadar announced its shutdown due to "financially unsustainable market conditions," causing its RADAR token to drop 30%. - Companies like PG Electroplast and GEM Aromatics reported revenue declines amid U.S. tariffs, GST changes, and raw material costs, reflecting broader economic challenges. - Geox cut 2025 sales forecasts by high single digits after 6.2% year-to-date revenue fall, while cost cuts helped stabilize its EBIT margin. - Tech stocks face volatility: Nvidia downgraded a