Date: Sat, Nov 15, 2025 | 12:50 PM GMT

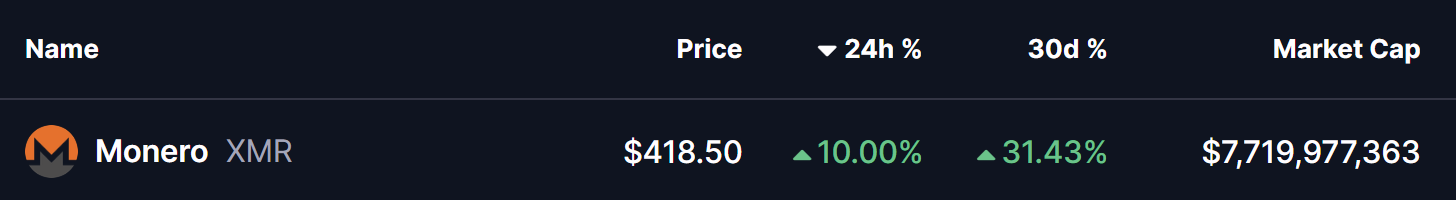

The broader altcoin market has come under heavy pressure over the past month as Ethereum (ETH) plunged more than 21% in 30 days. But despite this widespread correction, the privacy narrative has been one of the strongest outperformers, with ZEC, DASH, and now Monero (XMR) commanding the spotlight.

XMR has surged 10% today, but beyond the price action lies something far more significant — a developing technical structure that strongly hints at a bullish reversal. Even more compelling, this structure closely mirrors the same pattern that triggered Zcash’s (ZEC) explosive breakout.

Source: Coinmarketcap

Source: Coinmarketcap

XMR Mirrors ZEC’s Breakout Fractal

A direct comparison of XMR and ZEC on the daily timeframe reveals an almost identical formation unfolding — suggesting that a powerful fractal repetition may be in play.

As seen in the chart, ZEC reclaimed its 100-day moving average near the bottom of its curve and then broke through its first major resistance zone. Once it confirmed a neckline breakout from a rounding bottom pattern, ZEC launched into a staggering +750% rally, hitting new multi-month highs in an exceptionally short period.

ZEC and XMR Fractal Chart/Coinsprobe (Source: Tradingview)

ZEC and XMR Fractal Chart/Coinsprobe (Source: Tradingview)

Monero now appears to be tracing the same steps.

XMR has reclaimed its 100-day moving average, broken above its R1 resistance, and has just completed a neckline breakout around the $416 region. This neckline level mirrors the consolidation zone ZEC hovered under before its massive surge — adding further weight to the bullish fractal setup.

What’s Next for XMR?

If Monero continues to follow ZEC’s fractal behavior, the recent neckline breakout could act as the ignition point for the next major upswing. The $416 level now becomes a crucial support area; holding above it will be key to sustaining the momentum.

Based on technical projections, the next immediate target sits near $596, representing an upside potential of roughly 42% from current levels. And if the fractal continues to play out with the same intensity as ZEC’s rally, XMR could eventually aim for the $850+ zone — aligning with the scale of ZEC’s previous breakout move.

Still, while fractals provide powerful historical clues, they do not guarantee identical outcomes. Broader sentiment, liquidity conditions, and market catalysts will ultimately determine the strength and duration of any breakout.