The next crypto bull run looks like it will be driven by AI. Investors keep looking for projects that mix blockchain with machine learning, automation, and data intelligence. Tokens such as Fetch. AI , RENDER, Bittensor, Story, and the quickly rising Ozak AI stand out as the top five AI cryptocurrencies to keep an eye on in 2025. Each one brings its own real-world uses. From decentralized computing power to AI-driven analytics, these tokens offer something different. Analysts think they might bring some of the largest returns before 2026. Demand for smart blockchain solutions keeps growing fast.

Fetch.AI (FET)

Fetch. AI , or FET, leads in networks for autonomous AI agents. These agents handle real-time tasks like optimizing supply chains and trading energy. Right now, it trades around $0.2082. FET saw an 8.92% percent fall in the last 24 hours. Over the week, it fell by $21.57 percent. This comes with a market cap of $491.77 billion. Daily trading volume hits $127.94 million. The ecosystem lets businesses automate data sharing without middlemen. Analysts expect it to keep growing as a top AI token into 2026.

Render (RENDER)

Render, known as RENDER, runs a decentralized network for GPU rendering. Users can share and make money from unused computing power. This works for AI, three-dimensional modeling, and metaverse apps. It trades at $1.96. The market cap sits at $1.01 billion. 24–hour trading volume goes over $78.35 million. AI art, virtual reality, and augmented reality projects expand quickly. Render's usefulness grows right along with them. The move to the Solana network boosted speed and scalability. That makes it a solid pick for high returns in AI infrastructure before 2026.

Bittensor (TAO)

Bittensor, or TAO, combines AI computation with decentralized machine learning. Developers can train and earn from AI models together. It is priced at $418.69 now. The market cap reaches $4.28 billion. Daily trading volume comes to $720.12 million. Few tokens provide on-chain validation and rewards for AI model contributions. Demand for decentralized AI smarts keeps rising. TAO looks ready to anchor the Web3-AI world by 2026.

Story (IP)

Story Protocol, with token IP, opens up a fresh way to tokenize intellectual property. Creators can register, remix, and license digital IPs on-chain using AI tools. The token trades at $3.70. Market cap hits $1.19 billion. 24–hour volume stands at $74.03 million. AI helps track and handle digital ownership. Story Protocol connects creativity to blockchain in a real way that offers good long-term yields in the content space.

Ozak AI ($OZ)

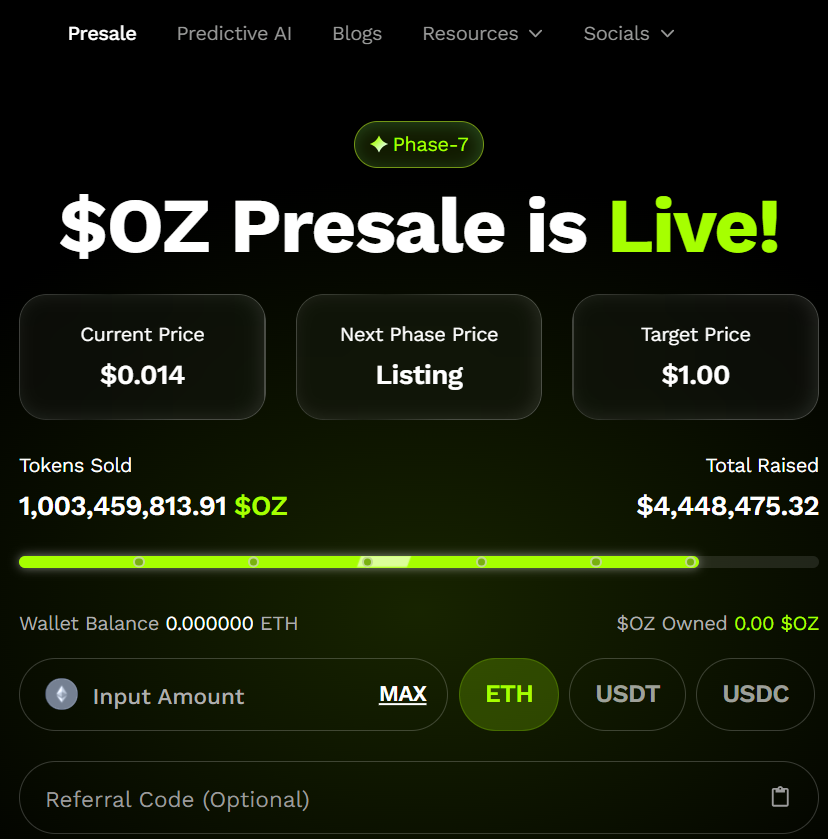

Ozak AI is a next-generation project combining AI and blockchain. The project raised over $4.44 million and sold more than one billion tokens. Ozak AI uses predictive analytics, real-time data modeling, and autonomous trading tools, bringing institutional-level yield to blockchain markets. The partnership with Dex3 improves liquidity handling, while Weblume integration allows AI dashboards to integrate smoothly into DeFi platforms.

The token works across chains and includes AI-powered automation. With an ambitious roadmap and expanding ecosystem, Ozak AI could surpass older AI tokens. Analysts see potential for significant returns as it lists on exchanges.

Conclusion

The crypto world shifts toward AI-powered setups. Tokens like FET, RENDER, TAO, IP, and Ozak AI lead in new ideas and uptake. The first four bring tested tech strengths, while Ozak AI features innovative solutions and strong AI integration. For those seeking big moves before 2026, these five cryptos matter a lot. Ozak AI in particular could shape how AI drives blockchain gains.