ZK Atlas Enhancement and Its Influence on Layer 2 Scaling

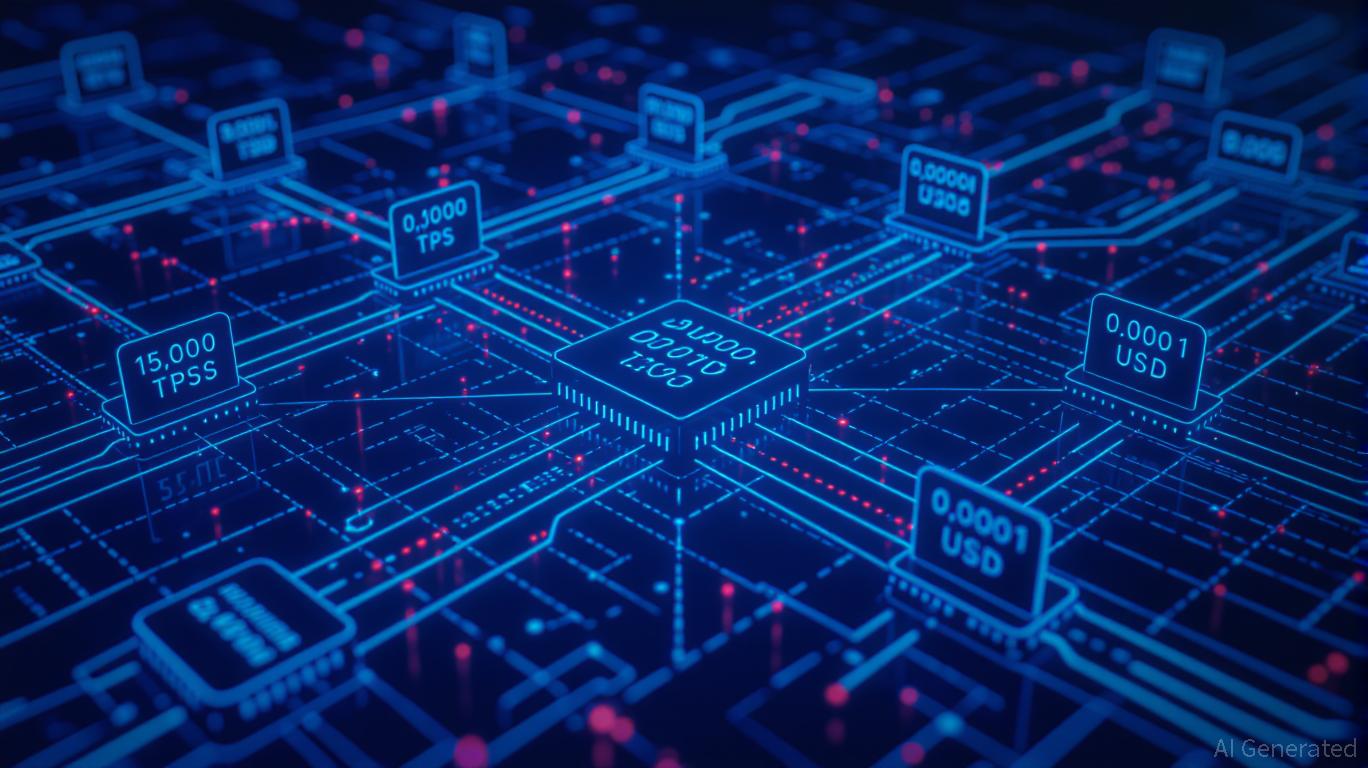

- The ZK Atlas Upgrade (Oct 2025) revolutionized Layer 2 scalability with 15,000+ TPS and $0.0001/tx costs via innovations like Atlas Sequencer and Airbender prover. - Vitalik Buterin's GKR protocol reduced ZK verification costs 10-15x, slashing Ethereum gas fees by 90% and boosting DeFi competitiveness. - ZK ecosystem TVL hit $3.5B by 2025, with $15B in Bitcoin ETF investments and 60.7% CAGR projected for ZK Layer 2 market growth to $90B by 2031. - Institutional adoption accelerated as stablecoins capture

Key Features of the

ZK

Atlas Upgrade

The ZK Atlas Upgrade brought forth three major breakthroughs: the Atlas Sequencer, Airbender prover, and ZKsync OS. Together, these innovations allow ZK protocols to

Importantly, the upgrade also incorporated Vitalik Buterin’s innovation with the GKR protocol, which

Developer Activity and Ecosystem Growth

The ZK Atlas Upgrade has sparked a notable increase in developer participation and ecosystem expansion. Bitget’s research shows that the total value locked (TVL) in ZK rollups—including zkSync,

Metrics on developer engagement further demonstrate the upgrade’s influence. ZKsync Era’s daily and weekly active wallet counts have soared, surpassing many Layer 1 networks. The ZK ecosystem has also

Institutional Adoption and Market Trends

The ZK Atlas Upgrade has propelled institutional involvement, especially within DeFi and stablecoin markets. Stablecoins now represent 30% of all on-chain crypto transaction volume,

Institutional funding has also grown, with spot Bitcoin ETFs channeling $15 billion into ZK-related ventures in 2025. This momentum is projected to persist, with estimates suggesting a 61% increase in institutional crypto allocations by 2026,

Challenges and Risks

Despite its advantages, the ZK Atlas Upgrade is not without obstacles. Regulatory oversight remains a pressing issue, particularly for privacy-oriented coins like Zcash. Furthermore, the technical demands of ZK technology—which require expertise in cryptography and distributed systems—may hinder adoption among smaller development teams.

Future Outlook and Investment Potential

The ZK Atlas Upgrade has established a foundation for scalable and affordable blockchain systems. With Ethereum’s “Lean Ethereum” initiative and the industry’s broader move toward Layer 2, ZK protocols are poised to lead the next wave of crypto growth. Investors should keep an eye on TVL trends, TPS gains, and institutional capital flows.

Nonetheless, prudence is necessary. Although the long-term perspective is optimistic, short-term market swings and regulatory ambiguity could affect returns. Spreading investments across various ZK projects (such as zkSync and StarkNet) and managing privacy coin exposure may help address these risks.

Conclusion

The ZK Atlas Upgrade marks a pivotal point for blockchain scalability. By tackling throughput, expenses, and interoperability, it has opened up new opportunities for DeFi, institutional finance, and international payments. For investors, the upgrade’s success will depend on ongoing developer involvement, regulatory progress, and sustained institutional interest. As the ZK ecosystem evolves, it presents a strong case for long-term investment in the post-upgrade landscape.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dogecoin News Today: Dogecoin Faces Key Support Challenge While EV2 Presale Attracts Growing Investor Confidence

- Dogecoin (DOGE) tests critical $0.115–$0.125 support, with a breakdown risking a $0.08–$0.09 decline amid weakening technical indicators. - EV2’s $0.01 presale has raised $400K+ for a Web3 shooter game, attracting investors seeking utility-driven crypto projects. - Grayscale’s DOGE ETF launch and institutional interest contrast with bearish market sentiment and regulatory uncertainties. - CleanCore’s 78% stock drop highlights risks of Dogecoin treasury bets as holdings erode below $0.238 average purchase

Ethereum Updates Today: AI Trends and Meme Craze Drive Crypto's Dramatic Rally Despite Bubble Concerns

- Datavault AI (DVLT) announced a meme coin airdrop for shareholders, boosting shares 4.91% pre-market. - Mutuum Finance (MUTM) raised $18.8M in presale, with 800M tokens sold and potential 500% returns for early buyers. - BitMine Immersion (BMNR) holds 3.6M ETH, citing Ethereum tokenization and regulatory progress as growth drivers. - Digi Power X (DGXX) raised price target to $5, planning 55MW HPC deployment and AI infrastructure shift. - J.P. Morgan warned of AI-driven market bubbles, while Sampo's buyb

Ethereum News Update: Buterin: Ethereum's Privacy Features Require Improved User Experience

- Vitalik Buterin introduces Kohaku, a privacy framework for Ethereum to enhance onchain security and user anonymity. - Launched at the Ethereum Cypherpunk Congress, Kohaku aims to integrate mixnets and ZK browsers while addressing usability gaps in privacy tools. - Buterin highlights the "last mile" challenge: advanced cryptography exists, but user experience remains fragmented with separate seed phrases and limited multi-sig options. - The Ethereum Foundation reinforces privacy as a core right, rebrandin

Ethereum News Today: Ethereum’s Layer-2 Migration: Enhancing Scalability, Diminishing Worth?

- Ethereum (ETH) fell to a four-month low below $3,000, marking its largest single-day drop since November 2025. - Network fundamentals weakened, with Total Value Locked (TVL) dropping 13% to $74 billion and DEX trading volume declining 27% monthly. - Growing migration to layer-2 solutions like Arbitrum and Polygon reduced base-layer fee demand, fragmenting Ethereum's economic model. - Analysts highlight Ethereum's leadership in RWA tokenization but note macroeconomic factors, including U.S. debt dynamics,