Bitcoin Updates Today: Fed Navigates Uncertainty as December Rate Cut Remains Unclear

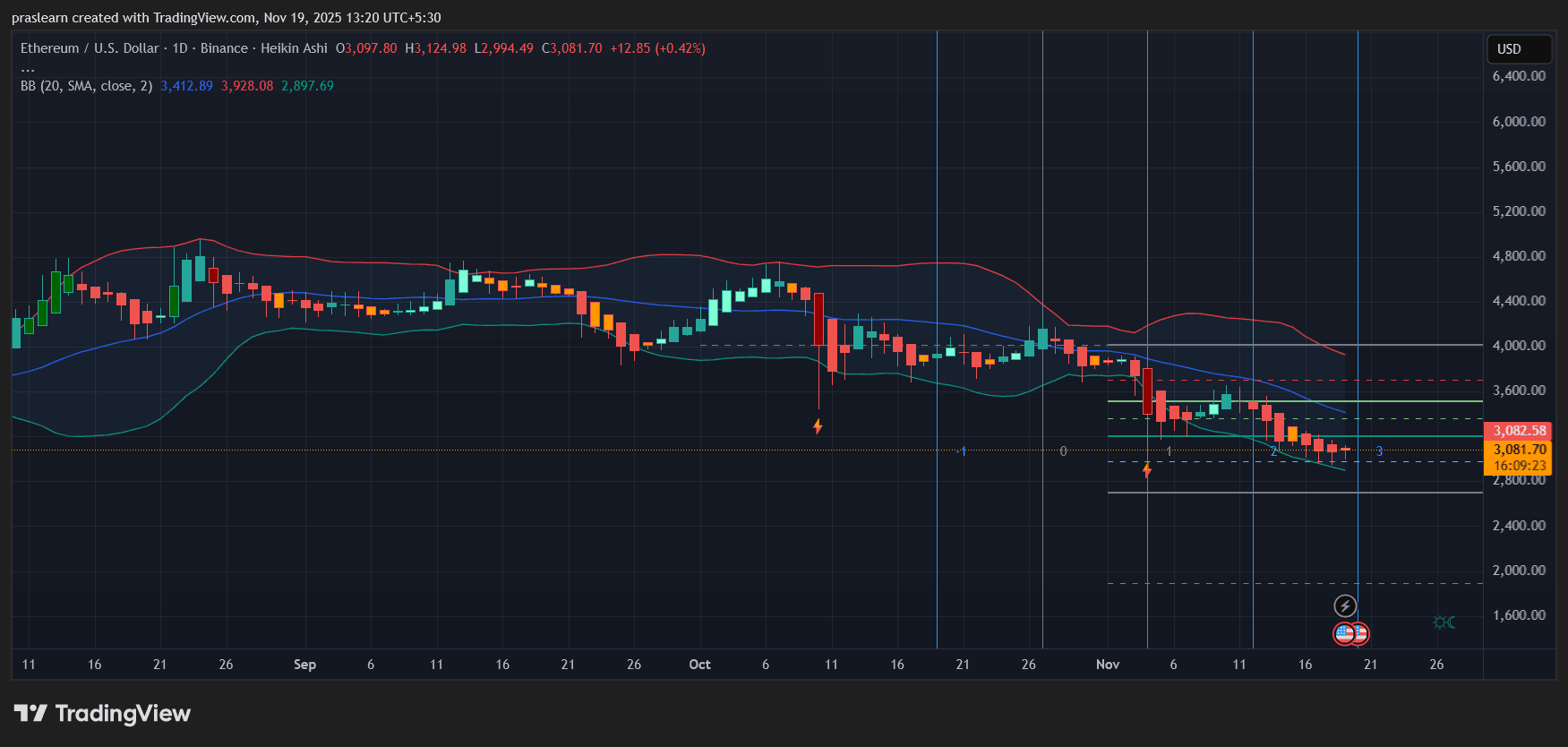

- Market expectations for a Fed rate cut in December dropped to 52% from 95% a month ago, reflecting deepening policymaker divisions. - Hawks like Collins emphasize inflation risks, while doves argue easing is needed to avoid restrictive policies amid weak labor data. - A government shutdown delayed critical economic reports, complicating decisions as structural shifts demand nuanced policy responses. - Bitcoin gains were capped by reduced cut odds, while broader markets remain sensitive to Fed signals on

The Federal Reserve faces a delicate balancing act over whether to lower rates in December, as market expectations have dropped to about a 52% probability for a 25-basis-point cut—down significantly from 95% just a month earlier.

Collins, who votes on the Federal Open Market Committee (FOMC), stated that unless there is "significant weakening in the labor market," further rate reductions could jeopardize progress on inflation, which

San Francisco Fed President Mary Daly illustrates the central bank's cautious approach,

The upcoming December meeting, set for December 9-10, will challenge the Fed to balance these conflicting objectives. Although holding rates steady appears more probable, policymakers have not dismissed the possibility of a cut, with some

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Harvard's $443 Million Investment Confirms Growing Institutional Interest in Cryptocurrency

- BlackRock launches Ethereum ETF in Delaware, expanding crypto offerings amid rising institutional demand. - Harvard's $443M IBIT investment marks 21% of its equity portfolio, signaling rare institutional crypto endorsement. - SEC's regulatory shifts normalize crypto ETFs, removing 2026 examination priority and enabling diversified index launches. - Market volatility sees $257M IBIT outflow as Bitcoin dips 25%, yet long-term institutional allocation persists. - Crypto's transition to strategic asset class

Buffett's Unexpected Investment in Tech Drives Alphabet's AI Boom

- Berkshire Hathaway's $4.3B Alphabet investment drove a 5% stock surge, marking Buffett's rare tech bet. - Alphabet's Gemini 3 AI model improves complex query accuracy and integrates into search/cloud products. - Analysts praise Gemini 3 as a "state-of-the-art" advancement closing AI performance gaps with rivals. - The model's commercial deployment and Buffett's backing position Alphabet as a key AI industry player.

Panera’s ‘Paper Cuts’ Takeaway: Prioritizing Quality Over Reducing Expenses

- Panera Bread’s CEO Paul Carbone launched the "Panera RISE" strategy to boost sales and restore customer trust by reversing cost-cutting measures like replacing romaine with iceberg lettuce. - Key initiatives include reintroducing premium ingredients, expanding menu options, and enhancing service to achieve $7 billion in systemwide sales by 2028. - JAB Holding and franchisees are funding the turnaround, while the IPO of Panera Brands remains delayed to prioritize customer satisfaction over short-term gain

Fed Uncertainty Keeps ETH Stuck in a Tight Downtrend