Crypto execs speculate on what’s to blame as Bitcoin slumped under $94K

Crypto executives speculate that outflows from crypto exchange-traded funds, long-term whale sales and escalating geopolitical tensions may be to blame for the recent market slump, as Bitcoin dropped to nearly $93,000 on Sunday.

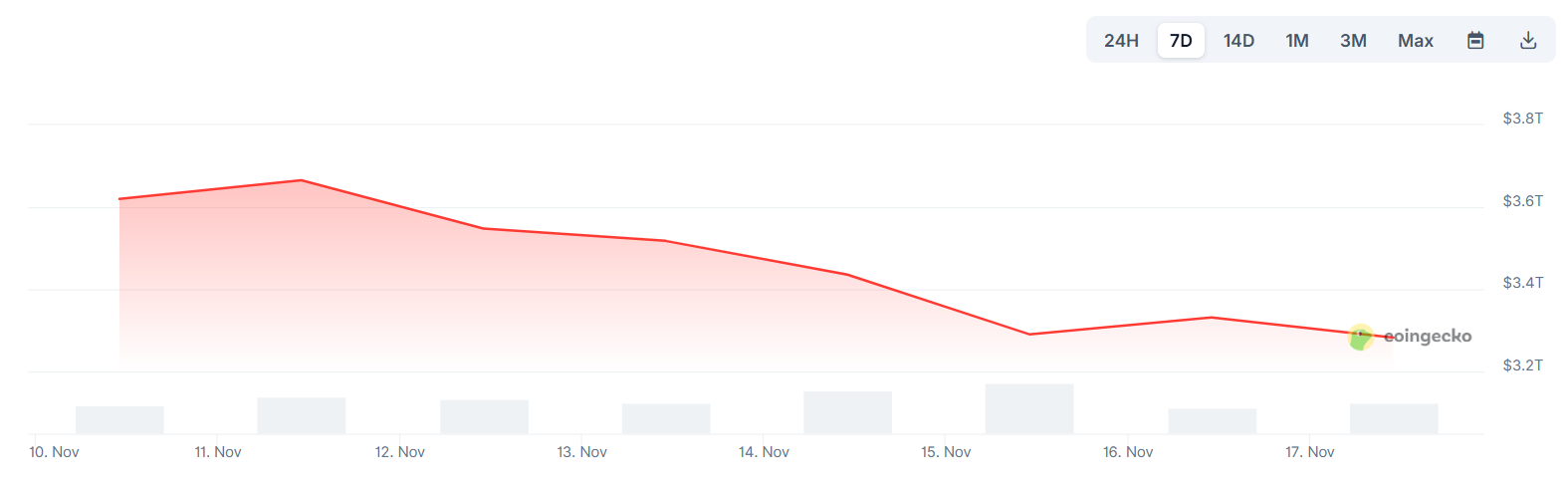

Bitcoin briefly fell to a year-to-date low of $93,029 on Sunday. The overall market capitalization has also seen a pullback in the last seven days, from $3.7 trillion on Nov. 11 to $3.2 trillion on Monday, according to CoinGecko.

Speaking to Cointelegraph, Ryan McMillin, chief investment officer of Australian crypto investment manager Merkle Tree Capital, said it’s not one single shock that’s causing the market slump.

Multiple factors are tanking crypto prices

McMillin pointed to the onchain data showing long-term holders “finally cashing in after an extraordinary run” as one cause, and “good fundamentals and liquidity tail winds for the price to go much lower.”

“At the same time, spot Bitcoin ETFs and other vehicles that were huge buyers earlier in the cycle have swung to net outflows just as global markets have turned more risk-off and rate-cut hopes have been pushed out.”

“Put that together and you have old coins being distributed into a softer bid in a macro environment that’s a lot less forgiving than it was six months ago,” McMillin added.

Matt Poblocki, the general manager of Binance Australia and New Zealand, said the volatility is a reminder that crypto remains a maturing asset class influenced by global macroeconomic and political events.

Meanwhile, Holger Arians, the CEO of Banxa, a crypto payment and compliance infrastructure provider, said markets are running very hot relative to the state of the world.

“We’re dealing with several unresolved and in some cases escalating geopolitical tensions. At the same time, global tech valuations have kept rising on future expectations. A broader risk-off moment was almost inevitable after a year of optimism,” he said.

“And while crypto can sometimes move independently from traditional markets, this is one of those periods where people are simply waiting, watching, and trying to make sense of a turbulent year.”

Other crypto executives on X also had ideas about the cause. Hunter Horsley, CEO of Bitwise Asset Management, believes the four-year cycle narrative may be to blame for the market pullback, as traders are spooked by the idea of a downturn every few years and end up contributing to it by selling.

Tom Lee, the chairman of Ether Treasury company BitMine, thinks that market makers with “a major hole” in their balance sheet might be falling prey to sharks circling to trigger liquidations.

Sharp corrections are a regular part of any market

However, most crypto analysts said the underlying market remains in a strong position.

“These kinds of sharp corrections are a normal part of a market cycle,” said Poblocki.

“What’s important is that we continue to see retail investors staying invested in the market and rotating toward blue-chip assets like Bitcoin and Ethereum rather than exiting altogether. That’s a strong sign of long-term confidence.”

“ETF flows have softened slightly in line with broader risk sentiment, but we’re not seeing major redemptions. The bigger picture hasn’t changed — that institutional participation remains high, and retail investors are taking a more disciplined approach,” he added.

Arians said the market pullback could reverse as the fundamentals are heading in the right direction, and there is more regulatory clarity, more real-world use cases and frequent instances of traditional finance stepping boldly into crypto.

“Even though prices feel soft, the infrastructure story underneath has never looked stronger. Stablecoin volumes, onchain activity, developer momentum, all moving quietly in the right direction. The market might feel slow, but the rails being laid now are setting up the next cycle,” Arians added.

Crypto market is still stronger than in previous cycles

McMillin shares a similar stance to macro analyst and Wall Street veteran Jordi Visser, who believes that old Bitcoin holders are simply selling to new traders who are ready to pick up the slack.

“In prior cycles, with this level of long-term holder selling, we would have seen a 70–80% drawdown by now; instead, despite very heavy OG distribution, prices are down far less because ETFs and other institutional channels are deep enough to absorb a lot of that stock,” he said.

“That’s a sign of a maturing market, and a necessary movement of coins from the few to the many.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Lloyds Completes Curve Purchase Amid Shareholder Disputes Over Valuation

- Lloyds acquires Curve for £120M amid shareholder backlash over undervaluation and governance concerns. - IDC Ventures, Curve's largest investor, rejects the deal via legal action, disputing transparency and valuation. - Lloyds aims to integrate Curve's payment tech to compete with Apple/Google Pay amid EU regulatory shifts. - The acquisition reflects fintech consolidation as banks exploit lower valuations to fast-track digital infrastructure. - Legal challenges and governance disputes could delay the dea

XRP News Update: XRP ETFs See Growth Amid Price Decline—Is a Repeat of the Past on the Horizon?

- Canary Capital's XRPC ETF , the first U.S. spot XRP ETF, launched with $58M in trading volume and $245M inflows on Nov 13, 2025. - Nine XRP ETFs, including Franklin Templeton's EZRP and Bitwise's entry, are set to debut within 10 days, boosting institutional adoption and liquidity. - Whale activity and token withdrawals signal accumulation ahead of ETF demand, while XRP's price dips below $2.30 amid ETF-driven market shifts. - Analysts compare XRP's post-ETF decline to Bitcoin's 2021 dip, suggesting pote

Fintech Companies Observe Nigeria's Declining Inflation While High Interest Rates and Core Inflation Persist

- Nigeria's inflation dropped to 16.05% in October 2025, creating opportunities for fintechs to expand services amid improved consumer spending potential. - High core inflation (18.69%) and unchanged central bank rates persist as barriers to affordable microloans and credit products for fintechs. - Regional inflation disparities (9.09%-20.14%) require tailored fintech solutions, with USSD/mobile interfaces targeting underserved rural and urban markets. - Africa's digitization efforts, including AfCFTA infr

Hyperliquid News Today: "NVIDIA's $500 Billion AI Order Backlog Sparks $5 Trillion Hype Amid Concerns of Excess Capacity"

- NVIDIA's $500B AI chip order backlog through 2026 highlights explosive demand for Blackwell/Rubin GPUs, positioning it as AI infrastructure leader despite geopolitical risks. - Q3 revenue forecast at $54.8B (+56% YoY) driven by $48B+ data center sales, fueled by Microsoft/Amazon hyperscaler investments in AI infrastructure. - Market skepticism grows over demand sustainability, with 90%+ spending concentrated in top cloud providers and U.S. export bans costing $10s of billions in China AI GPU sales. - $5T