After the major reshuffle in the crypto market, the true structural bottom has emerged.

Author: The Kobeissi Letter

Translation: Tim, PANews

Original Title: The "Golden Pit" After Leverage Clearance? Data Indicates a "Structural Bottom" Is Forming in the Crypto Market

In the past 41 days, the total market capitalization of cryptocurrencies has evaporated by $1.1 trillion, equivalent to an average daily outflow of $27 billion.

After the major liquidation on October 11, the total crypto market cap is now down about 10% from its previous level.

I believe this is a structural market adjustment, and this post will explain the reasons in detail.

This decline is quite unusual, because from a fundamental perspective, there have not been many substantial bearish factors in the crypto market.

Just a few days ago, President Trump stated that making the United States a "leader in the crypto field" is a top priority of his work.

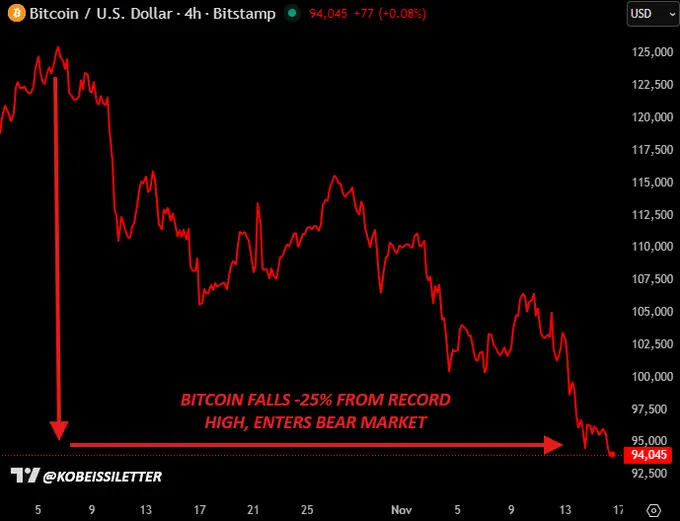

However, bitcoin has dropped 25% within a month.

This appears to be a structural decline, all starting with institutional capital outflows in the second half of October.

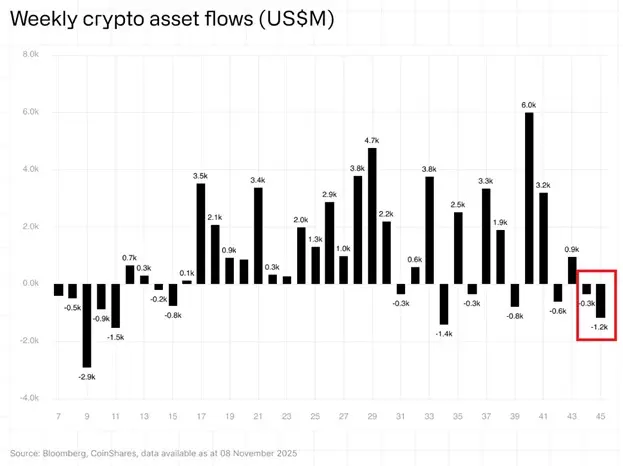

In the first week of November, crypto funds saw an outflow of $1.2 billion. A noteworthy issue is that leverage levels were too high at the time of the outflow.

Leverage usage in the crypto market is relatively aggressive. It is not uncommon for speculators to use leverage of 20x, 50x, or even 100x.

As shown in the chart below, with 100x leverage, only a 2% price fluctuation will trigger liquidation. When millions of traders use leverage simultaneously, it creates a domino effect.

Therefore, when the crypto market suddenly plunges, the scale of liquidations surges.

As happened on October 11, a liquidation frenzy of $1.92 billion caused bitcoin to record its first daily candlestick drop of $20,000.

Excessive leverage has made the market extremely sensitive.

In just the past 16 days, there have been 3 days where single-day liquidations exceeded $1 billion.

Single-day liquidations exceeding $500 million have become the norm.

Especially during periods of low trading volume, this leads to violent volatility in the crypto market. Moreover, this volatility is two-sided.

This also explains the sudden shift in market sentiment. The Crypto Fear & Greed Index has officially dropped to 10, which is "extreme fear."

The current index is now on par with the historical low of February 2025. Although bitcoin has risen 25% since its April low, leverage is amplifying investors' emotional swings.

Still don't want to believe all this?

Take a look at the comparison chart of bitcoin and gold since the major liquidation on October 11. For more than the past 12 months, gold and bitcoin, as safe-haven assets, have been highly correlated. But since early October, gold has outperformed bitcoin by 25 percentage points.

The downturn in the crypto market is even more pronounced in assets other than bitcoin. Take ethereum as an example: its cumulative decline so far this year has reached -8.5%. Since October 6, ethereum has plummeted by 35%.

Despite a broad rally in various risk assets, ethereum's decline has far exceeded the level of a typical bear market.

When you take a step back, the crypto market seems to be in a "structural" bear market. Although the fundamentals of the crypto market have improved, the factors influencing prices are changing. As with any efficient market, this problem will resolve itself.

Therefore, we believe the market bottom is near.

In addition to the crypto market, other assets are also presenting entry opportunities. The macroeconomy is shifting, and current stocks, commodities, bonds, and cryptocurrencies all have investment value.

The macro reality is that the global M2 money supply has reached a historic high of $137 trillion. Japan is brewing an economic stimulus plan of more than $110 billion, and Trump's $2,000 tariff dividend is about to be distributed. For cryptocurrencies, this decline is just a growing pain in the process of rising.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DASH Breaks Key Technical Levels Amid Privacy-Driven Momentum in 2026

An Uncertain Future For U.S. Banks Amid The Rise Of Paid Stablecoins