VISA May Integrate with Ripple’s ILP as XRP Holds $1.85–$2 Support

VISA Transactions Could Soon Flow Through Ripple’s Interledger Protocol

A recent report, highlighted by renowned crypto observer SMQKE, reveals a potential breakthrough in payments infrastructure that VISA transactions may soon be integrated with Ripple’s Interledger Protocol (ILP).

Therefore, this development could mark a significant milestone in bridging traditional financial systems with blockchain-based payment networks.

Ripple’s ILP, a protocol designed for seamless, cross-ledger payments, enables instant transfers across different payment networks without relying on intermediaries.

By connecting traditional financial rails like VISA to ILP, financial institutions could achieve faster, more efficient, and cost-effective transaction processing. The integration promises to reduce the friction and delays that often plague cross-border payments, which currently rely on legacy systems such as SWIFT.

The report indicates that VISA could leverage Ripple’s Interledger Protocol to enable near-instant, transparent payments across banks, digital wallets, and financial networks, offering faster fund access, lower fees, and a seamless payment experience for businesses and consumers.

Notably, Ripple’s Interledger Protocol is built for seamless interoperability, enabling real-time connections across diverse ledgers. This positions VISA to modernize its payment infrastructure while maintaining regulatory compliance and operational reliability, bridging traditional finance and digital assets.

Beyond speed and efficiency, integrating Ripple’s ILP with VISA could bridge traditional finance and blockchain, creating a seamless hybrid ecosystem. This move could drive mainstream adoption of digital currencies, positioning ILP as a key infrastructure for global payments.

Therefore, the report highlights the rising convergence of traditional finance and decentralized networks. Integrating VISA transactions with Ripple’s ILP could usher in a new era of cross-border payments, delivering unmatched speed, transparency, and scalability.

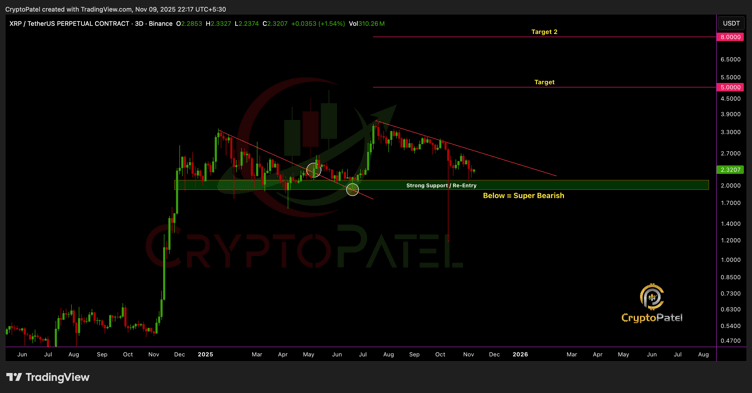

XRP Eyes $5–$8 as Strong Support Zone Bolsters Institutional Confidence

According to prominent market analyst Crypto Patel, XRP has established a decisive support zone between $1.85 and $2, signaling a robust foundation for both retail and institutional investors. This range, Patel notes, represents a strong liquidity and accumulation base, creating a favorable environment for potential price expansion in the months ahead.

XRP’s $1.85–$2 support zone is proving pivotal with the current price being $2.27. Historically, areas of high liquidity and concentrated institutional accumulation absorb selling pressure and anchor markets during volatility.

As Crypto Patel notes, XRP’s consolidation here reflects strong investor confidence and positions the coin for potential structural growth.

XRP continues its bullish momentum across multiple timeframes, with strong trading volumes and clear institutional accumulation signaling strategic positioning. Analyst Patel suggests that if the $1.85–$2 support holds, XRP could see a structural surge toward $5–$8, representing substantial upside potential.

Therefore, XRP’s $1.85–$2 support zone is more than a floor, it signals strong institutional backing, deep liquidity, and bullish momentum. If trends hold, a structural move toward $5–$8 is well-supported by market dynamics and investor activity, reinforcing XRP’s upward trajectory.

Conclusion

Integrating VISA transactions with Ripple’s Interledger Protocol could transform payments, combining traditional network reliability with blockchain’s speed, transparency, and interoperability. This leap promises a faster, more efficient ecosystem and marks a major step toward a truly connected global financial landscape.

On the other hand, XRP’s $1.85–$2 support zone highlights strong institutional interest and deep liquidity. With bullish momentum intact, this level not only defends current valuations but also positions XRP for a potential surge toward $5–$8.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Bitcoin's Sharp Decline Impacts Tech Stocks as Nasdaq Reflects $1.8 Trillion in Speculative Assets

- Bitcoin drops to $89,259, its lowest since April 2025, as traders brace for Fed rate-cut delays and market volatility. - Nasdaq-100 mirrors crypto slump, down 4% this month, highlighting growing equity-crypto correlation and correction fears. - Analysts warn of fragile investor sentiment, with leveraged crypto proxies like MicroStrategy losing 27% in November alone. - Global markets join decline, as S&P 500 and FTSE 100 hit key technical levels, intensifying scrutiny on Bitcoin's risk-indicator role.

U.S. Authorities Detain Crypto Mixer Creator Amid Crackdown on Money Laundering

- William Hill, co-founder of Samourai Wallet, was sentenced to four years for laundering $237M via crypto mixing services. - The case reflects U.S. enforcement of anti-money laundering laws against unlicensed crypto tools, with $250K fines and $6. 3M forfeitures imposed. - Prosecutors emphasized the "serious consequences" of laundering, contrasting with debates over privacy tools' role in stifling innovation or preventing crime. - The sentencing highlights tensions between crypto innovation and regulation

Incentives Enhance Collective Intelligence: Prediction Markets Surpass Expert Performance

- Prediction markets like Polymarket outperform experts by aggregating real-time bets, accurately forecasting events from politics to corporate strategies. - Platforms see $3B+ trading volume in Q3 2025, with bets on Meta's AI plans and Starbucks' acquisitions reflecting decentralized forecasting trends. - Regulatory challenges emerge as CFTC debates oversight of event contracts, complicating legal status under 1936 Commodity Exchange Act. - Industry projects $95.5B market value by 2035, forcing leaders to

Bitcoin Updates Today: Institutions Access Secure Bitcoin Investments Through New Hampshire’s Risk-Managed Bond

- New Hampshire becomes first U.S. state to approve a $100M Bitcoin-backed municipal bond, using digital assets as collateral for business loans. - The 160% collateralization model with automatic liquidation below 130% ensures taxpayer protection and institutional-grade security via BitGo custody. - Proceeds fund a Bitcoin Economic Development Fund, with Governor Ayotte calling it a "milestone" for innovation without public risk exposure. - The bond's success could inspire nationwide crypto-backed municipa