Bitcoin Updates: Bitcoin Declines While XRP ETF Gains Transform Approaches to Passive Income

- Bitcoin's 2025 price drop below 50-day support and 33.4% MSTR underperformance highlight market volatility amid Trump-era regulatory shifts. - XRP's $250M ETF debut (XRPC) drives institutional demand, with analysts forecasting $7-$24 price range amid mixed whale activity. - Mint Miner introduces XRP cloud mining with $5,500/day returns, leveraging AI and renewable energy to democratize passive income. - Market shifts show Bitcoin's waning "treasury" narrative and XRP's growing role in cross-border paymen

Bitcoin Price Swings and XRP ETF

In late 2025, Bitcoin (BTC) encountered notable challenges,

Wider market movements have been influenced by evolving political circumstances, especially during President Trump’s second administration, which brought a surge of institutional attention to

At the same time,

For those pursuing passive returns, new solutions are surfacing.

Ongoing selling pressure on Bitcoin remains a major issue, with its MVRV ratio at 1.7—signaling a balance between profit-taking and losses.

The dynamic between Bitcoin and XRP highlights a larger movement: investors are broadening their approaches to better manage risk and reward. While Bitcoin’s fixed supply continues to be a central argument, XRP’s utility in international payments and ETF-driven liquidity is redefining passive income prospects. For those prepared to face market swings, platforms such as Mint Miner and institutional-grade ETFs provide new opportunities to benefit from the changing crypto environment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: VanEck Issues Bitcoin an Ultimatum—Adopt Quantum-Resistant Privacy or Face Withdrawal

- VanEck CEO warns firm may exit Bitcoin if quantum computing threatens its encryption and privacy model. - Privacy coins like Zcash gain traction as alternatives, using zero-knowledge proofs to address Bitcoin's transparency risks. - Quantum-resistant crypto market grows rapidly, with IBM-Cisco quantum internet project and PQC sector projected to reach $2.84B by 2030. - Regulatory shifts and institutional investments in altcoins signal evolving crypto landscape amid security and privacy challenges.

Bitcoin Updates: Stimulus Fails to Curb Crypto Fluctuations; Uncertainty Over Hedging Function

- Japan's $135B stimulus package failed to curb Bitcoin's decline below $85,500 amid heightened market volatility. - Analysts debate crypto's role as an inflation hedge, with Fundstrat's Tom Lee framing it as a leading indicator for U.S. stocks. - Brazilian firm Rental Coins' $370M BTC collapse highlights sector fragility, filing Chapter 15 bankruptcy to recover assets. - Security threats persist in DeFi, with Aerodrome Finance's front-end attack and Coinbase's routine wallet migrations underscoring risks.

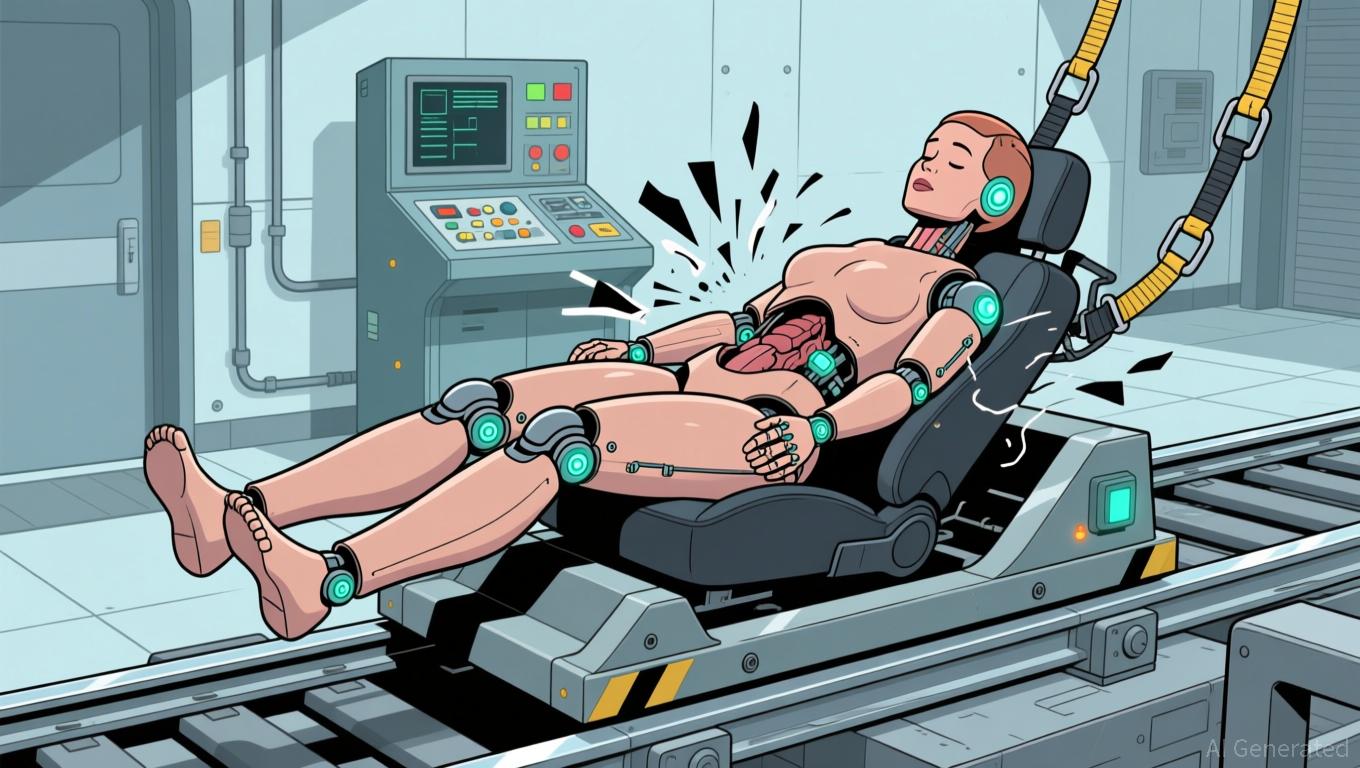

Polkadot News Today: "U.S. Requires Female Crash-Test Dummies to Tackle Longstanding Gender Inequality in Safety Engineering"

- U.S. DOT mandates female crash-test dummies in federal safety testing by 2027-2028 to address gender bias in vehicle design. - THOR-05F, representing average adult women, replaces outdated 1970s models that left women 73% more likely to suffer serious injuries in crashes. - NHTSA emphasizes scientific validation for the 150-sensor dummy, while automakers and IIHS express skepticism about current safety standards. - Advocacy groups praise the move as critical for closing safety gaps, but activists warn de

Assessing the Factors Behind COAI's Significant Price Drop in Late November 2025 and Its Long-Term Impact on Investment

- COAI's 88% year-to-date plunge in late 2025 exposed systemic risks in AI/crypto markets, driven by governance failures, regulatory ambiguity, and overvaluation. - C3.ai's $116.8M loss, leadership turmoil, and lawsuits triggered panic, while the CLARITY Act's vague oversight deepened institutional investor caution. - The selloff highlighted a stark divide between foundational AI tech and speculative crypto assets, with analysts warning against conflating sector-wide risks with isolated failures. - Long-te