XRP Price Is One Step From a Breakdown — Or a Cycle Bottom?

The XRP price sits on one level that decides everything. Momentum has weakened, but a major support band and a fresh yearly low in NUPL suggest a bottom may be forming. If buyers defend $2.154, XRP can attempt a rebound. If not, the chart opens to $2.065 and deeper levels.

The XRP price is down almost 9% this week, showing clear weakness after failing to hold its recent rebound. Sellers remain in control for now, but one support level continues to hold.

Whether this level survives decides if XRP forms a cycle bottom or slides into a deeper correction.

Weakness Shows Up In Momentum, But Support Still Holds

The first sign of pressure comes from momentum. Between October 13 and November 10, the XRP price made a lower high while the Relative Strength Index (RSI) made a higher high. RSI tracks buying pressure, and this pattern is called a hidden bearish divergence. It shows buying strength was rising, but not enough to push the price up.

That explains the week’s decline.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

XRP Flashes Bearish Divergence:

TradingView

XRP Flashes Bearish Divergence:

TradingView

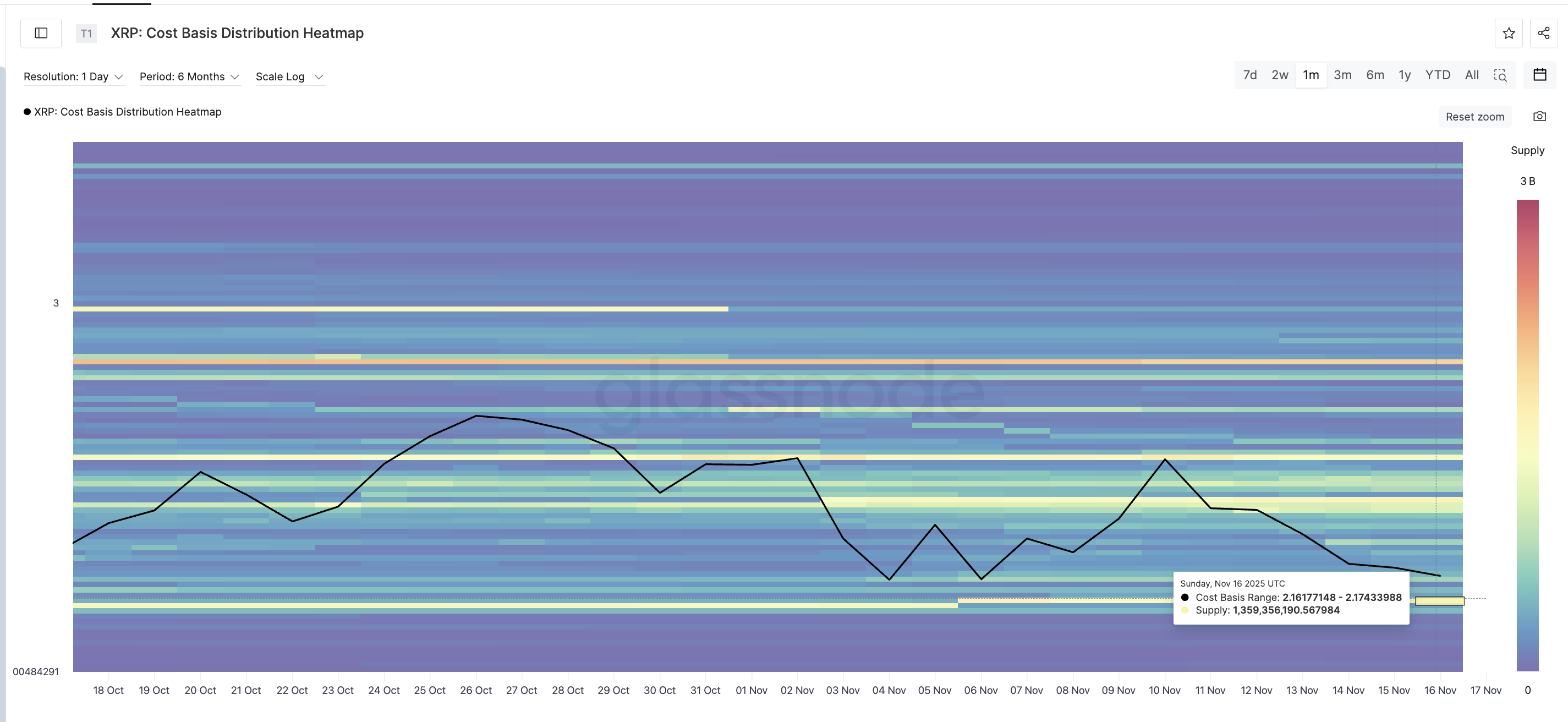

Even with that weakness, the $2.154 zone still holds. This is not just a chart level. The cost-basis heatmap confirms it. Between $2.161 and $2.174, XRP has a huge supply cluster of 1.359 billion tokens.

That makes this band the strongest support in the near term. The $2.154 level on the chart sits immediately under this cluster and could be the only thing standing between a bounce and a breakdown.

Support Cluster Could Limit Downside:

Glassnode

Support Cluster Could Limit Downside:

Glassnode

If this band holds, the divergence can be considered “played out,” opening the door for a recovery attempt.

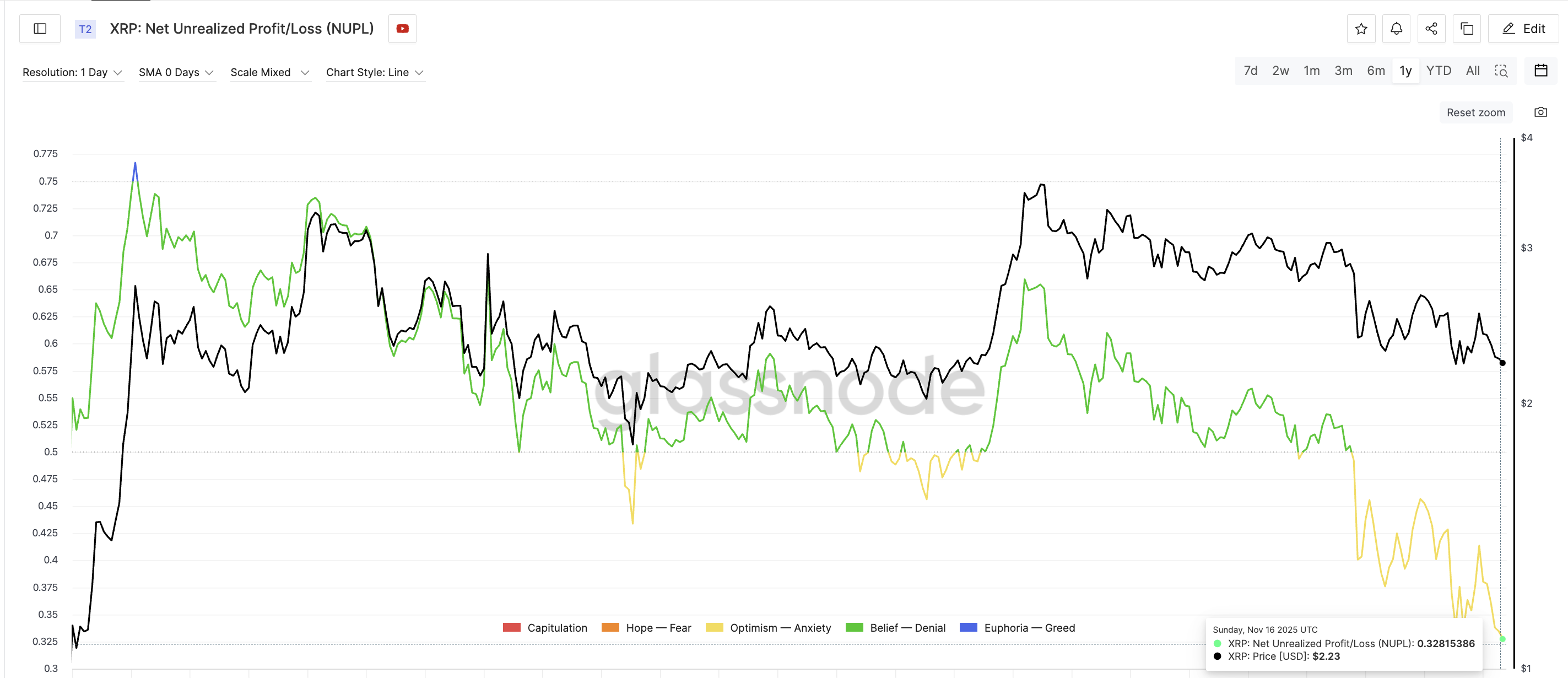

Sentiment Shows A Bottom May Be Forming

The second signal is psychological. XRP’s Net Unrealized Profit and Loss (NUPL) fell to 0.32 on November 16, its lowest reading in a year. NUPL measures investor sentiment—whether wallets hold paper profit or loss.

The last time NUPL hit a yearly low (0.43 on April 8), the XRP price rallied from $1.80 to $3.54 by July 22. That was a 96% rise.

XRP Flashes A Bottoming Signal:

Glassnode

XRP Flashes A Bottoming Signal:

Glassnode

This time, the NUPL is even lower, which means sentiment has reset more deeply. If the $2.154 support holds, the same type of bottoming behavior could form here, too.

XRP Price Levels To Watch Next

If the XRP price loses $2.154, the support zone breaks. In that case, there is little strong demand until $2.065, and falling under $2.06 opens a path toward even lower levels.

If buyers defend support instead, the first upside test sits at $2.394, a level with several prior rejections. A move above $2.394 starts a real rebound attempt.

XRP Price Analysis:

TradingView

XRP Price Analysis:

TradingView

If momentum improves further, XRP can push toward $2.696, and breaking that level brings a much stronger recovery into view.

For now, everything comes down to one question: Can the $2.154 support band survive long enough for sentiment to flip? If yes, the XRP price may be forming the same kind of bottom that drove its last major rally.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SEC Addresses Crypto Privacy Challenge: Balancing Investor Security and Technological Autonomy

- SEC hosts roundtable to address crypto privacy vs. surveillance tensions amid evolving regulatory framework. - Agency shifts focus to core compliance areas, deprioritizing crypto enforcement compared to prior administration. - DOJ intensifies crackdown on privacy tools, convicting Samourai Wallet founders for AML violations. - Regulatory divide between SEC and DOJ creates uncertainty as Congress delays digital asset bill. - Debate highlights tension between investor protection and crypto's decentralizati

JPMorgan Lowers Bullish's 2026 Projection, Adjusts Focus to Fundamental Earnings

- JPMorgan cuts Bullish's 2026 price target to $45 from $46, excluding $6.2M in high-margin stablecoin promotion revenue from IPO proceeds. - Bullish's Q3 results exceeded forecasts with $77M revenue and $29M adjusted EBITDA, though seasonal trading weakness tempered optimism. - Deutsche Bank upgrades Bullish to "Buy" with $51 target, citing U.S. expansion and infrastructure role for traditional finance firms in crypto. - Bullish's stock trades near 52-week low despite 72% Q3 revenue growth, as JPMorgan hi

Bitcoin News Update: Arizona's Approach to Bitcoin Through MSTR—Smart Equity Move or Risky Pension Gamble?

- Arizona's pension fund holds $13.5M in Bitcoin via 76,238 MSTR shares, down from $24M as the stock fell 60% since November 2024. - MSTR faces potential $2.8B outflows if excluded from MSCI indices, exacerbating liquidity risks amid its heavy reliance on index-linked passive flows. - The firm recently bought 8,178 BTC ($835.6M) to reach 649,870 tokens ($48.37B cost value), defended by CEO Saylor as a long-term strategy. - Institutional investors increasingly use equity-linked crypto exposure through firms

DASH Aster DEX: Transforming Decentralized Exchange Frameworks and Enhancing User Engagement in DeFi

- DASH Aster DEX emerges as a leading DeFi DEX in 2025 with a hybrid AMM-CEX model, cross-chain liquidity routing, and AI optimization. - The platform secures $50B in assets, processes 10,000 TPS, and achieves $1.399B TVL with 2 million users post-September 2025 TGE. - It outperforms Uniswap in weekly fee generation ($69.5M vs. $32M) while competing with PancakeSwap's $1.2T 365-day volume. - Strategic partnerships with Binance and YZi Labs enhance institutional credibility but expose risks in cross-chain i