Messari Report: Filecoin 2025 Q3 Status Survey

Revealing key data such as network utilization and storage volume, showcasing its ecosystem and economic dynamics.

Original Title: State of Filecoin Q3 2025

Original Author: Armita, Messari

Original Translation: Filecoin Network

Key Insights

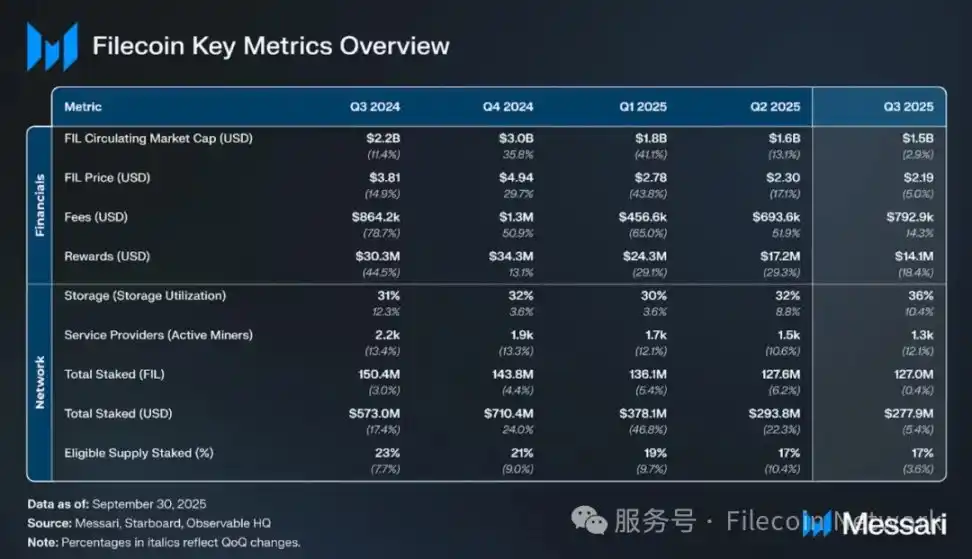

· Network utilization rose to 36% (from 32% in Q2), while total network storage capacity decreased by 10% quarter-on-quarter to 3.0 EiB. This reflects the exit of some SPs and improved network efficiency following the network v27 "Golden Week" upgrade.

· Total network fees increased by 14% quarter-on-quarter to $793,000, with growth almost entirely driven by penalties (accounting for 99.5%). With the removal of legacy sector methods, batch fees and base fees have dropped to nearly zero.

· Active storage demand remained stable, with the total amount of stored data only slightly decreasing by 1% quarter-on-quarter to 1,110 PiB. Although storage providers and allocators are adapting to the new Fil+ pathways and operational adjustments, the average daily new transaction volume dropped by 19%.

· The number of real datasets onboarded increased by 3% quarter-on-quarter to 2,491, of which 925 datasets exceeded 1,000 TiB in size, indicating continued growth in adoption of large-scale, persistent storage by enterprises and research institutions.

· The Filecoin Foundation and GSR Foundation jointly funded an impact project cohort, including The Starling Lab and CROSSLUCID's Oceanic Whispers project, further cementing Filecoin's key role in verifiable, socially-driven data preservation.

Project Overview

Filecoin (FIL) is committed to building a decentralized marketplace for data services, with its first core service being data storage based on the InterPlanetary File System (IPFS). Filecoin adopts a market-driven model where users negotiate variable-priced storage deals with storage providers. Storage deals are similar to service agreements, where users pay providers to store their data for a specified period.

Filecoin uses a cryptographic proof-based incentive model—namely Proof of Replication (PoRep) and Proof of Spacetime (PoSt)—to verify that storage providers reliably store client data during the protocol period. In addition, Proof of Data Possession (PoDP)¹ was launched in May 2025, adding ongoing lightweight verification for stored data and providing a hot storage layer for high-speed data availability. Providers earn the network-native token FIL by participating in storage deals. If storage providers fail to provide reliable uptime or act maliciously towards the network, their staked FIL will be slashed.

For data retrieval, Filecoin users pay retrieval providers to access data. Unlike onchain storage deals, retrieval deals use payment channels for offchain settlement, enabling faster retrieval speeds. In addition to storage and retrieval, Filecoin also aims to provide an open marketplace where compute power can be called directly over data, offering a more efficient alternative to traditional centralized systems. Key protocol upgrades to enable "compute-over-data" services include smart contracts (Filecoin Virtual Machine - FVM) and scaling solutions (InterPlanetary Consensus - IPC). With the upcoming Filecoin Onchain Cloud, the network's infrastructure will further expand to support full onchain cloud services.

Key Metrics

Performance Analysis

The primary use of Filecoin is to achieve decentralized data storage through two types of participants:

· Demand side, i.e., storage users who need data storage.

· Supply side, i.e., storage providers with idle storage capacity.

The metric for measuring Filecoin storage demand is the total amount of data in effective storage deals between users and storage providers.

Storage Deals

In Q3 2025, the total amount of data stored through active deals on Filecoin reached 1,110 PiB, down just 1% from 1,120 PiB in Q2, indicating that onchain storage demand remained generally stable. The average number of active deals slightly decreased by 1% to 35.2 million. Although total network capacity continues to shrink, the slight decline in data volume highlights Filecoin's ongoing transition from maximizing raw storage supply to supporting higher-value, enterprise-grade, and verified data workloads.

In Q3 2025, Filecoin's average daily new storage deal volume fell by 19% quarter-on-quarter, from 3.4 PiB to 2.8 PiB. This trend is the opposite of the previous quarter's growth, reflecting a cooling in new data onboarding activity, even though total active storage volume remained basically stable (only dropping from 1,120 PiB to 1,110 PiB). This divergence indicates that the pace of new data onboarding has slowed, but existing verified datasets remain stable.

The Filecoin Plus (Fil+) Allocator Pathways, launched at the end of Q2 2025, prioritize large verified data clients and streamline the onboarding process for enterprise users, resulting in fewer but higher-value deals. Today, verified storage dominates total network activity, while smaller, shorter-term regular deals have almost disappeared. Meanwhile, the network v27 "Golden Week" upgrade simplified SP operations and deprecated several old sealing and aggregation methods, temporarily reducing new deals as storage providers adapt to new toolsets. Miner consolidation is another reason, as many small operators have exited under stricter efficiency standards and increasing staking requirements.

Despite the short-term decline in new deal volume, overall utilization improved as existing verified datasets remained active. These datasets are particularly related to long-term archiving, scientific research, and enterprise use cases introduced through projects such as the "Culture and Science Preservation Program" launched in Q3.

Utility VS. Capacity

In Q3 2025, Filecoin's storage utilization increased from 32% in Q2 to 36%, while total network committed capacity fell by 10% quarter-on-quarter, from 3.3 EiB to 3.0 EiB. This inverse trend reflects ongoing SP consolidation and right-sizing of the network. The decline in total capacity was mainly due to the exit of some smaller or underperforming storage providers after the network v27 "Golden Week" upgrade introduced stricter operational and staking requirements. The upgrade, through proposals such as FIP-0101, FIP-0103, and FIP-0106, simplified sector sealing and maintenance processes, deprecated outdated and inefficient workflows, and prompted some SPs to phase out obsolete infrastructure. Meanwhile, the average daily new deal onboarding volume fell by 19% quarter-on-quarter, reducing the inflow of new data. As a result, although total network capacity contracted, the remaining storage space was utilized more efficiently, pushing up utilization even as the network shrank in size.

Clients

Filecoin currently targets enterprises and developers, providing cold storage solutions (e.g., data archiving and recovery). Low storage prices help attract traditional enterprises seeking cost-effective alternatives for massive amounts of data to be archived.

DeStor is a Filecoin service provider connecting clients with storage providers and has partnered with Qamcom Decentralized Data Security (DDS). Potential data clients for this partnership include Web3 gaming studio YayPal, with over 500,000 users, and AI marketing analytics platform Fieldstream. Other client-side solutions include:

· GhostDrive: Focuses on enhancing privacy and security through encryption, decentralization, and innovative storage optimization technologies;

· CIDGravity: Focuses on enterprise-level integration with open-source platforms such as Nextcloud.

In addition to cold storage, projects like Lighthouse, Akave, and Storacha are also driving the development of other storage solutions.

As of the end of Q3 2025, Filecoin hosted 2,491 onboarded real datasets, up 3% from 2,416 in Q2. Of these, 925 datasets exceeded 1,000 TiB in size, up 7% from 864 in Q2, highlighting continued market adoption of high-capacity, persistent storage. This growth is driven by ongoing Filecoin Plus onboarding activity, new on-ramp integrations (lowering the threshold for dataset access), and increased enterprise and research workloads.

FVM Momentum

The Filecoin Virtual Machine (FVM) allows developers to deploy Ethereum-like smart contracts directly on Filecoin's storage layer, enabling applications that automate data onboarding, pricing, retrieval, and compute coordination.

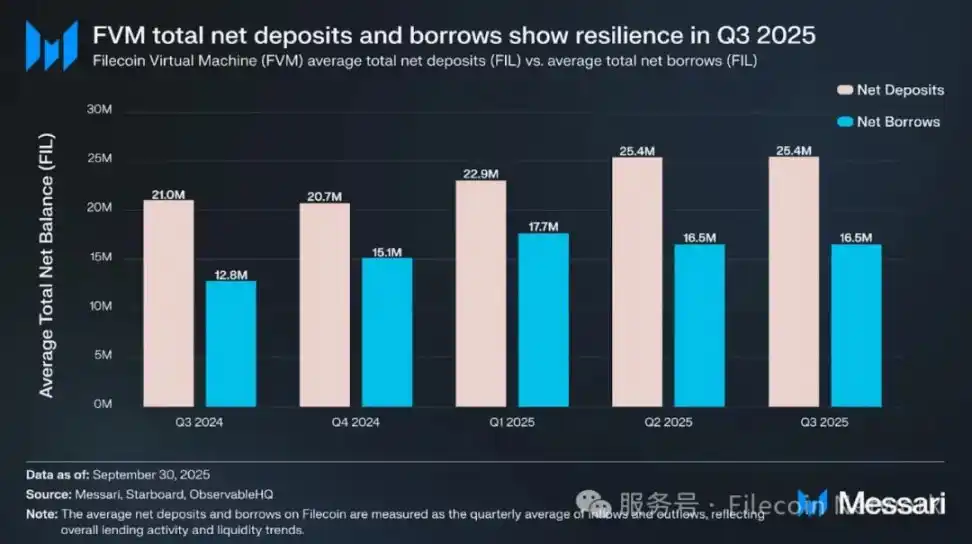

In Q3 2025, Filecoin's total inflow (net deposits) was $62.4 million, down 6.5% from $66.8 million in Q2; total outflow and lending volume for the same period fell by 6.8%, from $43.4 million to $40.5 million.

However, when measured in FIL terms, token activity showed the opposite trend: inflows increased slightly by 0.16% quarter-on-quarter, from 25.39 million FIL to 25.43 million FIL; outflows decreased slightly by 0.03%, from 16.53 million FIL to 16.52 million FIL. This difference is due to a 5% drop in FIL price this quarter (from $2.30 to $2.19), reducing the USD value of otherwise stable onchain token flows.

Financial Overview

Filecoin's revenue model is similar to Ethereum's, as it adopts a gas mechanism inspired by EIP-1559, where part of the network fees are burned to regulate network congestion. But unlike Ethereum, Filecoin's economic model is storage-driven, with storage users paying fees and storage providers earning income while managing collateral and penalties.

Network Fees

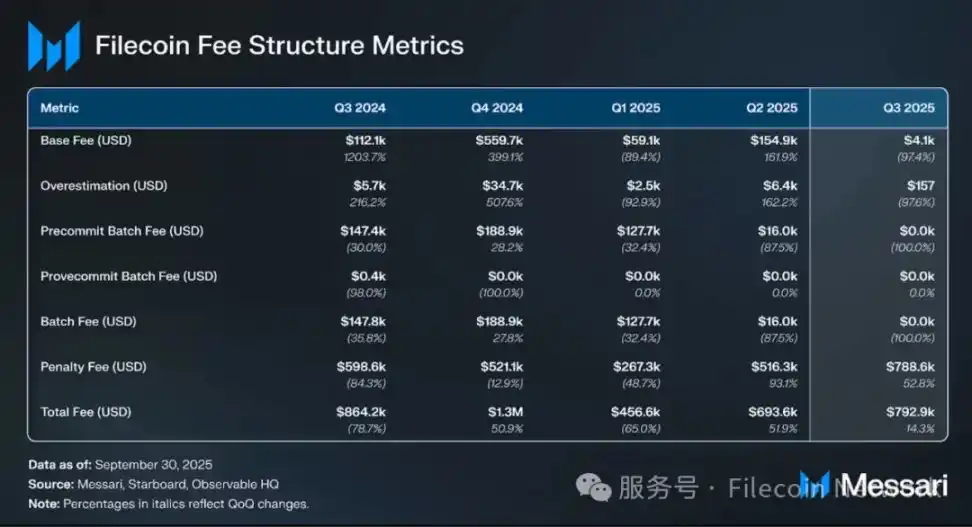

According to Messari's revenue analysis, Filecoin's fee structure is as follows:

· Base Fees: Determined by block space congestion, required for any storage proof.

· Batch Fees: Used to bundle multiple storage proofs to optimize costs.

· Overestimation Fees: Fees paid to optimize gas usage.

· Penalty Fees: Charged for storage provider failures or violations.

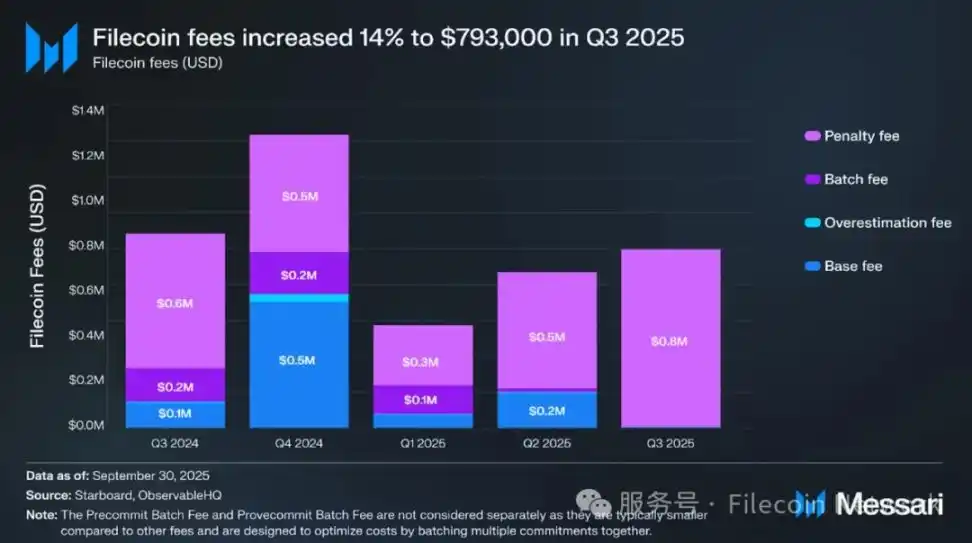

In Q3 2025, Filecoin's total network fees reached $792,900, up 14.3% quarter-on-quarter from $693,600 in Q2 2025. This growth was almost entirely driven by penalties, while base fees and batch-related fees collapsed after protocol-level changes introduced by the network v27 upgrade.

· Base Fees: Plummeted 97% quarter-on-quarter to $4,100. This decline reflects reduced onchain transaction throughput after several sector-related methods (FIP-0103, FIP-0106, FIP-0101) were deprecated, rather than a drop in network demand.

· Batch Fees: Fell 100% quarter-on-quarter to $0. This aligns with reduced sector onboarding activity and a continued decline in total active storage, resulting in a sharp drop in batch pre-commit transactions submitted by SPs.

· Overestimation Fees: Plummeted 98% quarter-on-quarter to just $157 (from $6,400 in the previous quarter), reflecting a decrease in gas-related activity as overall transaction frequency fell.

· Penalties: Soared 53% quarter-on-quarter to $788,600, accounting for about 99.5% of total network fees. This surge likely reflects an increase in slashing events during miner exits and stricter operational requirements amid network restructuring.

Q3 was a transitional period for the Filecoin economic model, with the network simplifying operational processes under v27. The reduction in batch and base fees reflects a shift from a high-volume, short-cycle onboarding model to fewer but larger verified deals. The surge in penalties highlights the operational pressure on smaller providers from higher quality standards. These trends indicate that the network is undergoing a consolidation period, with reduced fee activity from expansion but increased execution and efficiency among existing participants.

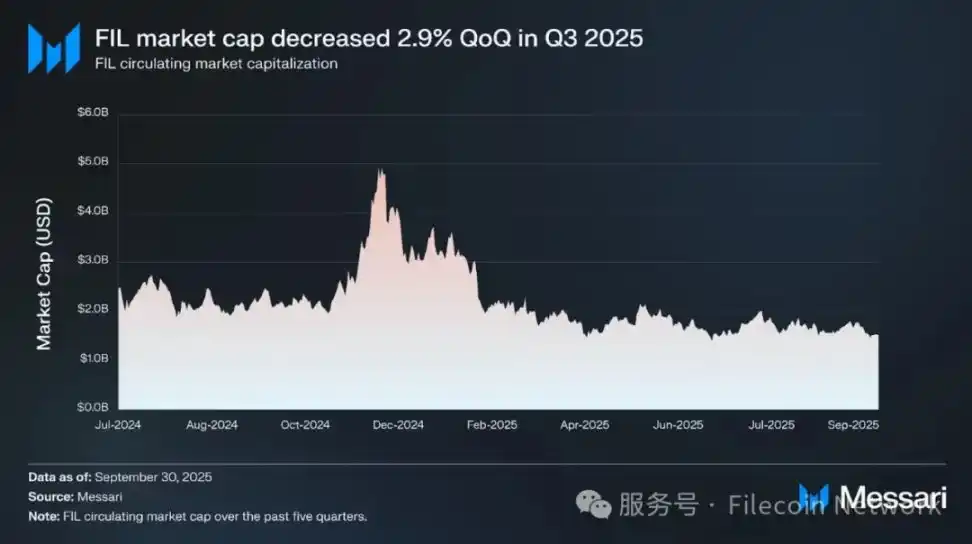

Market Cap

In Q3 2025, FIL's circulating market cap in USD terms fell 3% quarter-on-quarter to $1.5 billion, below $1.6 billion in Q2 2025. This decline was mainly driven by a 5% quarter-on-quarter drop in FIL token price (from $2.30 to $2.19), while circulating supply grew by 2.2% quarter-on-quarter to 692.4 million FIL, consistent with previous issuance rates.

DeFi Ecosystem

In Q3 2025, FIL's total staked amount fell slightly by 0.4% quarter-on-quarter, from 127.6 million FIL to 127.0 million FIL, marking the fifth consecutive quarter of decline. In USD terms, total staked value fell 5.4% to $277.9 million, mainly due to a 5% drop in FIL price this quarter, rather than a significant change in staking participation.

The eligible supply staking rate remained stable at 17%, unchanged from Q2 but down from 19% in Q1 2025, reflecting stable but relatively low network participation. Meanwhile, the annualized nominal yield dropped sharply from 52% to 24%. This is because the short-term yield spike in Q2, driven by declining staking participation and inflation-driven rewards, has normalized as staking activity stabilized.

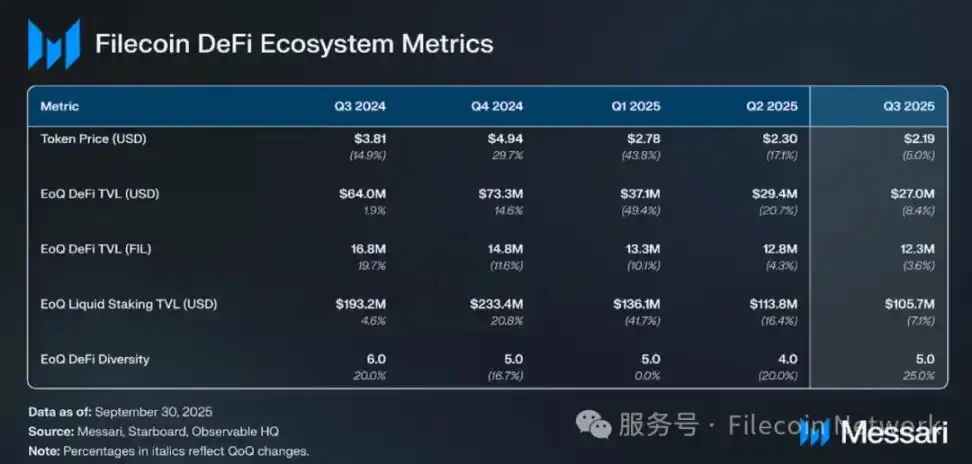

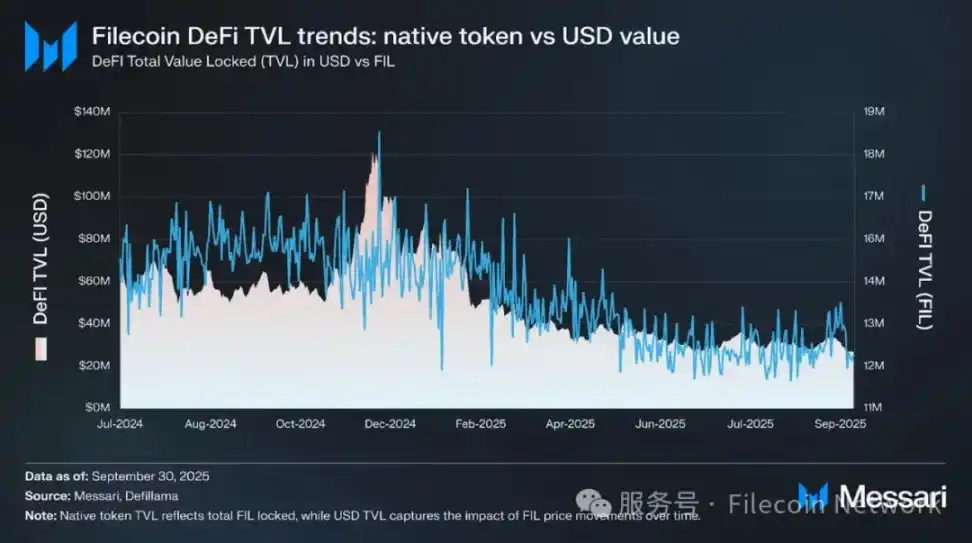

TVL Trends

In Q3 2025, Filecoin's DeFi activity continued to contract, extending the downward trend that began in early 2024. At the end of the quarter, total DeFi TVL fell 8.4% quarter-on-quarter to $27 million, down from $29.4 million in Q2, marking the fifth consecutive quarter of decline. When measured in FIL terms, the TVL decline was much milder, down 3.6% quarter-on-quarter to 12.3 million FIL, indicating that most of the value drop was due to the 5% decline in FIL price rather than substantial capital outflows.

Liquid staking TVL showed the same trend, falling 7.1% quarter-on-quarter to $105.7 million. This is because staking rewards normalized after the Q2 yield spike, and network incentives gradually weakened. In FIL terms, core liquidity products and staking participation remained stable, indicating that user participation and network engagement remained healthy even as USD-denominated metrics declined.

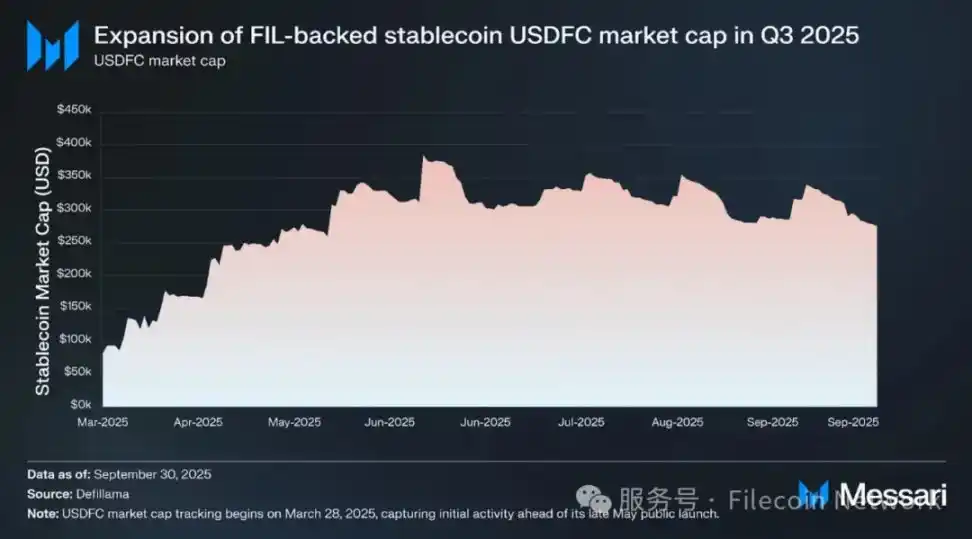

Stablecoins

USDFC is a FIL-backed stablecoin launched by Secured Finance in early 2025. It aims to increase liquidity within the Filecoin economy by allowing FIL as collateral and reducing FIL sell pressure. It provides a native, dollar-pegged asset for trading, lending, and DeFi applications without users needing to leave the Filecoin network.

In Q3 2025, USDFC's circulating supply fell 8.5% quarter-on-quarter, from $301,000 at the end of Q2 to $275,000 as of September 30, marking its first contraction since launch. After peaking at nearly $355,000 in mid-August, the stablecoin's circulating supply declined moderately throughout September as DeFi activity and yield opportunities cooled.

This pullback was market-driven, not structural. The 5% drop in FIL price reduced the value of collateral supporting new issuance, while staking and DeFi yields normalized from a short-term peak of 52% in Q2 to 24%, reducing minting incentives for liquidity providers and borrowers. After the network v27 "Golden Week" upgrade, participants prioritized protocol stability, also leading to a broader softening of onchain liquidity.

Despite this mild contraction, USDFC has maintained full peg stability and healthy circulation, indicating stable confidence among storage providers and DeFi participants. This contraction is not a sign of weakness but a natural consolidation phase following rapid expansion in Q2, laying the foundation for more robust growth as FIL-denominated markets and FVM-based integration solutions mature in 2025.

Qualitative Analysis

Protocol Upgrades

Network v27 Upgrade (Codename: "Golden Week"): The Filecoin network v27 upgrade (codename: "Golden Week") was successfully deployed at block height 5,348,280 on September 24, 2025, and officially completed the next day (September 25). This version focused on simplifying storage provider (SP) operations, enhancing EVM compatibility, and reducing technical debt.

Key Filecoin Improvement Proposals (FIPs) implemented include:

· FIP-0105: Introduced BLS12-381 precompiled contracts for Filecoin EVM (equivalent to EIP-2537) to support efficient BLS signature verification and enable cross-chain interoperability with Ethereum-based rollup solutions.

· FIP-0077: Introduced a deposit requirement for newly created storage provider (SP) IDs, equal to 10% of the initial pledge for 10 TiB of storage capacity (about 4 FIL at current rates), to curb spam account creation and improve network state efficiency.

· FIP-0103 / FIP-0106 / FIP-0101: Removed deprecated methods (such as "extend sector life," "prove replica update," "prove aggregate commit") to streamline SP Actor logic and maintenance work.

· FIP-0109: Enabled smart contract notifications for Direct Data Onboarding (DDO), allowing onchain applications to subscribe to storage events and programmatically trigger corresponding workflows.

· FRC-0108: Extended the snapshot format to include Fast Finality (F3) certificates, reducing node sync time and bandwidth requirements for new participants.

All major client implementations (Lotus, Venus, Forest, Curio, Boost) released compatible versions before upgrade activation. This upgrade enhanced developer tools and aligned the Filecoin Virtual Machine with Ethereum standards, laying the foundation for programmable data services and retrieval markets.

Cultural and Scientific Data Storage on Filecoin

On September 30, 2025, the Filecoin Foundation announced a new batch of partners who will preserve cultural and scientific archives on the Filecoin network. Building on early collaborations with several well-known institutions, this program highlights Filecoin's growing importance as a decentralized physical infrastructure network (DePIN) for persistent, verifiable, and censorship-resistant data storage. Newly preserved datasets on Filecoin include:

· Digital Public Library of America (DPLA): A pilot project to store selected materials from its more than 50 million cultural items, such as photographs, oral histories, and government documents.

· Earth Species Project (ESP): Preservation of the BEANS-Zero benchmark dataset, used to train NatureLM-audio—an audio language model for animal vocalizations—to ensure global researchers have resilient access to this data.

· Prelinger Archives: Tens of thousands of archival films documenting American social and cultural history, including Rick Prelinger's "Lost Landscapes" series.

· Rohingya Project: A community-led archive to preserve the cultural identity and oral histories of the stateless Rohingya community.

· CROSSLUCID's "Oceanic Whispers": Developed in part with RadicalxChange, this is an experimental data trust that stores marine protected area datasets on Filecoin and transforms them into interactive experiences with AI-generated content and partial ownership income models.

Together, these collaborations demonstrate how decentralized storage can support open science and cultural preservation through verifiable, tamper-proof archiving.

Ecological Integration and Collaboration

Filecoin Foundation and GSR Foundation Impact Cohort: On July 23, 2025, the Filecoin Foundation announced a partnership with the GSR Foundation to jointly launch the "Impact Cohort." This is a joint initiative to support five blockchain-based public good projects within the Filecoin ecosystem. The GSR Foundation, the philanthropic arm of digital asset market maker GSR, co-funded The Starling Lab for Data Integrity, Easier Data Initiative, Transfer Data Trust, Akashic, and CROSSLUCID's "Oceanic Whispers" with the Filecoin Foundation. Each project applies decentralized storage to socially impactful areas such as digital truth preservation, geospatial data access, art governance, and environmental management. This collaboration highlights Filecoin's key role as core technical infrastructure supporting social impact and real-world applications.

S3-Compatible Object Storage via Akave Cloud: On September 16, 2025, Akave announced the launch of an S3-compatible object storage service powered by Filecoin, designed for enterprise and DePIN use cases. This integration allows developers and organizations to store and access data using standard S3 APIs while benefiting from Filecoin's verifiable storage and retrieval guarantees. Akave's release aims to connect traditional cloud tools with decentralized infrastructure, simplifying enterprise migration to blockchain storage and enabling verifiable, low-latency "warm" data use cases through support for Proof of Data Possession (PDP).

Storacha's Bluesky Backup App: Storacha is a decentralized hot storage network built on Filecoin and IPFS, which released bsky.storage on June 12, 2025 (with adoption continuing to expand in Q3). This is a user-facing application that automatically backs up Bluesky social data every hour. The tool enables users to independently export and restore their posts and identity keys, further reinforcing Filecoin's grand vision for data portability, user ownership, and self-sovereign digital identity.

Developer Programs and Community Growth

7th Filecoin Developer Summit (FDS-7): Announced in September 2025, the 7th Filecoin Developer Summit is scheduled to be held online on October 16-17 and in person in Buenos Aires during DevConnect Argentina on November 13-15. The summit focuses on scaling Filecoin for enterprise and data-intensive applications and explores advances brought by network v27, including Direct Data Onboarding (DDO), BLS precompiled contracts, fast-finality snapshots, new retrieval markets, and AI data workflows.

Filecoin Onchain Cloud (Alpha Cohort): On August 12, 2025, FIL-Builders and FilOz launched the Onchain Cloud Alpha Cohort. The program introduces modules such as onchain payments, warm storage, standardized retrieval interfaces, and smart contract-based service level agreements (SLAs), enabling developers to easily deploy decentralized data services as if using smart contracts.

PL Genesis Hackathon – "Cracking the Sovereign Data Layer with Filecoin": As part of Protocol Labs' "Modular World" event series, this hackathon began in early June and ran until July 6, 2025. The event invited developers to experiment with decentralized data ownership and retrieval using Filecoin's onchain tech stack, exploring new applications for programmable storage and verifiable data access. The winning projects announced on September 5, 2025, showcased innovations such as smart contract-based retrieval logic, verifiable AI datasets, and developer tools for Data DAOs. The hackathon had a total prize pool of $15,000, strengthening developer engagement in Filecoin's evolving onchain cloud ecosystem.

Orbit Program and Community Events: During September 2025, the FIL Builders' Orbit Program expanded global developer outreach through a series of community workshops and hackathons. Highlight events included FIL Warsaw (September 5) and ETHAccra (September 4-6), featuring AI and DeFi bounty challenges; Code & Corgi workshops in Pune (September 12) and Delhi (September 25); and Decentralized Storage 101 co-hosted with Pacific Meta in Japan (September 18). These events focused on developer education around the Filecoin Virtual Machine (FEVM), data onboarding tools, and community-led open-source development.

Key Governance Developments

ProPGF Batch 1: On August 11, 2025, Protocol Labs completed the first batch of Filecoin Public Goods Funding (ProPGF), allocating $3.68 million to 14 ecosystem projects, including IPNI, CID Gravity Gateway, Curio Storage, Fil Ponto, and FilCDN Retrieval Services. The program supports forward-looking infrastructure and developer initiatives to strengthen Filecoin's core ecosystem and long-term sustainability.

RetroPGF Round 3: On August 25, 2025, the third round of Retroactive Public Goods Funding (RetroPGF) was announced, allocating 585,000 FIL to retroactively fund contributors who delivered verifiable impact across the ecosystem. This round adopted an Optimism-style public goods funding model, rewarding open-source contributions in infrastructure, tools, research, and client onboarding, reinforcing Filecoin's commitment to sustainable, impact-driven ecosystem growth.

Filecoin Plus (Fil+) Allocator Pathways: As of September 2025, the Fil+ governance team had reviewed over 140 allocator applications, with an approval rate of about 75%, and distributed over 450 PiB of DataCap (data quota). A new meta-allocator pathway was introduced to streamline enterprise onboarding and automate allocation tools. Regular governance calls and published recordings in August and September improved transparency, accountability, and operational efficiency within the program.

Conclusion

In Q3 2025, Filecoin's circulating market cap fell 3% quarter-on-quarter to $1.5 billion, mainly due to a 5% drop in FIL price to $2.19, while circulating supply grew by 2.2%. Network activity remained stable, with active storage volume down slightly by 1% to 1,110 PiB. Capacity shrank by 10% due to SP consolidation, pushing network utilization from 32% to 36%.

The network v27 "Golden Week" upgrade simplified storage operations, deprecated legacy sector methods, and enhanced FVM compatibility. While this temporarily slowed new deal formation, it improved long-term efficiency. Economic activity normalized, with total network fees up 14% quarter-on-quarter to $793,000, mainly driven by penalties; staking participation remained at 17%, and yields fell from 52% to 24%. As onchain yields cooled, DeFi TVL dropped 8% to $27 million, and FIL-backed stablecoin USDFC contracted 8.5% to $275,000.

On the ecosystem front, the Filecoin Foundation advanced cultural and scientific preservation efforts and launched a joint funding cohort with the GSR Foundation; Akave and Storacha announced new network applications; FIL-Builders and FilOz expanded developer programs through the Onchain Cloud Alpha Cohort and PL Genesis Hackathon. The team also announced FIL Dev Summit 7, to be held in Buenos Aires during DevConnect Argentina in November 2025, to showcase Filecoin's evolution toward verifiable, programmable data infrastructure.

Overall, Q3 reflected a consolidation phase, with the network becoming leaner and more efficient, focusing on verified data, enterprise storage, and laying the foundation for compute-over-data services.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fed's Jefferson Indicates a Halt in Interest Rate Adjustments

Why Molson Coors (TAP) Stock Is Dropping Today

Why Shares of Sirius XM (SIRI) Are Falling Today

Why Shares of PNC Financial Services Group (PNC) Are Rising Today