What Next For Dogecoin as Bitcoin 'Death Cross' Puts Major Memecoin in Crosshairs

DOGE rallied 4.4% to $0.156 before late-session selling erased momentum — but Bitcoin’s newly triggered Death Cross now threatens to reshape meme-coin market structure heading into the week.

News Background

- Bitcoin triggered a Death Cross on Nov. 16 as the 50-day MA fell below the 200-day MA for the first time since 2022 — historically a bearish macro signal.

- BTC dropped below $94,000 for the first time since May, deepening market-wide fear as sentiment plunged to Extreme Fear (10) on the Fear Greed Index.

- Analysts warn that while the Death Cross doesn’t guarantee further crashes, it tends to pressure high-beta assets like DOGE during liquidity contractions.

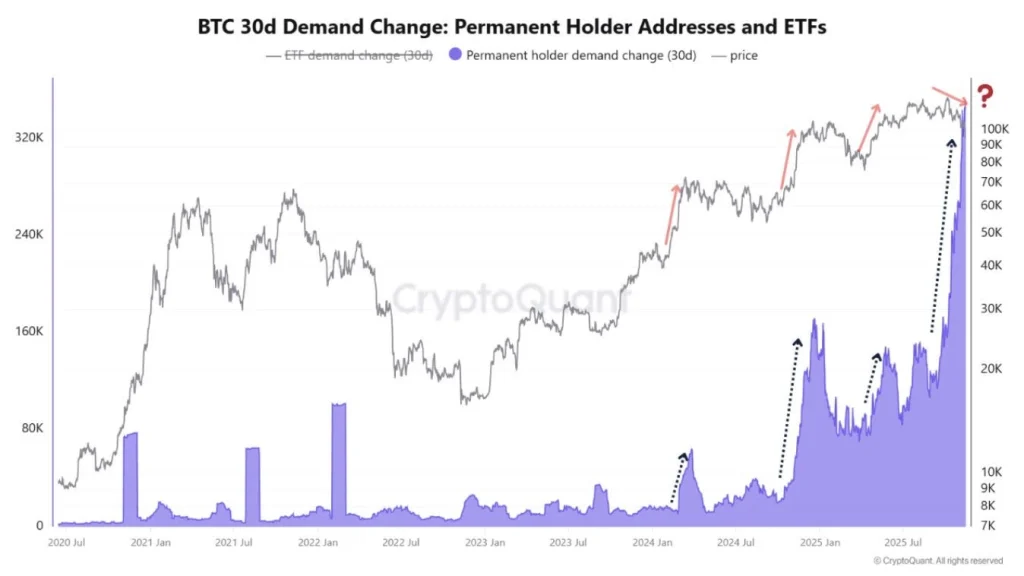

- Whale selling and accelerating spot Bitcoin ETF outflows contributed to broader risk-off contagion.

- Meme coin flows tightened as traders rotated into higher-liquidity majors, despite DOGE seeing intermittent whale accumulation events.

Price Action Summary

- DOGE climbed 4.41% to $0.156, with volume spiking 29.6% above weekly averages.

- Strong bid defense appeared at $0.1551–$0.1580, where buyers absorbed heavy sell pressure.

- DOGE broke above $0.1640 intraday before trending lower into the close.

- Final-hour profit-taking triggered a 2.57% drop, sending DOGE back toward key support.

- DOGE traded within a 5.8% intraday range, tracking broader BTC-driven volatility.

Technical Analysis

- Dogecoin opened the session with clear bullish structure, building an ascending pattern driven by strong volume at the $0.158 support zone.

- The rally benefitted from broader market stabilization ahead of the BTC Death Cross event but failed to produce a decisive breakout beyond the $0.163–$0.165 resistance band.

- The afternoon volume spike — 1.26B DOGE traded — confirmed aggressive defense of support and suggested institutional accumulation was present beneath market price.

- However, the tone shifted dramatically into the close. As BTC slid further below $94,000 and the Death Cross narrative spread across futures desks, DOGE experienced algorithmic rotational selling identical to previous BTC-driven risk-off episodes.

- The resulting 2.57% decline broke the final higher-low structure and confirmed that DOGE remains highly sensitive to Bitcoin’s macro trend shifts.

What Traders Should Watch Out For

- Market focus now shifts to whether Dogecoin can absorb Bitcoin-driven volatility or whether the newly formed Death Cross will suppress meme-coin momentum for several sessions.

- The $0.158 zone is the most important level on the chart — holding this area would signal that whale accumulation is offsetting macro selling pressure. A close below $0.158, however, puts DOGE at immediate risk of sliding toward $0.152–$0.148 as liquidity thins.

- On the upside, DOGE must reclaim $0.1604 and then decisively clear $0.163–$0.165 to neutralize the impact of BTC’s macro breakdown.

- Traders should monitor volume closely: contracting volume favors sideways chop, while renewed spikes above 1B DOGE indicate the potential for trend continuation.

- Additionally, Bitcoin ETF outflows and BTC’s ability to hold above $93,000 will dictate volatility across all meme coins — making macro correlation the dominant factor in DOGE’s near-term direction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Price Retests Major Bull Market Support at $92k: $130k or $80k Next? Analysts Insights

Why Analysts Say Warren Buffett’s Japan Strategy May Indirectly Boost Ripple and XRP

XRP News Today: Despite Record Inflows into XRP ETF, Token Experiences 4.3% Decline

- XRP fell 4.3% to $2.22 despite Canary Capital's XRPC ETF securing $245M inflows, outperforming 2025 ETF peers. - Analysts cite delayed ETF settlement mechanics , macroeconomic pressures, and $28M in XRP liquidations as key price drivers. - XRPC's success contrasted with $866M Bitcoin ETF outflows, highlighting shifting institutional crypto preferences. - Experts predict gradual XRPC-driven demand but warn XRP remains vulnerable below critical $2.30 support level.

Ethereum Updates: As Bitcoin Faces Greater Market Challenges, Corporate Treasuries Shift Focus to Ethereum

- BitMine Immersion appoints Chi Tsang as CEO, now holding 3.5M ETH ($12.4B) as it shifts focus to Ethereum financial services. - Strategy's stock plummets below Bitcoin treasury value (mNAV 1.24), reflecting waning investor confidence despite Saylor's bullish stance. - Ethereum drops 5.46% amid $259M ETF outflows, while Bitcoin falls below $95K after $1.4B liquidation event. - Corporate treasuries expand beyond BTC/ETH, with Forward Industries (Solana) and Cypherpunk (Zcash) adopting new crypto strategies