Cardano Price Crashes: Is $0.40 Next?

Cardano (ADA) price has slipped below the 0.47 mark, reflecting the same cautious tone that’s gripping broader markets after President Donald Trump’s tariff rebate proposal hit a political wall. Traders had briefly priced in optimism that stimulus-style rebates could lift consumer spending, but that narrative is fading fast — and risk assets, including crypto, are feeling it.

Cardano Price Prediction: Why ADA Price Is Falling

Trump’s delayed $2,000 tariff rebate plan has revived debate around fiscal constraints and deficit control. That uncertainty has pushed investors out of speculative plays and into defensive positioning. Cardano, like other altcoins, is suffering from the rotation — low trading volumes, declining sentiment, and a lack of fresh inflows from retail traders.

Even though the broader crypto market remains above key technical supports, ADA continues to lag, indicating weak buying pressure. Its price has now logged multiple consecutive red candles, suggesting that bulls are losing grip.

Cardano Price Prediction: The Trend Still Points Down

ADA/USD daily Chart- TradingView

ADA/USD daily Chart- TradingView

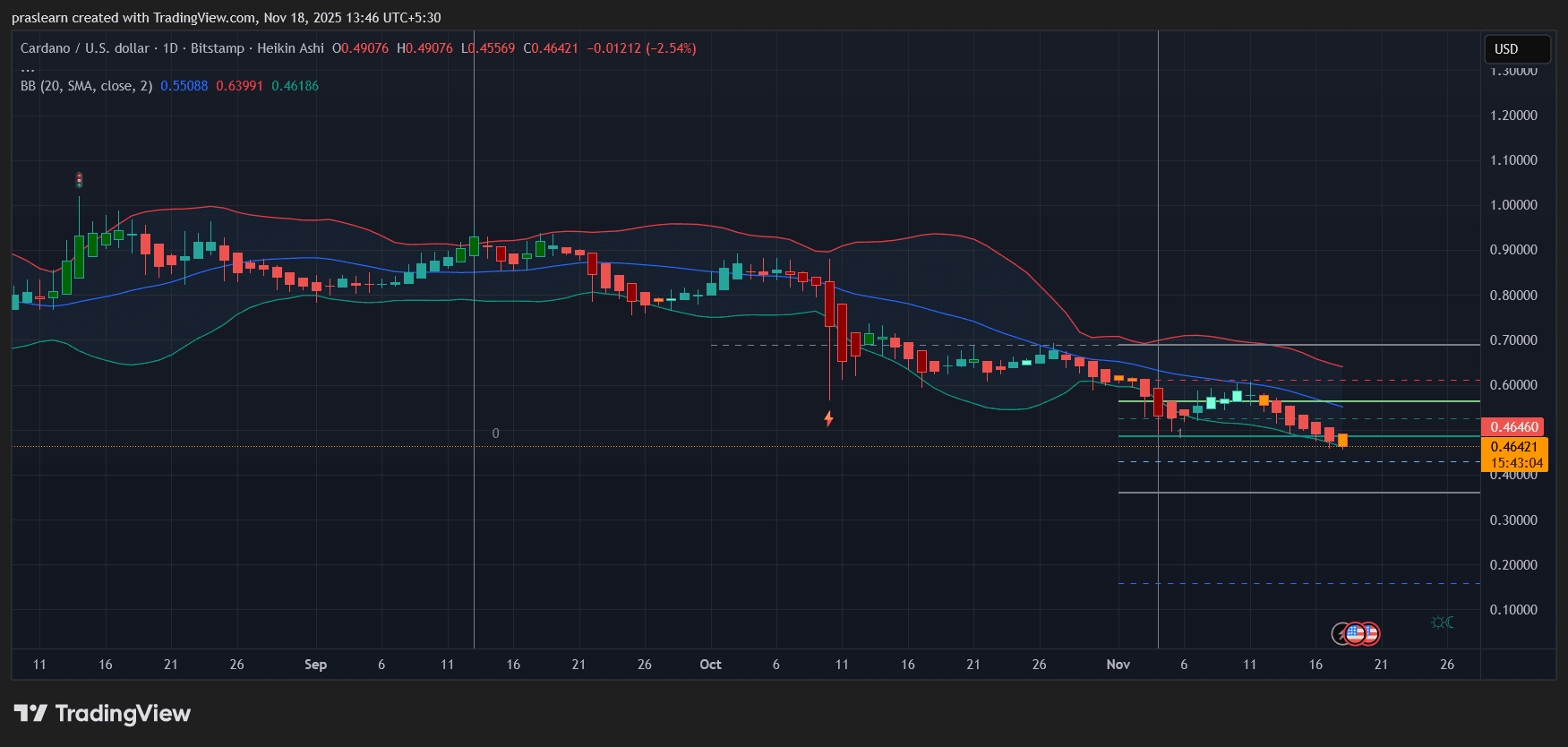

On the daily chart, ADA price trades near $0.46, sitting below both the 20-day SMA (around $0.55) and the middle Bollinger Band, confirming a sustained downtrend. The Bollinger Bands are widening again, a sign of rising volatility with downside bias.

Heikin Ashi candles show a string of solid-bodied red bars with minimal upper wicks — a classic continuation pattern of bearish momentum. Each attempt to rebound toward the $0.50–$0.52 zone has met quick selling pressure.

Support sits at $0.45, followed by a critical zone around $0.40, which marks the next potential accumulation range. A decisive daily close below $0.45 could invite a retest of $0.38–$0.40. Resistance lies near $0.55, where the 20-day SMA aligns with the mid-band — a key barrier for any short-term recovery.

Momentum and Market Psychology

Sentiment around ADA price remains cautious. RSI (not shown but inferred from current momentum) likely sits near oversold territory, which hints that a short-term technical bounce is possible. However, without positive macro or ecosystem news, such a rebound may be weak and short-lived.

Investors are increasingly focused on ADA’s declining network activity and slower DeFi adoption compared to Ethereum and Solana . Combined with macro headwinds — like delayed stimulus and debt concerns — the setup keeps ADA vulnerable.

Cardano Price Prediction: Consolidation Before Rebound?

If Cardano price manages to hold above $0.45 this week , it could stage a minor relief rally toward $0.50–$0.52. But unless it breaks and sustains above the $0.55 zone, the downtrend remains intact.

Failure to hold $0.45 would confirm a continuation toward $0.38–$0.40, where long-term investors may find value. Traders should watch for declining sell volume and a flattening of the Bollinger lower band as early signs of reversal.

Cardano’s current weakness isn’t just technical — it’s psychological. Uncertainty around U.S. economic policy, especially Trump’s tariff rebate debate, is cooling speculative appetite across markets. Until clarity returns, ADA price may continue to drift lower or move sideways, consolidating before its next major impulse.

If macro conditions stabilize and Bitcoin resumes its upward trajectory, $ADA could retest $0.60 by December. But for now, the path of least resistance remains down. Cardano sits at a crucial inflection point near $0.45. Expect short-term volatility and limited upside until macro policy uncertainty clears. Only a sustained close above $0.55 would signal a shift toward recovery.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ATOM rises 1.87% over 24 hours as network enhancements and governance proposals unfold

- ATOM rose 1.87% in 24 hours amid Cosmos' Iris-5 upgrade, introducing improved staking and cross-chain features despite 1-year 58.63% decline. - Three governance proposals aim to reallocate inflation funds to developer grants and boost validator incentives, with above-average community voting participation. - Ecosystem growth accelerates with new dApps and a cross-chain stablecoin aggregator, signaling maturing infrastructure and real-world use cases. - Analysts caution short-term volatility persists due

LTC Properties Rises 1.91% Over 24 Hours as Portfolio Adjusts and Dividends Remain Steady

- LTC Properties boosted Q3 earnings with portfolio rebalancing and 80% dividend payout ratio, ensuring monthly dividend coverage despite macroeconomic challenges. - 2025 guidance raised to $2.70-$2.83/share FFO range, reflecting $124.53M-$130.53M in total value as LTC prioritizes seniors housing over skilled nursing assets. - $270M invested in seniors housing portfolio (85% of $460M target), including a 7% yield acquisition, signaling strategic shift to stable income-generating properties. - Long-term deb

Elvis-Inspired Judge Steps Down Following Conduct Issues That Raise Questions About Fairness

- Missouri Judge Matthew Thornhill resigned after disciplinary commission found his Elvis-themed courtroom antics violated judicial conduct standards. - He admitted to wearing Elvis wigs, playing music, and making irrelevant references during proceedings, undermining courtroom solemnity. - His resignation includes a six-month unpaid suspension and 18-month reduced role before permanent departure, following prior 2008 misconduct. - Critics argue his actions eroded judicial impartiality, while Thornhill clai

Analyst Sets a Bold Bull Target for ETH at $12,000 in the Next 2-3 Years