Mt. Gox Just Moved Nearly $1B in Bitcoin. Should You Be Worried?

Mt. Gox just shook the crypto market again. After eight months of silence, the defunct exchange suddenly moved 10,608 Bitcoin worth almost 1 billion dollars, setting off a wave of speculation, fear, and on-chain detective work. The timing couldn’t be more dramatic: creditor repayments have already been pushed back to late 2026, leaving billions in locked-up BTC and a decade-long saga that refuses to end. The question now is simple. Was this just a routine shuffle, or a warning shot that more turbulence is coming?

What Triggered the Panic?

Mt. Gox suddenly shifted 10,608 BTC worth about 953 million dollars into a fresh wallet. This is the exchange’s biggest move in eight months, and the first transfer over the million-dollar mark since March. The crypto market wasn’t expecting any activity right now, especially because the exchange has once again pushed back creditor repayments to October 2026.

Why Is Mt. Gox Still Delaying Payments?

According to the trustee, creditor paperwork is still incomplete, so the repayment deadline has been officially extended by another year. This might sound frustrating, but it actually means one thing for the market: nearly 4 billion dollars worth of Bitcoin will stay locked up until late 2026. That delay reduces the immediate fear of a giant sell-off that could crush BTC’s price.

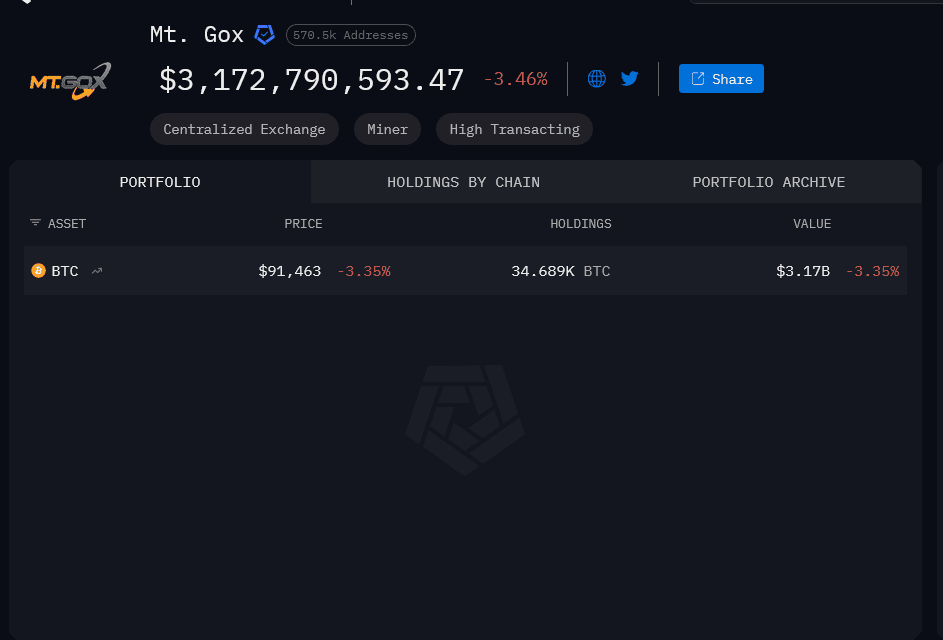

How Much Bitcoin Does Mt. Gox Still Hold?

Even after the latest transfer, Mt. Gox still controls 34,689 BTC valued at a little over 3.1 billion dollars. That stash hasn’t moved. And importantly, none of the newly transferred coins have been sent to exchanges. The receiving address labeled 1ANkD is just holding the 10,608 BTC for now, which suggests no sale is happening yet.

Is This a Sign They Are Preparing to Sell?

Some analysts think so. Jacob King from SwanDesk warned that Mt. Gox might be gearing up to dump the coins into a weak market.

This kind of speculation always shakes traders a bit, especially during corrections. But here’s the thing: on-chain data shows zero movements toward centralized exchanges. Until that happens, a sale isn’t confirmed.

Does Mt. Gox Still Affect Bitcoin’s Price?

Much less than before. Since the rehab process started releasing small batches of BTC in July 2024, Bitcoin has climbed from around 56,000 dollars to over 91,000 dollars today. Institutional buyers, corporate treasuries, and US spot ETFs are absorbing new supply far faster than Mt. Gox can release it.

Mt. Gox used to dominate the crypto world, handling more than 70 percent of all Bitcoin trades in its prime. Its collapse in 2014 after losing 850,000 BTC remains one of the largest disasters in crypto history. Since then, creditors have spent a decade waiting through endless delays, legal hurdles, and shifting repayment schedules.

The Bottom Line

Yes, the transfer grabbed headlines. Yes, people panicked. But the coins haven’t hit exchanges, and repayments are pushed to 2026, which actually keeps billions of dollars in Bitcoin off the market. For now, this is noise, not a threat. Investors should watch the wallets closely, but there’s no sign of a sell-off yet.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SEC Addresses Crypto Privacy Challenge: Balancing Investor Security and Technological Autonomy

- SEC hosts roundtable to address crypto privacy vs. surveillance tensions amid evolving regulatory framework. - Agency shifts focus to core compliance areas, deprioritizing crypto enforcement compared to prior administration. - DOJ intensifies crackdown on privacy tools, convicting Samourai Wallet founders for AML violations. - Regulatory divide between SEC and DOJ creates uncertainty as Congress delays digital asset bill. - Debate highlights tension between investor protection and crypto's decentralizati

JPMorgan Lowers Bullish's 2026 Projection, Adjusts Focus to Fundamental Earnings

- JPMorgan cuts Bullish's 2026 price target to $45 from $46, excluding $6.2M in high-margin stablecoin promotion revenue from IPO proceeds. - Bullish's Q3 results exceeded forecasts with $77M revenue and $29M adjusted EBITDA, though seasonal trading weakness tempered optimism. - Deutsche Bank upgrades Bullish to "Buy" with $51 target, citing U.S. expansion and infrastructure role for traditional finance firms in crypto. - Bullish's stock trades near 52-week low despite 72% Q3 revenue growth, as JPMorgan hi

Bitcoin News Update: Arizona's Approach to Bitcoin Through MSTR—Smart Equity Move or Risky Pension Gamble?

- Arizona's pension fund holds $13.5M in Bitcoin via 76,238 MSTR shares, down from $24M as the stock fell 60% since November 2024. - MSTR faces potential $2.8B outflows if excluded from MSCI indices, exacerbating liquidity risks amid its heavy reliance on index-linked passive flows. - The firm recently bought 8,178 BTC ($835.6M) to reach 649,870 tokens ($48.37B cost value), defended by CEO Saylor as a long-term strategy. - Institutional investors increasingly use equity-linked crypto exposure through firms

DASH Aster DEX: Transforming Decentralized Exchange Frameworks and Enhancing User Engagement in DeFi

- DASH Aster DEX emerges as a leading DeFi DEX in 2025 with a hybrid AMM-CEX model, cross-chain liquidity routing, and AI optimization. - The platform secures $50B in assets, processes 10,000 TPS, and achieves $1.399B TVL with 2 million users post-September 2025 TGE. - It outperforms Uniswap in weekly fee generation ($69.5M vs. $32M) while competing with PancakeSwap's $1.2T 365-day volume. - Strategic partnerships with Binance and YZi Labs enhance institutional credibility but expose risks in cross-chain i