Key Market Intelligence on November 18th, how much did you miss?

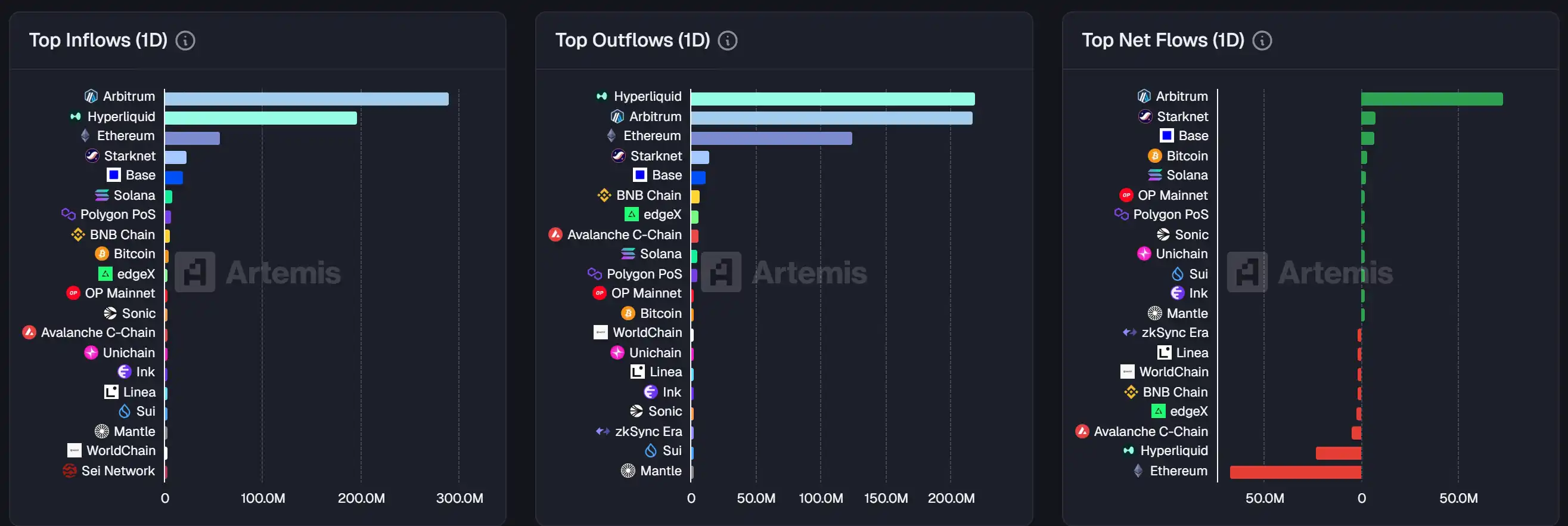

1. On-chain Funds: $73.2M USD flowed into Arbitrum today; $67.2M USD flowed out of Ethereum 2. Largest Gain/Loss: $67, $REKT 3. Top News: NVIDIA to release Q3 earnings report this Thursday, potentially triggering a global AI-related asset chain reaction

Top News

1. NVIDIA to Release Q3 Earnings Report This Thursday, Potentially Triggering Global AI-Related Asset Chain Reaction

2. New York Times Reports $28 Billion of "Dirty Money" Flowed Into Cryptocurrency Exchanges in the Last Two Years, With Binance as a Primary Recipient

3. HYPE Surges 12% Today, "Suspected HYPE Listing Insider" Whale Quickly Nets Over $3 Million in Profits

4. Mastercard Teams Up with Polygon to Build New Cryptocurrency Transfer System

5. Nasdaq 100 Index Futures Extend Losses to 1%

Trending Topics

Kaito

Here is the translation of the original content:

[HYPERLIQUID]

Hyperliquid took the spotlight today due to a major event: a $3 million withdrawal from OKX was split among 19 wallets and used to go long on POPCAT on the platform. This ultimately led to rapid liquidation resulting in a $4.9 million loss for HLP. Following the event, Hyperliquid paused its cross-chain bridge for maintenance.

Additionally, Hyperliquid launched NVDA-PERP, the first-ever permissionless perpetual contract for a single stock in the crypto space, seen as a significant innovation. The platform's innovative features and partnership with Polymarket for prediction markets also sparked discussions, highlighting its influence in the crypto ecosystem.

[POPCAT]

POPCAT experienced intense volatility today, stemming from malicious manipulation on Hyperliquid. A trader withdrew $3 million USDC from OKX, distributed it across 19 wallets, and established long positions ranging from $20 million to $30 million, creating a false buy wall at $0.21. After the buy wall was removed, the price plummeted, resulting in total liquidations of $63 million and a $4.9 million loss for HLP. The event was linked to previous manipulation activities, leading Hyperliquid to pause the Arbitrum cross-chain bridge, sparking widespread discussions on high-leverage risks and decentralized exchange security.

[POL]

Today's POL discussion focused on the integration of the world's largest fund network, Calastone, with Polygon, aiming to tokenize fund shares for 4,500 financial institutions across 58 markets. This move highlights Polygon's role in on-chain institutional finance, providing faster settlements, lower costs, and higher transparency.

Additionally, Polygon's influence in the Latin American market, stablecoin adoption, and rising transaction fees (indicating increased network activity) have also been of interest.

[ORD]

ORD's hot topic today is the launch of ZapApp, a self-custody crypto app based on Solana that supports KYC-free and gas-free transactions. Following the launch of ZapApp, the official distribution of $DOG tokens as a celebration sparked market enthusiasm. The app aims to simplify the transaction process and challenge the traditional exchange model by not charging listing fees, sparking discussions on exchange fairness and the potential disruptive nature of ZapApp.

Featured Articles

1. "Cryptocurrency Projects Still Queueing for Listing in This Bear Market"

On October 22, U.S. President Trump officially signed a pardon for CZ, but there is still much public misunderstanding surrounding the pardon itself. On November 15, CZ's personal lawyer and partner at the prominent law firm Baker Hostetler, Teresa Goody Guillén, was interviewed by Morgan Creek founder Anthony Pompliano. In her conversation with Pompliano, Teresa disclosed many previously undisclosed details about the allegations against her and the reasons and process behind the pardon. CZ himself has also retweeted and liked Teresa's interview content.

2. "A $500,000 Lesson: He Made the Right Prediction but Ended Up in Debt"

Recently, Stable completed two substantial rounds of pre-deposit activities, with the first tranche of $8.25 billion being quickly snapped up and the second tranche's qualified subscription amount exceeding $11 billion, causing widespread industry attention. Behind the impressive data, however, there are also backgrounds worth clarifying: the project is spearheaded by a key figure from Tether, and USDT as the native asset naturally forms a strong bond; the pre-deposits are highly concentrated among early institutions and insiders; and the timing between the "GENIUS Act" enactment and project acceleration is too close.

On-chain Data

On-chain Fund Flow for the Week of November 18

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Rate reduction prospects appear more uncertain as Federal Reserve leaders show strong support for Powell

Atmus Filtration Technologies (NYSE:ATMU) Reports Strong Performance for Q3 CY2025

AI hyperscalers are expected to boost the issuance of US corporate bonds in 2026, according to analysts

Polygon Labs Layoffs: Strategic Pivot Sees 30% of Workforce Cut Amid Open Money Stack Focus