Trump’s Federal Reserve Strategy: Hassett’s Proposed Reductions Face Resistance from Central Bank Prudence

- Trump plans to nominate Kevin Hassett as Fed chair, prioritizing aggressive rate cuts over Powell's cautious approach. - Hassett's market-driven policies face political risks, with internal resistance warning against destabilizing Fed independence ahead of 2026. - Fed officials remain divided on rate cuts, balancing inflation control against weakening labor market signals. - Critics argue Trump's focus on short-term cuts risks inflation, while Bessent's post-Thanksgiving recommendations will shape U.S. m

President Donald Trump is nearing a decision to select Kevin Hassett as his top choice to replace Jerome Powell as the head of the Federal Reserve, with the National Economic Council director signaling he would accept the role if offered. Hassett, known for advocating significant interest rate reductions, stated in a Bloomberg interview that he favors a 50 basis point cut to the Fed’s key rate at the December meeting,

Hassett’s possible nomination highlights Trump’s desire for a Fed leader who aligns with his economic agenda. During his interview, Hassett stressed his readiness to challenge the Fed’s present policies, which he claims have become “uncomfortably aligned with partisan interests.”

The political dynamics surrounding the nomination are still complicated.

The Federal Reserve itself is facing a tricky situation. Some members, such as Governor Christopher Waller, are pushing for rate reductions due to a softening job market, while others, including Cleveland Fed President Beth Hammack, believe policy should stay “somewhat restrictive” to fight ongoing inflation

Trump’s advocacy for a more accommodative Fed fits with his broader economic strategy, which also involves reducing tariffs and tackling inflation. Hassett, who has previously been on the Fed’s board, describes his approach as a mix of market-oriented reforms and structural changes aimed at lowering costs for consumers

As the administration nears a final decision, whoever is chosen will need to balance Trump’s expectations with the Fed’s responsibility to maintain long-term economic health.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Anti-CZ Whale Loses $61M Profit in 10 Days on Hyperliquid

Quick Take Summary is AI generated, newsroom reviewed. The "Anti-CZ Whale" lost $61 million in profit in 10 days, suffering losses on aggressive long positions in ETH and XRP. The whale's overall realized and unrealized profit dropped from $100 million to $38.4 million. One of the whale's accounts is running 12.22x leverage on a $255 million long exposure, with alarmingly thin 95.40% margin usage. The reversal highlights the high risk and volatility in perpetual futures trading, even for successful contrar

Watch Out: Numerous Economic Developments and Altcoin Events in the New Week – Here is the Day-by-Day, Hour-by-Hour List

‘I Won’t Back Down,’ Michael Saylor Reinforces Strategy’s Bitcoin Mission

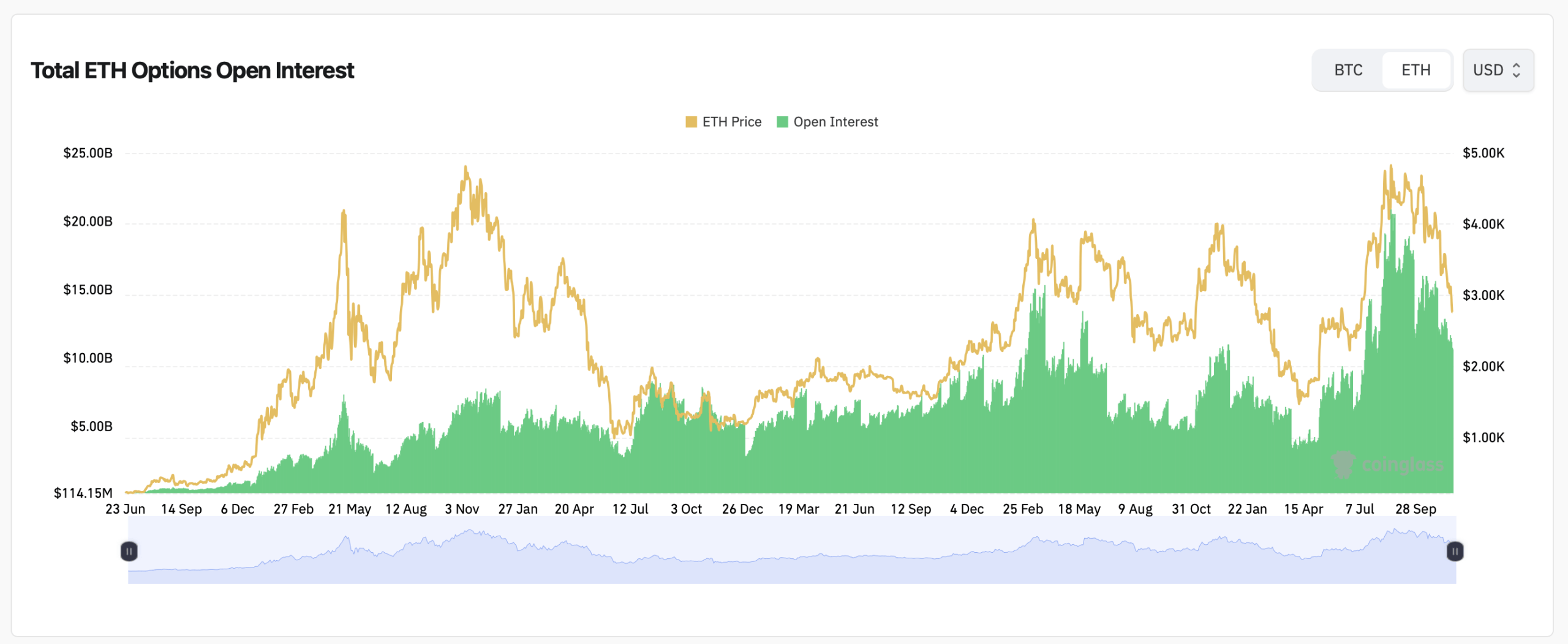

Ethereum Price Stalls as Derivatives Traders Load up for the Week Ahead