Trump Congressional Ally Discloses Latest Six-Figure Bitcoin Purchase

Rep. Brandon Gill (R-Texas) has added up to $300,000 total in Bitcoin and shares of the largest BTC exchange-traded fund to his sizable holdings in both assets, according to his most recent transaction report filed November 18 with the House of Representatives clerk.

Gill, a former investment banker and staunch ally of U.S. President Donald Trump, purchased between $100,000 and $250,000 in Bitcoin on October 20, and nine days later, bought between $15,001-$50,000 in BlackRock's iShares Bitcoin Trust ETF (IBIT). Periodic House transaction disclosures record a range and not the exact amount of an investment.

The first-term lawmaker, who sits on the House Budget Committee, has been an active purchaser of the largest cryptocurrency by market value, accumulating up to $2.6 million in Bitcoin since his January swearing-in, according to House transaction reports. He has also bought up to $150,000 in IBIT this year.

Gill's office did not immediately respond to a Decrypt request for comment.

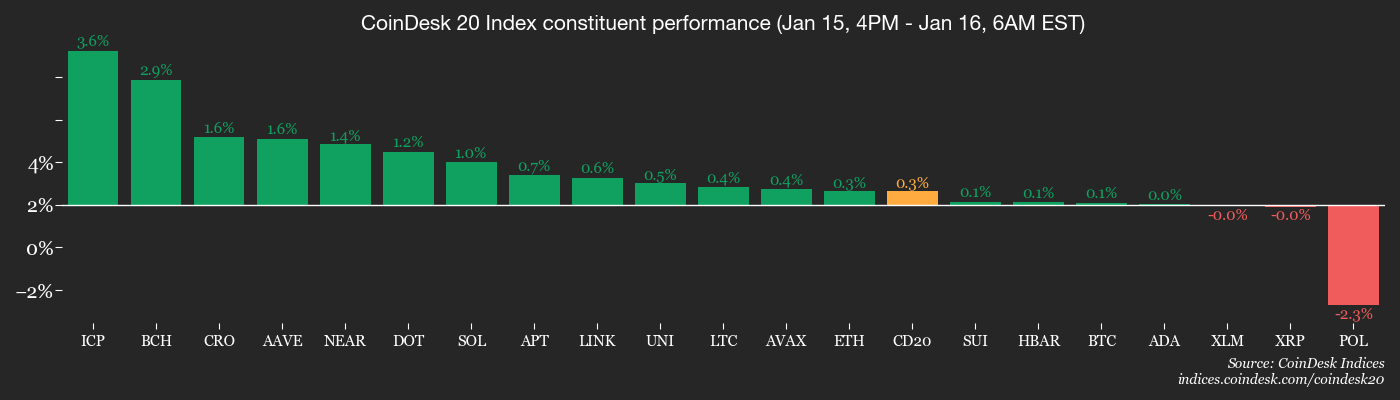

Bitcoin was recently trading at about $92,140, flat over the past 24 hours, although BTC is down about 27% since reaching a record high above $126,000 last month, according to crypto markets data provider CoinGecko.

BlackRock's IBIT manages more than $74 billion in assets, more than three times the next largest spot Bitcoin fund, according to data provider CoinGlass.

Gill's disclosures show that he purchased up to $1.5 million in Bitcoin in three installments over a three-week period starting in late June, including an investment worth up to $1 million on June 20. Earlier in the year, he bought $850,000 in BTC in four parts starting in late January, according to reports.

Gill did not properly disclose up to $500,000 of the earlier Bitcoin purchases within the 45-day window mandated by federal law, according to the government transparency group OpenSecrets.

He reported buying between $100,001 and $250,000 in BTC on both January 29 and February 27—but only disclosed the trades on June 2, after the deadline required under the Stop Trading on Congressional Knowledge (STOCK) Act.

Passed in 2012, the STOCK Act is designed to curb insider trading and ensure accountability by requiring timely reporting of lawmakers’ securities transactions, including those involving digital assets. However, violators face only a $200 fine that congressional ethics committees frequently waive.

Gill is a vocal supporter of crypto, and his January trade came days after Trump signed an executive order calling for reduced regulation on digital assets. The February buy occurred just before Trump unveiled a "strategic Bitcoin reserve" initiative on March 6. Gill made two additional Bitcoin purchases in May, which were reported on time.

Rep. Marjorie Taylor Greene (R-Georgia) has purchased up to $60,000 in IBIT this year, according to House disclosures. Earlier this year, Rep. Guy Reschenthaler (R-Pennsylvania) sold positions in Bitcoin, XRP and Solana.

Gill's other investments include the tech-focused Invesco QQQ Trust ETF, which tracks the technology-focused Nasdaq.

In an email to Decrypt, David Meyers, OpenSecrets' director of communications and marketing, wrote that "crypto transactions are no more—or less—ethical than stock transactions."

"Members of Congress are required to disclose both so the public can determine whether lawmakers are acting on behalf of their constituents or in their own self-interests," he wrote. "However, with the president's family heavily involved in the crypto industry, there are certainly questions to be answered as to whether investors are attempting to curry favor with the White House."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Reliable cloud mining platforms in 2026: Features, risks, and key differences

Senate bill, ETF flows pull market in conflicting directions: Crypto Daybook Americas

XRP Forecast for Jan 16: Can It Hold On the $2.01 Support Level?

XRP Nightmare and Conviction Scenarios as Price Slips Again