3 Bitcoin Mining Stocks To Watch In The Third Week Of November 2025

BMNR, BTDR, and HIVE face heavy declines but oversold conditions and strong fundamentals hint at possible rebounds in the third week of November.

When we look at Bitcoin’s price, the concern extends to the altcoins as well; however, it should also extend to the companies associated with BTC-related activities.

In line with the same, BeInCrypto has analysed three Bitcoin mining companies’ stock performance and what lies ahead for them.

BitMine Immersion Technologies (BMNR)

BMNR has dropped 24% this week and trades at $30.95. Despite the decline, Bitmine has continued accumulating ETH, adding 54,156 ETH worth more than $170 million over the past seven days. This signals a strong long-term conviction from the company.

The RSI is nearing the oversold zone, which often precedes a reversal. If conditions stabilize, BMNR could rebound from the $30.88 support and climb toward $34.94 or even $37.27, offering relief after a week of heavy losses.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

BMNR Price Analysis. Source:

TradingView

BMNR Price Analysis. Source:

TradingView

If Bitcoin weakens further, BMNR may follow the broader downturn. A deeper decline could send the stock below $27.80, with potential downside extending to $24.64. This would invalidate the bullish outlook and signal intensified bearish momentum.

Bitdeer Technologies Group (BTDR)

Bitdeer has recorded some of the steepest losses among Bitcoin mining stocks, falling 53% over seven sessions. The share price now sits at $10.63, reflecting intense selling pressure as broader market weakness continues to weigh on mining companies.

BTDR’s RSI is deep in the oversold zone, signaling conditions that often precede a reversal. If buyers step in, the stock could rebound from $9.56 and move toward $11.92, with potential upside extending to $15.24 if momentum strengthens.

BTDR Price Analysis. Source:

TradingView

BTDR Price Analysis. Source:

TradingView

If market conditions fail to improve, BTDR could continue its decline. A breakdown below $9.56 may drive the price toward $7.96. This would invalidate the bullish outlook and signal an extended downside for the mining firm.

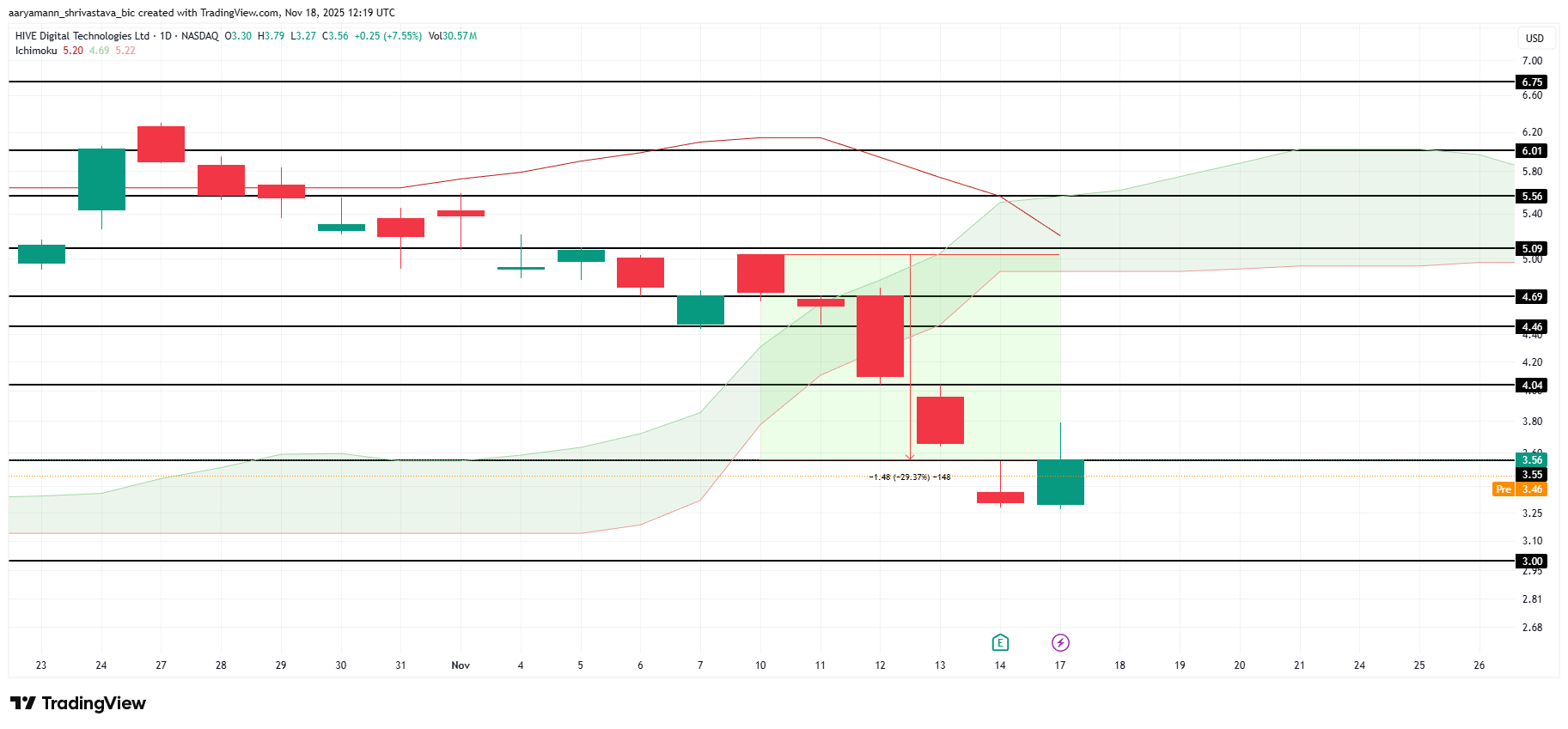

HIVE Digital Technologies Ltd. (HIVE)

Bitcoin mining company HIVE has dropped 29% over the past week but now trades at $3.56 after gaining 7.5% today. The surge follows the company’s announcement of 285% revenue growth in Q2, which has boosted investor confidence despite recent volatility.

This strong performance could fuel a broader recovery and lift HIVE toward $4.04. Restoring recent losses would require a move to $5.09. Reaching this target may take time, but it remains possible if momentum and sentiment continue improving.

HIVE Price Analysis. Source:

TradingView

HIVE Price Analysis. Source:

TradingView

If the stock fails to capitalize on the company’s earnings strength, HIVE may resume its decline. A drop toward the $3.00 support level or lower would invalidate the bullish thesis and signal renewed weakness.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

X Financial Shifts to Risk-First Approach: Third Quarter Revenue Drops 13.7% Amid Strategic Change

- X Financial reported 23.9% YoY revenue growth to RMB1.96B in Q3 2025, but saw 13.7% sequential decline due to cautious lending and risk prioritization. - Net income rose 12.1% annually to RMB421M but fell 20.2% sequentially, driven by higher credit provisions and operating costs. - Share repurchases under $100M buyback program totaled $67.9M, with $48M remaining as the company emphasizes disciplined risk management. - Strategic pivot to risk mitigation contrasts with broader fintech sector caution, refle

Ethereum News Today: Ethereum Faces $2,800 Test—Will It Surge to $3,000 or Retreat to $2,300?

- Ethereum tests $2,800 resistance, key threshold for November, with potential to rebound toward $3,000 if breakout succeeds. - Recent $55.7M inflow into ETH ETFs, led by Fidelity’s FBETH, signals cautious institutional interest after nine-day outflow streak. - Technical indicators show improved momentum with RSI rebound and MACD stabilization, but $2,800 remains critical for further gains. - Derivatives data and Coinbase’s ETH-backed lending expansion hint at conditional recovery, though liquidation risks

Ethereum Updates: Centralized DNS Compromise Highlights DeFi Weaknesses as Aerodrome Suffers $1 Million Loss

- Aerodrome Finance suffered a DNS hijacking attack on Nov 22, 2025, redirecting users to phishing sites that siphoned over $1M in assets through deceptive transaction approvals. - Attackers exploited vulnerabilities in centralized domain registrar Box Domains, forcing users to approve unlimited access to NFTs and stablecoins via two-stage signature requests. - The protocol shut down compromised domains, urged ENS-based access, and revoked recent token approvals, marking its second major front-end breach i

Trump and Mamdani’s Bet on Affordability: Uniting Opposing Ideologies

- Trump and Mamdani's Nov. 21 meeting highlights clashing ideologies on affordability and governance, with New York's $1.286T economy at stake. - Both leaders share focus on cost-of-living crises but differ sharply on solutions, with Trump threatening federal funding cuts and Mamdani advocating rent freezes. - Experts see the dialogue as critical for redefining strained city-federal relations, emphasizing urban centers' role as economic engines. - Mamdani's corporate tax proposals clash with Trump's deregu