BNB News Today: BNB Chain Integrates Classic Collectibles and Blockchain Through Tokenized Charizard Cards

- BNB Chain's SuperSuperRare launches a Gacha Point Leaderboard, tokenizing a PSA-graded Charizard Pokémon card as RWA. - Users can repurchase, trade, or redeem physical cards, bridging traditional collectibles with blockchain utility via FMV-based rankings. - Binance's partnership with BlackRock to tokenize U.S. Treasuries expands RWA adoption, enabling yield generation on custodied assets. - Collaborations like mXRP and institutional yield tools highlight BNB Chain's strategy to merge traditional and dec

SuperSuperRare on BNB Chain Debuts Gacha Point Leaderboard, Brings Pokémon Cards On-Chain as RWA

The

This move is in line with the broader momentum of RWA integration on BNB Chain. Earlier in November, Binance

BNB Chain’s commitment to RWA is also shown through partnerships with projects like

SuperSuperRare’s leaderboard approach highlights the increasing role of gamification and user engagement in DeFi. By linking rankings to FMV-based points, the platform encourages active participation while utilizing the value of verified physical assets. This strategy

As RWA adoption gains momentum, BNB Chain continues to strengthen its position as a center for hybrid financial solutions. With innovators like SuperSuperRare leading the way in tokenized collectibles and services like BUIDL expanding institutional reach, the network is establishing itself at the crossroads of traditional and decentralized finance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ALGO Falls 1.74% as 1-Month Results Remain Subdued

- Algorand (ALGO) dropped 1.74% on Nov 24, 2025, extending its 1-month decline to 20.35% amid sustained bearish sentiment. - The token’s annual price has fallen 57.76% from its peak, driven by macroeconomic volatility and uncertainty over potential interest rate cuts. - No ALGO-specific news or on-chain developments were reported, with price movements linked to broader economic factors and risk appetite shifts. - Analysts warn the bearish trend may persist unless major upgrades emerge, urging investors to

DOGE drops 53.85% over the past year after early dissolution of federal agency

- Trump's DOGE department, aimed at cutting federal spending, was disbanded early, with functions absorbed by OPM. - DOGE's aggressive cost-cutting, including $1.9B in canceled contracts, faced scrutiny over lack of transparency and legal concerns. - The DOGE cryptocurrency token fell 53.85% in a year, while Grayscale launched spot ETFs as the department dissolved. - Former DOGE staff now hold federal roles, but its legacy raises ongoing questions about executive authority in reform efforts.

YFI Value Increases by 1.18% During Market Fluctuations

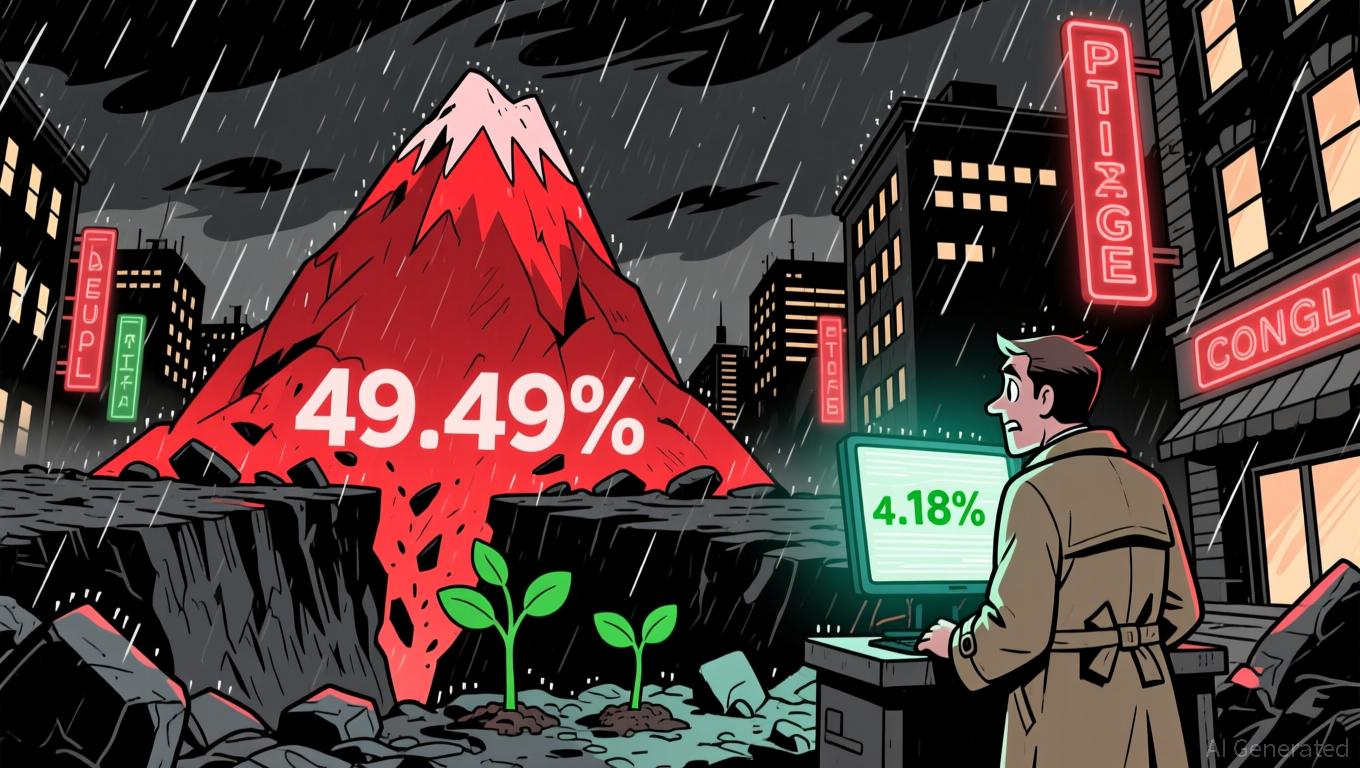

- YFI rose 1.18% in 24 hours to $4,036 but fell 49.49% annually, highlighting extreme volatility. - Short-term gains lack clear catalysts, with analysts noting broader market dynamics drive fluctuations. - Long-term bearish trends persist despite temporary rebounds, urging caution amid macroeconomic pressures.

Aave News Today: The Two Sides of DeFi: Aave's Expansion Increases Volatility Concerns

- Aave's AAVE token faces volatility risks near 0.57 support level, with whale accumulation and leveraged positions amplifying short-term instability. - A major Aave whale added 24,000 AAVE tokens (total 276,000) at $165 average cost, but remains vulnerable to repeat October 11 liquidation risks. - A $80M WBTC long position on Aave approaches $65,436 liquidation threshold, threatening forced selling and downward price pressure. - Tangem's Aave-integrated stablecoin yield feature highlights protocol's DeFi