Pi Coin Price Still In Green, Yet The Chart Now Shows 3 Red Flags — Pullback Soon?

Pi Coin price is still green on the monthly chart, but the short-term structure has shifted. A bearish engulfing pattern, weakening OBV, and a hidden bearish divergence now hint that the recent bounce may be losing strength. Unless PI reclaims key resistance soon, a deeper pullback zone could open up.

Pi Coin price is still up about 9% over the past month, but the short-term picture has started to soften. PI trades near $0.226 today, almost flat over the past 24 hours. Traders may see this as stability, but the charts are flashing several signs that the rebound from $0.209 may be running out of steam.

These early signals suggest a pullback could come unless buyers regain control.

Chart Signals Hint At A Weakening Bounce

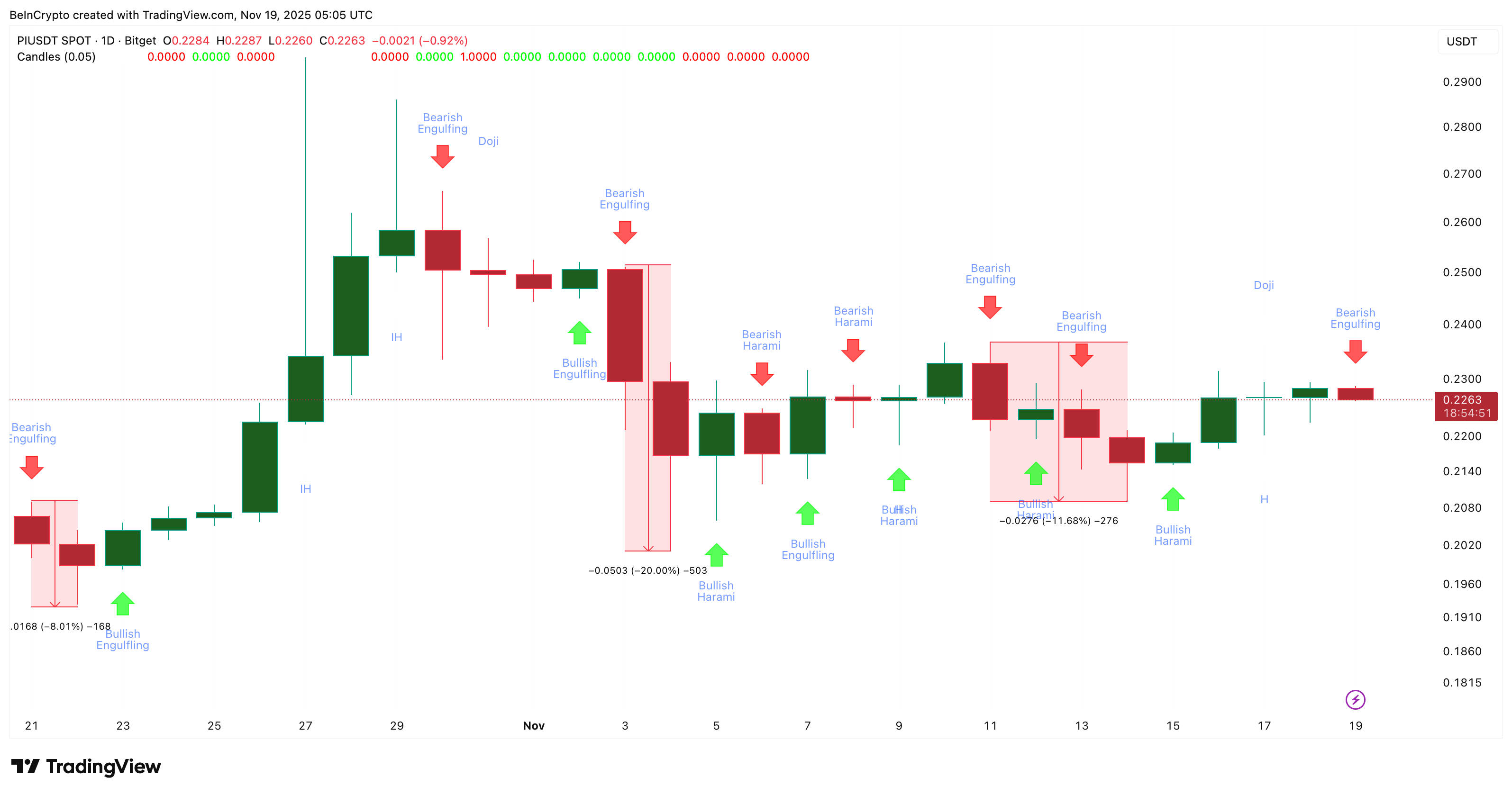

The first sign comes from a bearish engulfing pattern that formed on the daily Pi Coin chart. A bearish engulfing appears when a red candle fully covers the previous green candle. It often shows that sellers have regained control after buyers lose momentum.

Each time this pattern has appeared on Pi Coin since October 21, the price has dropped sharply, sometimes by 8% and sometimes by as much as 20%.

Key Candlestick Patterns:

TradingView

Key Candlestick Patterns:

TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

The second sign comes from the on-balance volume (OBV) indicator. OBV helps show whether real money is flowing into or out of a token.

Between November 14 and 18, OBV made higher lows while the price also made higher lows. That showed real buying support during the bounce. But OBV has now broken below the rising trend line that has supported it for days. If OBV falls under –1.36 billion, it will confirm a lower low on volume, which is already sell-biased. That shift usually happens when buyers lose strength and sellers take over, completely.

Pi Coin Volume Takes A Hit:

TradingView

Pi Coin Volume Takes A Hit:

TradingView

The third sign is a hidden bearish divergence on the Relative Strength Index (RSI). RSI measures buying strength.

Between November 16 and 18, the price made a lower high while the RSI made a higher high. This pattern is called hidden bearish divergence. It signals that the broader downtrend may still be in control and usually appears just before the next leg down in an ongoing downtrend.

Hidden Bearish Divergence Flashes:

TradingView

Hidden Bearish Divergence Flashes:

TradingView

Together, these three signals show that Pi Coin’s recent bounce still sits inside a bigger downward structure.

Pi Coin Price Levels That Matter Now

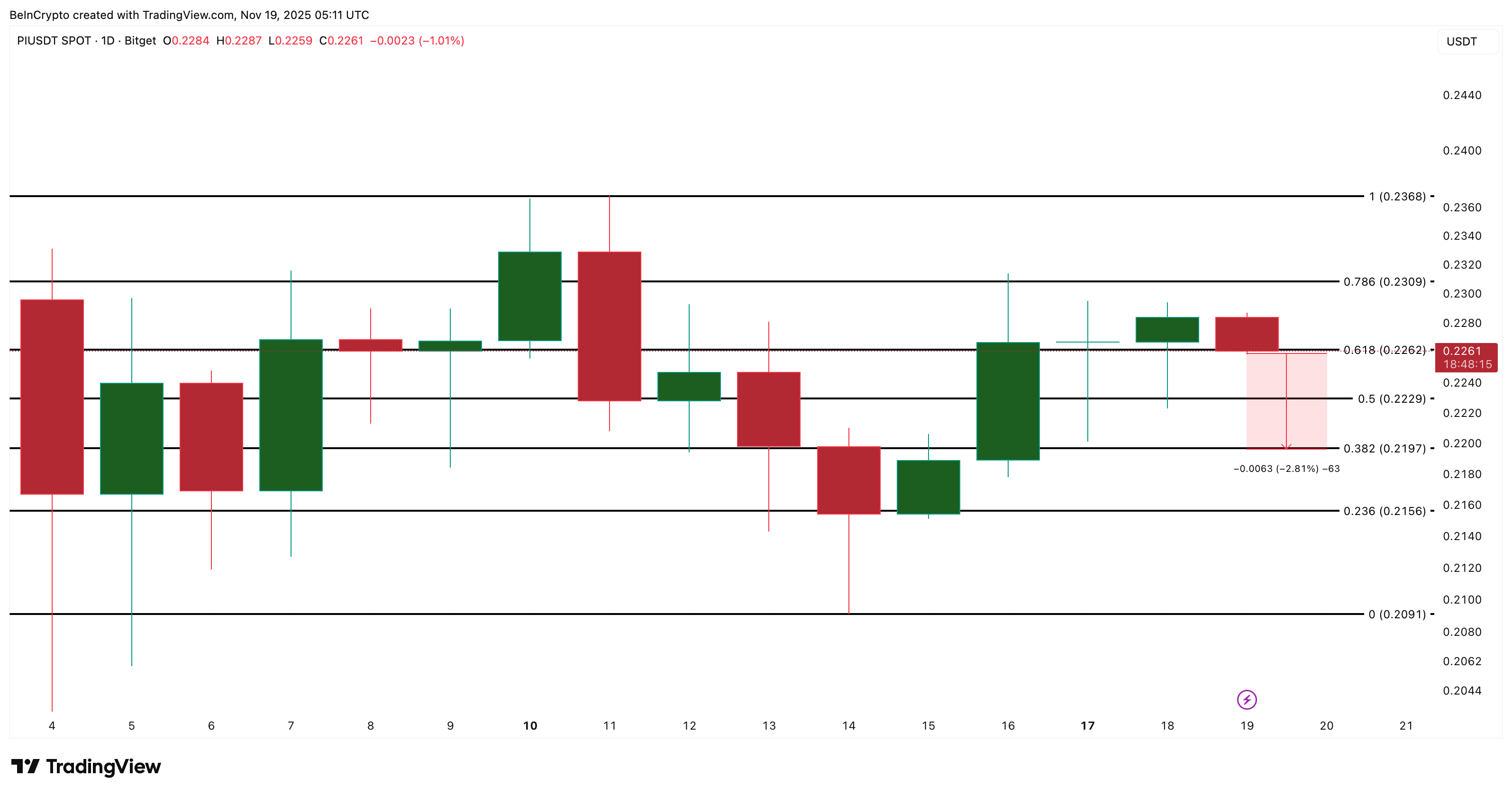

If a deeper pullback starts, the first key level PI must protect is $0.219. Holding above this level keeps the bounce alive. Losing it opens the way toward $0.209, which is the base where the last rebound began.

If buyers want to invalidate the bearish signs, PI needs to reclaim $0.230 and then break $0.236 with strong volume. Only then would the short-term trend flip back to positive.

Pi Coin Price Analysis:

TradingView

Pi Coin Price Analysis:

TradingView

Pi Coin price is still green on the monthly chart, but the latest structure suggests traders should stay cautious. The indicators show rising weakness, and unless PI clears its resistance soon, the pullback zone may come into play.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: Tether CEO: Bitcoin’s Strength Stems from Economic Independence

- Tether CEO Paolo Ardoino reaffirmed Bitcoin's value as a tool for financial freedom, emphasizing its role in enabling self-custody and autonomy from centralized institutions. - Tether's partnership with Ledn expands Bitcoin's utility by offering lending services without selling holdings, reinforcing its infrastructure-building strategy for digital assets. - Meanwhile, crypto firms like BitMine and Strategy face market volatility and regulatory risks, with BitMine reporting $328M income but declining stoc

Zcash (ZEC) Halving Scheduled for November 2025: Driving Market Outlook and Influencing Price Trends

- Zcash's 2025 halving cut block rewards by 50%, reducing daily supply to 1,800 ZEC and boosting institutional interest. - Arthur Hayes urged ZEC holders to shift funds to shielded pools, reducing liquidity amid EU AML pressures. - Cypherpunk and Grayscale's $137M investments, plus Zashi Wallet's launch, expanded Zcash's institutional and privacy-driven appeal. - ZEC surged to $750 post-halving, fueled by $108M in treasury investments and 104% growth in futures trading volume. - U.S. regulatory clarity and

Privacy-focused cryptocurrency ZEC sees price jump amid regulatory changes and shifting market sentiment

- Zcash (ZEC) surged to $683 in 2025, driven by U.S. regulatory clarity via the Clarity and Genius Acts, which legitimized privacy-focused crypto. - Institutional adoption grew, with Grayscale, Cypherpunk, and Winklevoss investing $137M-$58.88M in ZEC, viewing privacy as a strategic asset. - Quantum-resistant upgrades and shielded pools boosted ZEC's utility, though risks like regulatory shifts and overbought conditions remain. - Analysts debate ZEC's long-term viability, balancing its privacy innovation a

Bitcoin Updates: As Investors Pull Out of Bitcoin ETFs, Altcoins See Increased Inflows During November Sell-Off

- U.S. bitcoin ETFs lost $1.22B in net outflows for the week ending Nov 21, extending a four-week negative streak with total November redemptions reaching $3.79B. - Bitcoin fell below $82,000 amid a 7-month low, triggering a $350B crypto market cap drop as Citi noted 3.4% price declines per $1B ETF outflow. - Solana and XRP ETFs bucked the trend with $300M and $410M inflows, attracting institutional interest despite broader market weakness. - Analysts warn of potential 50% further Bitcoin declines, while F