Fed's Discussion on Lowering Rates: Balancing Job Market Concerns and Inflation Risks Amid Limited Data

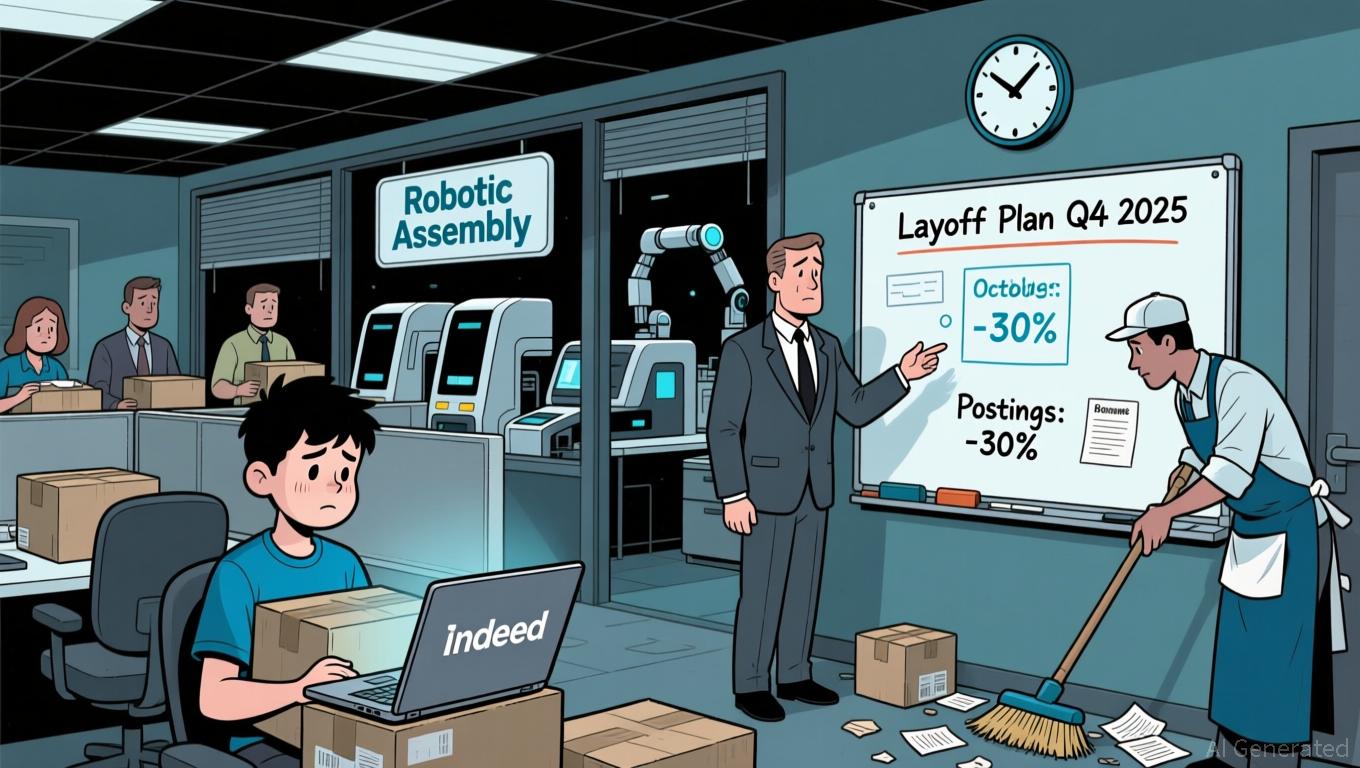

- Fed's December rate cut odds dropped to 52% as data gaps and labor market slowdown fuel investor uncertainty. - Governor Waller advocates 25-basis-point cut citing weak job growth and AI-driven hiring challenges, contrasting inflation-focused officials. - Key metrics like delayed September payrolls and October meeting minutes will shape final decision amid policy debate. - Global central banks and Trump's Fed chair selection add political risks to monetary policy neutrality. - Gold prices fell 3.4% as re

Uncertainty has increased regarding whether the Federal Reserve will lower rates in December, as the market

Waller

The Fed’s decision is further complicated by limited data.

The Fed’s dual mandate is facing new obstacles.

Investors are also wary of the Fed’s political environment.

The outcome of the Fed’s December meeting will likely

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Vitalik Buterin Drives ZK Technology Forward: Transforming Crypto Value and Industry Leadership by 2025

- Vitalik Buterin's 2025 ZK advocacy accelerated blockchain innovation, driving institutional adoption and redefining scalability, privacy, and decentralized infrastructure. - ZKsync's Atlas upgrade (15,000 TPS, near-zero fees) triggered a 50% ZK token price surge and $15B in institutional funding for ZK-based projects by late 2025. - Deutsche Bank , Sony , and 30+ institutions adopted ZK-powered hybrid compliance models, while ZKsync secured 15% Layer-2 TVL despite trailing Arbitrum's 45% market share. -

Hyperliquid News Today: Nvidia Drops 2% Amid Investor Worries Over Valuation as AI Enthusiasm Fades

- Nvidia shares fell 2% after post-earnings gains, reflecting cooling AI sector enthusiasm amid valuation concerns. - Q3 revenue hit $57B (62% YoY), driven by $51.2B data center sales, but growth bottlenecks and China's absence raised doubts. - CEO Huang defended "virtuous cycle" of AI adoption, while rivals like AMD/Broadcom gained traction with alternative solutions. - Analysts raised price targets but warned of sector fragility, with Nasdaq down 3% in November amplifying valuation scrutiny.

Crypto Innovators in Lisbon: Harnessing AI and Navigating Regulations for Lasting Impact

- The 2025 Crypto Content Creator Campus (CCCC) in Lisbon concluded with discussions on AI-driven monetization, authenticity, and crypto regulation for content creators. - Bybit CEO Ben Zhou emphasized AI's role in reshaping affiliate marketing and urged creators to prioritize storytelling and ethical compliance in a regulated crypto landscape. - Dr. Maye Musk highlighted authenticity in personal branding, while panels stressed sustainable strategies, diversified income streams, and AI as an "equalizer" fo

DASH Aster DEX Integration and Its Impact on Decentralized Exchange Trading

- Aster DEX's hybrid AMM-CEX model launched DASH token in Sept 2025, driving $27.7B daily volumes and $1.399B TVL through multi-chain liquidity. - Institutional backing from Binance and $704M airdrop fueled DASH's 1,650% surge, though price stabilized at $1 amid transparency concerns over token unlocks. - Platform's 5-7% yield collateral and 1001x leverage attract traders, but liquidity centralization risks and regulatory scrutiny challenge long-term sustainability. - Proactive measures like public token t