Nearly $115 Million Longs Liquidated As Bitcoin Drops to 7-Month Low, $70,000 Incoming?

Over $112 million in Bitcoin longs vanished as BTC plunged below $90,000 ahead of the FOMC minutes. Analysts warn the sell-off may extend toward $70,000 amid fading rate-cut expectations and accelerating ETF outflows.

In the past 60 minutes, over $112 million longs have been liquidated as traders de-risk in anticipation of the FOMC minutes.

Bitcoin slipped below the $90,000 psychological levels, blowing millions in long positions out of the water.

$115 Million Longs Wiped Out Amid FOMC Minutes Jitters

Data on Coinglass shows that over $112 million in long positions have been liquidated over the past hour. These positions were flushed out as the Bitcoin price dipped below the $90,000 psychological level, testing a seven-month low.

Bitcoin (BTC) Price Performance. Source: TradingView

Bitcoin (BTC) Price Performance. Source: TradingView

Meanwhile, the drop was not limited to the Bitcoin, as crypto stocks also registered losses, following the pioneer crypto’s fall to a 7-month low.

CRYPTO STOCKS FALL AS BITCOIN NEAR SEVEN-MONTH LOW🔸 COINBASE GLOBAL DOWN 4.9% 🔸 BITFARMS FALLS 7.5%🔸 STRATEGY SLIPS 10.3%🔸 RIOT PLATFORMS FALLS 3.7%🔸 HUT 8 MINING DOWN 3.3%🔸 MARA HOLDINGS DROPS 6.6%

— *Walter Bloomberg (@DeItaone)

It comes ahead of the October FOMC minutes, which is barely an hour out, suggesting investors are de-risking.

Beyond crypto and related stocks, indices were also down, with the Nasdaq and S&P 500 turning negative.

S&P 500 AND NASDAQ TURN NEGATIVE; S&P 500 DOWN 0.2%, NASDAQ DOWN 0.2%

— *Walter Bloomberg (@DeItaone)

This drop comes barely an hour before the October FOMC minutes release, with sentiment already reflected on social media.

Amid the anticipation, US President Trump said Fed chair Jerome Powell is “grossly incompetent,” citing too high interest rates.

Meanwhile, the Bureau of Labor Statistics has also revealed that it will not publish the October Jobs report. This gap likely steps from the recently concluded US government shutdown, which saw authorities run basically blind.

“After the September jobs report (out Thursday), there won’t be another jobs report until after the Dec. 9-10 FOMC meeting BLS: The October jobs report is cancelled. The November report won’t land until December 16. Sept JOLTS is also cancelled. October JOLTS will be published December 9,” wrote Nick Timiraos.

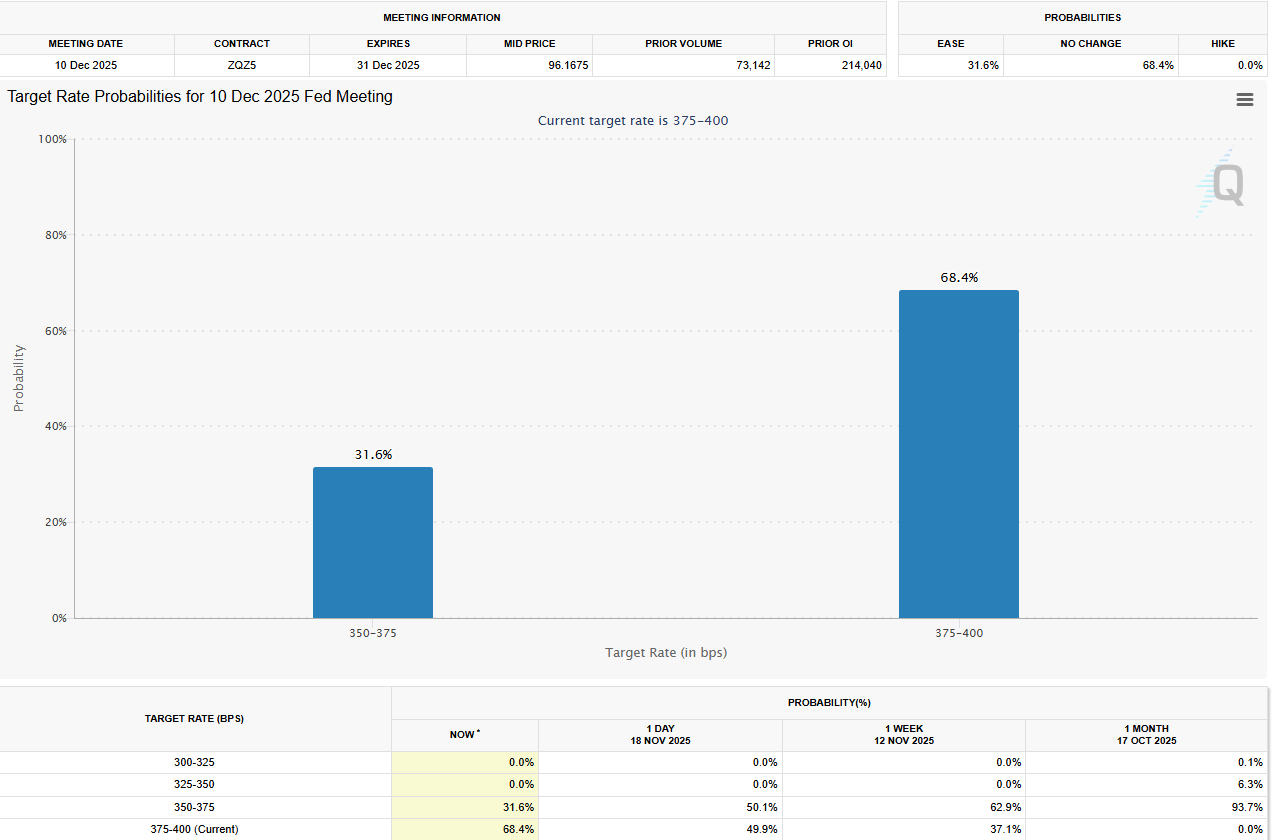

Based on this gap in the October Jobs report, December Fed rate cut bets have dwindled, with nearly 70% anticipating policymakers will hold interest rates steady.

Interest Rate Cut Probabilities. Source:

CME FedWatch Tool

Interest Rate Cut Probabilities. Source:

CME FedWatch Tool

Some analysts also ascribe the prevailing bearish sentiment to FUD (fear, uncertainty, and doubt), as institutional players signal a lack of conviction for BTC.

This is seen with ETF outflows from the likes of BlackRock, which the asset manager posting record negative flows of on Tuesday.

“BlackRock Dumps Record $523M in Bitcoin as BTC Slips Further in Bear Market. They sold $523M in Bitcoin, the largest single-day outflow IBIT has EVER recorded. Wall Street entered, profited, and exited. Bitcoiners got played hard,” analyst Jacob King remarked.

Even as the Bitcoin price continues to drop, some analysts say the downside potential remains very much alive, potentially as low as $70,000 in the near term, or worse.

Below $98,650, the next key Bitcoin $BTC levels are:• $75,740• $56,160• $52,820

— Ali (@ali_charts)

As of this writing, the Bitcoin price was trading for $88,977, down by almost 5% in the last 24 hours.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: XRP Declines as ETF Investments Unable to Halt Downward Momentum

- XRP fell below $2.00 as macroeconomic uncertainty and ETF inflows failed to reverse its bearish trend despite $105M in Bitwise ETF inflows. - Futures Open Interest dropped to $3.57B, whale sales of 200M XRP, and institutional outflows accelerated the decline below key technical levels. - Technical indicators show RSI at 43 and negative MACD, with analysts warning of potential 50% declines to $1.25 if $2.00 support breaks. - The SEC-approved Bitwise 10 Crypto Index ETF (4.97% XRP allocation) may reshape d

Data Shortfalls and Policy Conflicts Prevent Fed from Lowering Rates in December

- The Fed’s December rate cut prospects have dimmed, with officials citing data gaps and inflation concerns, reducing the CME FedWatch probability to 32%. - Delayed BLS labor market reports left policymakers without critical metrics, fueling skepticism about justifying a cut amid internal divisions. - Officials like Christopher Waller argue for easing due to a "stall speed" labor market, while Lorie Logan and Beth Hammack caution against premature cuts risking inflation and market instability. - Markets ha

Bitcoin News Update: US Investigates Whether Bitmain Devices Pose Threat to Power Grid, Raising Concerns Over Espionage

- U.S. government investigates Bitmain's mining hardware over espionage risks, led by DHS with agencies like FCC and NSC. - Senate Intelligence Committee warns Bitmain's devices near military sites could be remotely manipulated from China, linking them to CCP ties. - Bitmain denies allegations but faces scrutiny after Trump family's $314M purchase of 16,000 machines raised conflict-of-interest concerns. - Investigation highlights broader U.S. fears about China's crypto dominance, following Wyoming mining f

Bitcoin Updates: Bitcoin Drops 25% While ETFs Remain Stable, Underscoring Confidence from Institutions

- Bitcoin fell to $82,605 in Nov 2025, mirroring FTX-era losses with STHs holding 2.8M BTC at a loss. - ETF assets remain stable despite 25% price drop, showing institutional confidence amid retail distress. - Market corrections erased $120B in value, pushing total crypto cap below $2.8T as analysts warn of further declines. - Weak U.S. employment data and fading Fed rate cut hopes exacerbate fears of a potential $75K price target.