U.S. Technology Leaders Pursue Saudi AI Partnerships as Policy Discussions Continue at Home

- Nvidia's Nov. 19 earnings report, projected to show 56.4% revenue growth to $54.9B, will gauge the AI sector's health amid valuation concerns and market volatility. - Nasdaq-100 futures rose 0.6% as investors anticipate results that could either boost AI-driven stocks or trigger a sell-off, compounded by delayed data and Fed policy uncertainty. - Repeated mentions of Saudi Arabia's Humain AI partnership highlight Nvidia's strategic alignment with sovereign AI initiatives, reflecting global competition fo

Nvidia Corp. (NVDA) is preparing to announce a crucial earnings report on Nov. 19, drawing intense attention from both investors and analysts as the AI chip giant navigates a turbulent market environment. The upcoming report,

There is a sense of anticipation in the U.S. stock market, with futures ticking upward ahead of the earnings release. Nasdaq-100 futures

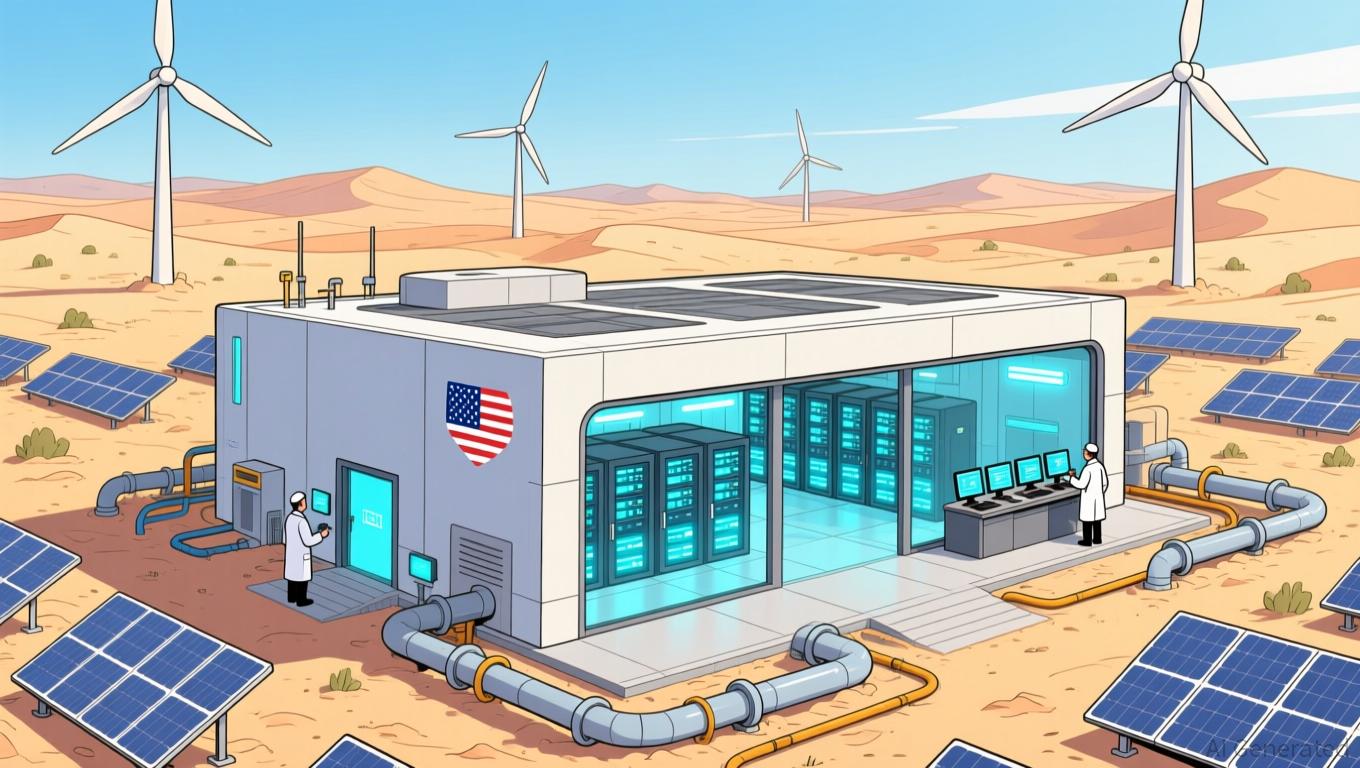

The geopolitical implications are significant. As the U.S. works to regulate the distribution of advanced AI technologies, Saudi Arabia’s Humain, backed by the country’s sovereign wealth fund, is emerging as a major contender in the global AI landscape.

As Nvidia’s earnings approach, the dynamic between business strategy, regulatory developments, and international AI rivalry is set to influence the sector’s direction. Strong results may bolster faith in the AI surge, while disappointing numbers could prompt a move toward more defensive industries. For now, attention is firmly fixed on the San Jose, California-based firm, whose ability to steer through these complex challenges will be a true test of its leadership in a rapidly evolving tech world.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates Today: Ark's Optimistic Move Stands Out Amid Crypto Market Downturn

- Ark Invest spent $10.2M via three ETFs to buy Bullish shares, a Thiel-backed crypto exchange, amid broader market declines. - Bullish's stock fell 4.5% despite Ark's purchases, though Q2 profits rose sharply from $116M loss to $108M gain. - Ark's crypto strategy focuses on firms with regulatory progress (e.g., NY license) and financial resilience, including Circle and BitMine investments. - The firm divested Tesla/AMD shares while Bitcoin fell below $90K, highlighting shifting priorities toward crypto an

Bitcoin News Update: Eternal Bull Tom Lee Rejects Bearish Doubts, Maintains $200k Bitcoin Prediction

- Tom Lee, BitMine's permabull, predicts Bitcoin will hit $150k–$200k by January 2026 despite current $90k price drop. - He attributes the bearish phase to temporary factors like Fed uncertainty and October sell-off anxiety, citing technical exhaustion signs. - Lee also forecasts Ethereum's "supercycle" growth, comparing its trajectory to Bitcoin's 2017 pattern amid rising long-term holder accumulation. - Market skepticism persists with $3.79B Bitcoin ETF outflows and warnings of 50% drawdowns, testing Lee

Zcash News Today: Zcash’s Quantum-Resistant Privacy Transforms It into an “Encrypted Bitcoin” for Enterprises

- Zcash (ZEC) surged 31% in a week as institutional demand for quantum-resistant privacy coins grows, driven by Cypherpunk Technologies' $18M ZEC purchase. - Cypherpunk, now holding 1.43% of ZEC supply, emphasizes Zcash's zero-knowledge proofs and quantum-safe cryptography as "encrypted Bitcoin" for institutional portfolios. - Zcash's 125% 30-day rally outperformed Bitcoin's decline, with shielded pool usage hitting multi-year highs amid rising concerns over blockchain surveillance. - Analysts highlight Zc

Bitcoin News Update: As MSCI Adjusts Sector Guidelines, Investors Rethink Their Approaches to AI and Bitcoin

- MSCI's revised GICS rules raise concerns over investment flows and Michael Saylor's Bitcoin strategy stock valuation due to sector classification changes. - The updated framework introduces ambiguity in asset categorization, prompting warnings about distorted performance metrics and unintended portfolio rebalancing. - High-growth sectors like AI face heightened volatility, with Alger and Pzena reports highlighting risks from rapid obsolescence and fee sensitivity. - Market uncertainty intensifies amid eq