Zerohash Amidst Crypto’s Ultimate Turmoil

- Zerohash faces liquidity and reputational risks amid crypto market turmoil, driven by unconfirmed survey claims and sector-wide volatility. - A $168M liquidation event on GMX highlights systemic risks from high-leverage trading, echoing prior $100M losses by trader James Wynn. - Regulatory uncertainty intensifies with U.S. stablecoin projections, EU MiCAR compliance shifts, and Trump-era pardons complicating compliance frameworks. - Institutional investors pivot to yield-bearing stablecoins (e.g., 15% AP

Zerohash, a provider of crypto infrastructure, is currently facing a challenging market landscape, marked by unverified survey reports and increased volatility across the cryptocurrency industry. The company's difficulties are unfolding alongside a broader market downturn,

The trader had taken large short positions in

The overall crypto market has experienced a deepening decline,

The U.S. Dollar Index (USD/CNH) has entered a period of consolidation,

The recent pardon of Binance founder Changpeng Zhao by the Trump administration has added further complexity to the regulatory landscape,

For Zerohash, the intersection of market turbulence, unclear regulations, and increased competition from new stablecoin products creates a complex set of obstacles. How the company responds to these evolving challenges will likely determine its ability to endure in an industry defined by both rapid change and persistent volatility.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

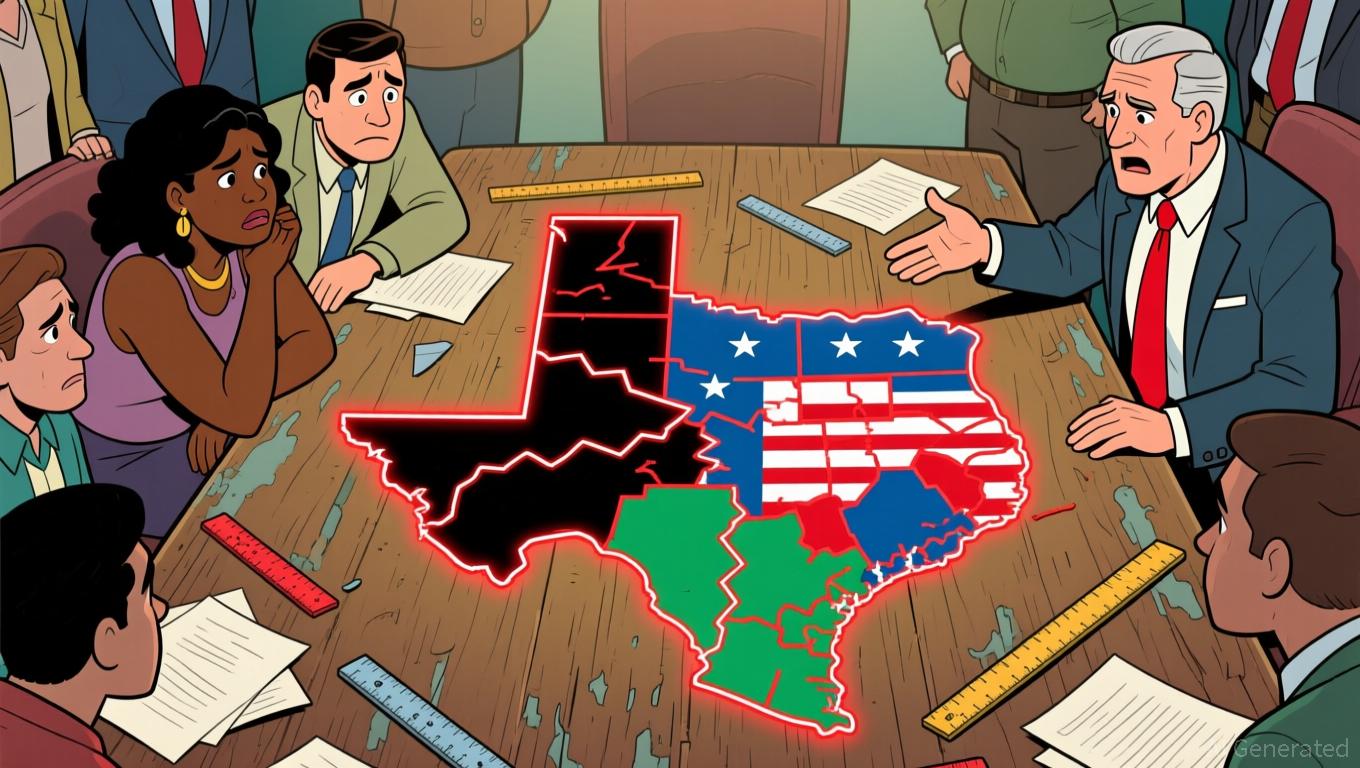

Supreme Court Decision Challenges Party Tactics in Racial Gerrymandering Cases

- Supreme Court Justice Alito blocked a lower court ruling that found Texas' 2026 redistricting plan racially discriminatory, preserving its implementation for the 2026 midterms. - Texas argued the lower court erred by conflating political and racial motivations, citing logistical challenges of changing the map 91 days before the primary. - The case tests boundaries between partisan strategy and racial gerrymandering, with LULAC criticizing the Supreme Court's pause as undermining fair representation for m

XRP News Today: Death Cross Emerges: XRP's Sharp Decline Highlights Broader Crypto Market Fragility

- XRP's price fell below $2.20 on Nov 19, 2025, signaling a "death cross" technical pattern linked to prolonged declines. - The bearish crossover of 50-day and 200-day EMAs suggests intensified selling pressure and potential 55% drop to $1.25. - The decline mirrors weakness in Bitcoin and Ethereum , reflecting systemic crypto market fragility amid macroeconomic and regulatory risks. - Analysts warn of erratic crypto behavior near key levels, emphasizing unpredictable volatility during this bearish phase.

XRP News Today: The Growth of Crypto: Institutional Funding Compared to Market Fluctuations and Risks of Delisting

- Bitwise launches XRP ETF (XRP) to offer institutional exposure to Ripple's blockchain, navigating risks like token depreciation and market volatility. - ARK Invest defies crypto pessimism by injecting $39M into crypto-linked stocks, adjusting its 2030 Bitcoin price target to $1.2M from $1.5M. - Coinbase acquires Solana-based DEX Vector (ninth 2025 deal), aiming to become an "everything exchange" amid surging DEX volume exceeding $1T. - GSR upgrades institutional platform with treasury workflows and marke

Solana News Today: Solana's Emission Reform: Charting a Course for Long-Term Blockchain Economic Stability

- Solana proposes SIMD-0411 to cut $2.9B token emissions over six years, accelerating inflation reduction to 1.5% by 2029. - The "leaky bucket" plan aims to curb supply growth by 3.2% annually, stabilizing market dynamics through scarcity-driven value. - Staking yields may drop from 6.41% to 2.42% by Year 3, risking 47 validators' profitability and forcing industry consolidation. - Institutional adoption surges with $421M in Solana ETF inflows and Coinbase's acquisition of Solana-based DEX Vector. - The ov