Ethereum Prioritizes Quantum Security as Vitalik Warns of Breakable Cryptography by 2028

Ethereum co-founder Vitalik Buterin has highlighted quantum resistance as a key element of the network’s long-term roadmap. This comes amid a rising risk of quantum computing advances that could potentially undermine current cryptographic systems. Ethereum Races to Go Quantum-Safe Speaking at the Devconnect conference in Buenos Aires, Argentina, Buterin explained the roadmap for Ethereum, including

Ethereum co-founder Vitalik Buterin has highlighted quantum resistance as a key element of the network’s long-term roadmap.

This comes amid a rising risk of quantum computing advances that could potentially undermine current cryptographic systems.

Ethereum Races to Go Quantum-Safe

Speaking at the Devconnect conference in Buenos Aires, Argentina, Buterin explained the roadmap for Ethereum, including goals for the next two years and “Lean Ethereum” themes.

For context, Lean Ethereum was introduced in July as a framework for the network’s long-term development. It focuses on simplicity, security, and efficiency at the base layer of the network. Notably, a major part of that vision is “quantum resistance everywhere,” according to Buterin.

He also warned that the cryptography securing Ethereum (ETH) and Bitcoin (BTC) could be vulnerable to quantum computing breakthroughs by 2028.

Although many experts still predict major quantum breakthroughs to be further out, the timeline is now under active scrutiny. Metaculus, a forecasting platform, estimates that quantum computers may be able to factor an RSA number by 2034—nearly 20 years earlier than its prior forecast.

Some experts warn that quantum computing risks could arrive as soon as 2028 to 2033. This comes amid rapidly accelerating progress in quantum hardware.

In late October, Google announced a major algorithmic breakthrough. The firm revealed that it had achieved the first verifiable quantum advantage by running the out-of-order time correlator (OTOC) algorithm.

An out-of-order time correlator (OTOC) algorithm refers to a computational algorithm designed to calculate OTOCs, which are special quantum correlation functions used to diagnose quantum chaos, scrambling, and information spreading in many-body systems.

“This is the first time in history that any quantum computer has successfully run a verifiable algorithm that surpasses the ability of supercomputers. Quantum verifiability means the result can be repeated on our quantum computer — or any other of the same caliber — to get the same answer, confirming the result. This repeatable, beyond-classical computation is the basis for scalable verification, bringing quantum computers closer to becoming tools for practical applications,” the blog read.

At the same time, IBM is working on IBM Quantum Starling. According to the company, it could be “the world’s first large-scale, fault-tolerant quantum computer.” It is scheduled for delivery to clients in 2029.

As quantum development accelerates and timelines compress, Ethereum’s push for early quantum resistance signals a broader shift: blockchain networks may soon need to prepare for a new cryptographic era—one where quantum security becomes a baseline requirement rather than a future consideration.

Ethereum’s Roadmap: What Will The Future Hold?

Meanwhile, Buterin placed quantum resistance alongside a list of long-term improvements that the team is exploring. This includes zk-friendly VMs, zk-friendly hash functions like Poseidon, formal verification, optimal consensus, and faster finality.

In the medium term (2025-26), the roadmap emphasizes scalability, including increases to the gas limit, upgrades such as EIP-7732, and block-level access lists (enabling parallel processing by nodes) to enhance throughput without compromising decentralization.

Looking further ahead (2026-27), Buterin outlined upgrades focused on censorship resistance, decentralization upgrades, and enhanced account abstraction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP and ETH Price Prediction As White House Threatens to Pull Back Clarity Act Bill

A new US bill says writing Bitcoin software isn’t a financial crime

SUI Price Prediction After Resolving the January 14 Mainnet Outage

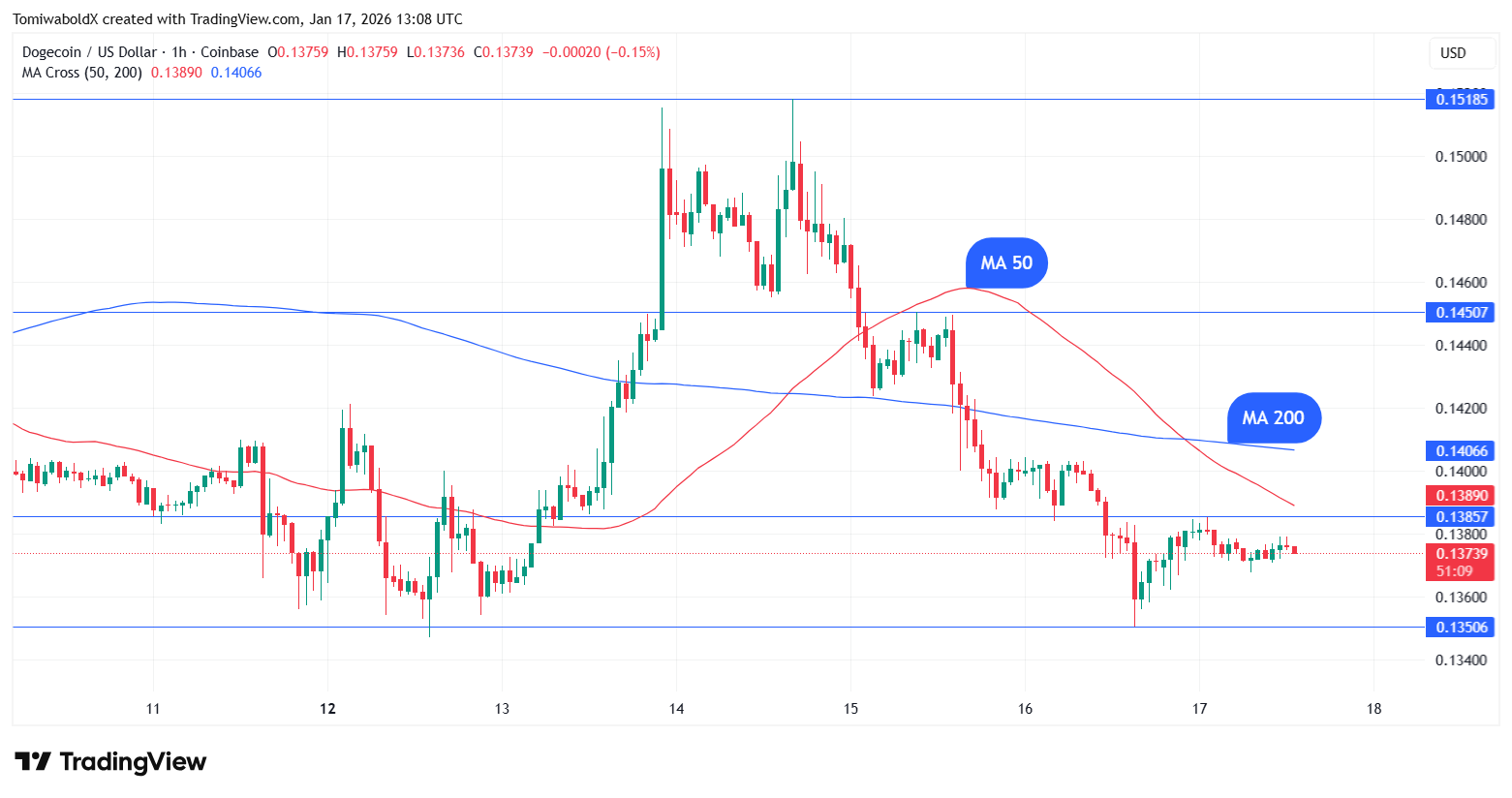

Dogecoin (DOGE) Oversold? Death Cross Sends Mixed Signals