Maple Finance barred from launching syrupBTC after Core Foundation injunctionMaple Finance’s syrupBTC is a direct rival to lstBTC

Maple Finance is facing an injunction from Core Foundation, the organization behind the Bitcoin-secured Core blockchain, over an alleged breach of confidentiality and exclusivity agreements tied to their Bitcoin yield partnership.

- Core Foundation accused Maple Finance of breaching a commercial agreement.

- A Cayman Islands court has granted an injunction restricting Maple Finance from launching syrupBTC.

- Maple Finance has denied all allegations against it.

“The Grand Court of the Cayman Islands has granted an injunction against Maple Finance entities, finding that there is a serious issue to be tried regarding Maple’s alleged breaches of its commercial agreement with Core Foundation to develop lstBTC, the joint Core-powered liquid staked Bitcoin token,” the foundation announced in a Nov. 19 X post.

The Core Foundation alleges that Maple misused confidential information and violated exclusivity provisions to build a competing product. Further, the foundation is challenging Maple’s right to declare an “impairment” on millions of dollars worth of Bitcoin it is holding for lenders in the “Bitcoin Yield product.”

Maple Finance’s syrupBTC is a direct rival to lstBTC

Maple Finance and Core Foundation partnered in early 2025 to launch lstBTC, a liquid staked Bitcoin product designed for institutional investors. The success of the initial rollout may have encouraged Maple to divert from the agreement and develop a rival offering, the announcement said.

Maple allegedly began misusing “confidential information” and internal resources from mid-2025 while simultaneously developing “syrupBTC,” a new liquid staking product intended to directly rival lstBTC, despite being bound by a 24-month exclusivity clause.

After Core Foundation initiated arbitration proceedings, the Honourable Justice Jalil Asif KC from the Grand Court of the Cayman Islands ruled that there was a serious issue to be tried in relation to Maple’s conduct.

“The Court found damages would not be an adequate remedy because of (i) the risk of Maple dealing in or shedding CORE tokens and (ii) the head-start Maple would gain by launching a competing product,” Core said.

Per the injunction, Maple is prohibited from launching or promoting syrupBTC, using Core Foundation’s confidential information, or dealing in CORE tokens without prior written consent while the legal process remains ongoing.

However, not long after the injunction was granted, Maple allegedly moved to declare an impairment worth millions of dollars against lenders in its Bitcoin Yield product, which, according to Core Foundation, casts further doubt on Maple’s handling of client assets and its obligations under the original agreement.

The foundation said it had been led to believe that the Bitcoin underpinning the yield product was held with “reputable custodians,” meaning those assets should have remained untouched regardless of internal issues at Maple.

“It is unclear why Maple maintains that they are unable to return the Bitcoin to their lenders at this time, or if they have the right to impair them,” Core Foundation said.

According to the announcement, the foundation added that it may “take this legal action as far as necessary” to protect its community.

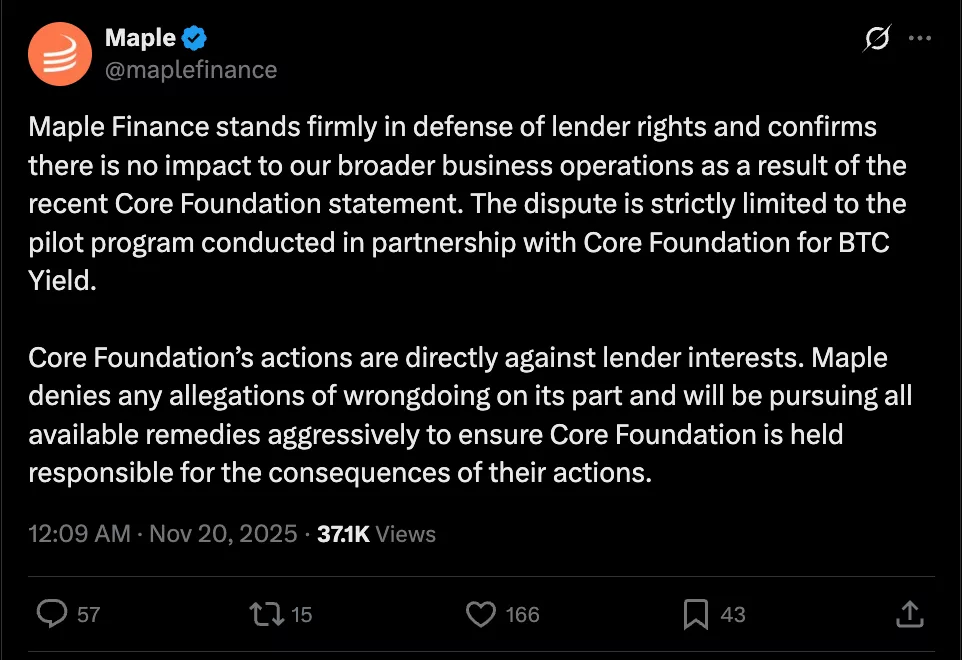

Maple Finance, however, denied all allegations in a Nov. 20 X post, adding that the dispute was limited to the pilot program. See below.

Maple Finance responds to Core Foundation. Source: Maple on X

Maple Finance responds to Core Foundation. Source: Maple on X

Maple sunsets SYRUP staking

Against this backdrop of legal tensions and product disputes, Maple Finance has undergone significant structural changes regarding the tokenomics of SYRUP, its native governance and fee-sharing token.

Earlier this month, Maple pulled the plug on SYRUP staking rewards and switched to a new revenue-based model, where 25% of all protocol revenue will be used to fund the newly formed Syrup Strategic Fund, which in turn, will buy back tokens and inject liquidity as required.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: XRP ETF Momentum Contrasts with Declining Network Engagement

- XRP's ETF inflows exceed $420M daily, contrasting with 50% lower on-chain payment volume and declining transaction counts. - Technical indicators show fragile bullish momentum below $2.28, while RSI rejection and EMA positioning highlight bearish pressure. - Fed's 81% rate cut probability and ETF-driven demand could push XRP toward $3, but network activity weakness raises sustainability doubts. - MACD buy signals clash with declining 50-day EMA ($2.38) and structural vulnerabilities in ETF-dependent pric

Ethereum News Update: North Korean Cybercriminals' Cross-Chain Money Laundering Reveals Vulnerabilities in Crypto Security

- North Korean hackers suspected in $36.8M Upbit breach used multi-chain laundering across Solana and Ethereum to obscure stolen assets. - Upbit froze transactions, pledged user reimbursements, and faces regulatory fines for delayed reporting amid a $10.3B merger with Naver. - Attack mirrors 2019 Lazarus tactics, exposing crypto industry vulnerabilities as stolen funds were rapidly converted into $1.6M via 185 wallets. - Market volatility surged with altcoin price spikes, while regulators intensify scrutin

Blazpay's 24-Hour Timer: AI-Powered Token Set to Dominate the 2025 Cryptocurrency Surge

- Blazpay's Phase 4 presale enters final 24 hours with $1.52M raised and 78.6% tokens sold, outpacing initial sales projections. - Analysts highlight 3.4x-5x return potential for early buyers, citing AI-powered trading tools, multichain infrastructure, and audit-backed security protocols. - Investors can purchase BLAZ tokens via USDT/ETH/BNB through the official portal, with referral incentives and gamified rewards boosting community engagement. - Project emphasizes real-world utility including automated t

Bitcoin News Update: MSCI Regulation Ignites Tension Between Bitcoin and Major Traditional Financial Institutions

- MSCI's proposed rule to exclude firms with over 50% crypto assets risks triggering $8.8B in forced Bitcoin sell-offs from index-tracking funds by 2026. - JPMorgan's analysis highlights existential threats for crypto-focused companies like Strategy (MSTR), which could face $2.8B in passive outflows alone. - Critics accuse MSCI and JPMorgan of bias, citing the bank's anti-crypto stance and the "binary cliff effect" of the 50% threshold destabilizing market eligibility. - The debate reflects a clash between