CryptoRover Flags Critical ETH Valuation Levels as Price Dips

Quick Take Summary is AI generated, newsroom reviewed. CryptoRover highlights ETH entering the “Likely Bottom Zone” on a long-term valuation model. Chart suggests ETH is 20–30% undervalued based on cycle-adjusted metrics. ETH trades near $3,022, down 3.5% on the day amid broad market pressure. Historical patterns show strong rebounds after similar valuations.References X Post Reference

A recent chart that was posted to X by a high-profile analyst CryptoRover (@cryptorover) has drawn the interest of Ethereum traders. ETH started at a price of $3,022, which is nearly 3.5 percent lower than the previous day when it was at 3,098. Additional early-stage metrics of the post showed significant global interest in ETH current valuation background, with 63 likes, 35 comments, and 7 reposts.

Mean-Reversion Model

According to normalized deviation to the Ethereum historical average in the same vein as on-chain metrics like MVRV Z-Score, the chart of CryptoRover depicts color-coded stripes of valuation of deep undervaluation to extreme overvaluation.

The present position of ETH at a normalized score of +0.1 implies that it fits within the fair-value range of 2,200-3,800 that indicates an underpricing of about 20-30 percent of long-term mean estimates. The model predicts possible mean reversion to around the range of 3,700 -4,000 at the early years of 2026 as long as the cycles trends persist.

Historical Parallels

In the 20182019 slump, ETH went through another phase of extreme underpriceing, which reached around $85, to an over ten times increase. Likewise, the 2022 bear-market minimums of about $900. It followed a recovery phase of about 3 years, to reach about 4,000 in 2024.

Statistics on various cycles indicate that 80 percent of all ETH purchases into the likely bottom zone have resulted in a gain greater than 50 percent within three to six months, which reinforces the bullish view of the present structure.

On-Chain Context Shape ETH’s Current Trajectory

Several more general factors have caused the price weakness of November 2025. Macro uncertainty is high since the Federal Reserve indicates slower rate reduction, which helps to increase the Bitcoin dominance now approximated at 58 percent. That move has put a strain on the altcoins such as Ethereum. On-chain indicators are a very optimistic view. In the meantime, the valuation indicators, including MVRV (close to 1.2), and NUPL, are consistent with the previous historical early-recovery state.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin ETFs Are Back: Did the Crash Just End?

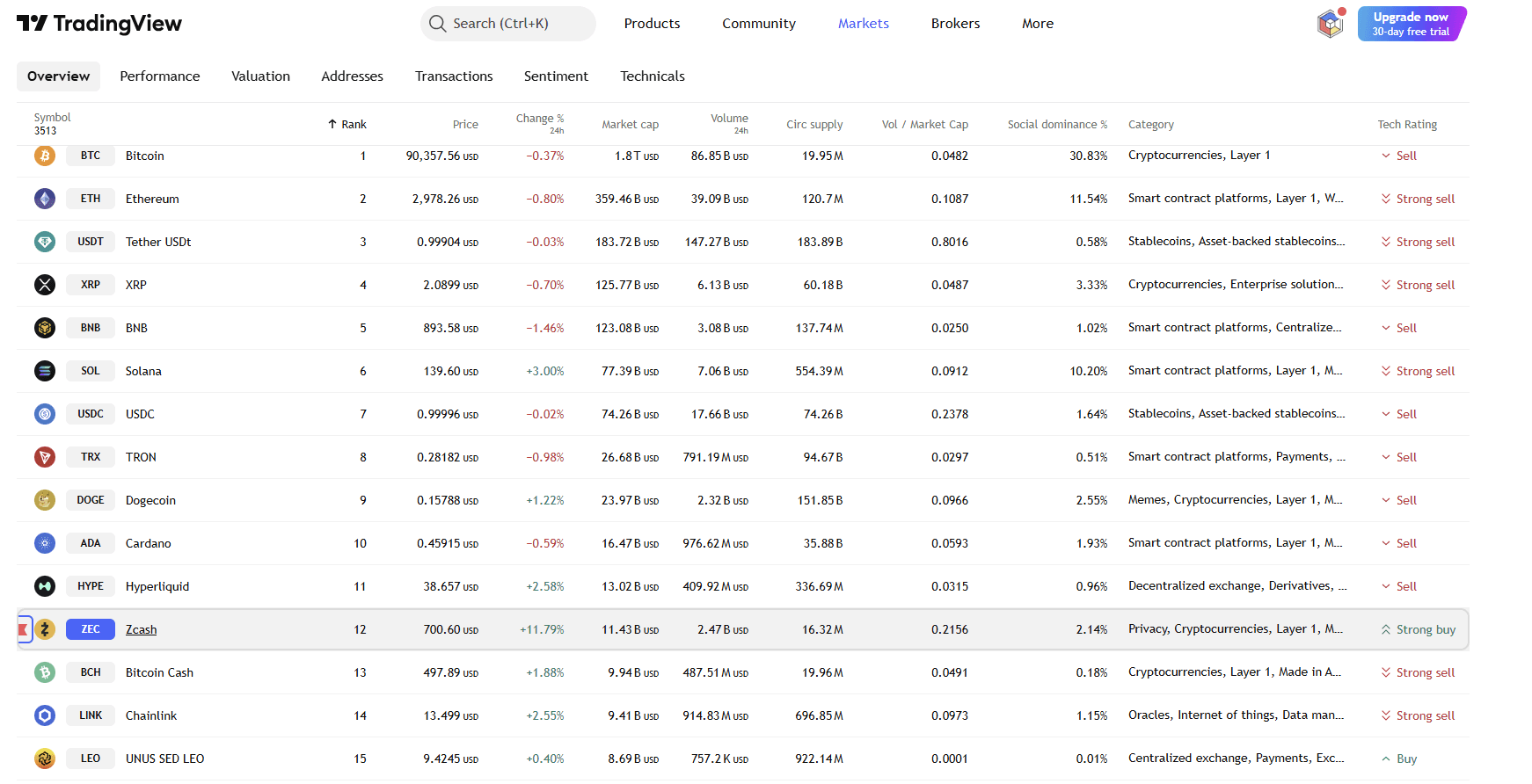

Should You Buy ZEC During the Market Crash? Here’s What’s Really Happening

Can Quantum Computers Break Crypto? Here's The Truth...

XRP News Today: Ripple Faces a Staking Dilemma on the XRP Ledger: Balancing Trust and Incentive Conflicts

- Ripple explores XRP Ledger staking to boost DeFi integration and institutional use. - CTO David Schwartz outlines two staking models, but implementation is distant due to architectural complexity. - Staking aims to enhance security and incentivize token holders, aligning with crypto trends while addressing bank needs for cost efficiency and compliance. - Ripple also seeks Fed account access to improve RLUSD stability, leveraging direct Treasury conversions for faster settlements.