Ethereum News Today: Ethereum’s Sharp Decline Puts DATs’ Accumulation Approach in Jeopardy

- Ethereum's drop below $3,000 triggered a DAT sector crisis, erasing annual gains and exposing risks in corporate ETH accumulation strategies. - BitMine faces $3.7B in unrealized losses as its mNAV ratio fell to 0.77, mirroring 64.3% of DATs trading below asset value amid $2B crypto fund outflows. - Firms like FG Nexus are selling ETH for buybacks, worsening downward pressure while experts warn the $3,000 level tests regulatory adoption progress. - Derivatives data shows 70% probability of Ethereum hittin

Ethereum’s recent slide below the $3,000 threshold has sparked a crisis among digital asset treasury (DAT) companies, wiping out gains made over the past year and revealing weaknesses in the corporate

This downturn came after BitMine’s $170 million ETH acquisition last week, bringing its total stash to 3.56 million ETH (valued at $11.1 billion). Despite this, the company’s stock has tumbled 35% this month,

Bearish sentiment is also evident in the derivatives market, where there is a 70% chance that Ethereum will fall to $2,750 by the end of the year,

Analysts caution that the current market is a major test for DATs’ durability. “The $3,000 mark serves as a benchmark for progress in regulatory and institutional adoption,” said

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

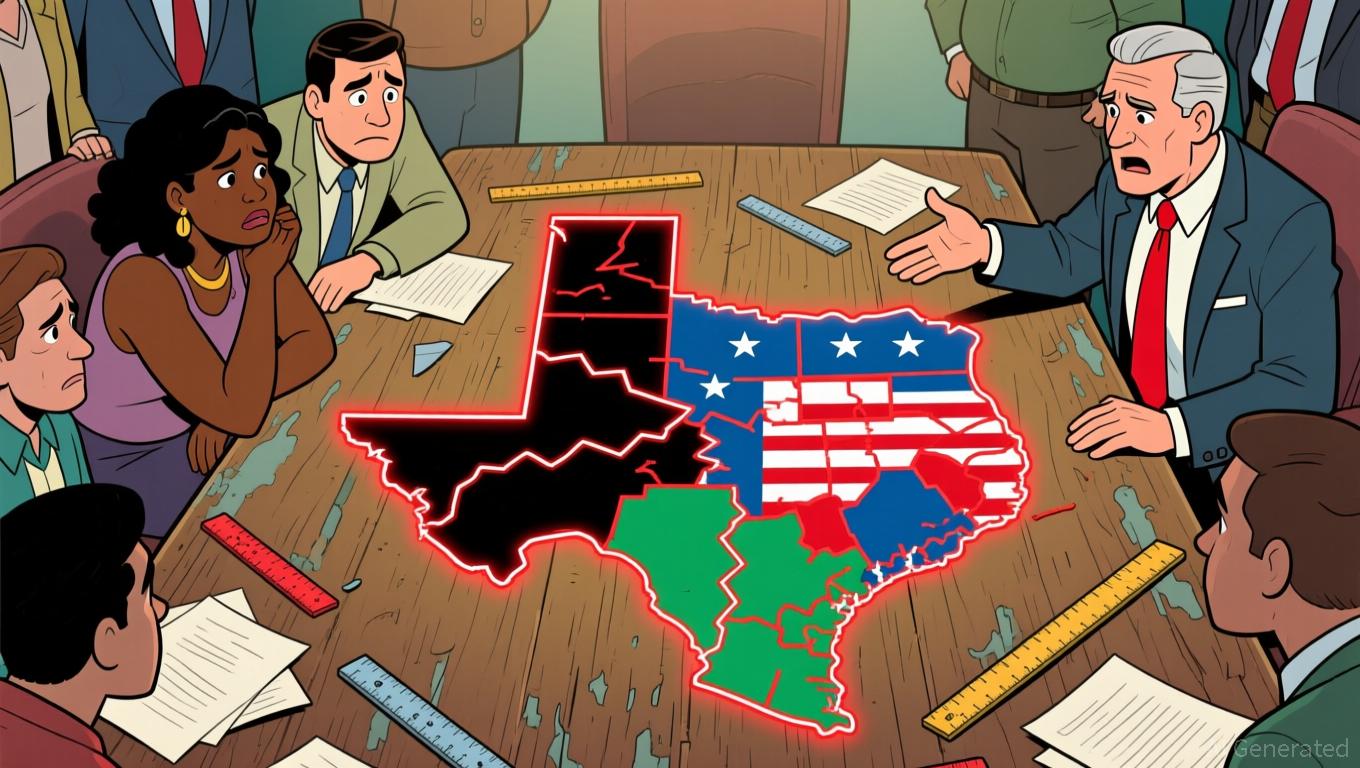

Supreme Court Decision Challenges Party Tactics in Racial Gerrymandering Cases

- Supreme Court Justice Alito blocked a lower court ruling that found Texas' 2026 redistricting plan racially discriminatory, preserving its implementation for the 2026 midterms. - Texas argued the lower court erred by conflating political and racial motivations, citing logistical challenges of changing the map 91 days before the primary. - The case tests boundaries between partisan strategy and racial gerrymandering, with LULAC criticizing the Supreme Court's pause as undermining fair representation for m

XRP News Today: Death Cross Emerges: XRP's Sharp Decline Highlights Broader Crypto Market Fragility

- XRP's price fell below $2.20 on Nov 19, 2025, signaling a "death cross" technical pattern linked to prolonged declines. - The bearish crossover of 50-day and 200-day EMAs suggests intensified selling pressure and potential 55% drop to $1.25. - The decline mirrors weakness in Bitcoin and Ethereum , reflecting systemic crypto market fragility amid macroeconomic and regulatory risks. - Analysts warn of erratic crypto behavior near key levels, emphasizing unpredictable volatility during this bearish phase.

XRP News Today: The Growth of Crypto: Institutional Funding Compared to Market Fluctuations and Risks of Delisting

- Bitwise launches XRP ETF (XRP) to offer institutional exposure to Ripple's blockchain, navigating risks like token depreciation and market volatility. - ARK Invest defies crypto pessimism by injecting $39M into crypto-linked stocks, adjusting its 2030 Bitcoin price target to $1.2M from $1.5M. - Coinbase acquires Solana-based DEX Vector (ninth 2025 deal), aiming to become an "everything exchange" amid surging DEX volume exceeding $1T. - GSR upgrades institutional platform with treasury workflows and marke

Solana News Today: Solana's Emission Reform: Charting a Course for Long-Term Blockchain Economic Stability

- Solana proposes SIMD-0411 to cut $2.9B token emissions over six years, accelerating inflation reduction to 1.5% by 2029. - The "leaky bucket" plan aims to curb supply growth by 3.2% annually, stabilizing market dynamics through scarcity-driven value. - Staking yields may drop from 6.41% to 2.42% by Year 3, risking 47 validators' profitability and forcing industry consolidation. - Institutional adoption surges with $421M in Solana ETF inflows and Coinbase's acquisition of Solana-based DEX Vector. - The ov