Bitcoin Is Officially Oversold For The First Time In 9 Months: What This Means For Price

Bitcoin has fallen sharply over the past several days, dropping to its lowest level in six months as bearish momentum strengthens. The decline has pushed BTC below key psychological thresholds and left traders preparing for additional downside. Yet despite the weakness, several indicators suggest a potential opportunity is emerging beneath the surface. Bitcoin Could Repeat

Bitcoin has fallen sharply over the past several days, dropping to its lowest level in six months as bearish momentum strengthens. The decline has pushed BTC below key psychological thresholds and left traders preparing for additional downside.

Yet despite the weakness, several indicators suggest a potential opportunity is emerging beneath the surface.

Bitcoin Could Repeat History

The Relative Strength Index has entered the oversold zone for the first time in nine months, signaling extreme selling pressure. The last time Bitcoin was officially oversold was in February, a period that preceded a notable recovery. Oversold conditions often hint at incoming reversals, but timing remains uncertain.

During the previous oversold event, Bitcoin fell an additional 10% before the rebound began. A similar pattern now could send BTC toward $77,164 before buyers regain control. If the decline is contained and this deeper drop is avoided, Bitcoin may bounce sooner.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Bitcoin RSI. Source:

TradingView

Bitcoin RSI. Source:

TradingView

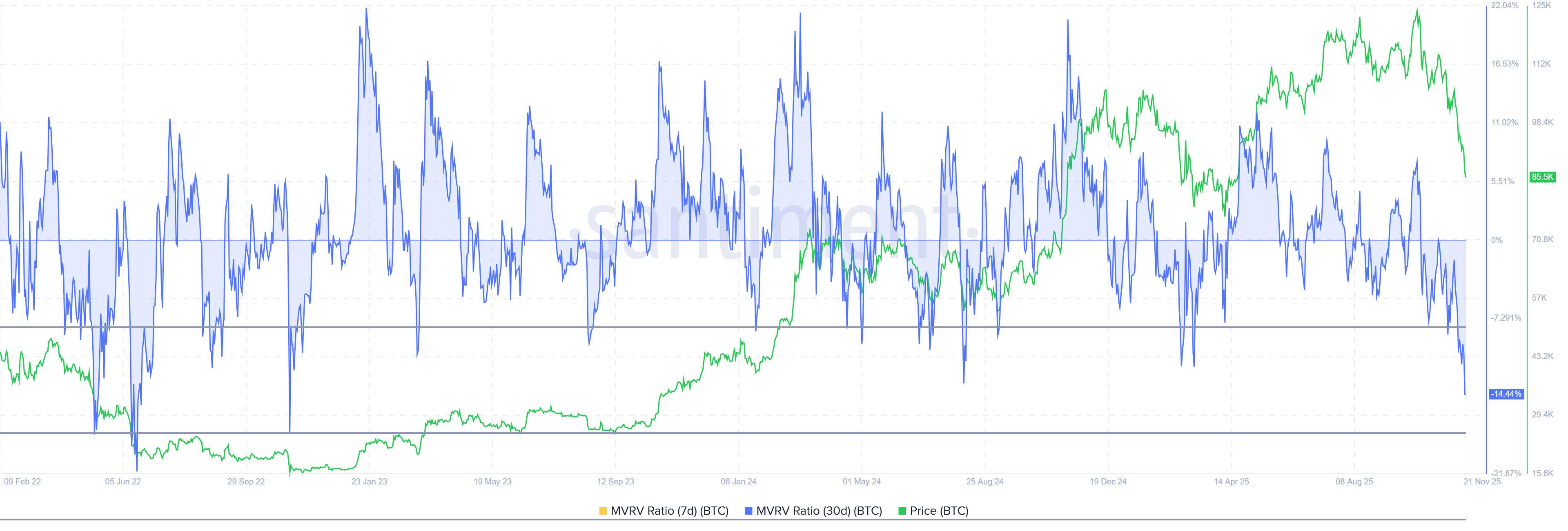

Macro momentum indicators are similarly pointing to undervaluation. Bitcoin’s MVRV Ratio sits at -14%, marking its lowest level in three years. The 30-day MVRV conveys two clear signals: holders are currently at a loss, and BTC is undervalued relative to historical norms. This environment tends to slow selling and increase accumulation.

The zone between -8% and -18% is historically known as the “opportunity zone,” a range where downside pressure typically saturates. Selling exhaustion often leads to steady accumulation, which in turn supports recovery.

Bitcoin MVRV Ratio. Source:

Santiment

Bitcoin MVRV Ratio. Source:

Santiment

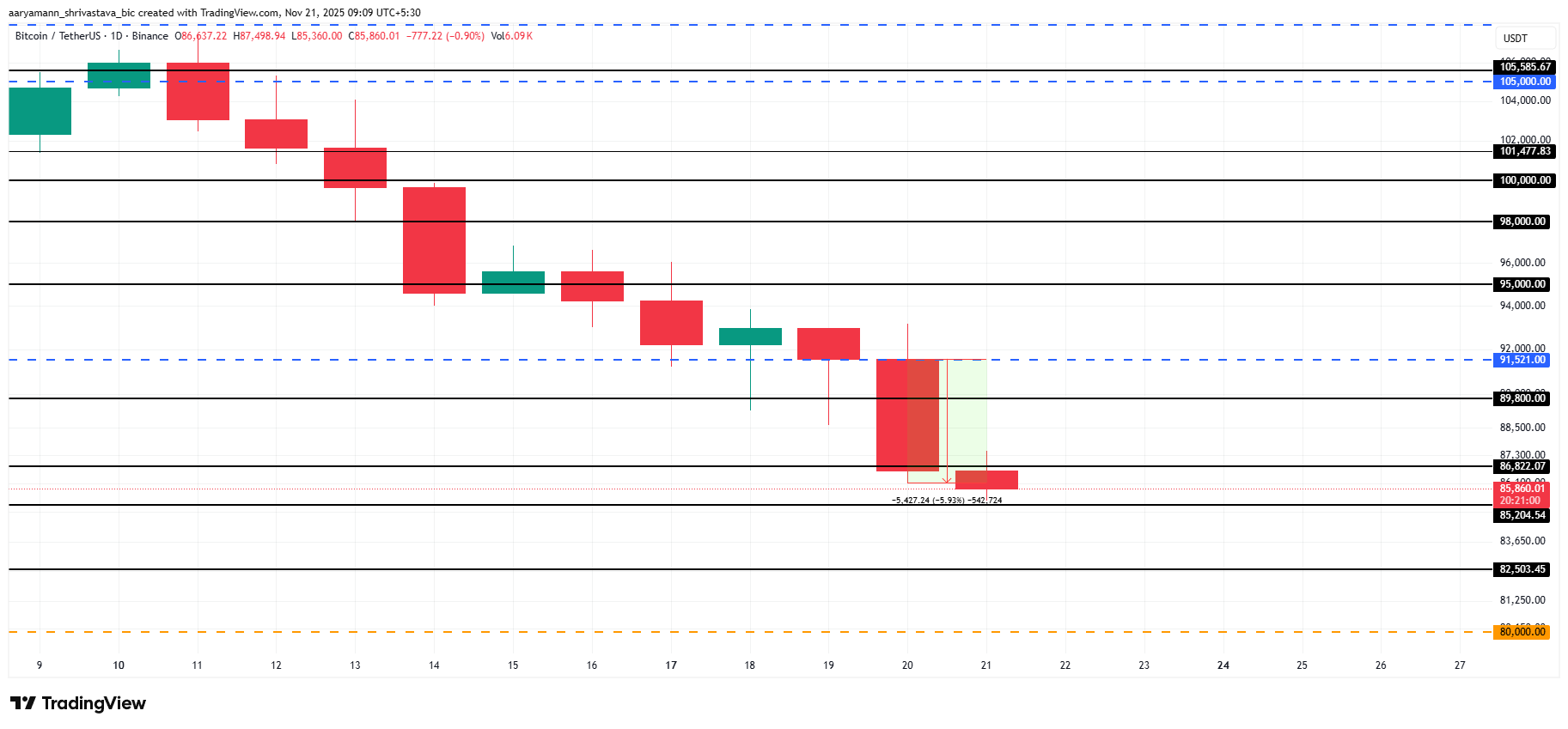

BTC Price Drops To $85,000

Bitcoin trades at $85,860 at the time of writing and is holding above the crucial $85,204 support level. Based on current indicators, BTC could experience a slight further downside before staging a rebound, especially if oversold conditions intensify.

A bearish continuation may drive Bitcoin to $77,164, aligning with the RSI’s historical pattern. Another possible scenario is a slide to $80,000 if BTC loses support at $85,204 and then $82,503. Both outcomes would reflect continued selling pressure before stabilization.

Bitcoin Price Analysis. Source:

TradingView

Bitcoin Price Analysis. Source:

TradingView

If Bitcoin manages to bounce from current levels, it could break above $86,822 and retest $89,800. A successful move higher would allow BTC to target a flip of $91,521 into support and push toward $95,000. This would invalidate the bearish outlook and signal a stronger recovery.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ICP Value Jumps 30% Over the Past Week as Ecosystem Broadens Strategically

- ICP's 30% price surge stems from strategic expansions, institutional partnerships, and decentralized AI advancements. - AIO-2030's launch positions ICP as a core infrastructure layer for privacy-preserving, cross-chain AI collaboration. - Inovia Capital's Abu Dhabi expansion signals institutional interest in ICP's blockchain-driven AI solutions in the Middle East. - Technical indicators show bullish momentum, with $6.00 as a key target and $8.25 as potential long-term resistance. - ICP's unique decentral

Internet Computer's Latest Rally: Will the Momentum Last or Is It Just a Temporary Spike?

- Internet Computer (ICP) surged in late 2025 due to institutional partnerships, technical upgrades, and speculative trading, but faces data credibility concerns. - Discrepancies in TVL figures (e.g., $237B vs. $1.14B) and unverified active wallet claims raise doubts about reported metrics and market fundamentals. - DApp usage dropped 22.4% in Q3 2025, highlighting a gap between infrastructure growth and user adoption, despite 50% compute capacity improvements. - Speculative trading volumes rose 261%, alig

Solana's Latest Price Fluctuations and Network Efficiency: Evaluating the Long-Term Investment Potential of High-Performance Smart Contract Platforms

- Solana maintains high-performance blockchain status with sub-2-second finality and low fees, attracting institutional adoption via Coinbase and PrimeXBT integrations. - Network faces declining user activity (3. 3M active addresses) and overreliance on speculative trading/meme coins, creating volatility risks for long-term viability. - Emerging competitors like Mutuum Finance challenge Solana by offering real-world asset tokenization models, highlighting need for non-speculative use cases. - Investors mus

The Abrupt 150% Decline in Solana’s Value: Causes, Impacts, and Potential Prospects