Hyperliquid's Latest Rise in Trading Activity: An In-Depth Look at On-Chain Liquidity and the Progression of DeFi

- Hyperliquid dominates decentralized derivatives with $317.6B Q3 2025 volume, 73% DEX market share, and $653B quarterly turnover. - HIP-3 growth mode slashed taker fees by 90%, while HyperEVM/HyperCore blockchain enables zero-gas, sub-second trades and cross-chain interoperability. - Platform faces volatility risks: 3 major 2025 attacks including $4.9M POPCAT bad debt incident, exposing thin-liquidity vulnerabilities. - HYPE token surged 640% post-2024 launch with $9.3B market cap, but faces competition f

On-Chain Liquidity: The Catalyst Behind Hyperliquid’s Expansion

Hyperliquid’s rise is rooted in its capacity to provide substantial, affordable liquidity—a vital element for attracting both individual and institutional traders. By July 2025, the platform had already surpassed $320 billion in perpetuals trading and generated $86.6 million in protocol revenue, with

A significant factor behind this liquidity boom is the introduction of Hyperliquid’s HIP-3 growth mode in November 2025. This program

DeFi Market Structure: Uniting EVM and Native Chains

Hyperliquid’s technical setup has also transformed the structure of DeFi markets. By merging HyperCore and HyperEVM, the platform

Additionally, Hyperliquid’s share of the decentralized derivatives market climbed to 73% of DEX trading volume in Q3 2025,

Navigating Crypto Volatility: Prospects and Challenges

Hyperliquid’s position in the volatile crypto sector is both an asset and a potential weakness. Its advanced Layer 1 blockchain (HyperBFT consensus, 0.2-second block intervals) supports complex derivatives strategies, including diversified and hedged trading through collaborations like D2 Finance

However, Hyperliquid’s prominence has also made it susceptible to market manipulation. In 2025, the platform experienced three significant incidents,

Investor Sentiment and Growth Potential

The performance of the HYPE token serves as an indicator of market confidence. Since its launch in November 2024,

Nonetheless, competition is intense. Aster’s rollout of 300x leverage (compared to Hyperliquid’s 40x maximum) has attracted traders seeking greater risk and reward,

Conclusion: Betting on DeFi’s Next Chapter

Hyperliquid’s recent surge in trading activity highlights its expertise in on-chain liquidity and DeFi technology. Its ability to generate $317.6 billion in trading volume without depending on incentive programs, along with its advancements in interoperability and order book mechanics, cements its status as a frontrunner in decentralized derivatives. Still, the platform’s exposure to volatility-related risks—stemming from both manipulation and fierce competition—remains a significant concern.

For investors, Hyperliquid stands as a bold wager on the evolution of DeFi. Its HIP-3 expansion strategy and staking framework indicate a platform geared for ongoing growth, but the ever-changing crypto volatility sector requires constant innovation. Those prepared to manage the risks may find Hyperliquid’s growth story as compelling as its impressive statistics.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

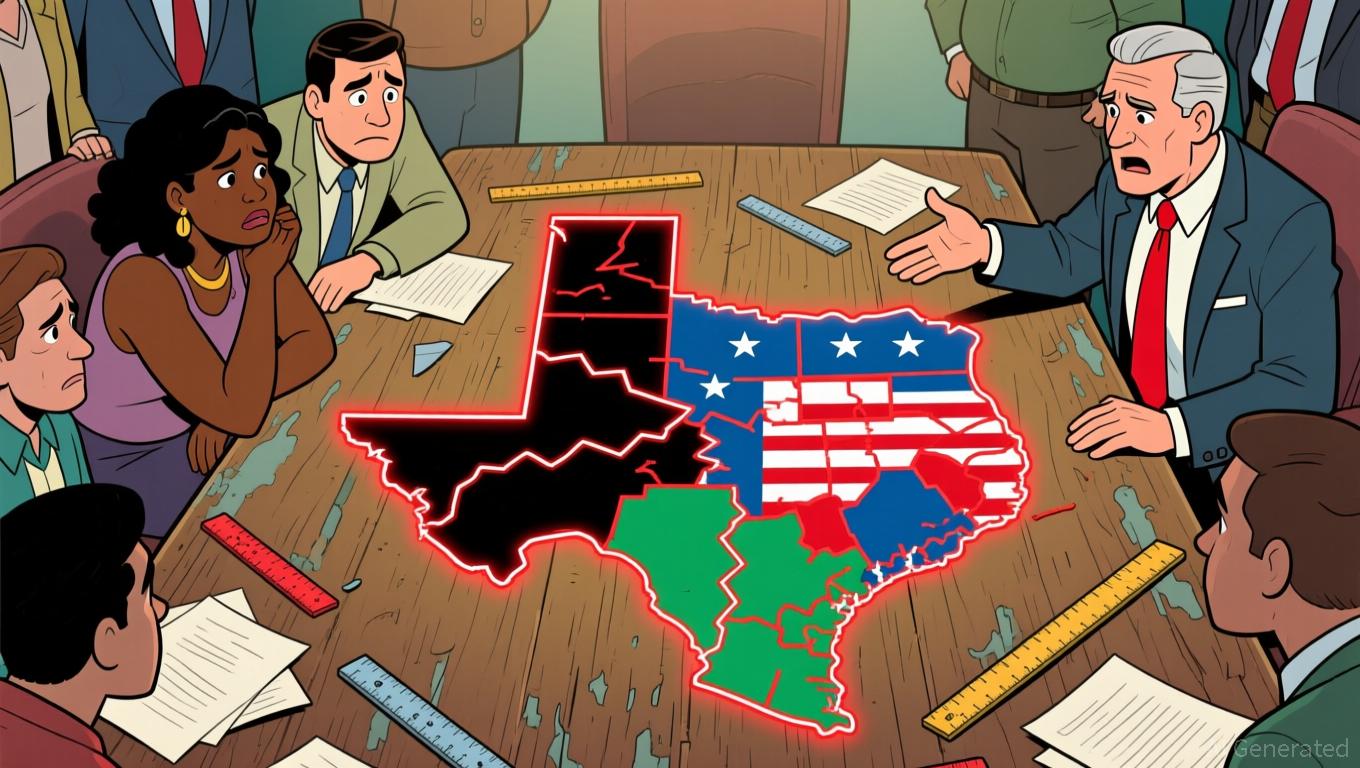

Supreme Court Decision Challenges Party Tactics in Racial Gerrymandering Cases

- Supreme Court Justice Alito blocked a lower court ruling that found Texas' 2026 redistricting plan racially discriminatory, preserving its implementation for the 2026 midterms. - Texas argued the lower court erred by conflating political and racial motivations, citing logistical challenges of changing the map 91 days before the primary. - The case tests boundaries between partisan strategy and racial gerrymandering, with LULAC criticizing the Supreme Court's pause as undermining fair representation for m

XRP News Today: Death Cross Emerges: XRP's Sharp Decline Highlights Broader Crypto Market Fragility

- XRP's price fell below $2.20 on Nov 19, 2025, signaling a "death cross" technical pattern linked to prolonged declines. - The bearish crossover of 50-day and 200-day EMAs suggests intensified selling pressure and potential 55% drop to $1.25. - The decline mirrors weakness in Bitcoin and Ethereum , reflecting systemic crypto market fragility amid macroeconomic and regulatory risks. - Analysts warn of erratic crypto behavior near key levels, emphasizing unpredictable volatility during this bearish phase.

XRP News Today: The Growth of Crypto: Institutional Funding Compared to Market Fluctuations and Risks of Delisting

- Bitwise launches XRP ETF (XRP) to offer institutional exposure to Ripple's blockchain, navigating risks like token depreciation and market volatility. - ARK Invest defies crypto pessimism by injecting $39M into crypto-linked stocks, adjusting its 2030 Bitcoin price target to $1.2M from $1.5M. - Coinbase acquires Solana-based DEX Vector (ninth 2025 deal), aiming to become an "everything exchange" amid surging DEX volume exceeding $1T. - GSR upgrades institutional platform with treasury workflows and marke

Solana News Today: Solana's Emission Reform: Charting a Course for Long-Term Blockchain Economic Stability

- Solana proposes SIMD-0411 to cut $2.9B token emissions over six years, accelerating inflation reduction to 1.5% by 2029. - The "leaky bucket" plan aims to curb supply growth by 3.2% annually, stabilizing market dynamics through scarcity-driven value. - Staking yields may drop from 6.41% to 2.42% by Year 3, risking 47 validators' profitability and forcing industry consolidation. - Institutional adoption surges with $421M in Solana ETF inflows and Coinbase's acquisition of Solana-based DEX Vector. - The ov