Altcoins Refuse to Die: 3 Positive Signals Emerge as Market Fear Hits Extreme

While the total market cap has entered its fourth consecutive week of decline and the market has lost nearly $1 trillion in November, data reveal a notable divergence in how investors are withdrawing capital. Mid- and low-cap assets show a surprisingly positive signal. What is this signal, and what does it mean in the current

While the total market cap has entered its fourth consecutive week of decline and the market has lost nearly $1 trillion in November, data reveal a notable divergence in how investors are withdrawing capital. Mid- and low-cap assets show a surprisingly positive signal.

What is this signal, and what does it mean in the current context? The following report provides a detailed explanation.

3 Positive Signals for Altcoins as the Market Becomes Most Pessimistic

The market sentiment index has stayed in “extreme fear” for most of November. Even so, several positive signals still emerge, acting as glimmers of hope for altcoins.

First, a report from CryptoQuant compares the market-cap performance of Bitcoin, large caps, and mid- and small-cap altcoins. It shows significant resilience in the lower-cap segment.

BTC vs. Altcoin Market Cap Comparison. Source:

CryptoQuant.

BTC vs. Altcoin Market Cap Comparison. Source:

CryptoQuant.

According to the comparative market-cap chart, Bitcoin experienced the sharpest drop in November. Large caps, which include the top 20 altcoins, also fell, but to a lesser extent. Mid- and small-cap altcoins declined only slightly and suffered less damage.

“Large caps are struggling, but not as much as BTC, while mid–small caps are showing real resilience,” analyst Darkfost noted.

In fact, the chart shows that only the market caps of Bitcoin and large caps have formed new all-time highs. Mid- and low-cap assets have yet to return to their late-2024 peaks. From a psychological perspective, once altcoins drop too deeply — often losing 80–90% of value — holders tend to view their assets as “already lost.” They then have little motivation to panic sell.

This leads to the second notable factor: a divergence between Bitcoin Dominance and OTHERS Dominance.

Bitcoin Dominance (BTC.D) measures Bitcoin’s share of the total market cap. OTHERS Dominance (OTHERS.D) measures the share held by all altcoins excluding the top 10.

Bitcoin Dominance and OTHERS Dominance. Source:

TradingView

Bitcoin Dominance and OTHERS Dominance. Source:

TradingView

The chart shows that in November, OTHERS.D rose from 6.6% to 7.4%. Meanwhile, BTC.D dropped from 61% to 58.8%.

This divergence implies that altcoin investors are no longer as easily panic-selling, even while sitting on losses. Instead, they are holding their positions and waiting for a recovery.

Historically, when BTC.D declines and altcoin dominance increases, the market often transitions into an altcoin bull cycle.

Additionally, Binance data indicate that 60% of the current trading volume now originates from altcoins. This is the highest level since early 2025.

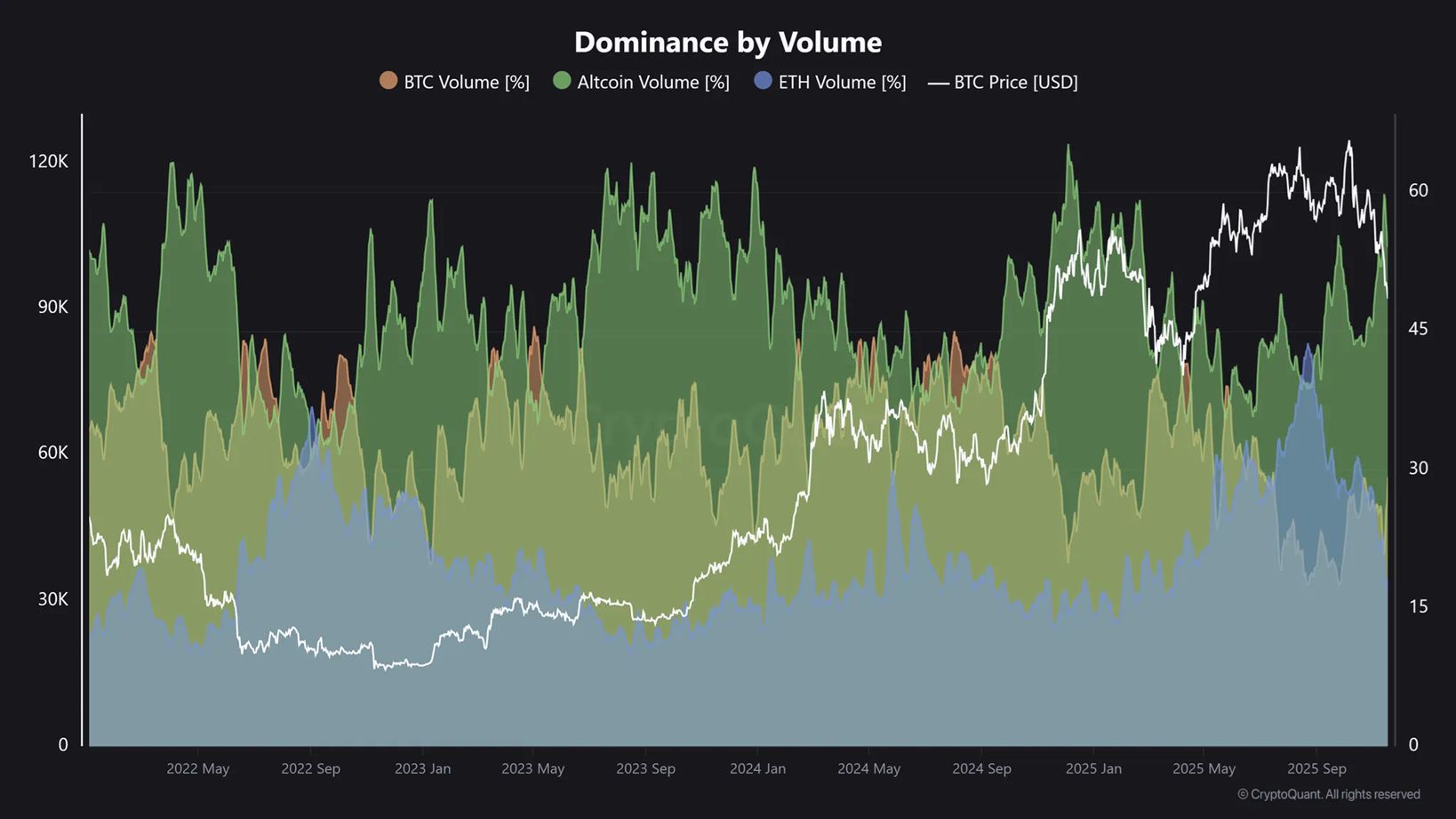

Dominance by Volume. Source:

CryptoQuant.

Dominance by Volume. Source:

CryptoQuant.

Analyst Maartunn believes this data highlights where actual trading activity is happening. Currently, activity is concentrated heavily outside major cryptocurrencies. Altcoins have once again become highly popular trading vehicles on Binance.

“Historically, an increased share of altcoin trading volume often coincides with increased speculation in the market,” maartunn said.

In summary, mid- and low-cap altcoins are receiving strong liquidity inflows. They also exhibit better price performance and higher market share ratios. These factors indicate that altcoin holders hold strong expectations for a recovery from the bottom region.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana News Update: Major Institutions Invest Billions While Solana Boosts Its Scarcity Approach

- Solana developers propose reducing future SOL emissions by 22M tokens to accelerate disinflation, targeting 1.5% terminal inflation twice as fast. - Institutional adoption grows via staking-enabled ETFs like VanEck's and Bitwise's BSOL , creating dual-income streams through exposure and yield. - Despite $424M in BSOL assets, Solana's price fell below $140 support, with derivatives data signaling short-term selling pressure and crowded long positions. - Coinbase's Vector acquisition enhances Solana's inst

Bitcoin Latest Updates: Macroeconomic Factors and Earnings Challenges Drive 44% DeFi Downturn

- Market analysts predict a 44% correction in DeFi and crypto sectors due to macroeconomic risks, Fed policy uncertainty, and weak corporate earnings. - HIVE Digital faces scrutiny over Bitcoin holdings reduction and shareholder dilution, while Hyster-Yale reports Q3 losses amid industry margin pressures. - Data center infrastructure emerges as a growth outlier with $11.1B backlog and $320B 2030 market projection, though labor shortages and permitting delays persist. - Goldman Sachs adjusts energy sector o

Ethereum Updates Today: Institutional Confidence Faces Challenges Amid Ethereum's Price Fluctuations and Upcoming Upgrades

- Galaxy Digital's 7,098 ETH withdrawal from Binance raises concerns over Ethereum's institutional activity and market stability amid macroeconomic pressures. - ETH faces $993M long liquidation risk below $2,600 and $1.07B short liquidation risk above $2,900, highlighting leveraged position fragility. - Institutional staking inflows remain steady despite declining ETH futures open interest (-7% weekly) and reduced ETF net inflows ($10M vs. $65M in October). - Upcoming Dencun upgrade (EIP-4844) aims to redu

Ethereum Updates: Consumer Graphics Cards Drive Cost-Effective and Decentralized Ethereum Scaling

- zkSync's Airbender prover achieved L1 block proofs using two RTX 5090 GPUs, praised by Vitalik Buterin as a "huge milestone" for Ethereum's scalability. - The breakthrough enables "gigagas L1" expansion, potentially reducing fees and enabling near-zero L2 costs through consumer-grade hardware accessibility. - Succinct's SP1 Hypercube demonstrated 99.7% real-time L1 proving under 12 seconds with 16 RTX 5090s, advancing ZK tech alongside zkSync's progress. - Buterin cautioned against over-optimism, noting