WLFI reserve firm ALT5 Sigma to be investigated for violating SEC disclosure requirements.

ALT5 Sigma, the reserve company partner of the Trump family’s cryptocurrency project "World Liberty Financial" (WLFI), stated in a filing submitted to the U.S. Securities and Exchange Commission (SEC) that its CEO was officially suspended on October 16, but internal emails show that the company’s board had actually placed him on temporary leave as early as September 4. Several securities regulatory experts indicated that this significant discrepancy in timing may have violated information disclosure rules. The enclosed emails also revealed that Chief Revenue Officer Vay Tham was simultaneously placed on leave because a special committee of the board is investigating certain matters related to the company. According to SEC regulations, publicly listed companies must disclose within four trading days (Form 8-K) after a significant change occurs in the actual performance of executive duties, and if a company deliberately submits false or misleading information, it may constitute a violation of anti-fraud regulations.

In August this year, ALT5 Sigma purchased a total of 1.5 billion USD worth of WLFI tokens through a circular transaction, with an estimated over 500 million USD ultimately flowing to entities associated with President Trump.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

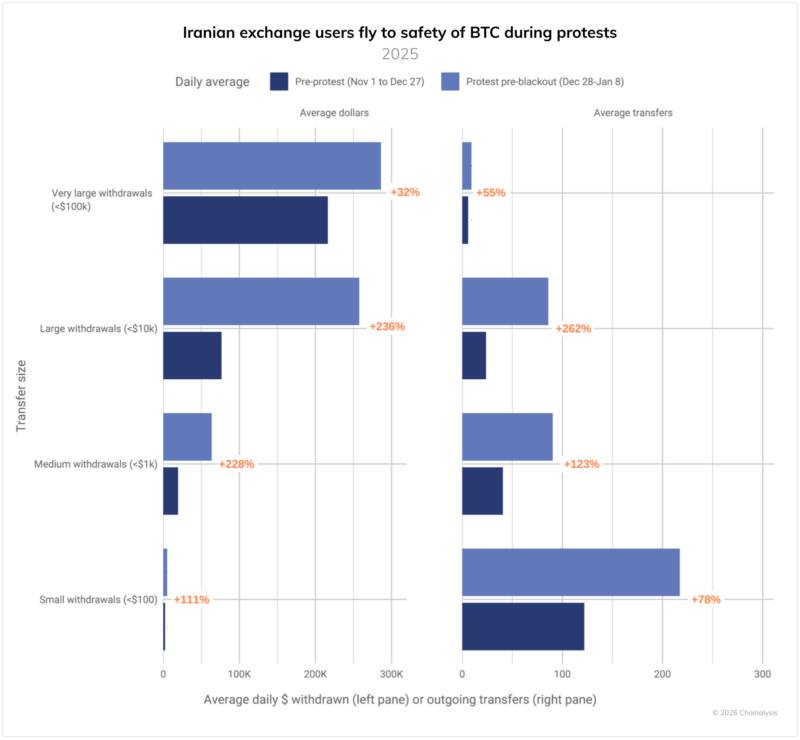

$7.8 Billion and Growing: What Iran’s Crypto Data Reveals About Crisis

Why is Sweetgreen's business struggling?

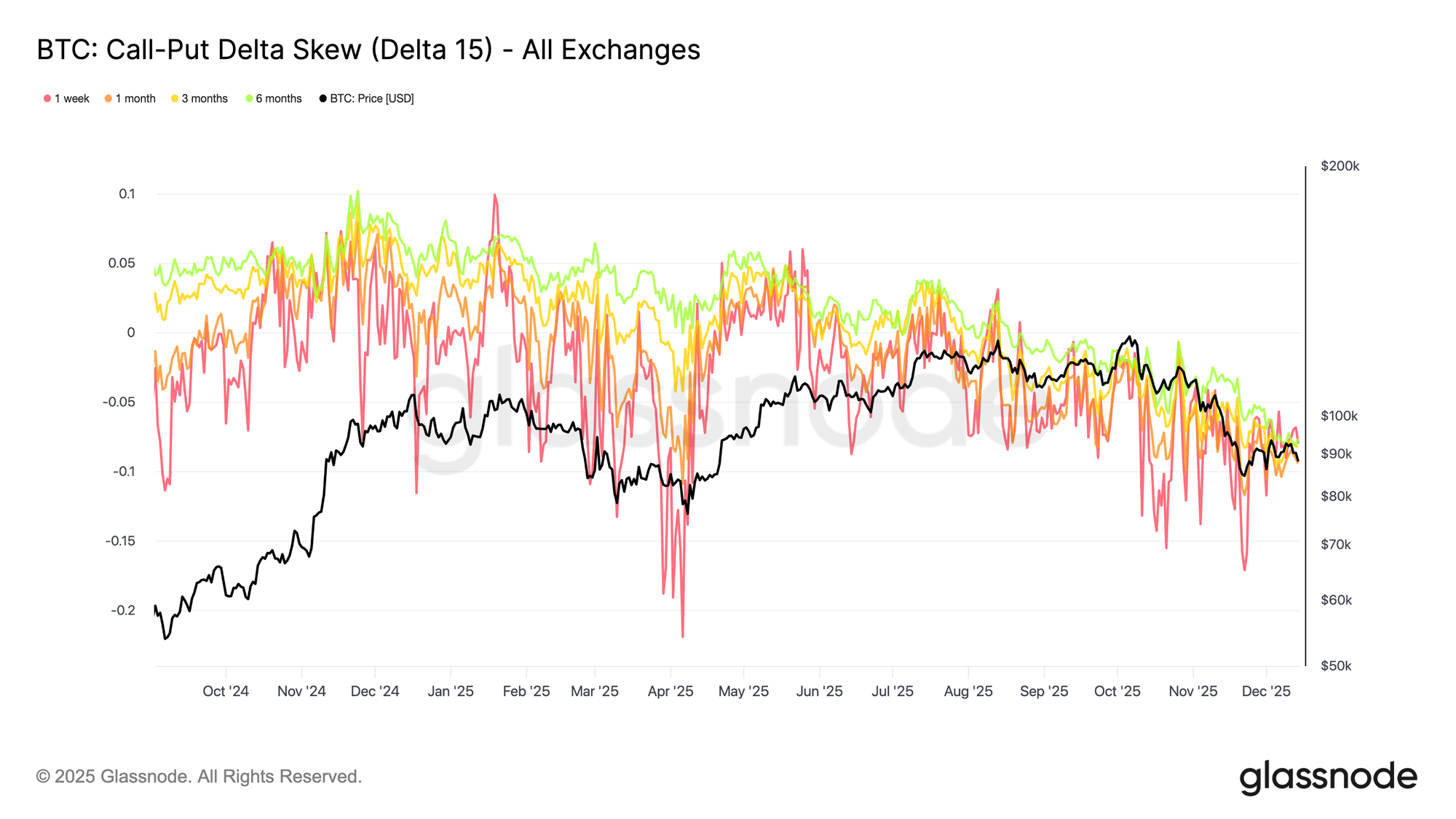

Product Update: New Options Metrics Suite