Vitalik Buterin Supports ZKsync: Strategic Impact on Ethereum Layer 2 Growth and Institutional Investment in Crypto

- Vitalik Buterin endorsed ZKsync's 2025 Atlas upgrade, highlighting its role in Ethereum's scalability and institutional adoption. - The upgrade enables 15,000 TPS with near-zero fees via ZK Stack, enhancing liquidity sharing and Layer 2 interoperability. - ZKsync attracted $15B in 2025 inflows, with ZK token surging 50% post-endorsement, signaling institutional confidence. - Upcoming Fusaka upgrade aims for 30,000 TPS, strengthening ZKsync's position against rivals like Arbitrum and Optimism . - Buterin'

Technical Progress and Ethereum’s Scalability Goals

Buterin has pointed out that the Atlas upgrade enables ZKsync to handle

Buterin’s commendation highlights ZKsync’s often-overlooked but transformative impact on Ethereum. “ZKsync’s contributions are not just incremental—they’re foundational,” he remarked, stressing that the upgrade’s design

Institutional Uptake and Market Effects

The Atlas upgrade has already sparked notable interest from major institutions. Zeeve’s report notes that

Additionally, ZKsync’s governance token, ZK, has

Looking forward, ZKsync’s upcoming Fusaka upgrade,

Strategic Impact on Ethereum’s Ecosystem

ZKsync’s achievements highlight a significant strategic evolution in Ethereum’s Layer 2 sector. By enabling instant liquidity sharing and minimizing dependence on centralized entities, the Atlas upgrade

For investors, Buterin’s endorsement—as Ethereum’s co-founder—carries substantial influence. His support not only affirms ZKsync’s technical strengths but also hints at a possible shift in Ethereum’s development focus toward ZK-based technologies. This could drive further progress in the sector, creating a positive feedback loop that benefits both ZKsync and the wider Ethereum network.

Conclusion

Vitalik Buterin’s backing of ZKsync’s Atlas upgrade represents a major milestone for Ethereum’s Layer 2 growth and the entry of institutional capital into crypto. The upgrade’s technical innovations, along with its alignment with Ethereum’s scaling objectives, make ZKsync a key component in the network’s future. For investors, the project’s rising institutional adoption, strong token performance, and forthcoming upgrades offer a strong case for long-term value. As the digital asset industry evolves, ZKsync’s role in connecting decentralized technology with enterprise applications is set to remain central to both investment and innovation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana News Update: Major Institutions Invest Billions While Solana Boosts Its Scarcity Approach

- Solana developers propose reducing future SOL emissions by 22M tokens to accelerate disinflation, targeting 1.5% terminal inflation twice as fast. - Institutional adoption grows via staking-enabled ETFs like VanEck's and Bitwise's BSOL , creating dual-income streams through exposure and yield. - Despite $424M in BSOL assets, Solana's price fell below $140 support, with derivatives data signaling short-term selling pressure and crowded long positions. - Coinbase's Vector acquisition enhances Solana's inst

Bitcoin Latest Updates: Macroeconomic Factors and Earnings Challenges Drive 44% DeFi Downturn

- Market analysts predict a 44% correction in DeFi and crypto sectors due to macroeconomic risks, Fed policy uncertainty, and weak corporate earnings. - HIVE Digital faces scrutiny over Bitcoin holdings reduction and shareholder dilution, while Hyster-Yale reports Q3 losses amid industry margin pressures. - Data center infrastructure emerges as a growth outlier with $11.1B backlog and $320B 2030 market projection, though labor shortages and permitting delays persist. - Goldman Sachs adjusts energy sector o

Ethereum Updates Today: Institutional Confidence Faces Challenges Amid Ethereum's Price Fluctuations and Upcoming Upgrades

- Galaxy Digital's 7,098 ETH withdrawal from Binance raises concerns over Ethereum's institutional activity and market stability amid macroeconomic pressures. - ETH faces $993M long liquidation risk below $2,600 and $1.07B short liquidation risk above $2,900, highlighting leveraged position fragility. - Institutional staking inflows remain steady despite declining ETH futures open interest (-7% weekly) and reduced ETF net inflows ($10M vs. $65M in October). - Upcoming Dencun upgrade (EIP-4844) aims to redu

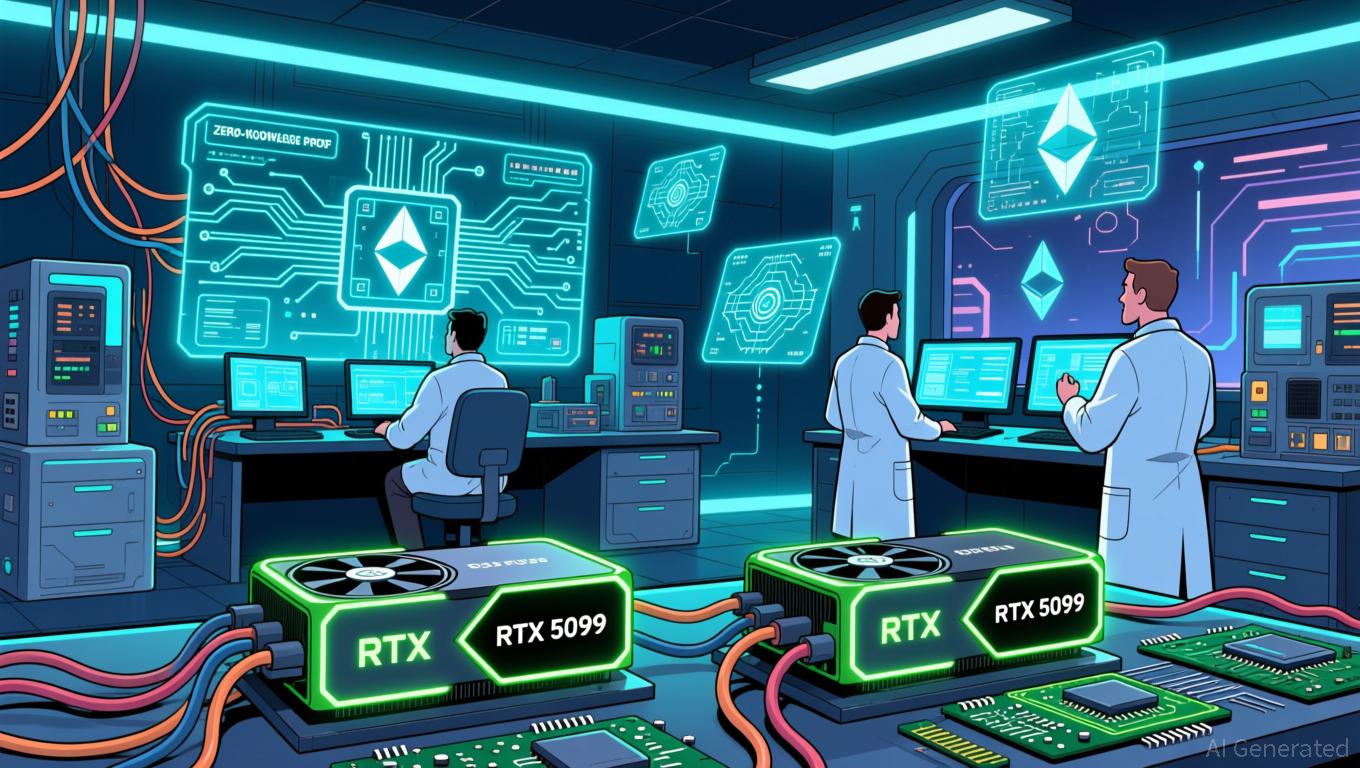

Ethereum Updates: Consumer Graphics Cards Drive Cost-Effective and Decentralized Ethereum Scaling

- zkSync's Airbender prover achieved L1 block proofs using two RTX 5090 GPUs, praised by Vitalik Buterin as a "huge milestone" for Ethereum's scalability. - The breakthrough enables "gigagas L1" expansion, potentially reducing fees and enabling near-zero L2 costs through consumer-grade hardware accessibility. - Succinct's SP1 Hypercube demonstrated 99.7% real-time L1 proving under 12 seconds with 16 RTX 5090s, advancing ZK tech alongside zkSync's progress. - Buterin cautioned against over-optimism, noting