Crypto Markets Wiped $1Trillion, but Raoul Pal sees a Strong Bitcoin Recovery

-

Crypto market lost $1 trillion, but Raoul Pal says sharp Bitcoin recoveries are normal.

-

Raoul Pal compares current crash to past cycles where Bitcoin bounced back strongly.

-

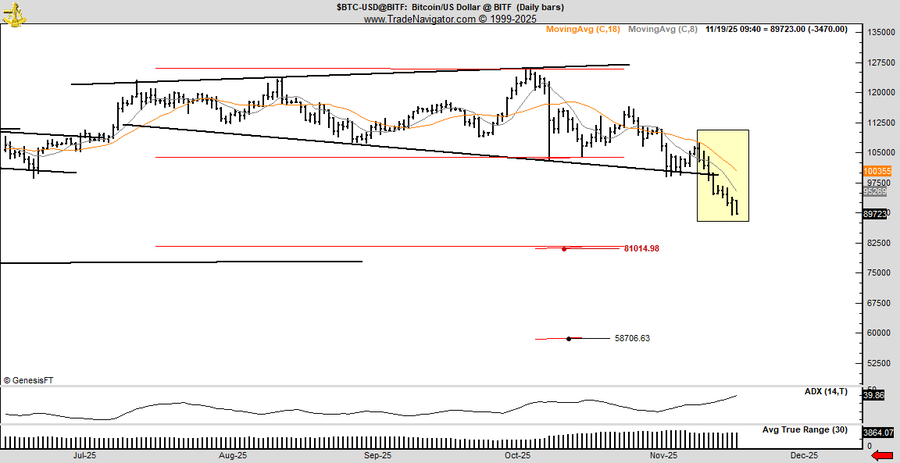

Analyst Peter Brandt warns Bitcoin could fall deeper toward $81,000 or even $58,000.

The crypto market is going through one of its toughest periods in over the past weeks, wiping out roughly $1 trillion from the market. Prices are falling fast, traders are panicking, and rumors about weakened market makers are adding more fear to the fire.

But while the drop looks scary, macro investor Raoul Pal believes this kind of heavy shake-out has happened before and often leads to strong recoveries.

Bitcoin’s Historical Pattern Repeating Again

In his post, Pal shared a striking long-term Bitcoin chart, comparing today’s drop with the shocking crash of 2021. Back then, Bitcoin fell 56% in just one month, Ethereum dropped 62%, and Solana plunged 68%.

Everyone panicked, and then the market suddenly flipped, and crypto exploded to new all-time highs.

That wasn’t the only time. From 2019 to 2020, Bitcoin fell 72% before bouncing back stronger. Between 2016 and 2017, Bitcoin saw seven drops of more than 30% each, yet the overall trend remained upward.

Each time, altcoins fell even harder. Each time, fear won in the short term, and patience won in the long term.

Pal’s View: Pain Now, Opportunity Later

Despite the chaos, Pal remains calm. He says he is adding to his positions during this drop because he sees the long-term trend as strong. However, he also reminds everyone that each person’s risk level and time horizon are different.

Pal also shared an important price point to watch. According to him, if Bitcoin can break above the $85,000 level and turn it into a strong support, the next target would be $89,326. He believes this zone could act as the next step before Bitcoin decides its bigger move.

Bitcoin Could Drop to $58K

While some analysts expect a recovery, veteran trader Peter Brandt is warning that Bitcoin could still see a deeper drop.

According to him, Bitcoin made a small breakout on November 11, but instead of building strength, the price kept falling for eight straight days, creating “lower highs.” This shows that sellers are still in control and buyers are not able to push the price up.

Based on his analysis, he sees $81,000 and $58,000 as important levels Bitcoin could revisit if the selling continues. A drop to $58,000, he said, could trigger strong panic among traders.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hyperliquid News Today: LivLive's Practical Profit Approach Ignites Crypto's Next 1000x Surge

- LivLive ($LIVE) surges in Q4 2025 crypto with 300% BLACK300 bonus, $2.1M raised in presale. - AR missions, wearable tech , and real-world utility drive $LIVE's 1000x potential vs. stagnant XRP/Hyperliquid. - $1K investment triples to 200,000 tokens via BLACK300, projected $50K value at $0.25 listing price. - XRP (-1.86%) and HYPE (+1.72%) lag as LivLive's closed-loop economy attracts asymmetric-return seekers.

Crypto Asset Management Strikes a Balance Between Volatile Profits and Professional Security Measures

- Digital Ascension Group, a crypto wealth manager, aids ultra-high-net-worth clients in navigating volatile markets through automated trading and institutional-grade security. - A Dallas client turned $11,000 into $498 million via culturally themed token trading, highlighting crypto's growing role in traditional wealth management. - The firm offers custody via Anchorage, multi-signature governance, and tax optimization, contrasting DeFi's risks with institutional safeguards akin to Charles Schwab. - Crypt

Trump and Socialist Mamdani Reach Agreement on Expenses Despite Republican Opposition

- Trump met with socialist mayor-elect Mamdani, showing rare bipartisan cooperation on affordability issues despite GOP's anti-socialist resolution. - Both leaders emphasized shared goals on housing costs and price controls, contrasting with Trump's earlier attacks on Mamdani's progressive policies. - The meeting highlighted Trump's strategic pivot to address inflation concerns while navigating GOP internal divisions over socialist policies. - Federal-state tensions emerged as Mamdani defended sanctuary ci

Bitcoin News Today: Bitcoin Approaches $80,500—Past Trends Indicate Possible Bullish Recovery

- Bitcoin fell to a seven-month low of $86,300, triggering $914M in liquidations but analysts predict a near-term rebound. - Technical support at $87,300 and inverted retail fear (Fear & Greed Index at 15) mirror 2018 patterns preceding 30% rallies. - Macroeconomic parallels to 2019 shutdown recovery and Fed easing suggest $80,500 half-life level could act as a catalyst. - Crypto outperformed traditional assets with ETH, SOL, XRP rising double-digits, while Deribit data shows mixed positioning around $90k-