Bitcoin Updates: Federal Reserve Pauses QT While Nvidia's AI Boom Sparks Bubble Concerns

- The Fed will end quantitative tightening by December 1, aiming to stabilize liquidity after years of balance-sheet reduction. - Nvidia reported $57.01B Q3 revenue, driven by $51.2B in AI-powered data center sales, surpassing Wall Street estimates by $2B. - Bitcoin rebounded above $90,000 following Nvidia's results, but AI bubble concerns persist with 45% of fund managers citing it as top risk. - Major investors like Peter Thiel and SoftBank have reduced Nvidia stakes, contrasting CEO Huang's "decades-lon

The Federal Reserve has revealed plans to conclude quantitative tightening (QT) by December 1,

Following the earnings release, Nvidia shares jumped 5%, lifting the broader market as the S&P 500 and Nasdaq Composite advanced 0.38% and 0.59%

Nonetheless, the rapid growth of AI remains controversial. Both regulators and investors have voiced caution: the Bank of England has highlighted potential systemic risks from AI in the financial sector, while

The Fed's move to stop QT introduces another factor to the broader economic picture. By ending the $2 trillion reduction in bonds, the central bank seeks to steady liquidity following years of contraction. This policy change, alongside Nvidia's AI leadership, indicates that markets could withstand short-term turbulence. However, with Bitcoin still trading below its $126,000 high and ongoing macroeconomic uncertainty, investors remain cautious

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

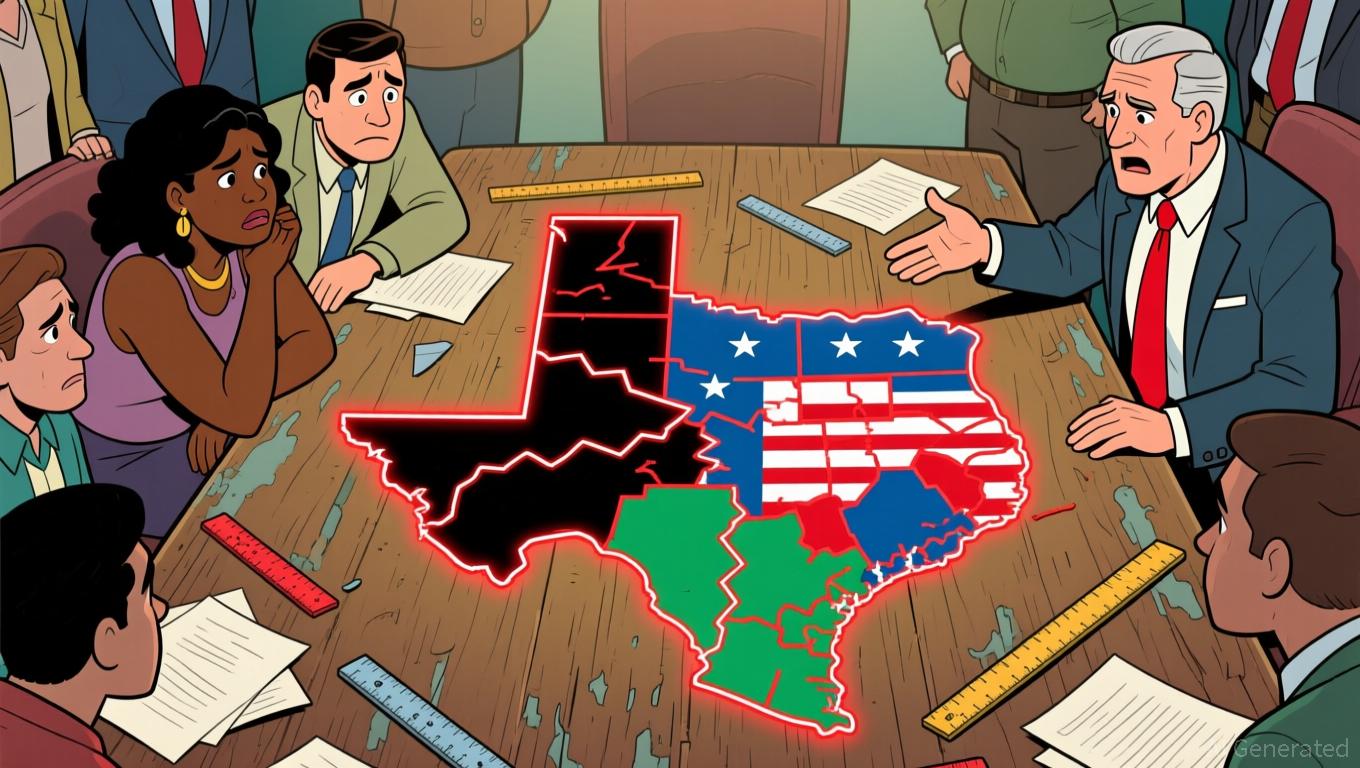

Supreme Court Decision Challenges Party Tactics in Racial Gerrymandering Cases

- Supreme Court Justice Alito blocked a lower court ruling that found Texas' 2026 redistricting plan racially discriminatory, preserving its implementation for the 2026 midterms. - Texas argued the lower court erred by conflating political and racial motivations, citing logistical challenges of changing the map 91 days before the primary. - The case tests boundaries between partisan strategy and racial gerrymandering, with LULAC criticizing the Supreme Court's pause as undermining fair representation for m

XRP News Today: Death Cross Emerges: XRP's Sharp Decline Highlights Broader Crypto Market Fragility

- XRP's price fell below $2.20 on Nov 19, 2025, signaling a "death cross" technical pattern linked to prolonged declines. - The bearish crossover of 50-day and 200-day EMAs suggests intensified selling pressure and potential 55% drop to $1.25. - The decline mirrors weakness in Bitcoin and Ethereum , reflecting systemic crypto market fragility amid macroeconomic and regulatory risks. - Analysts warn of erratic crypto behavior near key levels, emphasizing unpredictable volatility during this bearish phase.

XRP News Today: The Growth of Crypto: Institutional Funding Compared to Market Fluctuations and Risks of Delisting

- Bitwise launches XRP ETF (XRP) to offer institutional exposure to Ripple's blockchain, navigating risks like token depreciation and market volatility. - ARK Invest defies crypto pessimism by injecting $39M into crypto-linked stocks, adjusting its 2030 Bitcoin price target to $1.2M from $1.5M. - Coinbase acquires Solana-based DEX Vector (ninth 2025 deal), aiming to become an "everything exchange" amid surging DEX volume exceeding $1T. - GSR upgrades institutional platform with treasury workflows and marke

Solana News Today: Solana's Emission Reform: Charting a Course for Long-Term Blockchain Economic Stability

- Solana proposes SIMD-0411 to cut $2.9B token emissions over six years, accelerating inflation reduction to 1.5% by 2029. - The "leaky bucket" plan aims to curb supply growth by 3.2% annually, stabilizing market dynamics through scarcity-driven value. - Staking yields may drop from 6.41% to 2.42% by Year 3, risking 47 validators' profitability and forcing industry consolidation. - Institutional adoption surges with $421M in Solana ETF inflows and Coinbase's acquisition of Solana-based DEX Vector. - The ov