Why the United States Could See a New Political Party by 2026

Discontent with the two-party system is reaching a rolling boil, and several forces—from party rebranding debates to congressional feuds and billionaire-sized ambitions—are fueling talk that America may be on the edge of a new political party.

America May Be on the Brink of a New Political Party

A growing chorus of activists, lawmakers, and political influencers are hinting that the U.S. could see a new party emerge as early as 2026—and the motivations behind this push come from three distinct but converging fronts. Together, they paint a picture of a political environment where institutional loyalty is wearing thin and voters are searching for something that resembles a fresh start.

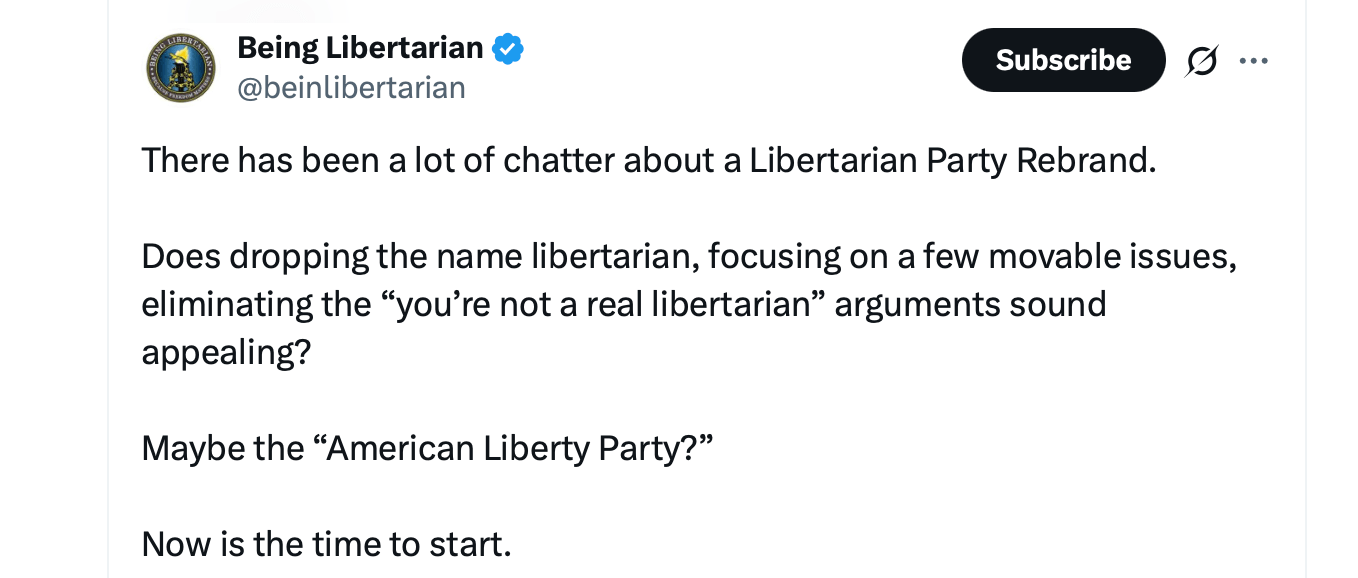

At the center of this shift is a longstanding debate inside the Libertarian Party. After decades of struggling to break through electorally, the party is weighing everything from a new name to a new platform—and even a new identity. Despite libertarian-leaning sentiment running deep among tens of millions of voters, the party’s 2024 result fell short of expectations, renewing questions about whether the “Libertarian” label has become more of an obstacle than a rallying point.

Internal discussions focus on broadening the party’s appeal to the estimated 30 million to 60 million Americans who favor lower spending, fewer wars, and stronger civil liberties. Advocates argue that these voters align with the movement’s core principles but are put off by ideological infighting and branding that feels too niche for a national audience. Proposals include softening hardline positions on open borders and pruning the platform to emphasize issues where public sentiment is already moving: transparency, restrained federal budgets and reform-minded governance.

Rebranding supporters say the party needs a modern identity to capture a growing base of independents and younger voters disillusioned by stale political dynamics. Ideas range from a complete renaming—“American Liberty Party” and “America Party” are frequently floated—to more cosmetic changes like updating logos and color schemes. Skeptics counter that altering the brand risks diluting decades of philosophical work, while others argue that the party is too fractured internally to agree on a shared path forward.

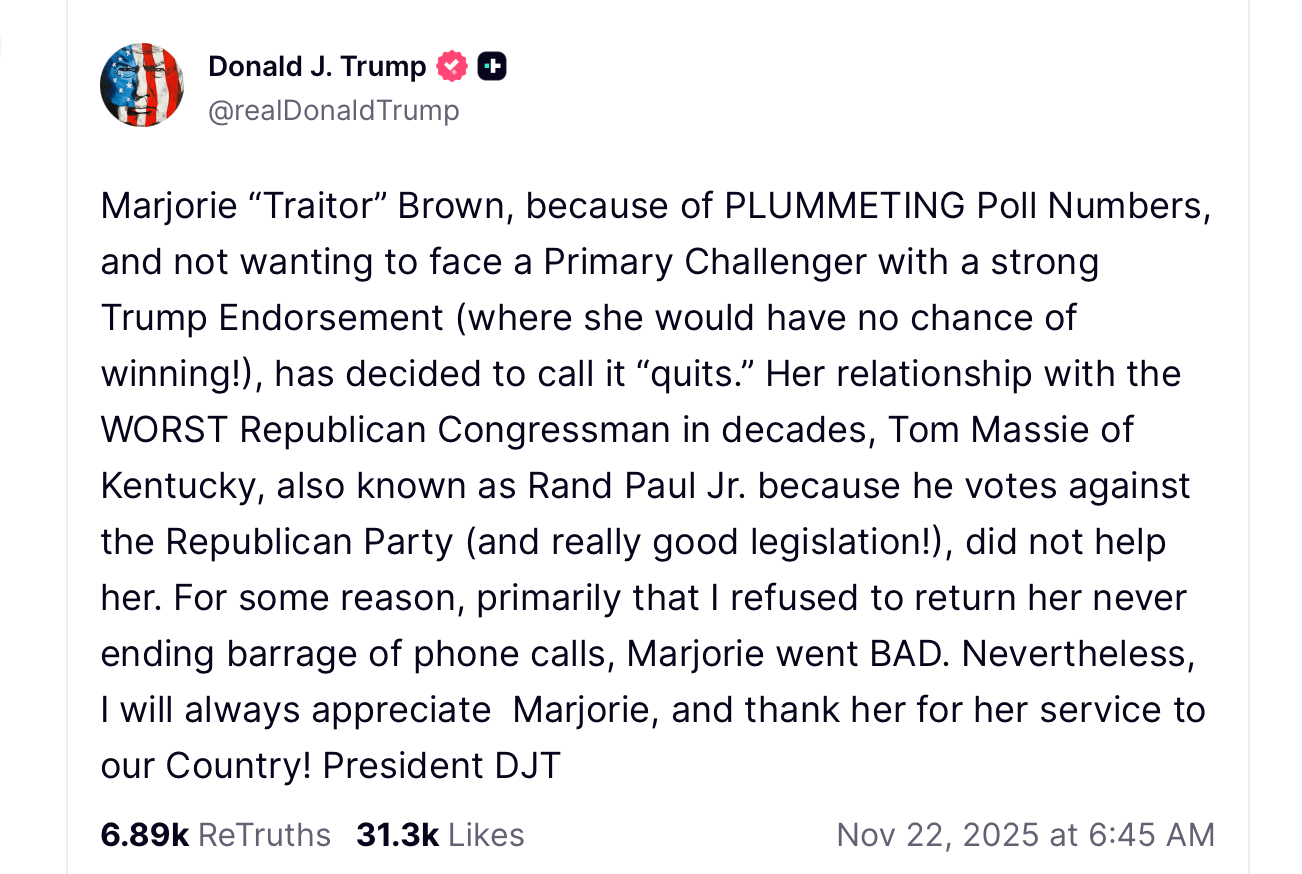

But the pressure isn’t only coming from Libertarians themselves. A second fault line is widening inside the Republican Party, driven by increasingly public clashes between President Donald Trump and several libertarian-leaning lawmakers. His disputes with figures like Sen. Rand Paul and Rep. Thomas Massie have broadcast the split between traditional fiscal conservatives and a White House focused on aggressive policy rollouts and political conformity.

The feud intensified over transparency legislation—specifically a bipartisan bill seeking the release of remaining Jeffrey Epstein files—which prompted the President to threaten primary challenges against critics and brand them as disloyal. These confrontations have exposed deeper ideological tensions. Lawmakers aligned with libertarian ideals often oppose expansive spending packages and broad foreign policy measures, a pattern that has irritated Republican leadership during a term that demands unified support.

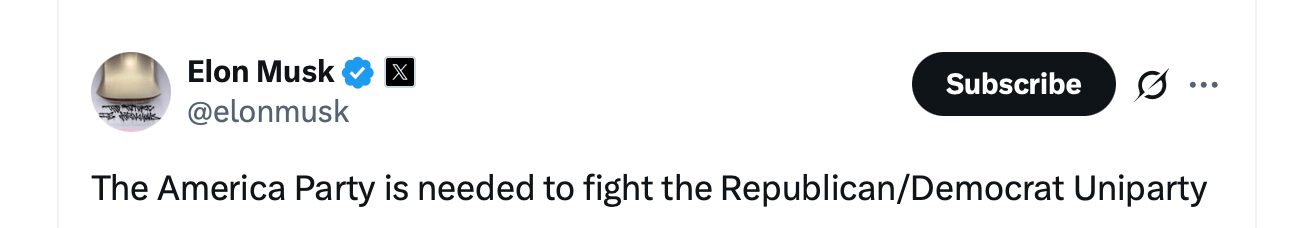

The friction is significant enough that some strategists warn it could push libertarian-minded voters further away from the GOP—either back toward the Libertarian Party or toward a new movement altogether. Enter the third, and perhaps most unpredictable, catalyst: Elon Musk’s dramatic but still-undeveloped “America Party” announcement during a high-profile dispute with the administration.

Musk spent much of early 2025 championing the Department of Government Efficiency (DOGE), only to break from the President over a massive spending bill he called financially reckless. His Independence Day declaration that a new party had been “formed” electrified supporters on X and briefly caught betting markets off guard.

While his party remains more conceptual than operational, Musk’s critique resonated with voters frustrated by mounting federal debt and partisan gridlock. His rhetoric about representing “the 80% in the middle” sharpened broader conversations about whether the U.S. political system still reflects the priorities of moderate and independent voters. Even without official filings or a visible organizational structure, Musk’s wealth and influence keep speculation alive that he could revive the endeavor if political conditions shift.

Yet Musk’s path is not without obstacles. Ballot access alone demands significant financial and logistical commitments, and history has not been kind to third-party efforts—even those with massive name recognition. Internal backlash from Republicans concerned about vote-splitting also prompted Musk to slow his efforts. But the idea continues to linger, especially among voters who feel unrepresented in an increasingly adversarial political climate.

Read more: CME Futures and Betting Markets Align on Fed’s Potential Quarter-Point Cut in December

What ties these three developments together is a sense that the traditional political structure is straining to contain competing ideological factions. Libertarians frustrated with brand identity struggles, conservatives at odds with party leadership, and centrists searching for fiscal restraint all find themselves orbiting the same question:

Is the current two-party system capable of evolving, or is something entirely new required?

The Libertarian Party’s internal debates show a desire to adapt before irrelevance becomes permanent. Congressional conflicts illustrate how ideological diversity inside the GOP may lead some voters—and lawmakers—to reconsider their political homes. Musk’s aborted attempt highlights how quickly a credible third-party conversation can dominate national attention, even without institutional backing.

Combined, these forces signal that the appetite for an alternative is growing. Polls consistently show more than 60% of Americans believe a third party is needed—an attitude that is gaining traction as political conflicts intensify. Whether that results in a rebranded Libertarian movement, a splinter faction breaking from major parties, or a fully new organization depends on how these pressures continue to develop over the next election cycle.

But one thing is clear: The political landscape heading into 2026 is far more fluid than it has been in years. Voters no longer assume the existing parties will adapt to meet their priorities. Increasingly, they’re wondering whether the next era of American politics will require building something entirely new.

FAQ ❓

- Why do people expect a possible new party in the U.S.?

Rising voter dissatisfaction, internal party clashes and high-profile reform movements are driving speculation about a new political party. - How does the Libertarian Party factor into these discussions?

The Libertarian Party is weighing a major rebrand that could broaden its appeal and reshape its national presence. - What role does congressional tension play in this trend?

Public conflicts between the President and libertarian-leaning lawmakers highlight internal fractures that may push voters toward alternatives. - Is the America Party from Elon Musk still active?

The idea remains dormant but influential, keeping open the possibility of a future revival if political conditions favor it.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: SEC Approves Altcoin ETFs, Boosting Institutional Investment in Cryptocurrency

- SEC approves multiple XRP/DOGE ETFs from 21Shares, Franklin Templeton, and Grayscale, signaling growing institutional acceptance of altcoins. - 21Shares' TOXR ETF gains automatic approval via CME CF XRP-Dollar tracking, with Coinbase and BNY Mellon handling custody/admin functions. - Franklin Templeton's XRP Trust removes restrictive clauses to accelerate listing, offering regulated exposure without custody risks from ledger forks. - Grayscale expands crypto offerings with XRP/DOGE ETFs on NYSE, joining

Germany's Solar Turning Point: Spotlight on Legislation, Infrastructure, and Ideological Differences

- Germany's SolarPlus Forum 2025 emphasized legislative clarity, funding innovation, and cross-sector collaboration to accelerate solar adoption amid evolving energy policies. - Outdated regulations and permitting hurdles were highlighted as barriers, with calls to align Bundestag reforms with market demands like gas surcharge removal by 2026. - Cement industry growth (5.7% CAGR) and green innovations support infrastructure needs, though energy cost volatility and compliance challenges persist. - Internati

Polkadot Latest Updates: ECB Raises Concerns: Cryptocurrency and Stock Market Downturns Resemble Dot-Com Bubble Threats

- ECB warns U.S. equity/crypto corrections threaten stability, urging central banks to retain rate-cut flexibility amid market volatility. - JPMorgan links crypto ETF outflows to retail investor behavior, noting $4B November sales contrast with $96B equity ETF inflows. - U.S. Treasury downplays recession risks, citing 2026 growth optimism despite shutdown impacts and services-driven inflation. - MSCI highlights tech valuation risks akin to dot-com era, while DeFi faces $12B liquidity crisis with 95% capita

Novartis Increases 2030 Growth Projections Despite Analysts' Concerns About Patent Threats

- Novartis raised 2030 sales growth targets to 5-6% annually, driven by high peak sales expectations for oncology drugs Kisqali and Scemblix. - CEO Vas Narasimhan highlighted eight de-risked drugs with $3-10B peak potential, but analysts warned of patent expirations and uncertain pipeline progress beyond 2030. - Shares rose 0.5% post-announcement, while Exact Sciences surged 17% on its $105/share acquisition by Abbott and Samsung Biologics saw a 71% valuation re-rating after spin-off. - J.P. Morgan caution