Dogecoin Is Overvalued, But Monday Could Flip the Script

Dogecoin has been sliding over the past several days as bearish sentiment spreads across the broader crypto market. Despite the decline, the meme coin is currently overvalued due to heightened speculation surrounding the upcoming launch of Grayscale’s Dogecoin ETF (GDOG). This hype may translate into substantial transaction volume on Monday, potentially reshaping DOGE’s short-term outlook.

Dogecoin has been sliding over the past several days as bearish sentiment spreads across the broader crypto market. Despite the decline, the meme coin is currently overvalued due to heightened speculation surrounding the upcoming launch of Grayscale’s Dogecoin ETF (GDOG).

This hype may translate into substantial transaction volume on Monday, potentially reshaping DOGE’s short-term outlook.

Dogecoin Investors Provide Support

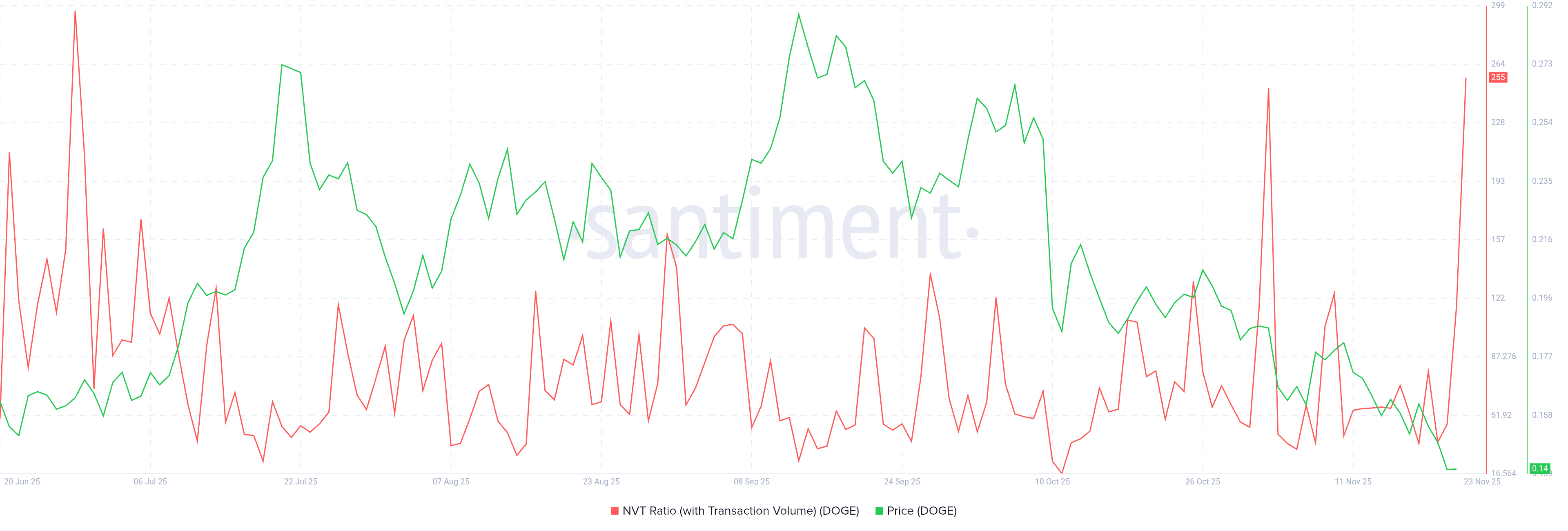

Dogecoin’s NVT Ratio is spiking sharply, signaling a disconnect between valuation and on-chain activity.

The ratio compares market capitalization with transaction volume, and a surge typically indicates limited transactional utility relative to price. While DOGE is attracting strong social attention and broad support, its actual transaction levels are not keeping pace.

This mismatch can often lead to overvaluation, which in bearish conditions may trigger a drop.

However, the timing of this spike aligns with the anticipated launch of Grayscale’s Dogecoin ETF. The ETF is expected to draw notable capital inflows, which could reset the NVT Ratio and restore balance between price and on-chain activity.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Dogecoin NVT Ratio:

Santiment

Dogecoin NVT Ratio:

Santiment

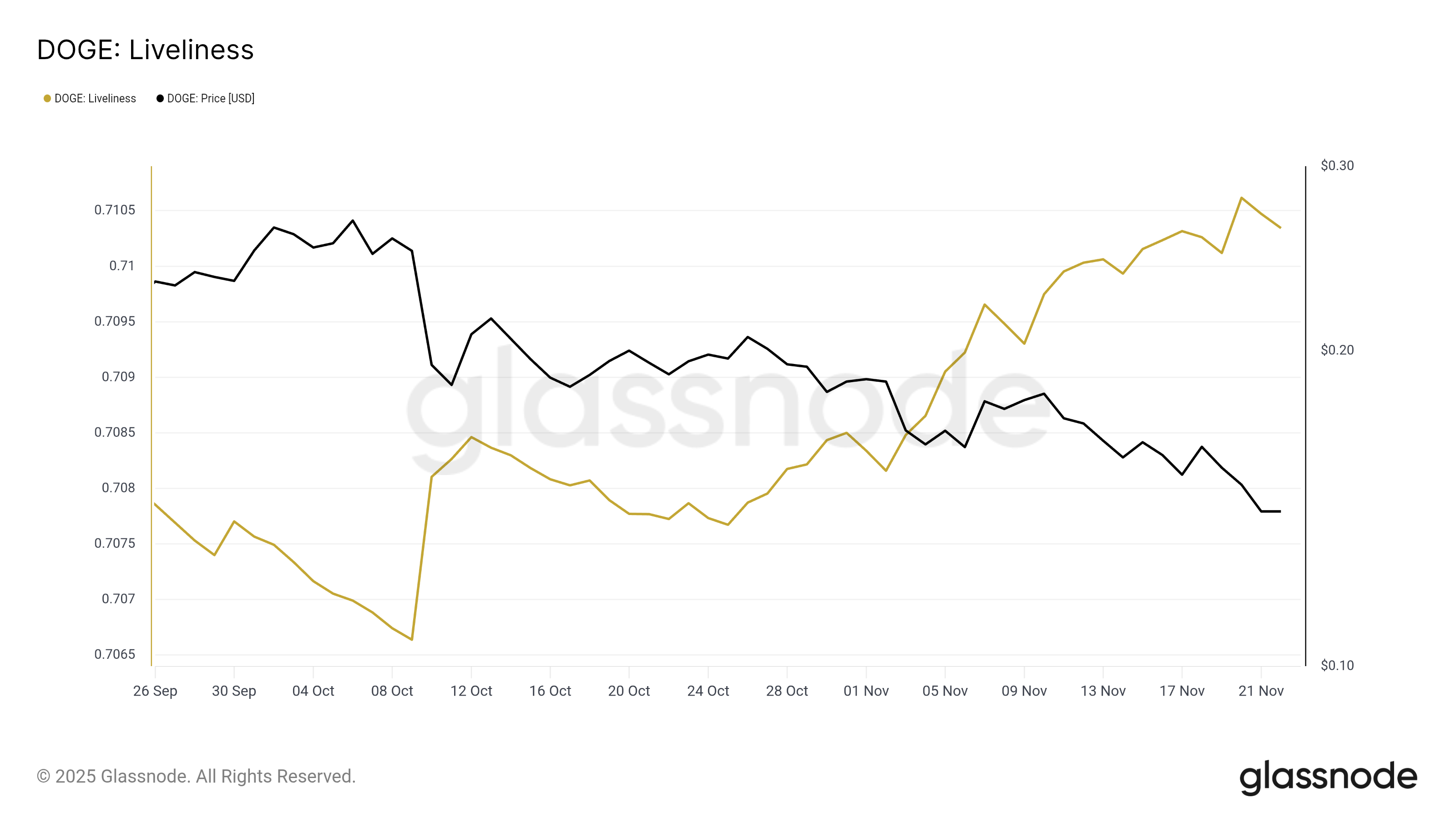

Macro indicators also paint an encouraging picture. Dogecoin’s Liveliness metric has been rising for several days, indicating increased HODLing behavior among long-term holders.

Liveliness rises when coins remain dormant for longer periods rather than being spent, suggesting that key holders are protecting their positions.

This trend is particularly important during downturns. Long-term holders often act as the backbone of price stability, resisting volatility caused by short-term traders.

Their continued conviction reduces the risk of abrupt sell-offs and shows confidence in Dogecoin’s ability to recover once market conditions shift.

Dogecoin Liveliness. Source:

Glassnode

Dogecoin Liveliness. Source:

Glassnode

DOGE Price Could Shoot Up

Dogecoin is trading at $0.143 and holding near the $0.142 support level. The meme coin remains trapped under a month-long downtrend that it has repeatedly failed to break. Current bearish conditions make recovery difficult without a significant catalyst.

The launch of the DOGE ETF could provide that catalyst. A successful debut may lift DOGE above $0.151, opening the path toward $0.165. A move of this scale would invalidate the downtrend and signal a shift in momentum supported by new inflows.

DOGE Price Analysis. Source:

TradingView

DOGE Price Analysis. Source:

TradingView

If the ETF hype fails to translate into buying pressure, Dogecoin could extend its decline. A drop toward $0.130 remains possible.

But if DOGE does not face a drop this sharp, it may continue struggling beneath the $0.151 resistance, prolonging the ongoing downtrend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: "ETFs Drive Crypto's Turbulent Path: Will XRP and Bitcoin Conquer Market Fluctuations?"

- XRP and Bitcoin face volatility amid ETF launches, regulatory shifts, and macroeconomic pressures, with XRP dropping 8.72% to $1.91 on November 20. - XRP ETFs like Canary Capital’s $245M net inflow product and Bitwise’s upcoming offerings signal growing institutional interest despite structural challenges like concentrated supply. - SEC-approved Bitcoin ETFs and the GENIUS Act’s regulatory clarity boost crypto adoption, while BlackRock’s IBIT saw $60.61M inflows after a five-day outflow streak. - Technic

Ethereum News Today: Ethereum Faces a Pivotal Moment: Will the Rise of Altcoin ETFs Ignite a Bullish Recovery?

- Ethereum faces critical support at $2,873, with RSI near oversold levels signaling potential deeper correction or trend reversal above $3,554 EMA. - Altcoin ETFs (XRP, SOL) attract $500M inflows vs. $4.2B outflows from BTC/ETH ETFs, reflecting shifting institutional/retail capital allocation. - Coinbase's $1M ETH-backed USDC loans and $73.6B Q3 DeFi credit volume highlight Ethereum's role in onchain liquidity solutions. - Arbitrum challenges Ethereum's RISC-V proposal, advocating WebAssembly for smart co

Dogecoin News Today: Institutional ETF Adoption Signals Dogecoin's Transition from Meme Status to Mainstream Acceptance

- Dogecoin's 40/30/30 temperature metric crossed a critical threshold, signaling potential market dynamics shifts after months of stagnation. - The first U.S. leveraged Dogecoin ETF (TXXD) launched by 21Shares marks institutional adoption, enhancing liquidity and mainstream credibility. - Historical patterns show temperature spikes precede bull markets, though current macroeconomic uncertainty complicates trend interpretation. - Analysts view the composite metric as a systemic shift indicator, not a direct

Bitcoin News Update: Bitcoin ETFs See $3.55B Outflow Amid Death Cross and Waning Rate Optimism Trigger Sell-Off

- U.S. spot Bitcoin ETFs lost $3.55B in November 2025, with BlackRock's IBIT accounting for 63% of outflows amid crypto market declines. - Bitcoin's drop below $90,000 triggered stop-loss orders and leveraged liquidations, with $903M in single-day outflows on Nov. 14. - Analysts cite bearish technical signals, fading Fed rate-cut hopes, and a fourth "death cross" as key drivers of institutional selling pressure. - Ethereum ETPs lost $74.2M while Solana ETFs gained $26.2M, reflecting divergent crypto asset