Grayscale’s Dogecoin and XRP ETFs Set for NYSE Debut on November 24

Grayscale's new Dogecoin and XRP ETFs debut comes as the SEC, under Chairman Paul Atkins, shifts toward faster, disclosure-focused reviews of digital asset products.

Grayscale will introduce new exchange-traded fund products tied to Dogecoin and XRP on Nov. 24 after securing approval to list both vehicles on the New York Stock Exchange.

The Grayscale Dogecoin Trust ETF (GDOG) and the Grayscale XRP Trust ETF (GXRP) will debut as spot ETPs holding their respective underlying tokens.

Grayscale Expands ETF Lineup With Dogecoin and XRP

The firm is converting its existing private trusts into fully listed ETFs, a move that represents a major liquidity event for current investors.

GXRP will enter a market that already includes spot products from Canary Capital and Bitwise.

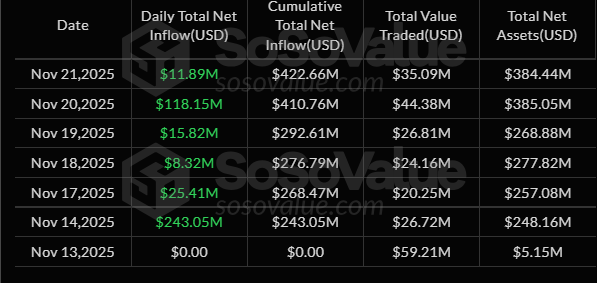

Those funds have drawn about $422 million in combined inflows during their first two weeks of trading, signaling early institutional interest in XRP-linked products.

XRP ETFs Daily Inflow Since Launch. Source:

SoSoValue

XRP ETFs Daily Inflow Since Launch. Source:

SoSoValue

On the other hand, GDOG will be one of the first Dogecoin ETF available to US investors.

Dogecoin, once a meme token, has grown into the ninth-largest cryptocurrency by market capitalization. Its deep retail following has made it one of the most frequently traded and discussed digital assets, a trend Grayscale expects will support ETF demand.

Considering this, Bloomberg Intelligence analyst Eric Balchunas said the product could attract as much as $11 million in volume on its first trading day.

Grayscale Dogecoin ETF $GDOG approved for listing on NYSE, scheduled to begin trading Monday. Their XRP spot is also launching on Monday. $GLNK coming soon as well, week after I think

— Eric Balchunas (@EricBalchunas) November 21, 2025

GDOG and GXRP’s launch broadens the mix of crypto ETFs available in the US market, extending the industry’s expansion beyond Bitcoin and Ethereum products that dominated the initial wave of approvals.

Their arrival also reflects shifting regulatory conditions in Washington.

Both approvals are part of a broader acceleration in digital asset oversight under Securities and Exchange Commission (SEC) Chairman Paul Atkins.

Since taking office, Atkins has moved the agency away from a “regulation by enforcement” approach and toward a disclosure-focused framework.

Through his “Project Crypto” initiative, he has signaled that the SEC is open to reviewing compliant digital asset products, clearing the path for issuers seeking to list new ETFs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fed's Potential December Rate Reduction Depends on Inflation and Labor Market Dynamics

- The Fed enters a blackout period before its December meeting, with markets expecting a rate cut despite internal divisions over inflation and labor market signals. - Meeting minutes revealed a "strong split" among policymakers, with some favoring easing due to cooling labor markets and modest policy tightness, while others caution against premature action. - New York Fed President John Williams' remarks on "room for further adjustment" boosted market bets for a December cut, though Morgan Stanley revised

Zcash (ZEC) Price Rally: Is a Revival of Privacy Coins Possible in 2025?

- Zcash (ZEC) surged 472% to $420 in 2025, driven by regulatory clarity and institutional adoption under U.S. Clarity/Genius Acts. - Grayscale's $137M ZCSH investment and 30% Q4 shielded supply growth highlight Zcash's privacy-flexibility appeal over Monero. - Electric Coin Co.'s Orchard protocol and Winklevoss's 1.25% ZEC acquisition reinforce Zcash's position as top privacy coin ($7B market cap). - Critics warn of Bitcoin competition risks and hype claims, while Zcash's sustainability hinges on balancing

DASH Experiences Rapid Growth: Uncovering the Forces Behind Its Rise

- DASH's 2025 price surged 150% YTD driven by 35% active address growth and 50% transaction volume increase. - Aster DEX integration boosted TVL to $1.4B and daily volumes over $27.7B via hybrid AMM-CEX model. - Institutional adoption and emerging market demand for privacy features (77% transaction obfuscation) fueled momentum. - ASTER token's 1,650% surge and DeFi partnerships highlight DASH's role in bridging liquidity fragmentation.

SolarPlus Forum 2025 Review: A Clear Look at Germany’s Evolving Solar Landscape