Derivatives Market Heats Up Again in the Last Week of November – What Does It Mean?

Binance futures trading volume has seen a massive increase across major assets. Meanwhile, Deribit options data indicate that traders are adopting protective strategies, notably through heavy put purchases and large-scale call selling by entities. Together, this suggests that the market is entering a high-volatility phase, where the next move is likely to be large, and

Binance futures trading volume has seen a massive increase across major assets. Meanwhile, Deribit options data indicate that traders are adopting protective strategies, notably through heavy put purchases and large-scale call selling by entities.

Together, this suggests that the market is entering a high-volatility phase, where the next move is likely to be large, and options traders are leaning defensively.

Crypto Derivatives Traders Position for Big Move With Futures and Puts Activity

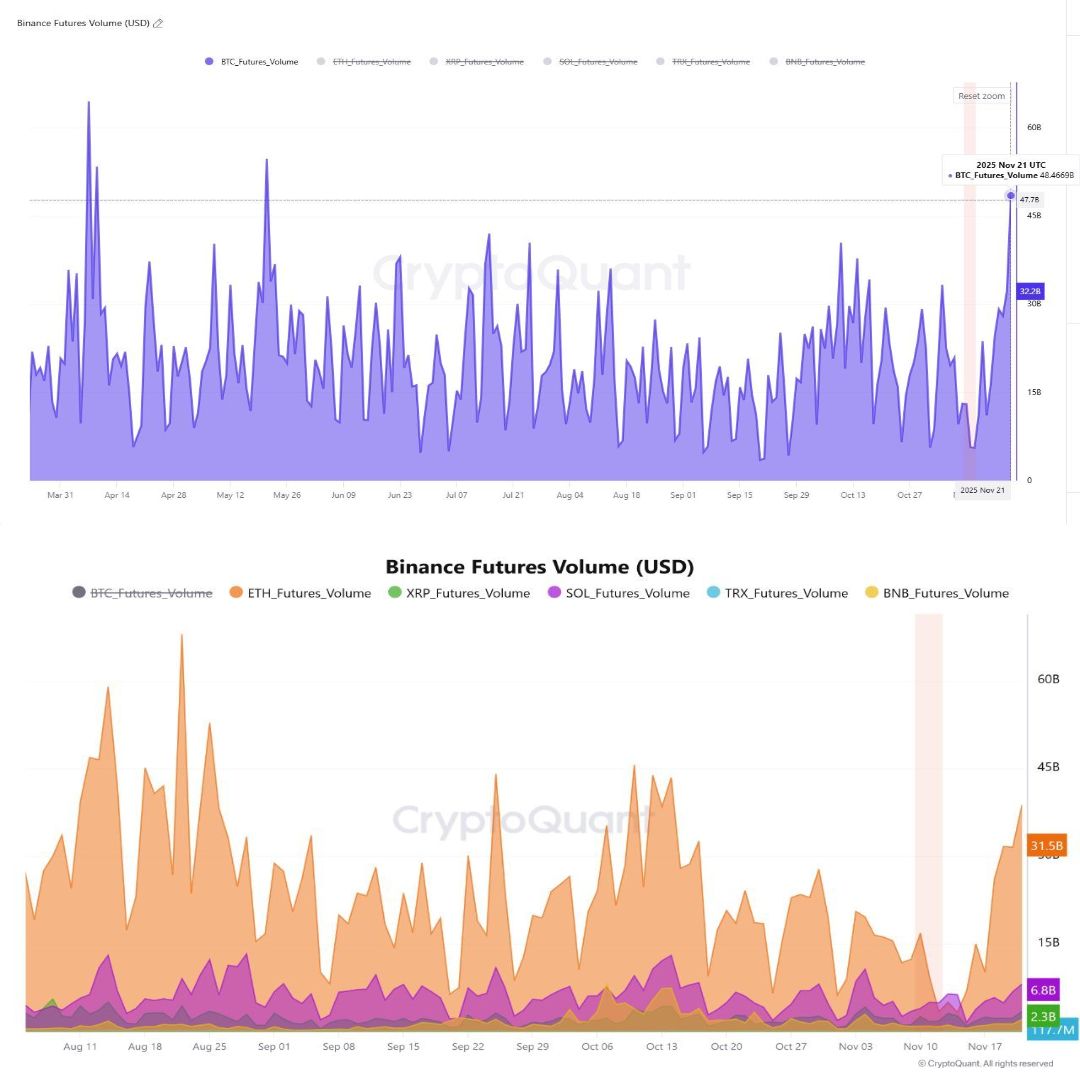

The cryptocurrency derivatives market witnessed a notable shift in late November. Futures trading volume surged across all major assets on Binance, the world’s leading cryptocurrency exchange by trading volume.

On Sunday, Bitcoin futures reached a trading volume of $48.4 billion, one of the largest spikes in recent months. Ethereum (ETH), Solana (SOL), XRP (XRP), TRON (TRX), and BNB (BNB) futures also saw concurrent jumps, suggesting coordinated positioning rather than isolated speculation.

“When futures wake up like this, it usually means traders are positioning for a much larger move – not grinding sideways. Both hedgers and momentum traders are re-entering with size, and Binance is once again where the liquidity rush is happening. The quiet phase is over. Volatility is back on the table,” an analyst wrote.

Crypto Futures Volume. Source:

X/CryptosR_Us

Crypto Futures Volume. Source:

X/CryptosR_Us

Parallel to the futures activity, the Bitcoin options market is undergoing a noticeable shift. According to Deribit, options flows have “front-run the market moves” in recent weeks, with a strong tilt toward downside protection.

A key development is the sudden disappearance of a large call-selling entity widely known as the Call Overwriting Fund (OF). Throughout the summer and into October, this entity consistently sold Bitcoin call options, a strategy typically used by funds and miners to generate yield against long spot holdings. Their absence has removed a major source of volatility suppression, contributing to rising implied volatility.

At the same time, put buying has intensified significantly since Bitcoin traded above $110,000. Traders have been accumulating downside protection in the $102,000 to $90,000 range, rolling their hedges lower as spot prices weakened.

At one point, more than $2 billion in open interest was concentrated in the $85,000 to $95,000 strike zone. Recent volumes show continued activity down to the $82,000 and $80,000 levels, with some speculative positioning in far-out-of-the-money strikes as low as $60,000 to $20,000.

This pattern reflects growing caution among funds seeking to protect assets under management amid rising volatility. The combination of reduced call supply, heavy put demand, and higher realized volatility has pushed put skew sharply higher, with 1-month 15-delta puts pricing roughly 20% richer than equivalent calls.

The simultaneous reawakening of both derivatives markets tells a compelling story. Futures traders are quickly deploying capital and pushing volumes to new highs, while options participants are implementing hedging tactics. This signals that the market is bracing for a major event rather than settling into a trend.

Cryptocurrency analyst The Flow Horse recently emphasized how crypto options markets differ from those in traditional finance. The analyst noted that crypto options tend to be led by sophisticated players, making flow analysis especially useful in forecasting market direction.

“One of the reasons I keep telling people to pay attention to the options market is because the flow is often ahead of the spot tape. My theory has been that in crypto, the options market is not crowded with retail the way it is in tradfi, and that it acts more as a filter for the more sophisticated participants,” the analyst said.

This perspective is especially relevant now. If options markets reflect the moves of sophisticated capital, strong put protection suggests these investors remain cautious. Combined with elevated futures activity, the derivatives market is primed for an expansion in volatility.

Whether this volatility expansion resolves to the upside or accelerates the existing correction remains uncertain. Nevertheless, market participants broadly agree: the calm phase has ended, and crypto’s next major chapter is about to begin.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Abercrombie's Resurgence Fueled by Nostalgia: Surpassing Sales Expectations and Leaving Doubters Behind?

- Abercrombie & Fitch's Q2 2025 $1.2B sales and $2.32 EPS exceeded forecasts, driven by customer-centric strategies and a Taco Bell collaboration. - Analysts show mixed reactions: BTIG lowers price target to $118 while maintaining "Buy," JPMorgan downgrades to "neutral" over growth concerns. - The Hollister x Taco Bell capsule collection (11 styles) targets Gen Z with "future vintage" nostalgia, aligning with CEO Fran Horowitz's retail expertise expansion. - Despite 6.6% YoY revenue growth and consistent e

ECB Raises Concerns Over Systemic Threats While Canada Develops Stablecoin Rules

- Canada's 2025 budget introduces stablecoin regulations requiring reserves, redemption policies, and risk frameworks, overseen by the Bank of Canada with $10M allocated for implementation. - ECB warns $280B stablecoin market risks destabilizing finance by draining bank deposits, triggering reserve asset fire sales, and threatening U.S. Treasury markets during "runs." - Industry advocates like Coinbase argue reserve-backed stablecoins enhance stability, while firms like Republic Technologies invest $100M i

Ethereum Updates Today: Institutional Interest in Ethereum Rises Despite Negative Technical Indicators

- Ethereum faces conflicting short-term volatility and long-term institutional adoption growth, with $7.4B real-world assets tokenized and major banks expanding Ethereum-based frameworks. - Upcoming Dencun upgrade (2026) aims to boost scalability via EIP-4844, but governance risks persist as 10.4% of ETH is controlled by nine firms, warns co-founder Vitalik Buterin. - Bearish technical indicators show ETH below key moving averages, with $2,850 support level critical; quantum computing threats could break E

The Federal Reserve's Change in Policy and Its Impact on Solana and the Wider Cryptocurrency Market

- Fed's 2025 rate cut and QT end boosted risk assets, with Solana ETFs seeing $37.33M inflows amid Bitcoin outflows. - Solana's DEX volume surpassed $1T, driven by institutional confidence post-Coinbase acquisition. - Policy uncertainty caused short-term Solana price dips, but growing institutional interest highlights its macro-hedging appeal. - Anticipated 2026 QE could further boost Solana's ecosystem as liquidity expands and fiscal flows increase.