Cardano News Today: Blockchain Dispute: Should Those Responsible for Chain Splits Face Legal Action or Should Open-Source Creativity Be Safeguarded?

- Solana co-founder Anatoly Yakovenko praised Cardano's swift recovery from a November 2025 chain split, calling its resilience "pretty cool" despite a malicious transaction exploiting a deserialization bug. - Cardano's Ouroboros consensus model enabled rapid convergence without hard forks, preserving transaction throughput and avoiding fund losses through emergency node upgrades. - A public debate emerged between Yakovenko and Cardano founder Charles Hoskinson over legal accountability, with Hoskinson adv

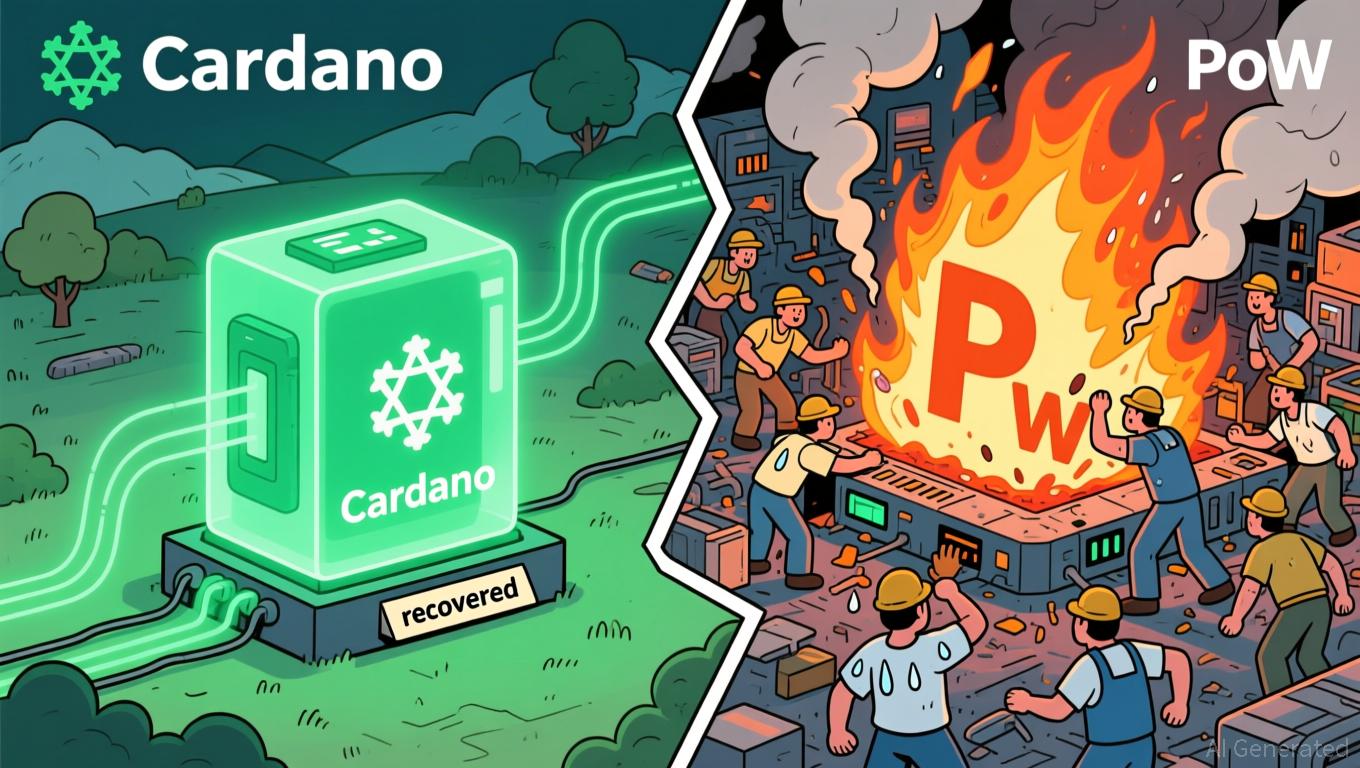

Cardano's network architecture has received public recognition from Solana Co-Founder Anatoly Yakovenko, who applauded its robust design after the blockchain quickly bounced back from a recent chain split. Yakovenko described the blockchain's durability as "pretty cool" and pointed out the complexities involved in developing a Nakamoto-style consensus protocol without relying on proof-of-work.

The chain split also ignited a public discussion between Hoskinson and Yakovenko about whether the event should be handled as a criminal case. Hoskinson maintained that the attack—carried out by a dissatisfied stake pool operator (SPO) who exploited testnet weaknesses—deserved legal consequences, claiming it inflicted "catastrophic harm" on the ecosystem

Cardano's effective management of the situation has strengthened its standing as a resilient PoS blockchain. Observers pointed out that the fork demonstrated the network's capacity to self-heal without stopping operations, which is rare in the cryptocurrency sector

Yakovenko's commendation reflects increasing mutual respect among blockchain leaders, but the incident also underscores persistent challenges in protecting PoS networks from targeted attacks. The ongoing debate about legal responsibility raises important questions about how to balance network resilience with regulatory measures in decentralized systems

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Visa Executives' Share Dealings: Standard Financial Actions, Not Indicators for the Market

- Visa executives conducted routine stock transactions in late 2025, exercising shares to cover tax liabilities and surrendering portions to offset costs. - Senior officers including CFO Chris Suh and Tullier Kelly Mahon executed trades under prearranged plans, aligning with standard insider financial management practices. - Analysts emphasize these moves reflect personal financial strategies rather than market signals, though transparency remains critical amid regulatory scrutiny of executive compensation

Dogecoin News Update: Chainsaw Ambitions Halted: DOGE Ends Operations Eight Months Ahead of Schedule

- Trump's DOGE agency, led by Musk, disbanded eight months early, failing to cut $2 trillion in spending. - Critics accused it of overreaching, while OPM absorbed its functions and former members transitioned to new roles. - Mixed reactions persist, with states creating local equivalents and questions about long-term impact.

Revolut Achieves $75 Billion Valuation, Overtaking Major Traditional Banks

- Revolut's $75B valuation surge reflects a $30B increase since 2024, driven by a funding round led by top-tier investors including Fidelity and Dragoneer. - The fintech reported $1.4B pre-tax profit growth and plans $13B in investments to expand to 100 million customers across 30 new markets by 2027. - CEO Nik Storonsky aims to secure UK banking licenses while pursuing global expansion in Mexico, Colombia, and India with regulatory approvals already secured. - Analysts highlight crypto trading and interes

Dogecoin News Today: Traditional Financial Sector Welcomes Crypto with the Introduction of Grayscale's GDOG and GXRP ETFs

- Grayscale's GDOG and GXRP ETFs launched on NYSE Arca on November 24, 2025, marking crypto's mainstream financial integration. - The ETFs convert private trusts into tradable products, enabling institutional access to Dogecoin and XRP without digital wallets. - Derivatives volumes for DOGE and XRP surged pre-launch, while XRPC and SOL ETFs show growing demand for regulated crypto exposure. - Divergent regulatory approaches emerge: GDOG holds physical Dogecoin via Coinbase , contrasting derivative-based mo