A 300% Spike in Selling Pressure Could Threaten the Ethereum Price Bounce

Ethereum price bounced almost 10% from this week’s lows near $2,600, and the price is up about 1% today. The move looks positive, but the recovery may not last. Two major bearish signals have emerged simultaneously. Together, they threaten to end the bounce before it grows. Holder Selling Surges 300% as a Death Cross Forms

Ethereum price bounced almost 10% from this week’s lows near $2,600, and the price is up about 1% today. The move looks positive, but the recovery may not last.

Two major bearish signals have emerged simultaneously. Together, they threaten to end the bounce before it grows.

Holder Selling Surges 300% as a Death Cross Forms

Two connected signals now point to deeper weakness.

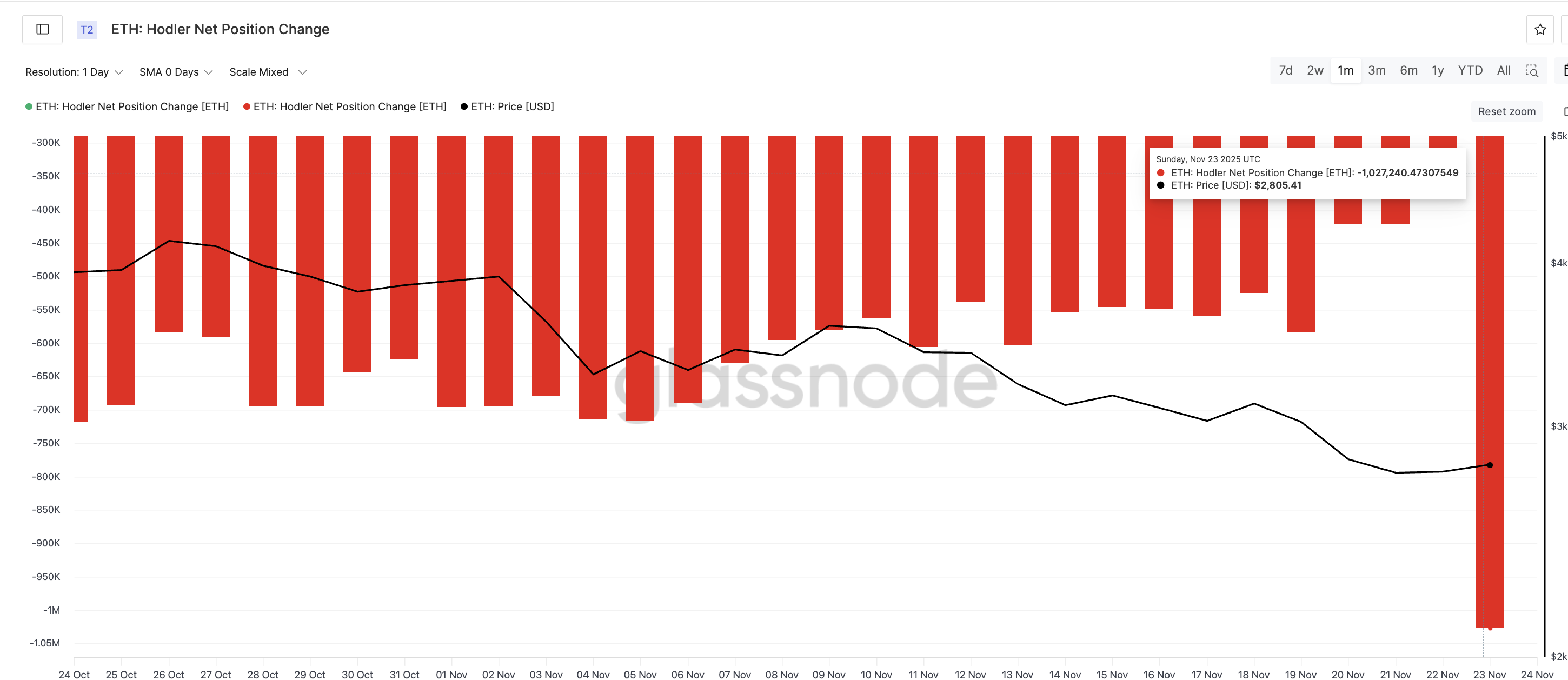

The first comes from long-term investors, often called hodlers. These are wallets that usually hold ETH for more than 155 days. When hodlers increase their selling, it usually shows fear or a shift in long-term belief.

On November 22, net selling from these wallets was about 334,600 ETH. On November 23, it jumped to 1,027,240 ETH — a 300% spike in one day. This is a major exit from long-term holders and adds heavy supply at a time when ETH already trades in a broader downtrend.

ETH Sellers Have The Upper Hand:

Glassnode

ETH Sellers Have The Upper Hand:

Glassnode

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

At the same time, a death cross has almost formed. A death cross appears when the 50-day exponential moving average (EMA) drops under the 200-day EMA. An EMA gives more weight to recent prices, so it reacts faster than a simple moving average.

When the 50-day EMA crosses below the 200-day, it signals strong downward momentum. That could hit the ETH prices significantly if the selling pressure continues to rise.

Bearish Risks Build:

TradingView

Bearish Risks Build:

TradingView

Here is the key connection:

Hodler selling is rising sharply at the exact moment the EMA structure is turning bearish. That means the selling pressure is reinforcing the death-cross signal instead of slowing it down. When these two appear together, recoveries usually fail and prices retest lower supports.

Ethereum Price Action: Downside Risk Still Outweighs the Bounce

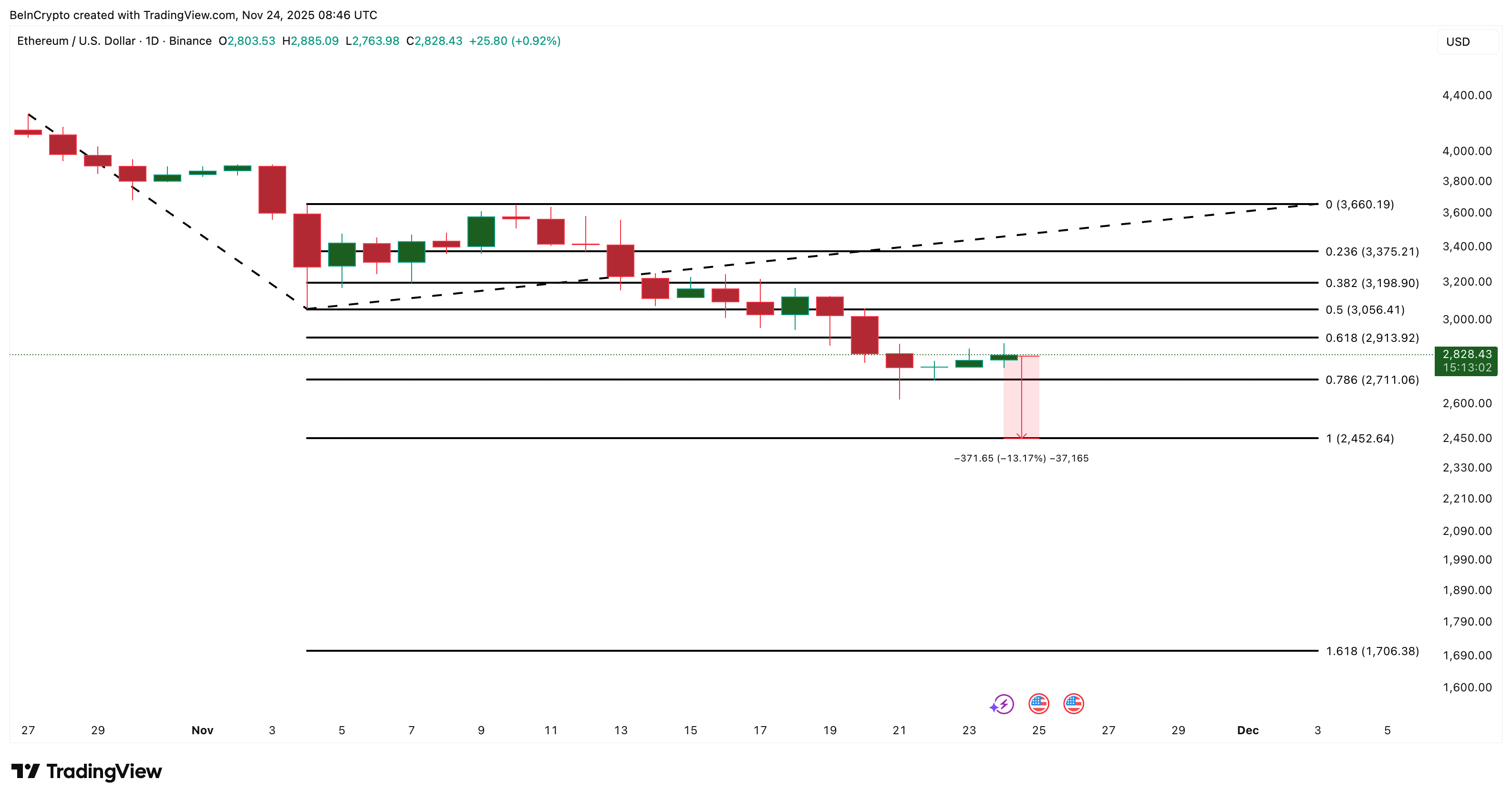

Ethereum now trades near $2,820, but the chart shows more pressure above than support below.

The first level ETH must defend is $2,710, the 0.786 Fibonacci zone. Losing this level opens a drop toward $2,450, which marks roughly a 13% downside from current levels. If the death cross completes while hodler selling continues, ETH can fall directly toward this level and even under it if the market conditions weaken.

Ethereum Price Analysis:

TradingView

Ethereum Price Analysis:

TradingView

Below $2,452, the next deeper support sits near $1,700 — the broader extension from the descending structure. This only activates if the trend accelerates and sellers remain dominant.

Upside remains limited unless the ETH price can reclaim:

- $3,190, the first meaningful resistance

- $3,660, the stronger ceiling that signals an early trend shift

Under current conditions, hitting these levels looks difficult because both bearish signals — the surge in hodler selling and the death-cross setup — remain active.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Update: Institutional Embrace of Ethereum Solidifies Its Position as a Pillar of the Global Financial System

- U.S. banks now legally hold Ethereum (ETH) under the GENIUS Act, accelerating institutional adoption of the second-largest cryptocurrency. - BitMine Immersion (BMNR), holding 3.63M ETH, plans 2026 staking via MAVAN, boosting Ethereum's utility in stablecoin and asset security. - Tether's $10B 2025 profits and $4.6B Q3 crypto VC rebound highlight growing institutional confidence in digital assets and ETPs. - TrustLinq and Ourbit's compliance innovations, aligned with Trump-era crypto policies, address AML

Innovation and Regulation Converge: Canada Introduces QCAD Stablecoin

- Canada approves QCAD as its first regulated CAD-backed stablecoin, issued by Stablecorp's QCAD Digital Trust. - The 1:1 peg to the Canadian dollar is secured through reserves at regulated institutions, ensuring transparency and stability. - Backed by Circle and Coinbase , QCAD aims to bridge traditional finance and digital economy via instant, low-cost transactions. - The approval sets a regulatory precedent, supporting Canada's global leadership in crypto innovation while enhancing consumer trust.

Evaluating the Sustainable Value Growth and Investor Motivations within TWT's Updated Tokenomics Framework

- TWT's 2025 rebrand to TON shifts tokenomics toward gamified utility, institutional alignment, and real-world adoption. - Supply management combines daily issuance (88,137 TON) with burns and strategic staking (217.5M tokens) to balance inflation and scarcity. - Gamified Trust Premium tiers and cross-chain FlexGas expansion enhance user engagement while institutional partnerships boost liquidity and infrastructure integration. - TON Strategy Company's $84.7M Q3 profit and PoS rewards demonstrate instituti

Bitcoin Updates: MetaPlanet Secures $130M Loan Using Bitcoin as Collateral to Increase Holdings Amid Market Downturn

- MetaPlanet secured a $130M loan backed by 30,823 BTC to expand Bitcoin holdings and repurchase shares, targeting 210,000 BTC by 2027. - The firm shifted to preferred stock financing to reduce shareholder dilution, mirroring MicroStrategy's strategy while leveraging a $500M credit facility. - Despite Bitcoin's 23% unrealized loss, MetaPlanet remains bullish, buying BTC at $108k amid Japan's $273B stimulus-driven market selloff. - Japan's regulatory developments and SoftBank's crypto investments highlight