JPMorgan Closed His Accounts, But You Don’t Throw Out a Bitcoin CEO by Accident

Strike CEO and Twenty One Capital co-founder Jack Mallers says JPMorgan Chase abruptly shut down his personal bank accounts and refused to explain why. The move has sparked new concerns over the “debanking” of crypto executives at a time when Wall Street banks are facing mounting pressure over their relationships with digital-asset firms. Mallers Says

Strike CEO and Twenty One Capital co-founder Jack Mallers says JPMorgan Chase abruptly shut down his personal bank accounts and refused to explain why.

The move has sparked new concerns over the “debanking” of crypto executives at a time when Wall Street banks are facing mounting pressure over their relationships with digital-asset firms.

Mallers Says JPMorgan Gave No Reason: “We Aren’t Allowed to Tell You”

In a series of posts on X (Twitter), Mallers revealed that Last month, JPMorgan Chase threw him out of the bank, citing a bizarre incident that disregarded his family’s three-decade-long relationship with the bank.

Allegedly, each time he asked for an explanation, the bank reportedly repeated the same line: “We aren’t allowed to tell you.”

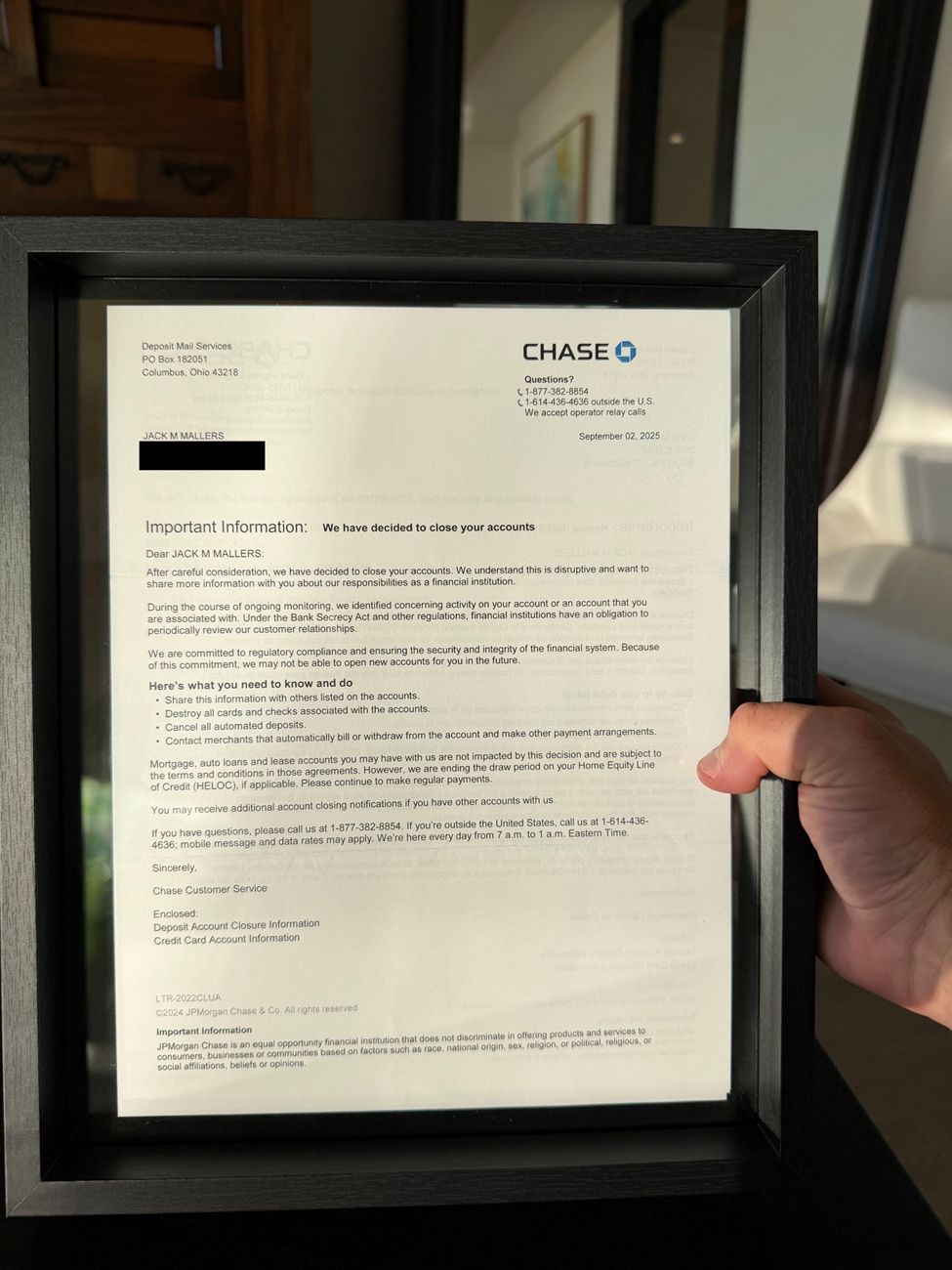

Mallers also shared an image of a letter he claims came from JPMorgan, stating that the bank had identified “concerning activity” and warning that it may not open new accounts for him in the future.

Alleged letter from JPMorgan to Jack Mallers. Source:

Alleged letter from JPMorgan to Jack Mallers. Source:

The incident has since triggered speculation online, with many users suggesting that “Operation Chokepoint 2.0” may still be active. Notably, this rhetoric suggests that banks are under quiet pressure to sever ties with cryptocurrency businesses.

According to Tether CEO Paolo Ardoino, the move was likely for the best, with Mallers advocating for freedom from centralized entities.

His comments added fuel to the broader debate about whether traditional banks can coexist with Bitcoin-native leaders who view decentralization as a form of resistance, not disruption.

Debanking Flashpoint Comes as JPMorgan Faces MicroStrategy Fallout

The timing of Mallers’ account closure is notable. JPMorgan is currently under scrutiny for its research surrounding a potential MSCI reclassification that could result in MicroStrategy being expelled from major equity indexes.

MSCI is considering a rule that excludes companies whose digital assets comprise more than 50% of total assets, placing MicroStrategy, which holds 649,870 BTC at an average price of $74,430, directly in its crosshairs.

JPMorgan analysts estimate this could trigger $2.8 billion in passive fund outflows tied to MSCI alone, and up to $8.8 billion if other index providers adopt similar criteria.

The backlash intensified following new Senate findings showing JPMorgan under-reported suspicious Jeffrey Epstein transactions for years. Senator Ron Wyden accused the bank of enabling Epstein’s crimes, renewing calls for criminal investigation.

For critics, Mallers’ treatment fits into a pattern of questionable judgment and selective enforcement. It also reflects the reality that when Bitcoin CEOs are pushed out of banks without explanation, the implications extend far beyond a single closed account.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

USDe's total value locked drops by 50% even as onchain activity remains strong, highlighting the vulnerability of DeFi yields

- Ethena's USDe stablecoin TVL fell 50% to $7.6B amid yield compression and unwinding leveraged carry trades, despite rising onchain transaction volume. - The synthetic stablecoin's 5.1% APY now lags Aave's 5.4% USDC borrowing rates, triggering outflows as leverage strategies become unprofitable. - Collapsing 10x leverage loops and maturing perpetual tokens accelerated TVL decline, exposing fragility of yield-bearing stablecoins in risk-off markets. - Chaos Labs recommends lowering Aave V3 stablecoin borro

Klarna's CEO Turns Crypto Skepticism into a Stablecoin Innovation

- Klarna , a Swedish fintech , launches KlarnaUSD, its first stablecoin, after CEO Sebastian Siemiatkowski previously dismissed crypto as impractical. - Pegged to the U.S. dollar, the stablecoin uses Stripe's Open Issuance platform and Tempo blockchain, with a 2026 public launch planned. - Aimed at cutting $120 billion in annual cross-border payment fees, it targets 114 million users and $112 billion in GMV, aligning with a $27 trillion stablecoin market surge. - The move deepens Klarna's partnership with

Bitcoin News Today: Bitcoin’s $13.3B Options Expiration Depends on 15% Surge to Protect Major Positions

- Bitcoin (BTC-USD) fell 30% from its $126,000 peak to $87,080 amid ETF outflows, stablecoin liquidity declines, and leverage unwinds. - A $13.3B options expiry on Dec 26, 2025, features a $1.74B call condor bet targeting $100,000–$118,000, with profits capped at $112,000. - November saw $3.5B in Bitcoin ETF outflows, while stablecoin market cap dropped $4.6B, signaling heightened liquidity risks. - Market stability signs include a 32 RSI near oversold levels and reduced downside protection costs, though s

Bitcoin Updates Today: Bitcoin's Volatility: Surrender or Endurance from Institutions?

- Bitcoin's recent price drop and negative funding rates suggest market capitulation, with open interest collapsing 32% since late October 2025. - Institutional holdings like KindlyMD's $681M BTC stash and Harvard's ETF investments highlight growing long-term confidence in Bitcoin's stability. - Q3 2025 crypto VC surged 290% to $4.65B, while experts diverge: Standard Chartered targets $200K BTC by year-end, Kraken predicts $80K–$100K consolidation. - Macro risks including Japan's reserve rules and AI-drive